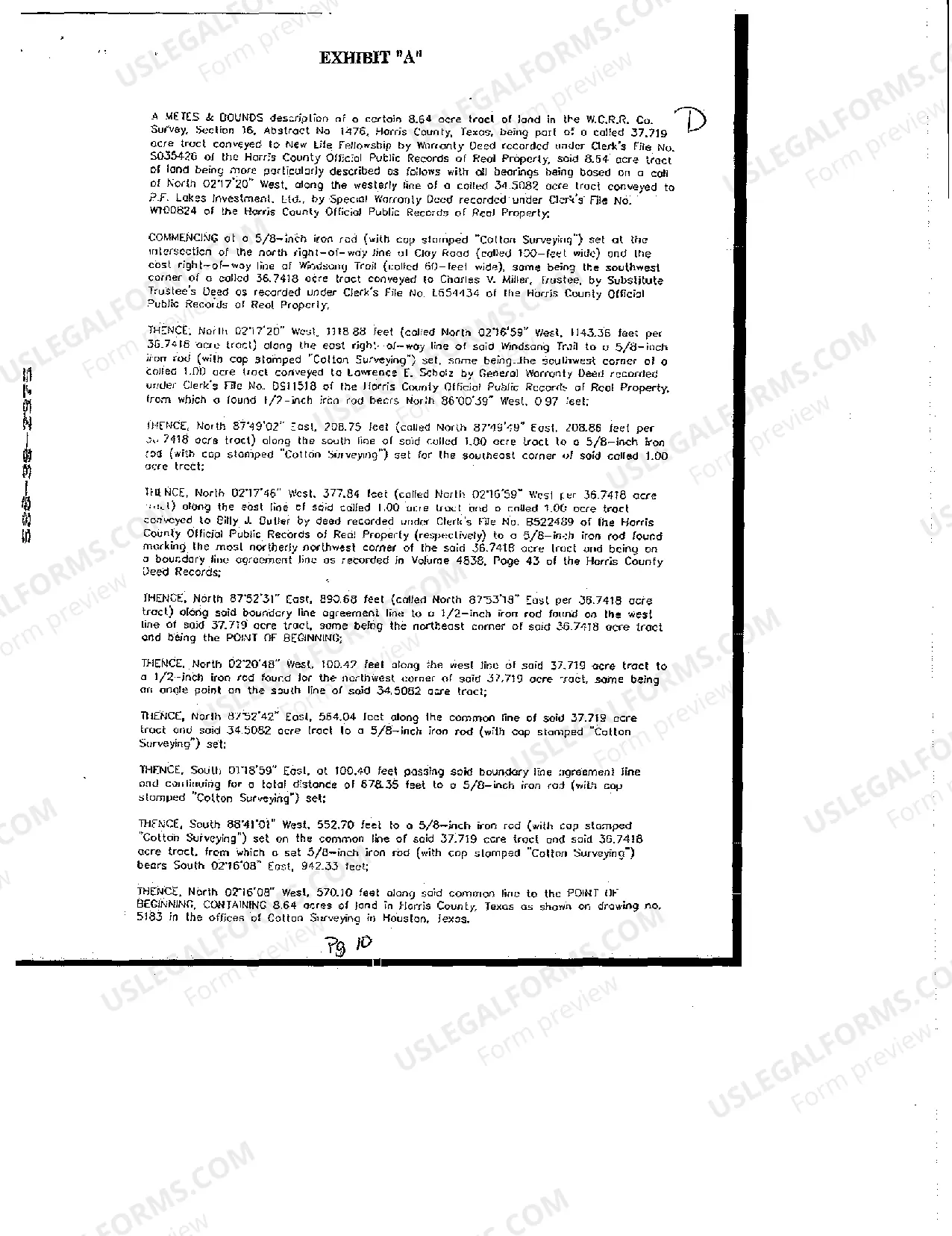

Pearland Texas Development Loan Deed of Trust A Pearland Texas Development Loan Deed of Trust is a legal agreement entered into between a borrower and a lender for financing a development project in Pearland, Texas. This agreement secures the lender's interest in the borrower's property by creating a lien against it. The Deed of Trust serves as a document that outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable penalties or fees. It also acts as a mechanism to transfer the title of the property to a trustee who holds it until the loan is fully repaid. The Development Loan Deed of Trust ensures that the lender has rights to the property if the borrower defaults on the loan. In such cases, the lender can initiate foreclosure proceedings, sell the property, and recoup their investment. Different types of Pearland Texas Development Loan Deed of Trust may include: 1. Residential Development Loan Deed of Trust: This type of Deed of Trust is used when financing the development of residential properties in Pearland, Texas. It applies to loans taken for building single-family homes, townhouses, or residential complexes. 2. Commercial Development Loan Deed of Trust: This Deed of Trust is employed for financing the development of commercial properties, such as offices, retail buildings, warehouses, or industrial facilities in Pearland, Texas. Security Agreement: The Security Agreement is an integral part of the Pearland Texas Development Loan Deed of Trust. It is a legal contract that details the collateral pledged to secure the loan. This agreement allows the lender to take ownership or sell the collateral if the borrower defaults on the loan. The Security Agreement specifies the nature and description of the collateral, such as real estate, personal property, or even future assets acquired during the development project. It also sets forth the rights and responsibilities of both the borrower and the lender in relation to the collateral. Financing Statement: A Financing Statement, also known as a UCC-1 form, is an essential component of the Pearland Texas Development Loan Deed of Trust. It is a public record that serves as notice to third parties about the lender's security interests. This statement is typically filed with the Secretary of State's office to establish the priority of the lender's claim on the collateral. The Financing Statement contains detailed information about the borrower, lender, collateral, and other relevant details. It serves as an essential tool for potential creditors to determine if a particular property has existing liens or encumbrances. In summary, a Pearland Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are crucial legal documents that protect the interests of lenders and borrowers during development projects. They ensure that the loan is secured with collateral, outlines the terms, and provides a mechanism for recourse in case of default. Different types of Deeds of Trust may be utilized based on the nature of the development, such as residential or commercial.

Pearland Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Pearland Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney solutions that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Pearland Texas Development Loan Deed of Trust, Security Agreement and Financing Statement or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Pearland Texas Development Loan Deed of Trust, Security Agreement and Financing Statement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Pearland Texas Development Loan Deed of Trust, Security Agreement and Financing Statement is proper for you, you can select the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!