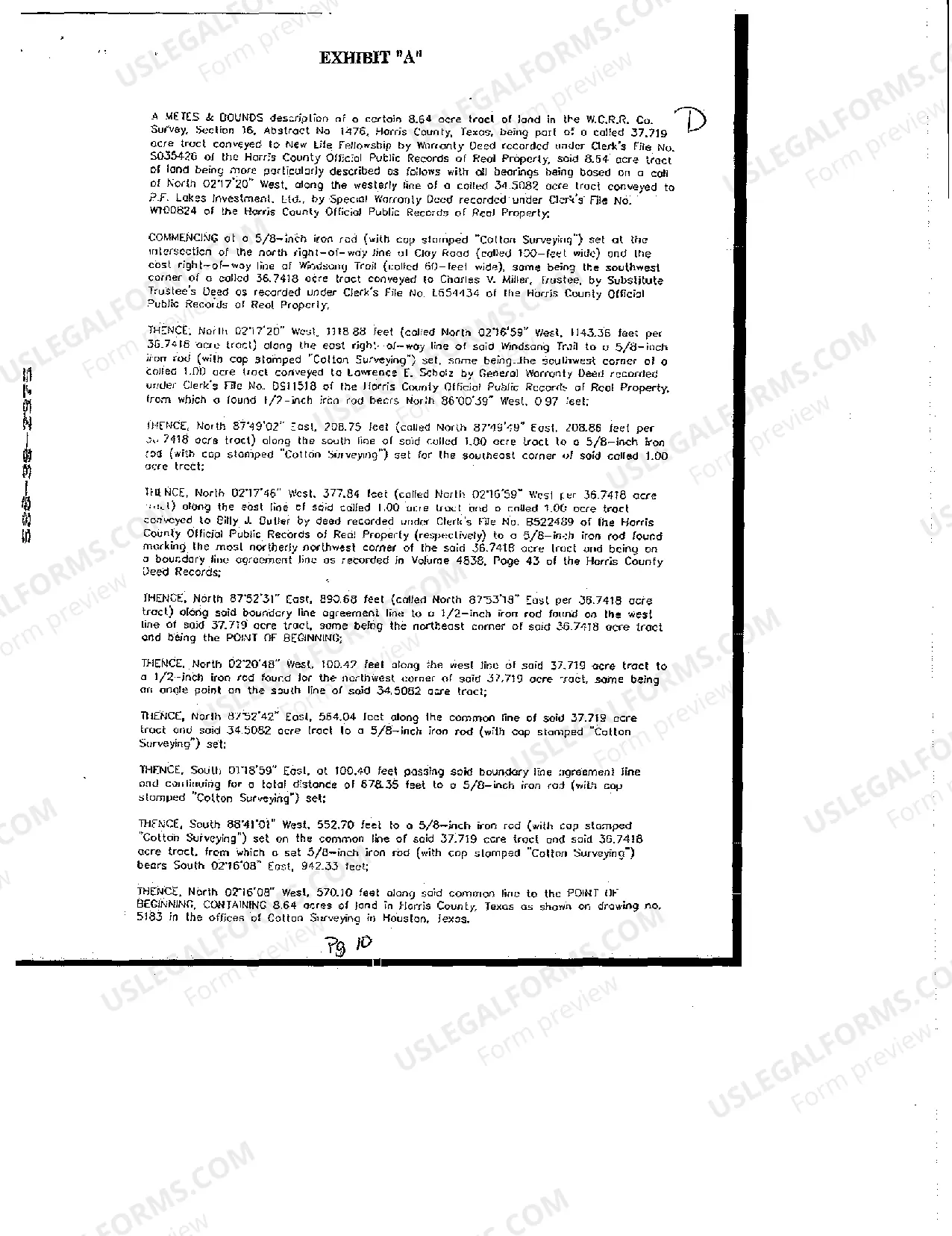

Beaumont Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are legal documents that play a crucial role in property development and financing in Beaumont, Texas. Let's delve into each of these documents and understand their purpose, as well as potential variations: 1. Beaumont Texas Development Loan Deed of Trust: A Deed of Trust is a legal instrument used to secure a loan by granting the lender a legal interest in the property. This document serves to protect the rights of the lender in case the borrower defaults on the loan. In the context of a development loan, the Deed of Trust ensures that the borrower's property and assets can be used as collateral for securing the loan amount. Keywords: Beaumont Texas, Development Loan, Deed of Trust, Collateral, Loan Default. 2. Beaumont Texas Security Agreement: A Security Agreement is a legally binding contract that establishes a creditor's security interest in the borrower's personal or business assets. For development loans, this agreement allows the lender to claim the property or other assets held by the borrower in the event of loan default. The Security Agreement provides additional security for the lender by outlining the specific collateral that will be used to secure the loan. Keywords: Beaumont Texas, Security Agreement, Development Loan, Collateral, Default. 3. Beaumont Texas Financing Statement: A Financing Statement is a document filed with the appropriate state agency to serve as public notice that a secured interest exists in the borrower's property or assets. In Beaumont, Texas, the filing is typically done with the County Clerk's office. The Financing Statement provides information about the borrower, lender, collateral, and other details necessary to publicly establish the secured interest in the property or assets. Keywords: Beaumont Texas, Financing Statement, Secured Interest, Public Notice, County Clerk. It is essential to note that while these documents serve similar purposes, their specific content may vary depending on the terms negotiated between the borrower and lender. Different types or variations of these documents can arise based on the unique circumstances and requirements of the loan agreement. Nonetheless, the fundamental objective remains the same: to safeguard the lender's interests by securing the loan with collateral.

Beaumont Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Beaumont Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any law education to create such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Beaumont Texas Development Loan Deed of Trust, Security Agreement and Financing Statement or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Beaumont Texas Development Loan Deed of Trust, Security Agreement and Financing Statement quickly using our reliable platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps prior to obtaining the Beaumont Texas Development Loan Deed of Trust, Security Agreement and Financing Statement:

- Be sure the form you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the form and read a short description (if available) of cases the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment method and proceed to download the Beaumont Texas Development Loan Deed of Trust, Security Agreement and Financing Statement once the payment is through.

You’re good to go! Now you can proceed to print out the form or fill it out online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.