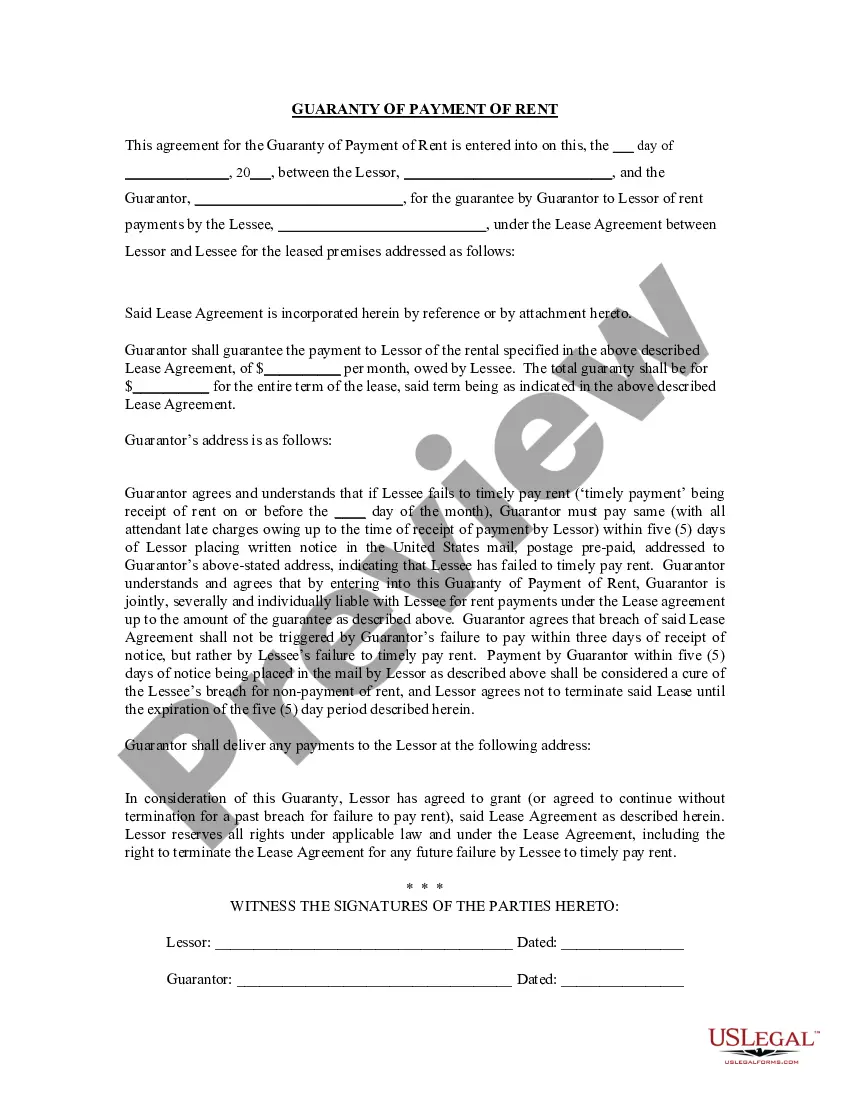

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Killeen Texas Guaranty or Guarantee of Payment of Rent is a legally binding agreement that provides assurance to the landlord that the rent will be paid on time and in full, even if the tenant fails to fulfill their financial obligations. This guarantee acts as a security measure for the landlord, ensuring consistent rental income and mitigating potential financial risks. There are two primary types of Killeen Texas Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: In this type of guarantee, a third party, typically a financially stable individual, agrees to assume responsibility for the tenant's rent payment if they default. The personal guarantor's creditworthiness and financial stability play a crucial role in assuring the landlord that any unpaid rent will be covered. Landlords often require a personal guaranty from tenants who may have a limited credit history or inadequate income documentation. 2. Corporate Guaranty: In certain cases, when the tenant is a business entity, such as a corporation or limited liability company (LLC), the landlord may request a corporate guaranty. This agreement holds the business entity responsible for fulfilling the rental payment obligations if the tenant fails to do so. The corporate guarantor's financial strength and creditworthiness act as a safeguard for the landlord against potential rent defaults. Both types of guarantees provide landlords with added security and reduce the financial risks associated with renting out a property. Landlords often require these guarantees, especially if the tenant's financial situation is uncertain or if they have a history of missed payments. These guarantees offer peace of mind to landlords, assuring them that they will receive their rent as agreed upon and helping to maintain a stable cash flow for their rental property. It is essential for both tenants and guarantors to carefully review and understand the terms and obligations outlined in the Killeen Texas Guaranty or Guarantee of Payment of Rent before entering into such an agreement. Seeking legal advice is recommended to ensure all parties fully comprehend their responsibilities under the guarantee and to protect their respective interests.Killeen Texas Guaranty or Guarantee of Payment of Rent is a legally binding agreement that provides assurance to the landlord that the rent will be paid on time and in full, even if the tenant fails to fulfill their financial obligations. This guarantee acts as a security measure for the landlord, ensuring consistent rental income and mitigating potential financial risks. There are two primary types of Killeen Texas Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: In this type of guarantee, a third party, typically a financially stable individual, agrees to assume responsibility for the tenant's rent payment if they default. The personal guarantor's creditworthiness and financial stability play a crucial role in assuring the landlord that any unpaid rent will be covered. Landlords often require a personal guaranty from tenants who may have a limited credit history or inadequate income documentation. 2. Corporate Guaranty: In certain cases, when the tenant is a business entity, such as a corporation or limited liability company (LLC), the landlord may request a corporate guaranty. This agreement holds the business entity responsible for fulfilling the rental payment obligations if the tenant fails to do so. The corporate guarantor's financial strength and creditworthiness act as a safeguard for the landlord against potential rent defaults. Both types of guarantees provide landlords with added security and reduce the financial risks associated with renting out a property. Landlords often require these guarantees, especially if the tenant's financial situation is uncertain or if they have a history of missed payments. These guarantees offer peace of mind to landlords, assuring them that they will receive their rent as agreed upon and helping to maintain a stable cash flow for their rental property. It is essential for both tenants and guarantors to carefully review and understand the terms and obligations outlined in the Killeen Texas Guaranty or Guarantee of Payment of Rent before entering into such an agreement. Seeking legal advice is recommended to ensure all parties fully comprehend their responsibilities under the guarantee and to protect their respective interests.