Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

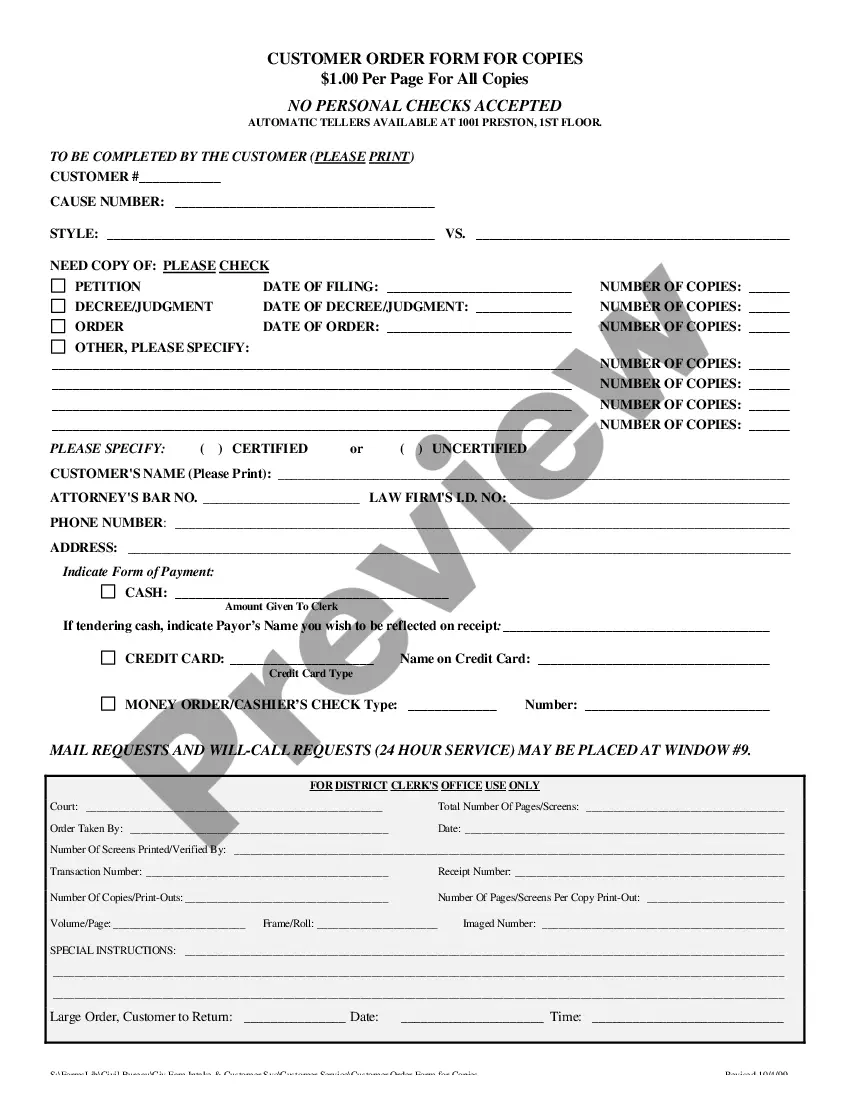

Carrollton Texas Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is a comprehensive resource designed to assist individuals in understanding and navigating the bankruptcy process in the Carrollton area of Texas, specifically within the Eastern District. This informational guide, along with its corresponding forms package, encompasses both Chapter 7 and Chapter 13 bankruptcies, which are the two most common types of personal bankruptcies filed in the United States. Chapter 7 Bankruptcy: The Carrollton Texas Eastern District Bankruptcy Guide and Forms Package provides detailed instructions and forms for individuals seeking relief through Chapter 7 bankruptcy. Chapter 7 bankruptcy involves liquidation of non-exempt assets to discharge debts. It is typically suitable for individuals with little or no disposable income. Chapter 13 Bankruptcy: The guide also covers the Chapter 13 bankruptcy process, offering step-by-step guidance and necessary forms for individuals looking to reorganize their debts. Chapter 13 bankruptcy allows debtors to create a feasible repayment plan over a period of three to five years, enabling them to retain their assets while gradually paying off their debts. Key Features of Carrollton Texas Eastern District Bankruptcy Guide and Forms Package: 1. Guidance: The guide provides a detailed overview of the bankruptcy process, including eligibility criteria, required documentation, and the steps involved in filing for bankruptcy in the Eastern District of Texas. 2. Forms Package: This package includes all the necessary forms and schedules required by the bankruptcy court, helping individuals accurately complete the required paperwork for their specific bankruptcy type. 3. Filing Instructions: The guide offers comprehensive instructions on how to properly fill out the forms, ensuring accuracy and avoiding potential pitfalls that could lead to delays or complications in the bankruptcy process. 4. Exemptions and Laws: It covers the exemptions available under Texas and federal bankruptcy law, informing individuals about which assets they can protect from liquidation or seizure during bankruptcy proceedings. 5. Means Test Assistance: For individuals considering Chapter 7 bankruptcy, the guide provides assistance with the means test, which determines an individual's eligibility based on their income and expenses. 6. Financial Management Education: The guide may include information on mandatory financial management courses required to complete the bankruptcy process successfully. It may provide recommendations for approved credit counseling agencies. By utilizing the Carrollton Texas Eastern District Bankruptcy Guide and Forms Package, individuals can gain a better understanding of their options and confidently navigate the complex bankruptcy process. Whether filing for Chapter 7 or Chapter 13 bankruptcy, this resource aims to alleviate the stress associated with the process and empower individuals to regain control of their financial future.