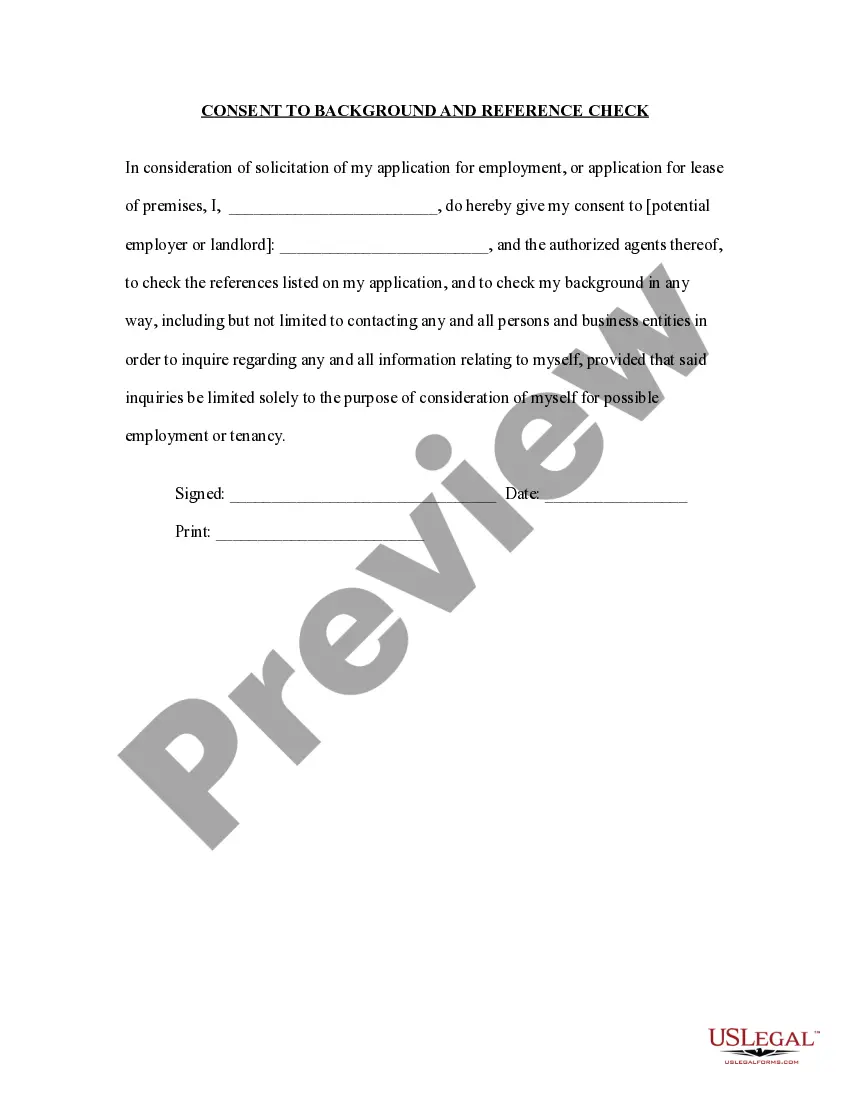

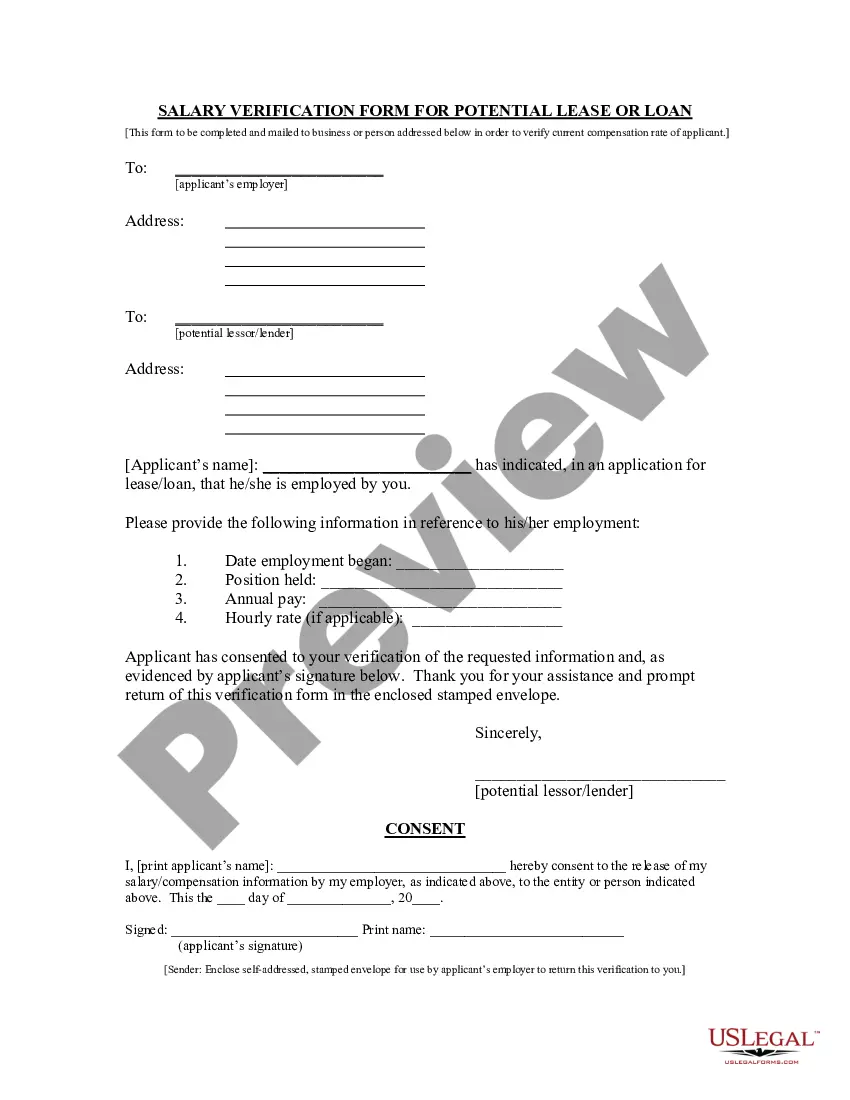

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application for lease (please see Form -827LT "Application for Residential Lease"). A Tenant Consent Form comes with the Salary Verification Form, and should also be sent to the employer.

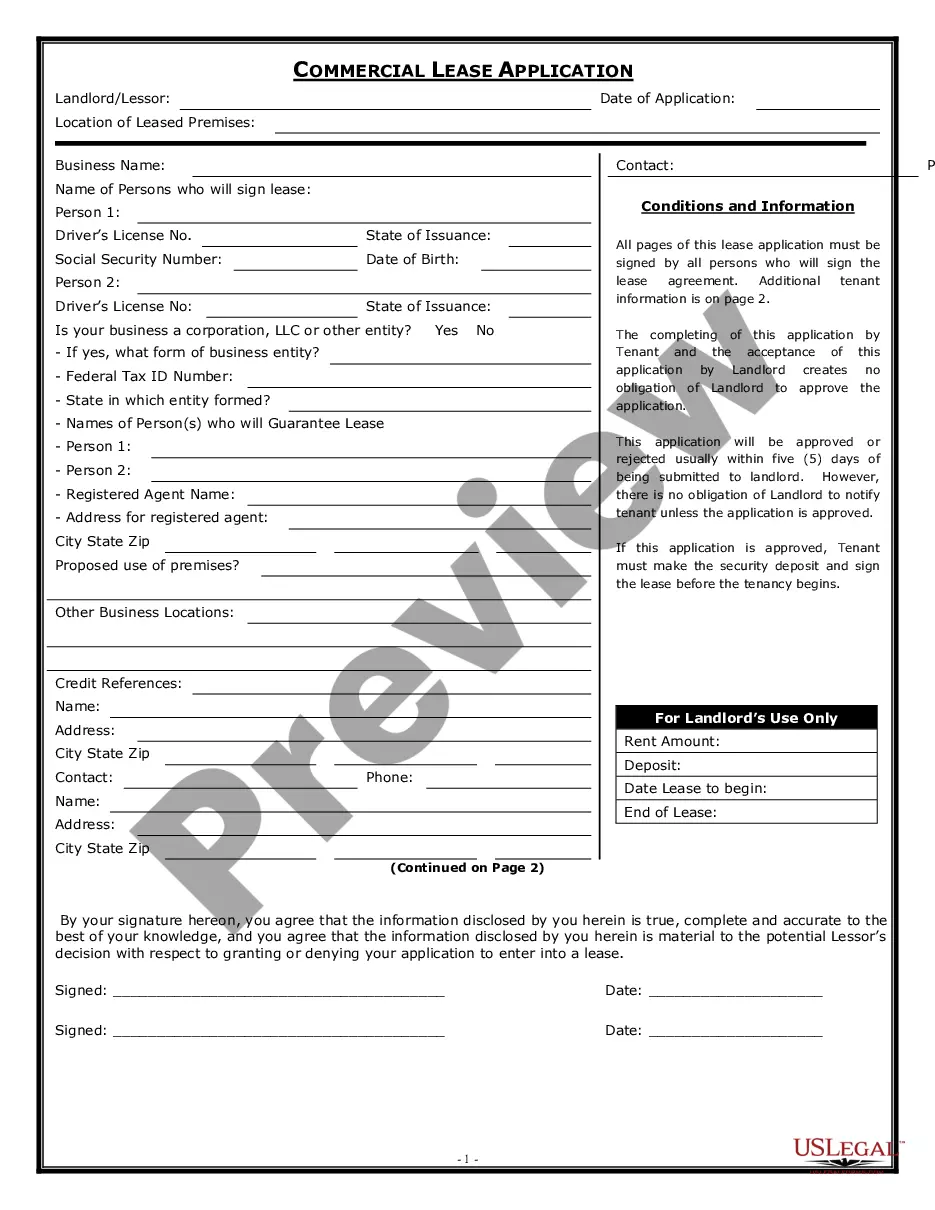

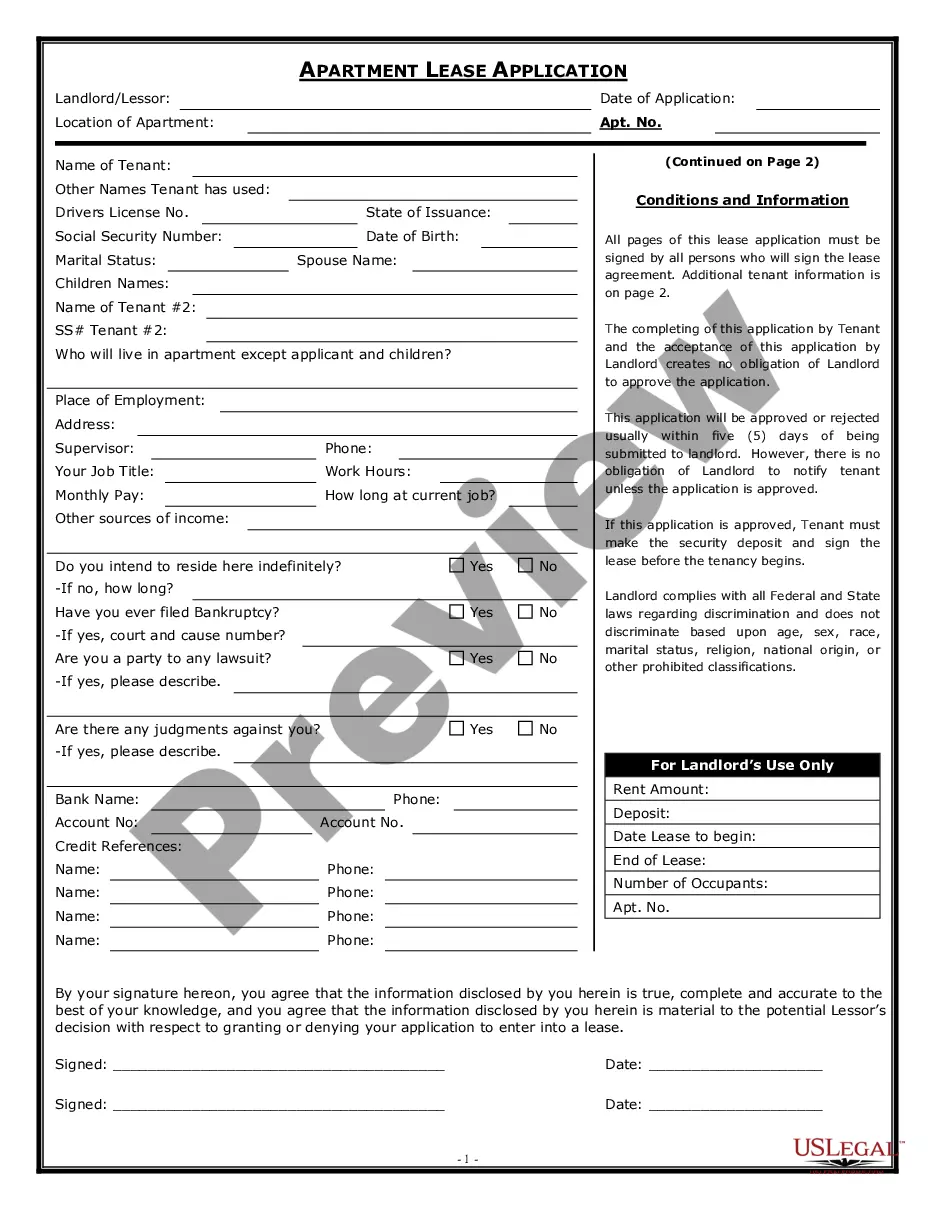

The Sugar Land Texas Salary Verification form for Potential Lease is a crucial document used by landlords, property management companies, and real estate agents in Sugar Land, Texas, to assess the financial background of potential tenants. This form aims to validate an applicant's income and ensure that they meet the necessary financial requirements to afford the lease or rental property. By utilizing this verification form, property owners gain valuable insights into an individual's employment details and income stability, allowing them to make informed decisions while selecting tenants. The information provided helps landlords determine if the applicant's salary corresponds to the rental property's monthly cost and gauge the individual's ability to make timely rental payments. The Sugar Land Texas Salary Verification form typically includes the following important sections: 1. Personal Information: This section will require the prospective tenant to provide their full name, contact details, and any additional personal identification information required by the landlord or leasing agent. 2. Employment Details: Here, the form will request the applicant to disclose their current employer's name, address, and contact information. Along with this, the form may ask for the length of employment, job title, and supervisor's name to verify the individual's job stability. 3. Income Verification: This section is crucial for landlords to assess an applicant's financial capability. The form will ask for details regarding the applicant's salary, such as the monthly, annual, or hourly wage. It might also inquire about additional sources of income, such as bonuses, commissions, or allowances. 4. Authorization and Release: This segment ensures that the applicant grants permission to their employer or financial institution to release income-related information to the landlord or property management company. It may also include a clause validating the applicant's awareness that the provided details will be treated confidentially. Different types of Sugar Land Texas Salary Verification forms for Potential Lease may have slight variations depending on the preferences and requirements of different property owners or management companies. Some forms may include additional sections, such as references or credit check authorization, while others focus solely on income verification. Nonetheless, the fundamental purpose of these forms remains consistent — to establish the veracity of an applicant's income and ascertain their eligibility to rent a property in Sugar Land, Texas. In conclusion, the Sugar Land Texas Salary Verification form for Potential Lease is an indispensable tool for property owners and landlords in Sugar Land, Texas. It aids in evaluating a potential tenant's financial stability, helping property owners make informed decisions during the tenant selection process while minimizing the risk of defaulting on rent payments.The Sugar Land Texas Salary Verification form for Potential Lease is a crucial document used by landlords, property management companies, and real estate agents in Sugar Land, Texas, to assess the financial background of potential tenants. This form aims to validate an applicant's income and ensure that they meet the necessary financial requirements to afford the lease or rental property. By utilizing this verification form, property owners gain valuable insights into an individual's employment details and income stability, allowing them to make informed decisions while selecting tenants. The information provided helps landlords determine if the applicant's salary corresponds to the rental property's monthly cost and gauge the individual's ability to make timely rental payments. The Sugar Land Texas Salary Verification form typically includes the following important sections: 1. Personal Information: This section will require the prospective tenant to provide their full name, contact details, and any additional personal identification information required by the landlord or leasing agent. 2. Employment Details: Here, the form will request the applicant to disclose their current employer's name, address, and contact information. Along with this, the form may ask for the length of employment, job title, and supervisor's name to verify the individual's job stability. 3. Income Verification: This section is crucial for landlords to assess an applicant's financial capability. The form will ask for details regarding the applicant's salary, such as the monthly, annual, or hourly wage. It might also inquire about additional sources of income, such as bonuses, commissions, or allowances. 4. Authorization and Release: This segment ensures that the applicant grants permission to their employer or financial institution to release income-related information to the landlord or property management company. It may also include a clause validating the applicant's awareness that the provided details will be treated confidentially. Different types of Sugar Land Texas Salary Verification forms for Potential Lease may have slight variations depending on the preferences and requirements of different property owners or management companies. Some forms may include additional sections, such as references or credit check authorization, while others focus solely on income verification. Nonetheless, the fundamental purpose of these forms remains consistent — to establish the veracity of an applicant's income and ascertain their eligibility to rent a property in Sugar Land, Texas. In conclusion, the Sugar Land Texas Salary Verification form for Potential Lease is an indispensable tool for property owners and landlords in Sugar Land, Texas. It aids in evaluating a potential tenant's financial stability, helping property owners make informed decisions during the tenant selection process while minimizing the risk of defaulting on rent payments.