The Austin Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement refer to legal documents related to real estate development loans in Austin, Texas. These documents are crucial in securing the lender's interests in the loan transaction and provide a framework for the repayment and collateral protections. The primary purpose of a Development Loan Deed of Trust is to establish a lien on the property being financed. The deed of trust outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional provisions specific to the loan agreement. It also specifies the remedies available to the lender in case of default on the loan. The Security Agreement works in conjunction with the Deed of Trust. It is a legal contract that creates a lien on the borrower's personal property or assets to secure the loan. This agreement lists all the collateral offered by the borrower, which could include land, buildings, equipment, inventory, or other valuable assets. In case of default, the lender has the right to seize and sell the collateral to recover the outstanding loan amount. The Financing Statement, or UCC-1 Financing Statement, is a document filed with the Secretary of State or county recorder's office. It is essential for perfecting the lender's security interest in the collateral listed in the Security Agreement. The Financing Statement provides public notice that the lender has a legal claim to the borrower's assets and helps protect the lender's priority status in case of other competing creditors. Different types of Austin Texas Development Loan Deeds of Trust, Security Agreements, and Financing Statements may vary depending on the specific terms and conditions negotiated between the lender and borrower. Some potential variations or subtypes may include: 1. Residential Development Loan Deed of Trust, Security Agreement, and Financing Statement: Specifically designed for residential real estate developments, such as subdivisions or housing projects. 2. Commercial Development Loan Deed of Trust, Security Agreement, and Financing Statement: Geared towards financing commercial property development, such as office buildings, retail centers, or industrial projects. 3. Mixed-Use Development Loan Deed of Trust, Security Agreement, and Financing Statement: Suitable for developments that combine residential, commercial, and other uses within a single project. 4. Land Development Loan Deed of Trust, Security Agreement, and Financing Statement: Specifically tailored for financing undeveloped land or infrastructure projects, like roads or utilities, to prepare the land for future development. It is important to consult with a legal professional or experienced lender when dealing with Austin Texas Development Loan Deeds of Trust, Security Agreements, and Financing Statements, as they involve complex legal considerations that may vary based on the specifics of the transaction.

Austin Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Austin Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Regardless of social or professional rank, finalizing legal-related documentation is an unfortunate requirement in today's work setting.

Frequently, it's almost impossible for someone without a legal background to create this kind of paperwork from scratch, primarily due to the complicated terminology and legal intricacies they entail.

This is where US Legal Forms comes to the rescue.

Verify that the form you selected is tailored to your area since the laws of one state or county do not apply to another.

Review the form and read through a brief summary (if available) of scenarios the document can be applicable for.

- Our service provides an extensive catalog comprising over 85,000 ready-to-use state-specific documents suitable for practically any legal scenario.

- US Legal Forms is also an excellent tool for associates or legal advisors who wish to save time by utilizing our DIY forms.

- No matter if you need the Austin Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement or any other document that will be recognized in your state or county, with US Legal Forms, everything is accessible.

- Here's how to obtain the Austin Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement in moments using our reliable service.

- If you are currently a subscriber, you can proceed to Log In to your account and access the needed form.

- However, if you are new to our platform, please follow these steps before downloading the Austin Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement.

Form popularity

FAQ

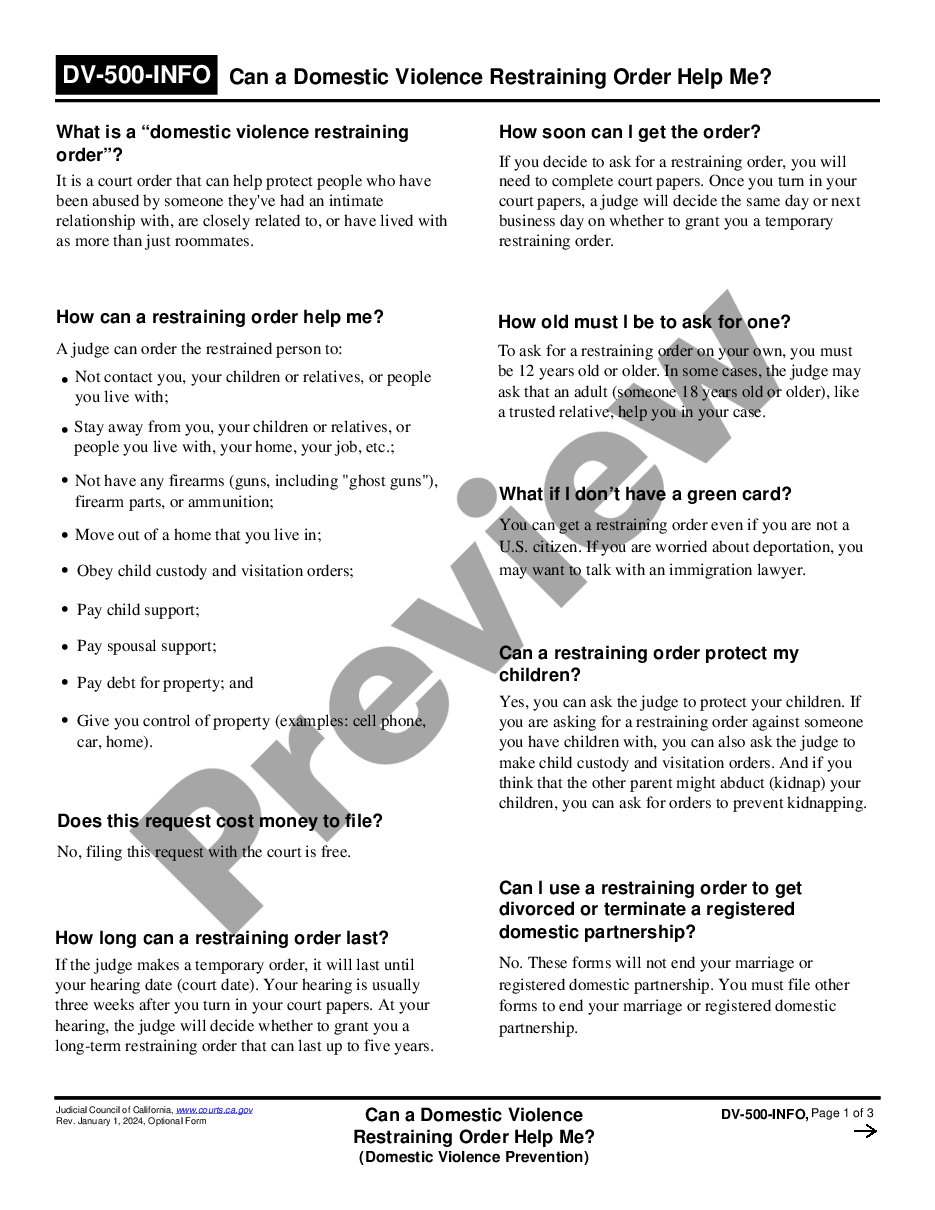

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

If a deed is not recorded, then the grantor could sell the land to a second grantee. In that case, the second grantee would get to keep the land if they were the first to record their deed and did not have actual knowledge of the deed to the first grantee.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

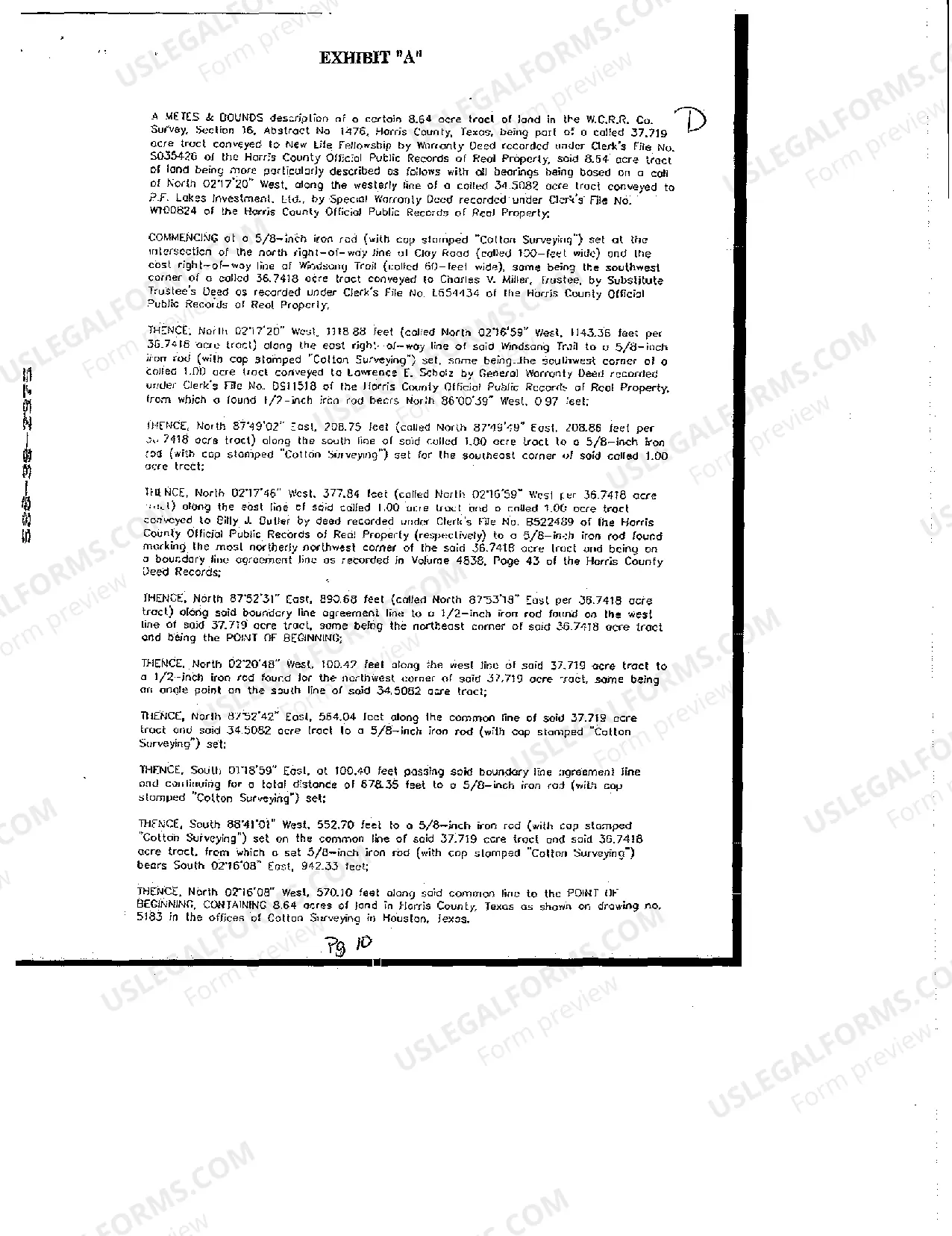

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

This includes deeds, wills, trusts, oil and gas leases and many other kinds of documents. In fact, any document that must be filed in the deed records is required to be notarized.

Deeds of trusts are frequently used in Texas in real estate transactions to create an agreement such as a mortgage.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

The grantor must sign the deed and have it notarized. Depending on the type of deed, the grantor's spouse may also need to sign it. The grantee does need to sign the deed but may need to sign related agreements in some circumstances. 4.

Interesting Questions

More info

The property, together with certain equipment and contents, was purchased by the seller. The property was delivered as requested. The individual purchasing the property and a lender make this agreement, which states that the property buyer will repay a loan. The accompanying notes are an integral part of these financial statements. Code § 26.02(b). The title company will defend you in court if there is a claim against your property, and will pay for covered losses. Evaluate your position and create a legacy that lasts. Explore. Business. A map through the stages of healthy business growth. Our principal real estate holdings are currently in the Austin, Texas, area. Financial Statements; No Material Adverse Effect.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.