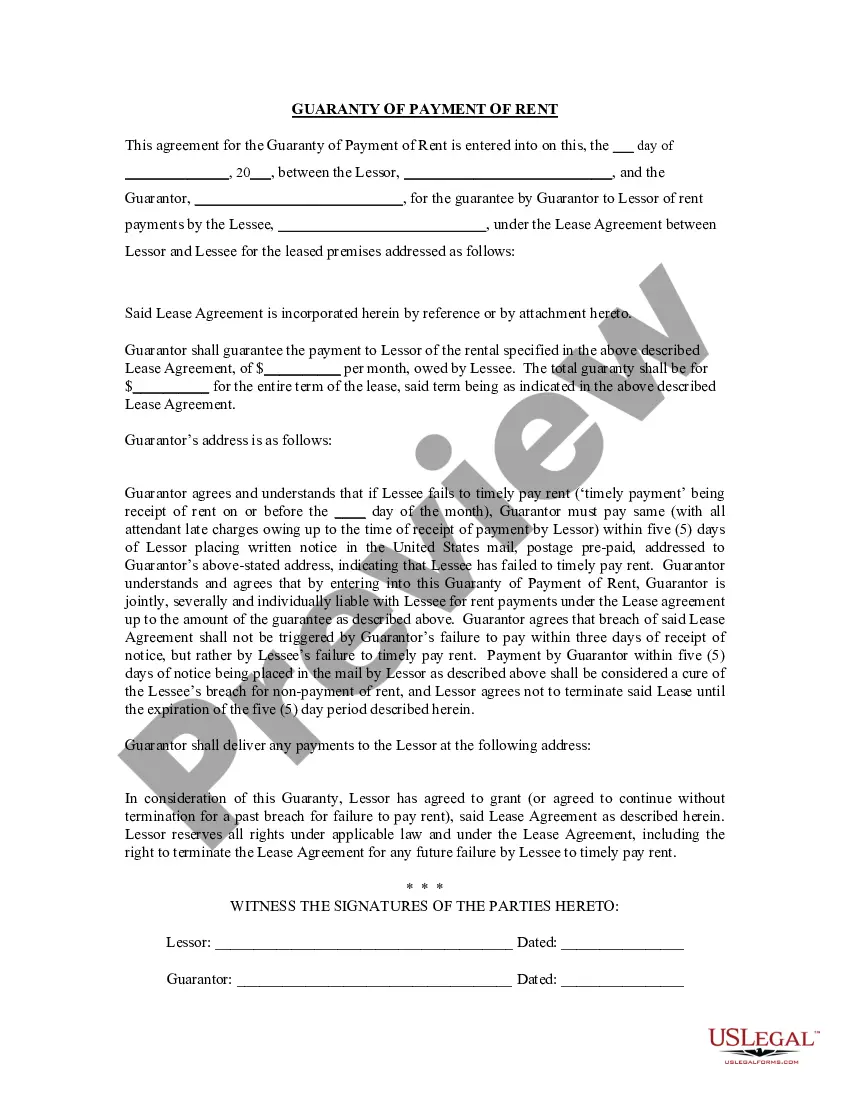

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

The Pasadena Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the timely and complete payment of rent by a tenant or third party in the city of Pasadena, Texas. This agreement provides landlords with a sense of security by mitigating the risks associated with potential tenant defaults or delays in rental payments. Landlords often rely on these guarantees to protect their financial interests and maintain consistent cash flow. There are different types of Pasadena Texas Guaranty or Guarantee of Payment of Rent that landlords can opt for, including: 1. Personal Guaranty: This form of guarantee is commonly used when the tenant is an individual or a sole proprietorship. The personal guarantor, usually the tenant themselves or a trusted individual, takes responsibility for ensuring prompt rent payments. 2. Corporate Guaranty: In cases where the tenant is a corporation or a limited liability company (LLC), a corporate guarantor assumes the responsibility for rent payment. This entity can be the tenant's parent company, a subsidiary, or another related business entity that agrees to guarantee the rent. 3. Third-Party Guaranty: When a tenant lacks the financial stability or creditworthiness to sufficiently assure the landlord, a third-party guarantor can step in. This independent guarantor, such as a family member, friend, or a specialized guarantee service, guarantees the tenant's rent obligations. 4. Cash Security Deposit: Although not technically a guarantee, landlords may require a cash security deposit from the tenant in addition to a guaranty. This deposit serves as a form of collateral in case of any unpaid rent or damages to the property. The landlord can access this deposit under specific circumstances and within the legal framework. 5. Surety Bond: An alternative to traditional guarantees, a surety bond involves a third party (usually an insurance or bonding company) issuing a bond on behalf of the tenant. This bond acts as a guarantee that the rent will be paid as agreed, ensuring the landlord's financial security. Pasadena Texas Guaranty or Guarantee of Payment of Rent agreements play a vital role in safeguarding the landlord's interests, ensuring consistent rental income, and minimizing potential financial risks. Landlords should consult legal professionals or utilize standard agreement templates to draft and execute a comprehensive and enforceable guaranty that adheres to relevant laws and regulations in Pasadena, Texas.The Pasadena Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the timely and complete payment of rent by a tenant or third party in the city of Pasadena, Texas. This agreement provides landlords with a sense of security by mitigating the risks associated with potential tenant defaults or delays in rental payments. Landlords often rely on these guarantees to protect their financial interests and maintain consistent cash flow. There are different types of Pasadena Texas Guaranty or Guarantee of Payment of Rent that landlords can opt for, including: 1. Personal Guaranty: This form of guarantee is commonly used when the tenant is an individual or a sole proprietorship. The personal guarantor, usually the tenant themselves or a trusted individual, takes responsibility for ensuring prompt rent payments. 2. Corporate Guaranty: In cases where the tenant is a corporation or a limited liability company (LLC), a corporate guarantor assumes the responsibility for rent payment. This entity can be the tenant's parent company, a subsidiary, or another related business entity that agrees to guarantee the rent. 3. Third-Party Guaranty: When a tenant lacks the financial stability or creditworthiness to sufficiently assure the landlord, a third-party guarantor can step in. This independent guarantor, such as a family member, friend, or a specialized guarantee service, guarantees the tenant's rent obligations. 4. Cash Security Deposit: Although not technically a guarantee, landlords may require a cash security deposit from the tenant in addition to a guaranty. This deposit serves as a form of collateral in case of any unpaid rent or damages to the property. The landlord can access this deposit under specific circumstances and within the legal framework. 5. Surety Bond: An alternative to traditional guarantees, a surety bond involves a third party (usually an insurance or bonding company) issuing a bond on behalf of the tenant. This bond acts as a guarantee that the rent will be paid as agreed, ensuring the landlord's financial security. Pasadena Texas Guaranty or Guarantee of Payment of Rent agreements play a vital role in safeguarding the landlord's interests, ensuring consistent rental income, and minimizing potential financial risks. Landlords should consult legal professionals or utilize standard agreement templates to draft and execute a comprehensive and enforceable guaranty that adheres to relevant laws and regulations in Pasadena, Texas.