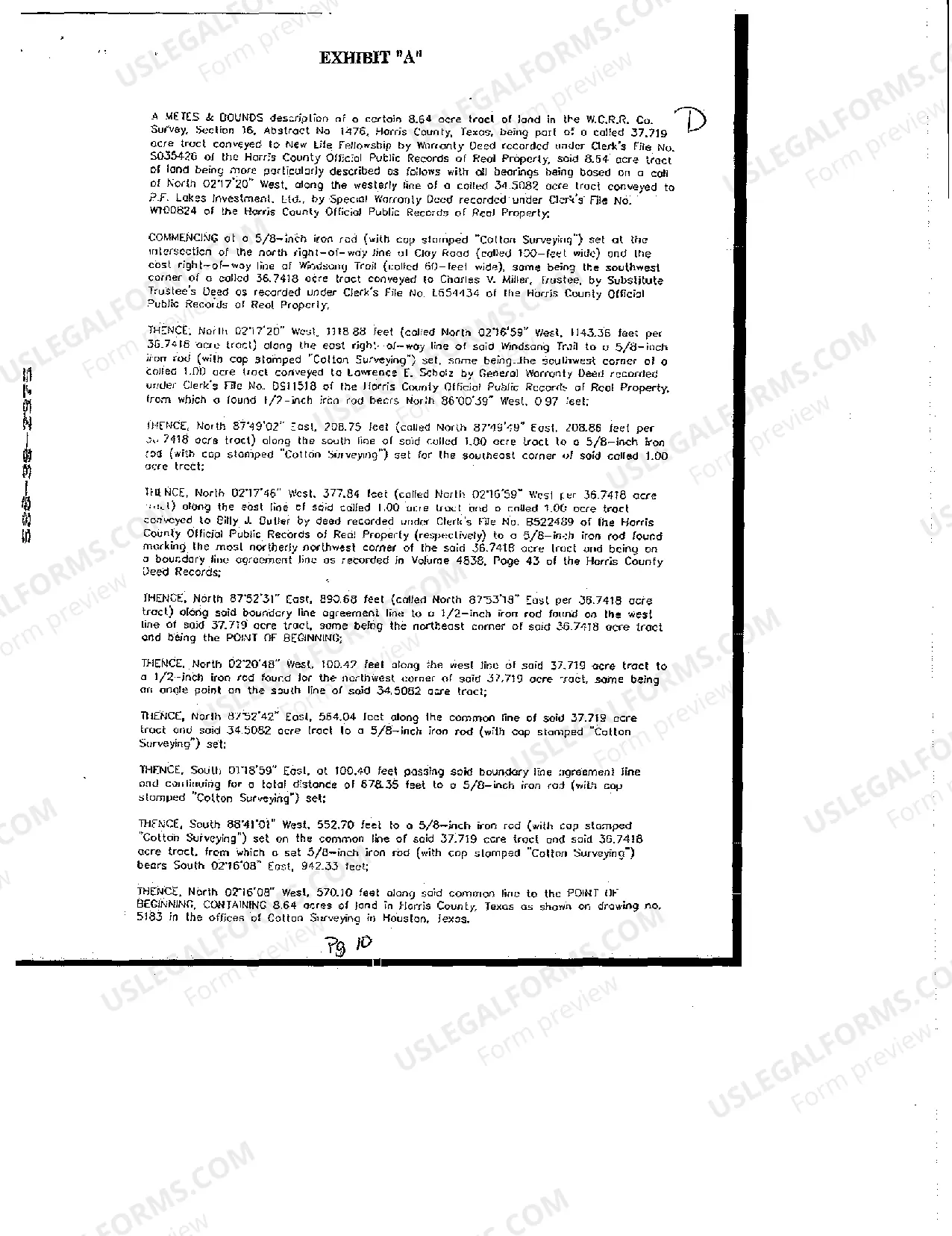

The Fort Worth Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are important legal documents that establish and secure loans for development projects in Fort Worth, Texas. These documents provide lenders with necessary safeguards and rights to protect their interests in the loan and the development project. The Development Loan Deed of Trust serves as a legal agreement between the borrower (typically a developer or property owner) and the lender (such as a bank or financial institution). It outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. The deed of trust also grants the lender a security interest in the property being developed, which typically serves as collateral for the loan. This means that in the event of default, the lender has the right to take possession of the property and sell it to recover their investment. The Security Agreement is another critical component of the loan documentation. It provides an additional layer of security for the lender by allowing them to file a lien on specific assets related to the development project, such as land, buildings, or equipment. By establishing this lien, the lender ensures that they have a priority claim on these assets in the event of default or bankruptcy. This helps protect their investment and increases the likelihood of repayment. The Financing Statement is a document filed with the appropriate governmental authority, typically the county recorder's office, to publicly notify other creditors and parties about the lender's security interest in the property. This statement provides important information, including the names of the borrower and lender, a description of the property, and the terms and conditions of the loan. By filing the financing statement, the lender establishes their priority position as a secured creditor and puts others on notice of their interest in the property. It is important to note that the specifics of the Fort Worth Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement can vary depending on the circumstances and parties involved. Different types of these documents may exist based on the nature of the development project or the preferences of the lender. Some examples of variations could include a Construction Loan Deed of Trust, a Master Security Agreement for multiple projects, or specific Financing Statements for different phases of construction. Overall, the Fort Worth Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement play a crucial role in facilitating development projects in Fort Worth, Texas. They provide lenders with the necessary legal tools to safeguard their investments and ensure repayment, while also offering borrowers access to the capital needed for their projects.

Fort Worth Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

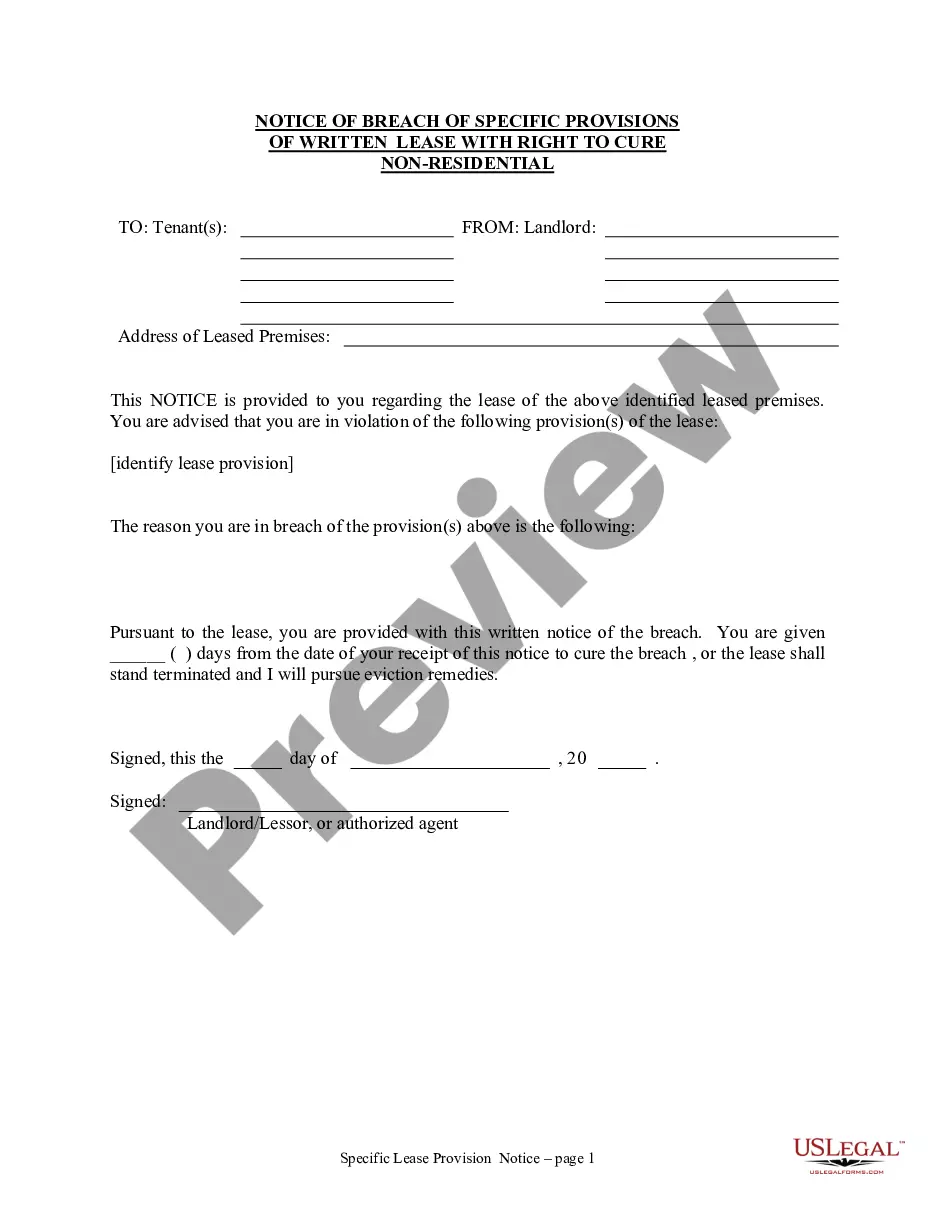

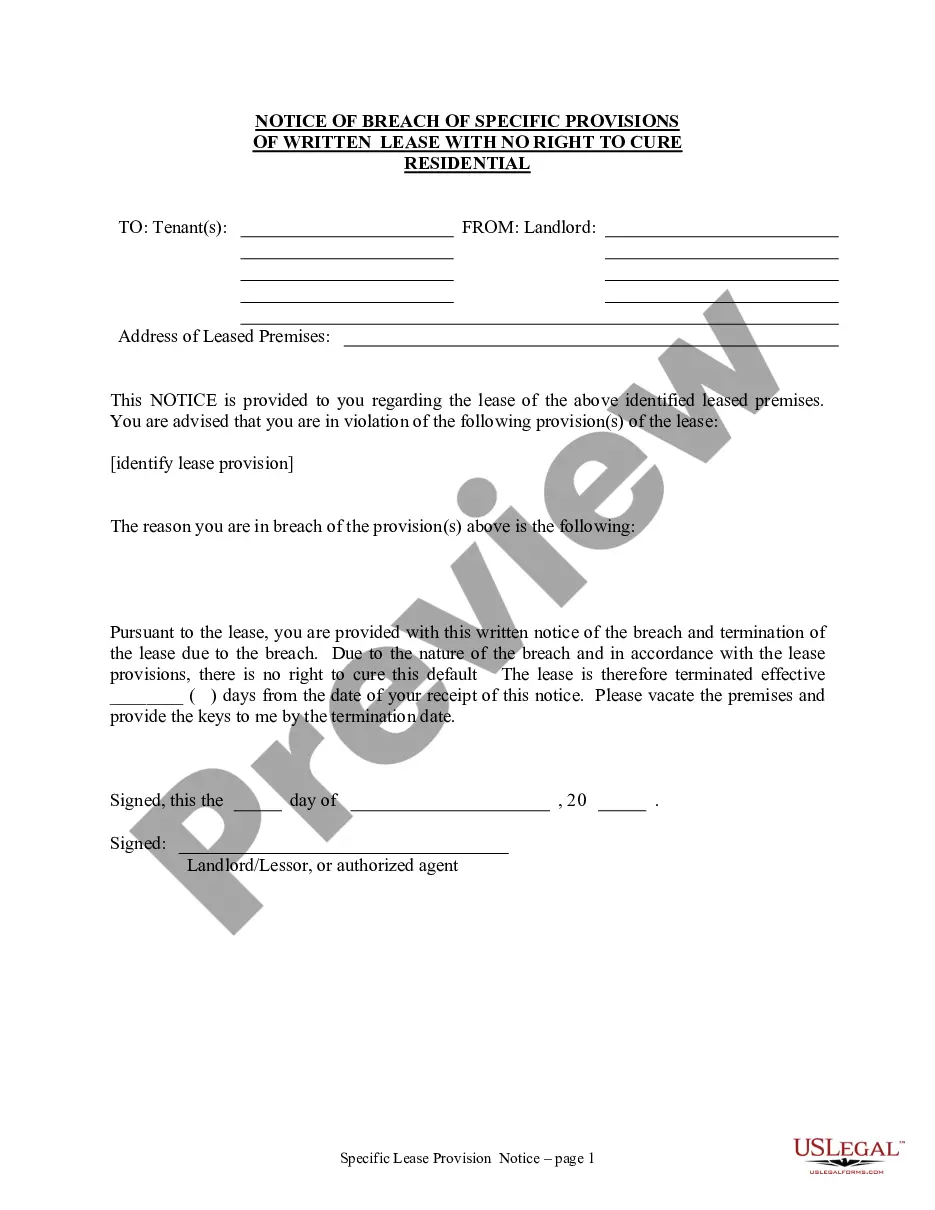

How to fill out Fort Worth Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

We consistently endeavor to reduce or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney solutions that are typically quite expensive.

However, not every legal challenge is as intricate.

Many can be handled independently.

Utilize US Legal Forms whenever you need to locate and download the Fort Worth Texas Development Loan Deed of Trust, Security Agreement and Financing Statement or any other document conveniently and securely. Simply Log In/">Log In to your account and click the Get button next to it. If you have misplaced the document, you can always redownload it in the My documents section. The process is equally simple if you’re new to the platform! You can create your account in a matter of minutes. Ensure to verify if the Fort Worth Texas Development Loan Deed of Trust, Security Agreement and Financing Statement conforms to the laws and regulations of your state and region. Additionally, it is crucial to review the form's outline (if available), and if you find any inconsistencies with your original requirements, look for a different template. Once you’ve confirmed that the Fort Worth Texas Development Loan Deed of Trust, Security Agreement and Financing Statement suits your needs, you can select the subscription option and proceed to payment. Following that, you can download the document in any available file format. With over 24 years in the industry, we’ve assisted millions by providing customizable and up-to-date legal documents. Take full advantage of US Legal Forms now to conserve effort and resources!

- US Legal Forms is an online assortment of current DIY legal papers spanning everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our repository empowers you to manage your affairs without resorting to an attorney.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and areas, significantly easing the search process.