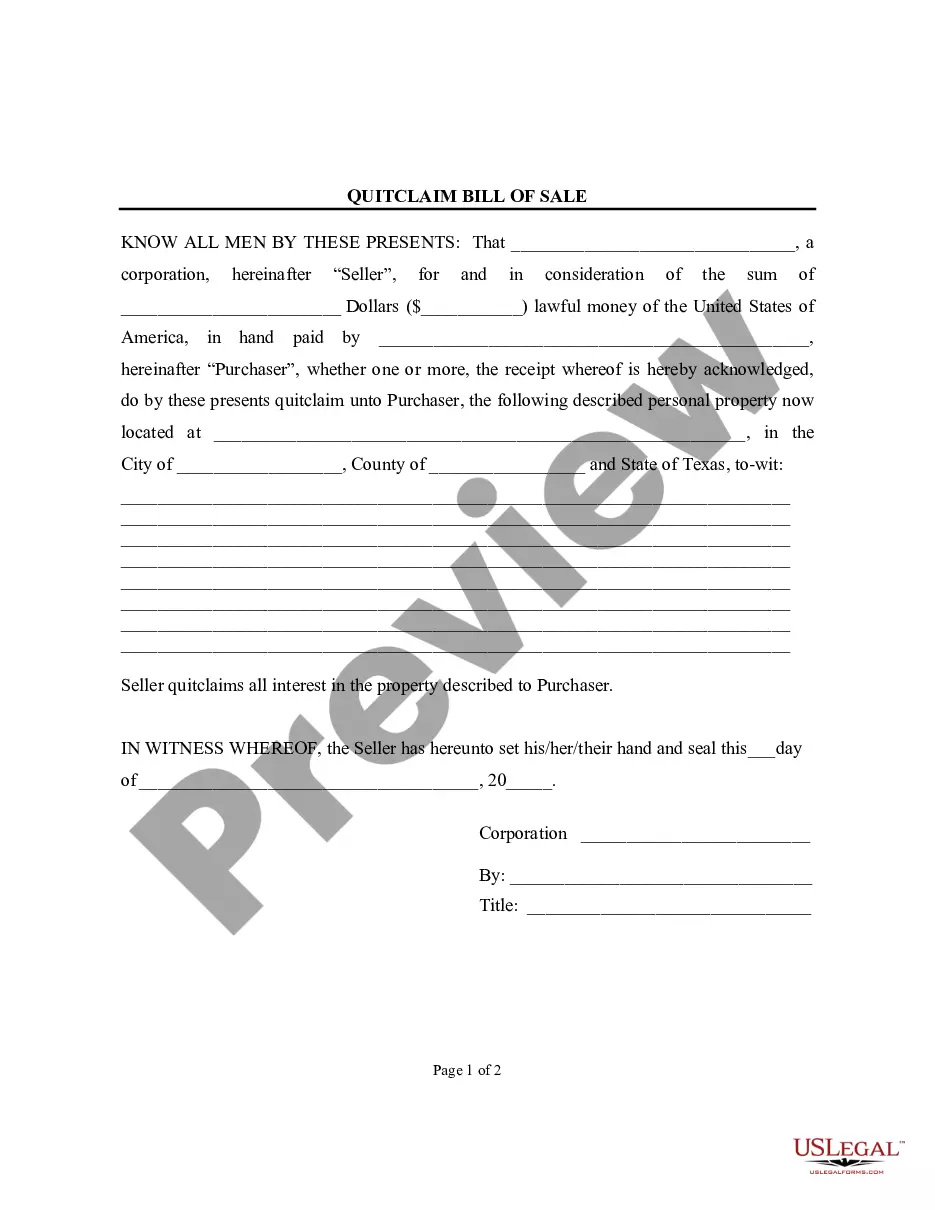

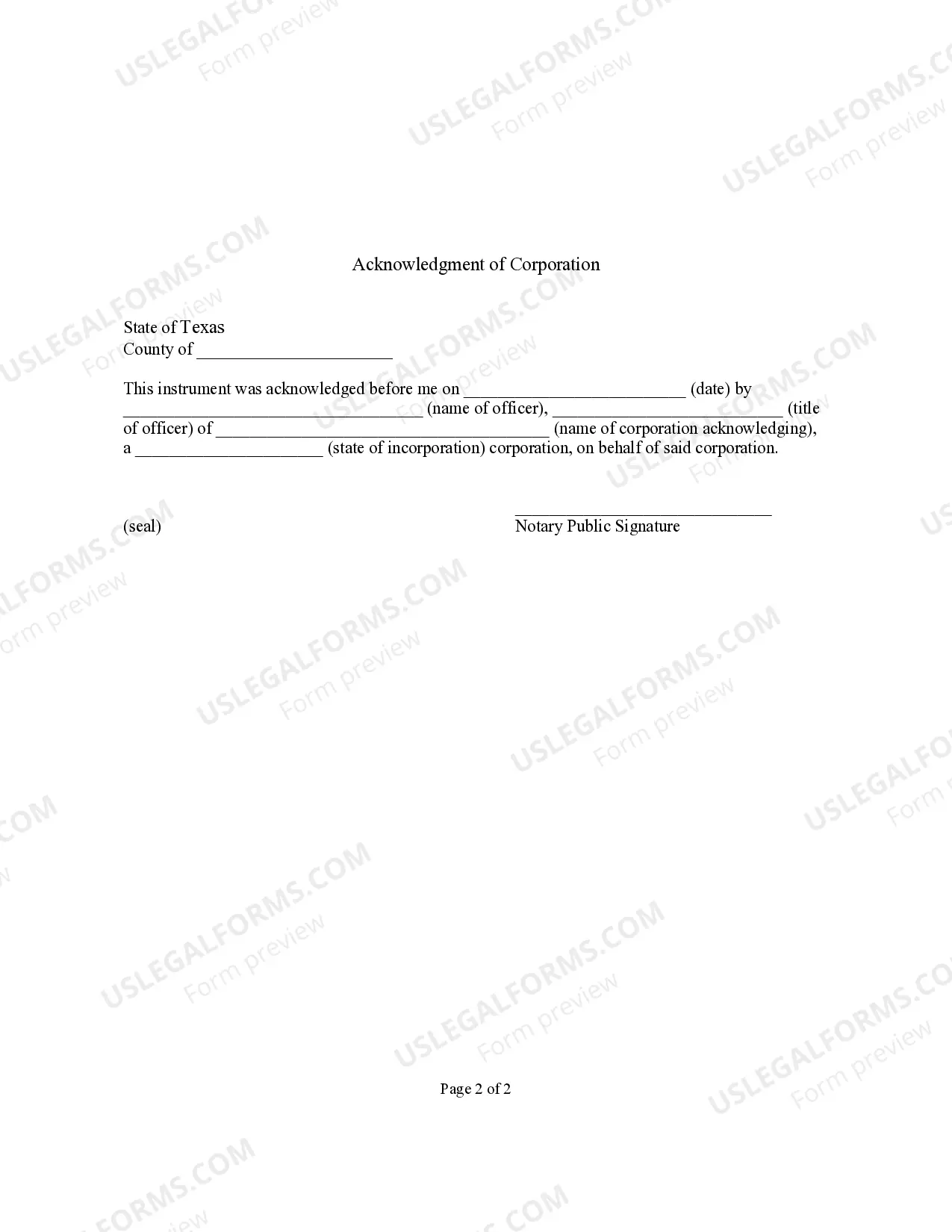

This Bill of Sale without Warranty by Corporate Seller is a Bill of Sale with an appropriate state specific Acknowledgment by corporation Seller. This is a Quitclaim Conveyance. This form complies with all applicable state statutory law.

A Harris Texas Bill of Sale without Warranty by Corporate Seller is a legal document that outlines the transfer of ownership rights from a corporate seller to a buyer for a specific item or property. This type of bill of sale signifies that the seller does not provide any warranties or guarantees regarding the item being sold. In the state of Texas, there are various types of Harris Texas Bills of Sale without Warranty by Corporate Seller. Some common bill of sale variations include: 1. Vehicle Bill of Sale without Warranty by Corporate Seller: This type of bill of sale is used when a corporation sells a motor vehicle, including cars, trucks, motorcycles, trailers, or recreational vehicles, to a buyer without providing any warranties. 2. Boat Bill of Sale without Warranty by Corporate Seller: When a corporation sells a watercraft, such as a boat, yacht, or jet ski, without offering any warranties, a boat bill of sale without warranty is used to document the transaction. 3. Equipment Bill of Sale without Warranty by Corporate Seller: This variant of the bill of sale is employed when a corporate entity sells machinery, tools, electronics, or any type of equipment to a buyer without any warranties. 4. Real Estate Bill of Sale without Warranty by Corporate Seller: In some cases, a corporation may transfer ownership of real estate property without providing any warranties. This type of bill of sale is used to record the sale of land, buildings, or any other type of real property. Regardless of the specific type, a Harris Texas Bill of Sale without Warranty by Corporate Seller typically includes key information such as the date of sale, the names and contact details of both parties involved, a detailed description of the item being sold, the purchase price, and a statement explicitly stating that the seller is not providing any warranties or guarantees. It is crucial to note that a Harris Texas Bill of Sale without Warranty by Corporate Seller should always be signed and dated by both the seller and the buyer to ensure its legal validity. Additionally, it is recommended to seek legal assistance or consult the appropriate resources to create an accurate and comprehensive bill of sale tailored to the specific transaction.A Harris Texas Bill of Sale without Warranty by Corporate Seller is a legal document that outlines the transfer of ownership rights from a corporate seller to a buyer for a specific item or property. This type of bill of sale signifies that the seller does not provide any warranties or guarantees regarding the item being sold. In the state of Texas, there are various types of Harris Texas Bills of Sale without Warranty by Corporate Seller. Some common bill of sale variations include: 1. Vehicle Bill of Sale without Warranty by Corporate Seller: This type of bill of sale is used when a corporation sells a motor vehicle, including cars, trucks, motorcycles, trailers, or recreational vehicles, to a buyer without providing any warranties. 2. Boat Bill of Sale without Warranty by Corporate Seller: When a corporation sells a watercraft, such as a boat, yacht, or jet ski, without offering any warranties, a boat bill of sale without warranty is used to document the transaction. 3. Equipment Bill of Sale without Warranty by Corporate Seller: This variant of the bill of sale is employed when a corporate entity sells machinery, tools, electronics, or any type of equipment to a buyer without any warranties. 4. Real Estate Bill of Sale without Warranty by Corporate Seller: In some cases, a corporation may transfer ownership of real estate property without providing any warranties. This type of bill of sale is used to record the sale of land, buildings, or any other type of real property. Regardless of the specific type, a Harris Texas Bill of Sale without Warranty by Corporate Seller typically includes key information such as the date of sale, the names and contact details of both parties involved, a detailed description of the item being sold, the purchase price, and a statement explicitly stating that the seller is not providing any warranties or guarantees. It is crucial to note that a Harris Texas Bill of Sale without Warranty by Corporate Seller should always be signed and dated by both the seller and the buyer to ensure its legal validity. Additionally, it is recommended to seek legal assistance or consult the appropriate resources to create an accurate and comprehensive bill of sale tailored to the specific transaction.