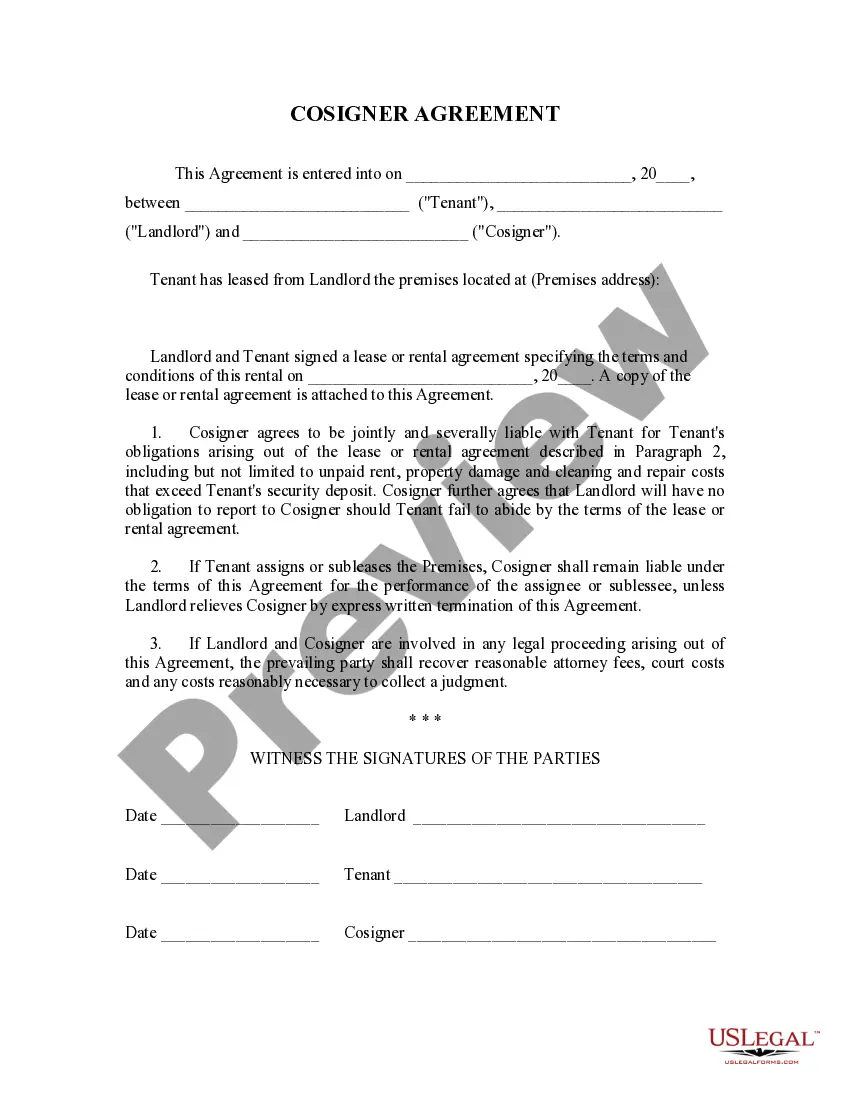

This is a Landlord Tenant Lease Co-Signor Agreement for use by a landlord in contracting with a cosignor on a lease to be liable for rent, damage, etc., if the tenant fails to pay. Cosignor is thereby liable to landlord for payment of rent should tenant not fulfill his/her contractual obligation.

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Harris Texas Landlord Tenant Lease Co-Signer Agreement is a legally binding contract that outlines the responsibilities and obligations of a co-signer in a rental lease agreement between a landlord and tenant in Harris County, Texas. This agreement is typically used when a prospective tenant does not meet the landlord's qualification criteria, such as having an insufficient credit history or unstable income. The Harris Texas Landlord Tenant Lease Co-Signer Agreement serves as a guarantee for the landlord, providing additional financial security in case the tenant fails to fulfill their lease obligations, including payment of rent or any damages caused to the property. By signing this agreement, the co-signer becomes equally liable for the terms and conditions of the lease, assuming all financial responsibilities if the tenant defaults on their obligations. The main purpose of the Harris Texas Landlord Tenant Lease Co-Signer Agreement is to protect the landlord's interests and minimize the risk of financial loss. It allows landlords to evaluate the co-signer's creditworthiness, employment status, and ability to meet the financial demands of the lease. This agreement helps establish a legal relationship between the landlord and the co-signer, providing a framework for financial accountability and ensuring rent and other obligations are met. It is important to note that there may be different types or variations of the Harris Texas Landlord Tenant Lease Co-Signer Agreement based on specific circumstances and requirements. Some common variations may include: 1. Guarantor Agreement: This type of co-signer agreement ensures that the guarantor will be responsible for all lease obligations if the tenant fails to fulfill them. It typically covers financial aspects, such as rent payments and property damages. 2. Joint and Several Liability agreements: This agreement holds both the tenant and the co-signer jointly and severally liable for the tenancy obligations. Each party can be held responsible for the entire lease obligations, including unpaid rent or damages caused by either party. 3. Limited Guarantee Agreement: In this type of co-signer agreement, the co-signer's liability is limited to a specific portion or duration of the lease. For example, the co-signer may be responsible for rent payments only for the first six months of the lease term. It is crucial for both landlords and co-signers to thoroughly review and understand the terms and conditions of the Harris Texas Landlord Tenant Lease Co-Signer Agreement before signing. Seeking legal advice is recommended to ensure compliance with local laws and regulations.Harris Texas Landlord Tenant Lease Co-Signer Agreement is a legally binding contract that outlines the responsibilities and obligations of a co-signer in a rental lease agreement between a landlord and tenant in Harris County, Texas. This agreement is typically used when a prospective tenant does not meet the landlord's qualification criteria, such as having an insufficient credit history or unstable income. The Harris Texas Landlord Tenant Lease Co-Signer Agreement serves as a guarantee for the landlord, providing additional financial security in case the tenant fails to fulfill their lease obligations, including payment of rent or any damages caused to the property. By signing this agreement, the co-signer becomes equally liable for the terms and conditions of the lease, assuming all financial responsibilities if the tenant defaults on their obligations. The main purpose of the Harris Texas Landlord Tenant Lease Co-Signer Agreement is to protect the landlord's interests and minimize the risk of financial loss. It allows landlords to evaluate the co-signer's creditworthiness, employment status, and ability to meet the financial demands of the lease. This agreement helps establish a legal relationship between the landlord and the co-signer, providing a framework for financial accountability and ensuring rent and other obligations are met. It is important to note that there may be different types or variations of the Harris Texas Landlord Tenant Lease Co-Signer Agreement based on specific circumstances and requirements. Some common variations may include: 1. Guarantor Agreement: This type of co-signer agreement ensures that the guarantor will be responsible for all lease obligations if the tenant fails to fulfill them. It typically covers financial aspects, such as rent payments and property damages. 2. Joint and Several Liability agreements: This agreement holds both the tenant and the co-signer jointly and severally liable for the tenancy obligations. Each party can be held responsible for the entire lease obligations, including unpaid rent or damages caused by either party. 3. Limited Guarantee Agreement: In this type of co-signer agreement, the co-signer's liability is limited to a specific portion or duration of the lease. For example, the co-signer may be responsible for rent payments only for the first six months of the lease term. It is crucial for both landlords and co-signers to thoroughly review and understand the terms and conditions of the Harris Texas Landlord Tenant Lease Co-Signer Agreement before signing. Seeking legal advice is recommended to ensure compliance with local laws and regulations.