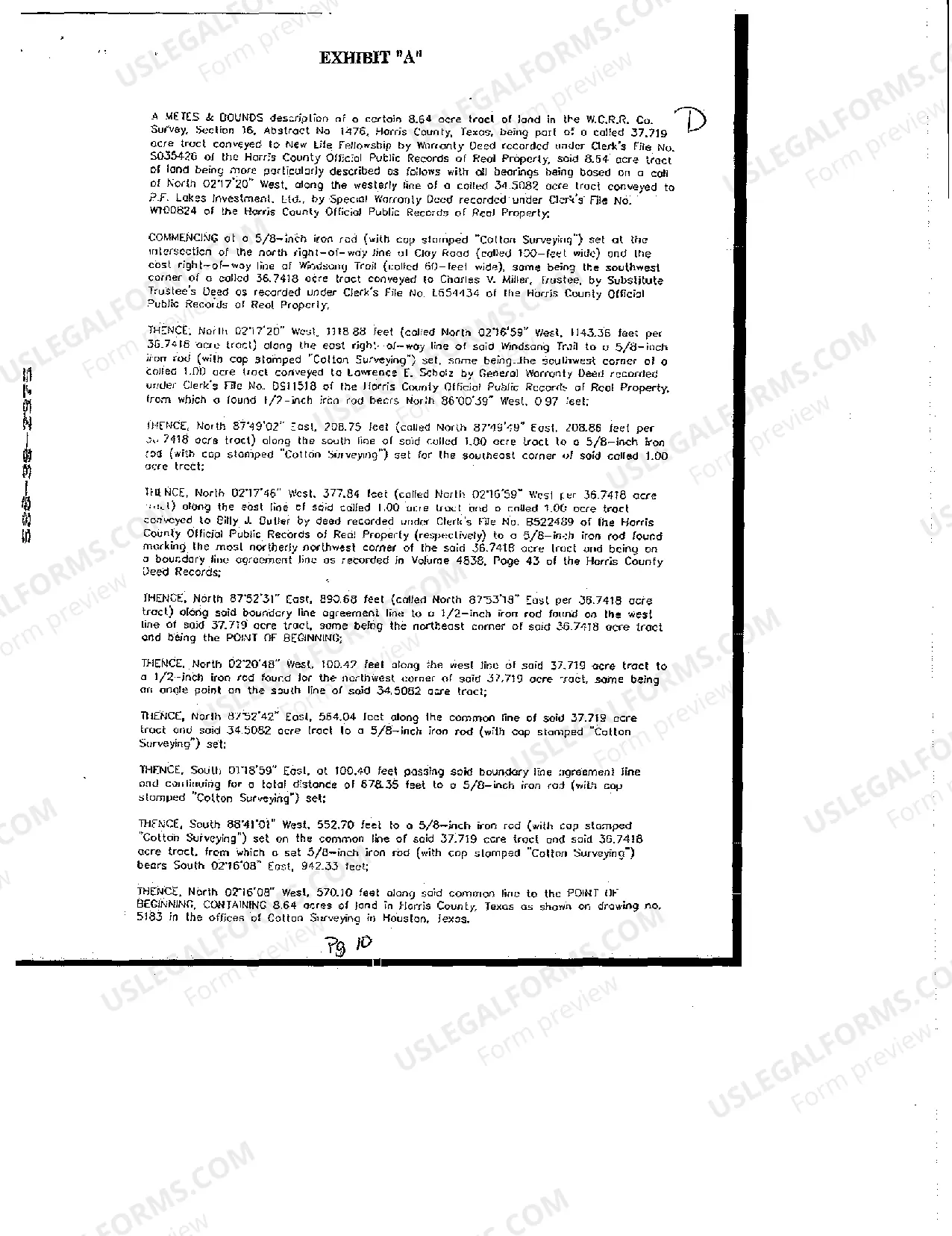

The Plano Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are crucial legal documents used in real estate and financing transactions within Plano, Texas. These documents provide a framework for securing lenders' rights and interests in a development loan. They contain specific provisions and clauses that protect both the lender and the borrower, ensuring a reliable and legally binding transaction. Now, let's explore each document in detail, along with their different types, if applicable. 1. Plano Texas Development Loan Deed of Trust: The Plano Texas Development Loan Deed of Trust is a legal instrument that serves as security for the repayment of a development loan. It involves three parties: the borrower (developer), the lender, and the trustee. This document outlines the details of the loan, such as the principal amount, interest rate, repayment terms, and any specific conditions agreed upon. The borrower pledges the property and any improvements as collateral, allowing the lender to exercise certain rights if the borrower defaults on the loan. The Deed of Trust is recorded in the county records, publicly evidencing the lender's secured interest. Types of Plano Texas Development Loan Deed of Trust: a) Junior Deed of Trust — In case the borrower seeks additional financing, a junior deed of trust may be created, subordinate to the primary deed of trust. This arrangement grants the subsequent lender a lower priority, ensuring the primary lender's first claim on the property in case of default or foreclosure. b) Senior Deed of Trust — A senior deed of trust denotes the primary loan secured by the property. It holds a higher priority over any junior liens or encumbrances. This type is typically used when no additional financing is involved. 2. Security Agreement: The Security Agreement is a document accompanying the Plano Texas Development Loan. It establishes a legal interest in personal property to secure repayment of the loan. In real estate development, this may include assets such as construction equipment, materials, or fixtures that are not considered part of the real property. By executing a Security Agreement, the borrower grants the lender a security interest in these assets, providing an additional layer of assurance. This agreement includes a detailed description of the collateral, any restrictions on its use, and provisions for default or repossession. 3. Financing Statement: The Financing Statement is a document filed with the Secretary of State to publicly disclose the lender's security interest in the borrower's personal property. It is essential for perfecting the lender's claim and establishing priority in case of competing claims from other creditors. The financing statement contains detailed information about the debtor, the collateral, and the secured party. It effectively serves as public notice and enables other parties to identify existing liens on the property. Developers and lenders engaging in Plano Texas real estate projects must carefully draft and execute these documents to protect their interests. Hiring an experienced attorney with expertise in real estate and financing transactions is crucial to ensure the proper structuring and adherence to legal requirements.

Plano Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Plano Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Plano Texas Development Loan Deed of Trust, Security Agreement and Financing Statement becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Plano Texas Development Loan Deed of Trust, Security Agreement and Financing Statement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Plano Texas Development Loan Deed of Trust, Security Agreement and Financing Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!