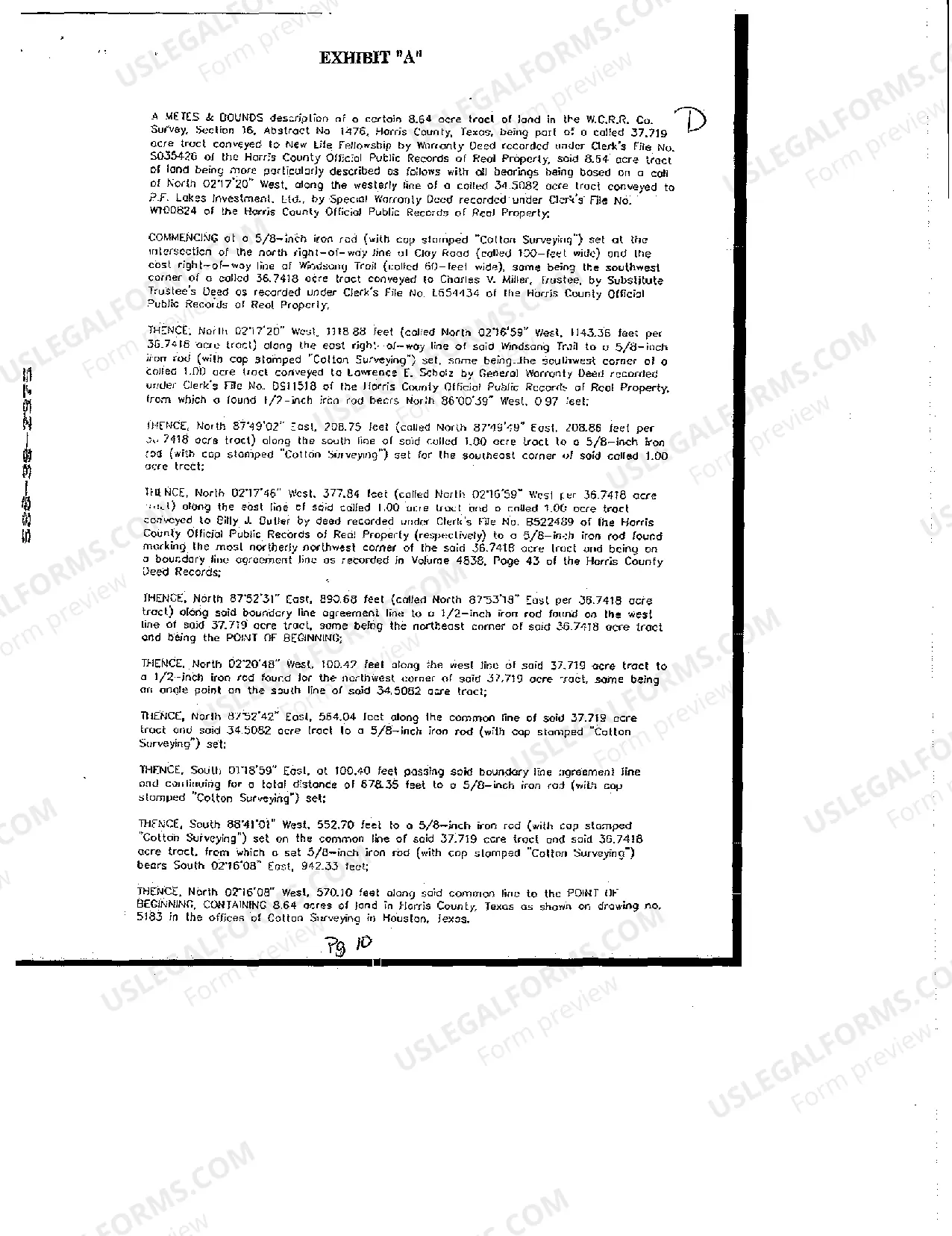

The League City Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are legal documents that play a crucial role in the real estate development process within League City, Texas. These documents establish a financial relationship between a lender and a borrower, typically a developer, seeking funds for development projects. They provide a secured loan structure, ensuring that the lender's interests are protected in case of default or non-payment by the borrower. The League City Texas Development Loan Deed of Trust sets out the terms and conditions of the loan, outlining the responsibilities and rights of both parties. It specifically involves a trust agreement, where the borrower (grantee) transfers the legal title of the property to a trustee until the loan is repaid. This trust agreement serves as the collateral for the loan, providing the lender with a means of recourse if the borrower fails to fulfill their payment obligations. The Security Agreement is another essential document associated with the League City Texas Development Loan. It allows the lender to claim additional collateral to secure the loan, such as personal property or future proceeds from the project. This agreement helps further protect the lender's interests by providing alternative forms of repayment if the real estate alone cannot cover the debt. To record and make the loan's details public, a Financing Statement is typically filed with the appropriate office, such as the County Recorder's Office or Secretary of State. This document provides notice to other potential creditors or interested parties that the lender has a security interest in the borrower's property. While these terms generally describe the League City Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement, it's important to note that different types or variations of these documents may exist based on the specific circumstances and requirements of the loan or development project. For instance, particular loan agreements may incorporate additional provisions or restrictions depending on the nature of the development, such as residential, commercial, or mixed-use projects. It is recommended to consult a legal professional or mortgage specialist to ensure compliance with local regulations and to tailor these documents appropriately for each scenario.

League City Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out League City Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Benefit from the US Legal Forms and have instant access to any form template you want. Our useful platform with a huge number of document templates simplifies the way to find and obtain almost any document sample you need. You are able to download, fill, and certify the League City Texas Development Loan Deed of Trust, Security Agreement and Financing Statement in just a couple of minutes instead of surfing the Net for many hours attempting to find the right template.

Utilizing our collection is a superb strategy to raise the safety of your document filing. Our professional lawyers regularly check all the documents to ensure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you get the League City Texas Development Loan Deed of Trust, Security Agreement and Financing Statement? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Moreover, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, stick to the tips below:

- Open the page with the form you require. Make sure that it is the template you were looking for: verify its title and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Choose the format to obtain the League City Texas Development Loan Deed of Trust, Security Agreement and Financing Statement and change and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable document libraries on the web. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the League City Texas Development Loan Deed of Trust, Security Agreement and Financing Statement.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!