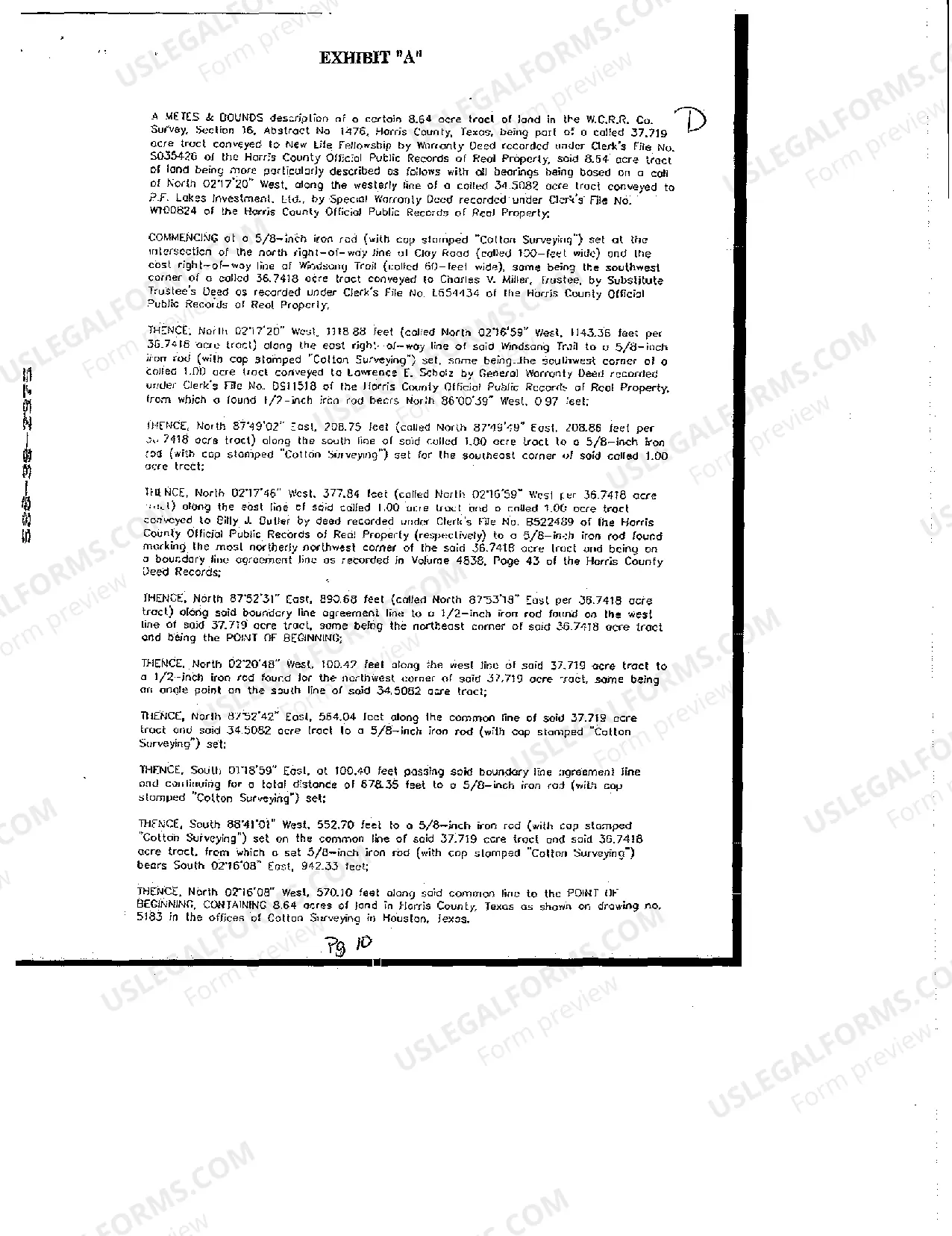

Title: Pasadena Texas Development Loan Deed of Trust, Security Agreement and Financing Statement Introduction: The Pasadena Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are essential legal instruments utilized in real estate and property development transactions in Pasadena, Texas. These documents establish the terms, conditions, and security arrangements to protect lenders and facilitate financing for development projects. This article aims to provide a detailed description of these documents, shedding light on their importance and potential variations. 1. Pasadena Texas Development Loan Deed of Trust: The Pasadena Texas Development Loan Deed of Trust serves as a crucial document in real estate financing arrangements. It is a legal contract between a borrower and a lender that creates a lien on a property to secure the loan. This lien ensures that if the borrower defaults on the loan, the lender has the right to foreclose and sell the property to recover its investment. Keywords: Pasadena Texas development loan deed of trust, real estate financing, lien, borrower, lender, loan default, foreclosure, property investment. 2. Security Agreement: The Security Agreement, often accompanying the Development Loan Deed of Trust, provides additional security measures for lenders. This document allows the borrower to pledge collateral, such as machinery, equipment, or any other valuable assets, to secure the loan. In case of default, the lender possesses the right to seize and sell the pledged assets to recover the outstanding debt. Keywords: Security agreement, collateral, default, valuable assets, pledge, lender, borrower, outstanding debt. 3. Financing Statement: A Financing Statement is an important document used to publicly record the security interest of a lender in a development project. This statement is filed with a designated state authority, such as the county clerk's office, to provide public notice of the lender's claim to the property being used as collateral. It ensures that other potential lenders or creditors are aware of the existing lien, minimizing the risk of multiple claims on the same property. Keywords: Financing statement, security interest, development project, public notice, collateral, lender's claim, risk mitigation. Different types of Pasadena Texas Development Loan Deed of Trust, Security Agreement and Financing Statement: a) Ordinary Development Loan Deed of Trust: This type of Deed of Trust is the most commonly used in Pasadena, Texas, for development loans. It typically covers standard terms and conditions, outlining the obligations, rights, and responsibilities of both lender and borrower. b) Residential Development Loan Deed of Trust: This variation is specific to residential development projects in Pasadena, Texas. It may include additional clauses related to zoning, homeowner associations, and compliance with residential building codes. c) Commercial Development Loan Deed of Trust: This Deed of Trust variant caters specifically to commercial development projects, such as shopping centers or office complexes, in Pasadena, Texas. It may address commercial zoning regulations, leasing restrictions, and the intended purpose of the property. Conclusion: The Pasadena Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are vital legal documents used to secure financing for property development projects. These documents ensure a lender's protection and provide clarity on the borrower's responsibilities. Understanding different variations of these documents allows parties to customize and address specific aspects of their projects, such as residential or commercial development.

Pasadena Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Pasadena Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

If you are looking for a legitimate document, it’s challenging to find a more suitable location than the US Legal Forms website – one of the largest collections online.

With this collection, you can access a vast number of document samples for business and personal purposes categorized by types and states or keywords.

Utilizing our sophisticated search feature, locating the latest Pasadena Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement is as simple as 1-2-3.

Receive the document. Choose the file format and download it to your device.

Make alterations. Complete, edit, print, and sign the obtained Pasadena Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement.

- If you are already familiar with our site and possess a registered account, all you need to do to obtain the Pasadena Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have accessed the template you need. Review its description and use the Preview option (if available) to view its contents. If it does not meet your requirements, use the Search feature at the top of the page to find the necessary document.

- Verify your choice. Click on the Buy now button. Then, select your desired pricing plan and provide information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

This Deed of Trust is a security agreement and financing statement under the Uniform Commercial Code for the benefit of Lender as secured party for any of the items specified above as part of the Property which, under applicable law, may be subject to a security interest pursuant to the Uniform Commercial Code, and

A Standard Document used to convey Texas real property to a revocable trust. This Standard Document can be drafted as a warranty deed or special warranty deed and contains integrated notes and drafting tips.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.

Section 13.001 - Validity of Unrecorded Instrument (a) A conveyance of real property or an interest in real property or a mortgage or deed of trust is void as to a creditor or to a subsequent purchaser for a valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed

Recording Deeds Texas does not require that a deed be recorded in the county clerk's real property records in order to be valid. The only requirement is that it is executed and delivered to the grantee, which then makes the transfer fully effective.