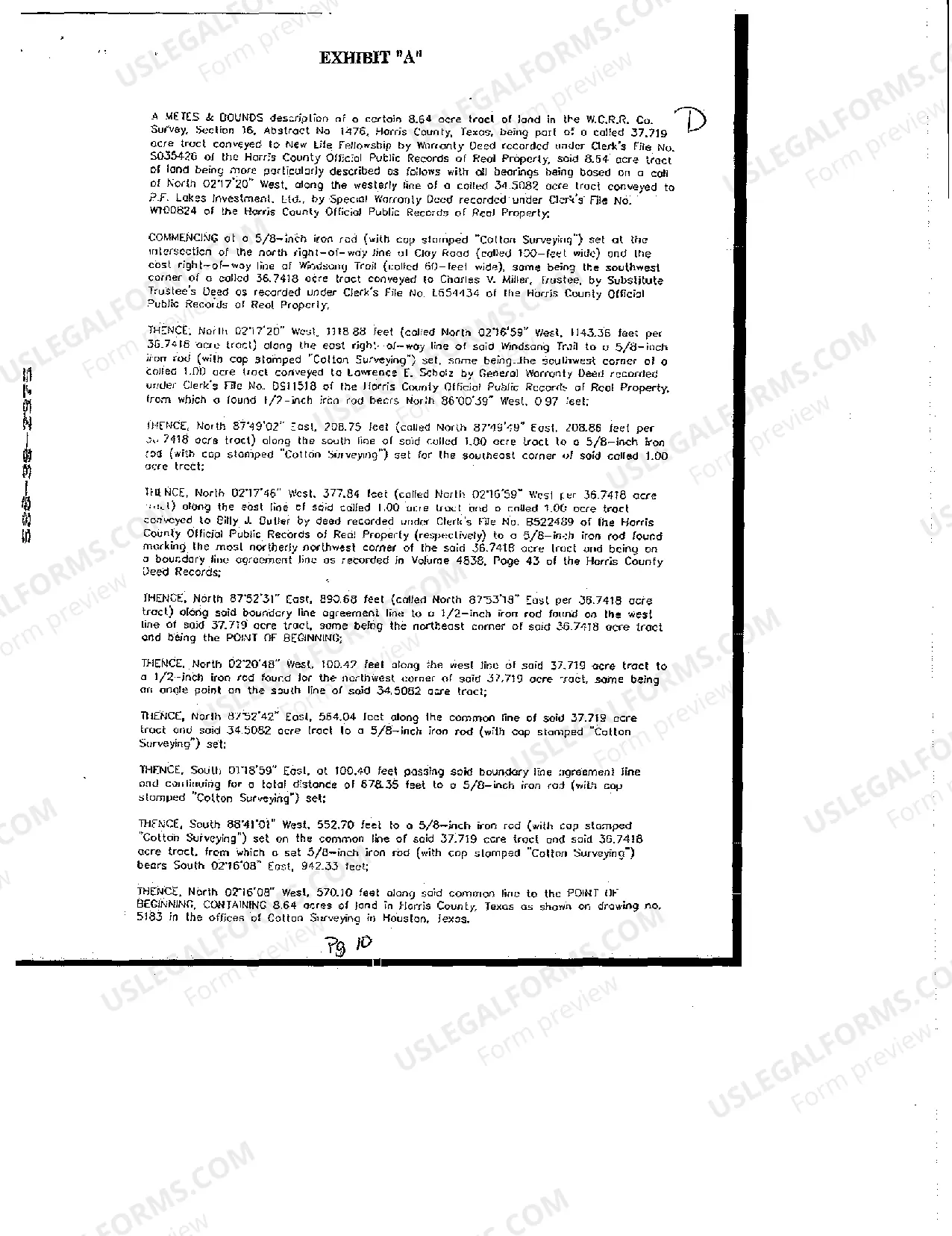

The Harris Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are crucial legal documents used in real estate and property development transactions in Harris County, Texas. These documents play a vital role in securing loans, establishing trust agreements, and providing collateral for lenders. Targeted keywords that should be included are "Harris Texas Development Loan," "Deed of Trust," "Security Agreement," "Financing Statement," "real estate," "property development," and "Harris County, Texas." Types of Harris Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement: 1. Harris Texas Development Loan Deed of Trust: The Harris Texas Development Loan Deed of Trust serves as a legal agreement between the borrower and the lender, granting the lender a secured interest in the property being developed. It outlines the terms and conditions of the loan, including repayment schedule, interest rate, and foreclosure procedures. This deed of trust ensures that the lender has a lien on the property until the loan is fully repaid. 2. Harris Texas Development Loan Security Agreement: The Harris Texas Development Loan Security Agreement is a document that creates a lien on personal property owned by the borrower, which serves as collateral for the loan. This agreement allows the lender to seize and sell the borrower's personal property in case of default or non-payment. It typically includes a detailed description of the collateral, conditions for default, and remedies available to the lender. 3. Harris Texas Development Loan Financing Statement: The Harris Texas Development Loan Financing Statement is a public record that provides notice to other potential lenders about the lender's security interest in the property being developed. It is filed with the County Recorder's Office and includes information about the borrower, lender, and collateral involved in the loan. This document ensures that other creditors are aware of the existing lien, avoiding conflicting claims on the property. These documents are crucial for both lenders and borrowers in Harris County, Texas, as they establish legal boundaries and safeguards in property development loans. It is essential to consult with legal professionals experienced in Texas real estate law to ensure accurate and compliant preparation and execution of these documents. These contracts provide security, transparency, and protection for all parties involved in the development loan process.

Harris Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Harris Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Harris Texas Development Loan Deed of Trust, Security Agreement and Financing Statement becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Harris Texas Development Loan Deed of Trust, Security Agreement and Financing Statement takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Harris Texas Development Loan Deed of Trust, Security Agreement and Financing Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!