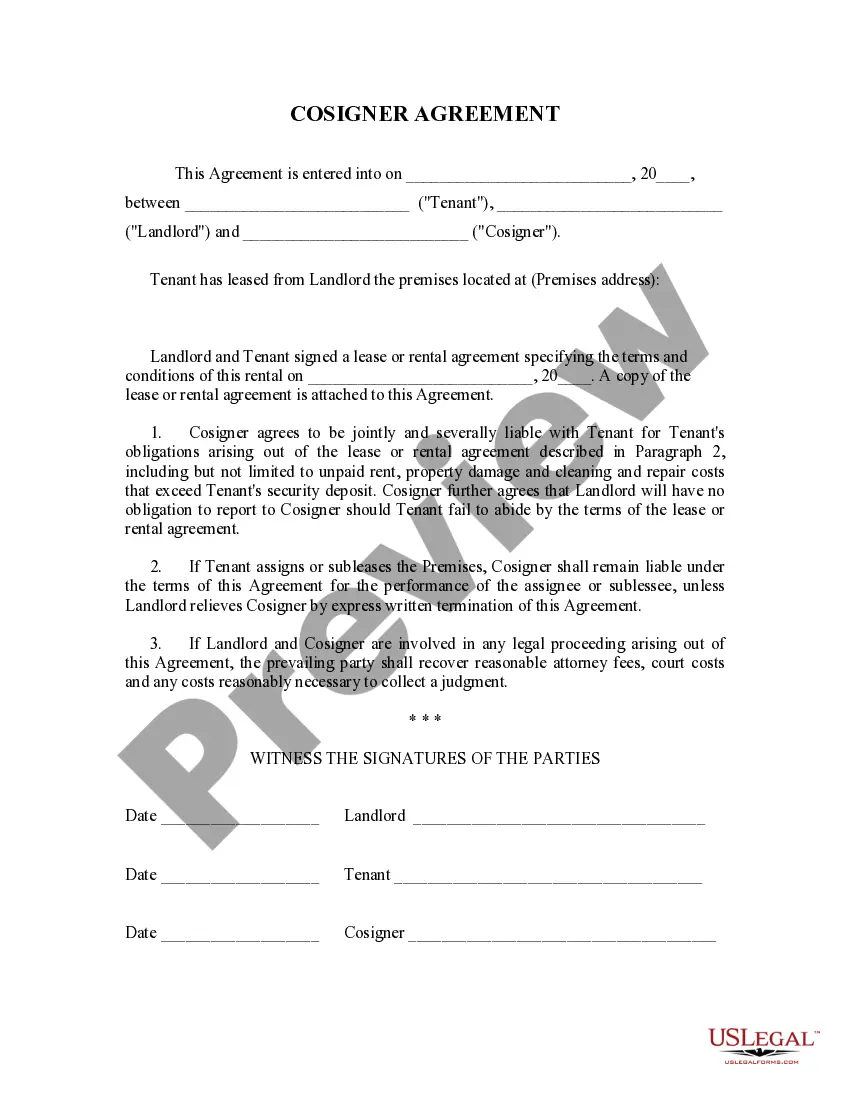

This is a Landlord Tenant Lease Co-Signor Agreement for use by a landlord in contracting with a cosignor on a lease to be liable for rent, damage, etc., if the tenant fails to pay. Cosignor is thereby liable to landlord for payment of rent should tenant not fulfill his/her contractual obligation.

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Dallas Texas Landlord Tenant Lease Co-Signer Agreement: A Detailed Description A Dallas Texas Landlord Tenant Lease Co-Signer Agreement is a legally binding document created to provide additional security to landlords when leasing their property to tenants who may have insufficient credit or income. This agreement involves a third party known as a co-signer who agrees to guarantee the lease obligations and responsibilities of the primary tenant. The co-signer enters into this agreement to protect the landlord's interests and ensure timely payments and adherence to the lease terms. The Dallas Texas Landlord Tenant Lease Co-Signer Agreement typically includes the following key provisions: 1. Parties: The agreement identifies the landlord, primary tenant, and co-signer. It establishes their legal obligations and rights under the lease. 2. Guarantor's Liability: The co-signer acknowledges their responsibility to pay rent, fees, damages, and other charges if the primary tenant fails to fulfill their obligations mentioned in the lease agreement. 3. Financial Information: The co-signer provides their financial details, including income, employment, credit history, and assets, to prove their ability to fulfill the lease obligations in case of default by the primary tenant. 4. Joint and Several liabilities: This clause states that the primary tenant and the co-signer are both individually and collectively responsible for fulfilling the terms of the lease agreement. 5. Release or Release Condition: The agreement may include a provision allowing the co-signer to be released from their obligations if certain conditions are met, such as the primary tenant establishing a positive rental history or reaching a specific credit score. 6. Duration of Agreement: The co-signer's obligation under the agreement typically lasts for the entire duration of the lease term, including any extensions or renewals. 7. Notice: The agreement specifies how both parties should provide notice to each other, whether it is related to payment defaults, termination, or other matters. 8. Governing Laws: The agreement ensures that any disputes or legal matters will be resolved in accordance with the laws of the state of Texas and specific regulations applicable in Dallas. Different Types of Dallas Texas Landlord Tenant Lease Co-Signer Agreements: 1. Regular Co-Signer Agreement: This is the standard agreement where a third party co-signs the lease for a tenant who may not meet the landlord's criteria solely based on their credit or income qualifications. 2. Parent/Guardian Co-Signer Agreement: In cases where a student or young adult is the primary tenant, their parent or legal guardian may act as the co-signer to provide additional assurance to the landlord. 3. Institutional Co-Signer Agreement: Some landlords may require a co-signer from an academic institution or employer who is willing to guarantee the lease obligations on behalf of the tenant. These different types of co-signer agreements cater to specific scenarios and provide flexibility to landlords while mitigating potential risks associated with leasing their property to tenants with lower creditworthiness or income levels in Dallas, Texas.Dallas Texas Landlord Tenant Lease Co-Signer Agreement: A Detailed Description A Dallas Texas Landlord Tenant Lease Co-Signer Agreement is a legally binding document created to provide additional security to landlords when leasing their property to tenants who may have insufficient credit or income. This agreement involves a third party known as a co-signer who agrees to guarantee the lease obligations and responsibilities of the primary tenant. The co-signer enters into this agreement to protect the landlord's interests and ensure timely payments and adherence to the lease terms. The Dallas Texas Landlord Tenant Lease Co-Signer Agreement typically includes the following key provisions: 1. Parties: The agreement identifies the landlord, primary tenant, and co-signer. It establishes their legal obligations and rights under the lease. 2. Guarantor's Liability: The co-signer acknowledges their responsibility to pay rent, fees, damages, and other charges if the primary tenant fails to fulfill their obligations mentioned in the lease agreement. 3. Financial Information: The co-signer provides their financial details, including income, employment, credit history, and assets, to prove their ability to fulfill the lease obligations in case of default by the primary tenant. 4. Joint and Several liabilities: This clause states that the primary tenant and the co-signer are both individually and collectively responsible for fulfilling the terms of the lease agreement. 5. Release or Release Condition: The agreement may include a provision allowing the co-signer to be released from their obligations if certain conditions are met, such as the primary tenant establishing a positive rental history or reaching a specific credit score. 6. Duration of Agreement: The co-signer's obligation under the agreement typically lasts for the entire duration of the lease term, including any extensions or renewals. 7. Notice: The agreement specifies how both parties should provide notice to each other, whether it is related to payment defaults, termination, or other matters. 8. Governing Laws: The agreement ensures that any disputes or legal matters will be resolved in accordance with the laws of the state of Texas and specific regulations applicable in Dallas. Different Types of Dallas Texas Landlord Tenant Lease Co-Signer Agreements: 1. Regular Co-Signer Agreement: This is the standard agreement where a third party co-signs the lease for a tenant who may not meet the landlord's criteria solely based on their credit or income qualifications. 2. Parent/Guardian Co-Signer Agreement: In cases where a student or young adult is the primary tenant, their parent or legal guardian may act as the co-signer to provide additional assurance to the landlord. 3. Institutional Co-Signer Agreement: Some landlords may require a co-signer from an academic institution or employer who is willing to guarantee the lease obligations on behalf of the tenant. These different types of co-signer agreements cater to specific scenarios and provide flexibility to landlords while mitigating potential risks associated with leasing their property to tenants with lower creditworthiness or income levels in Dallas, Texas.