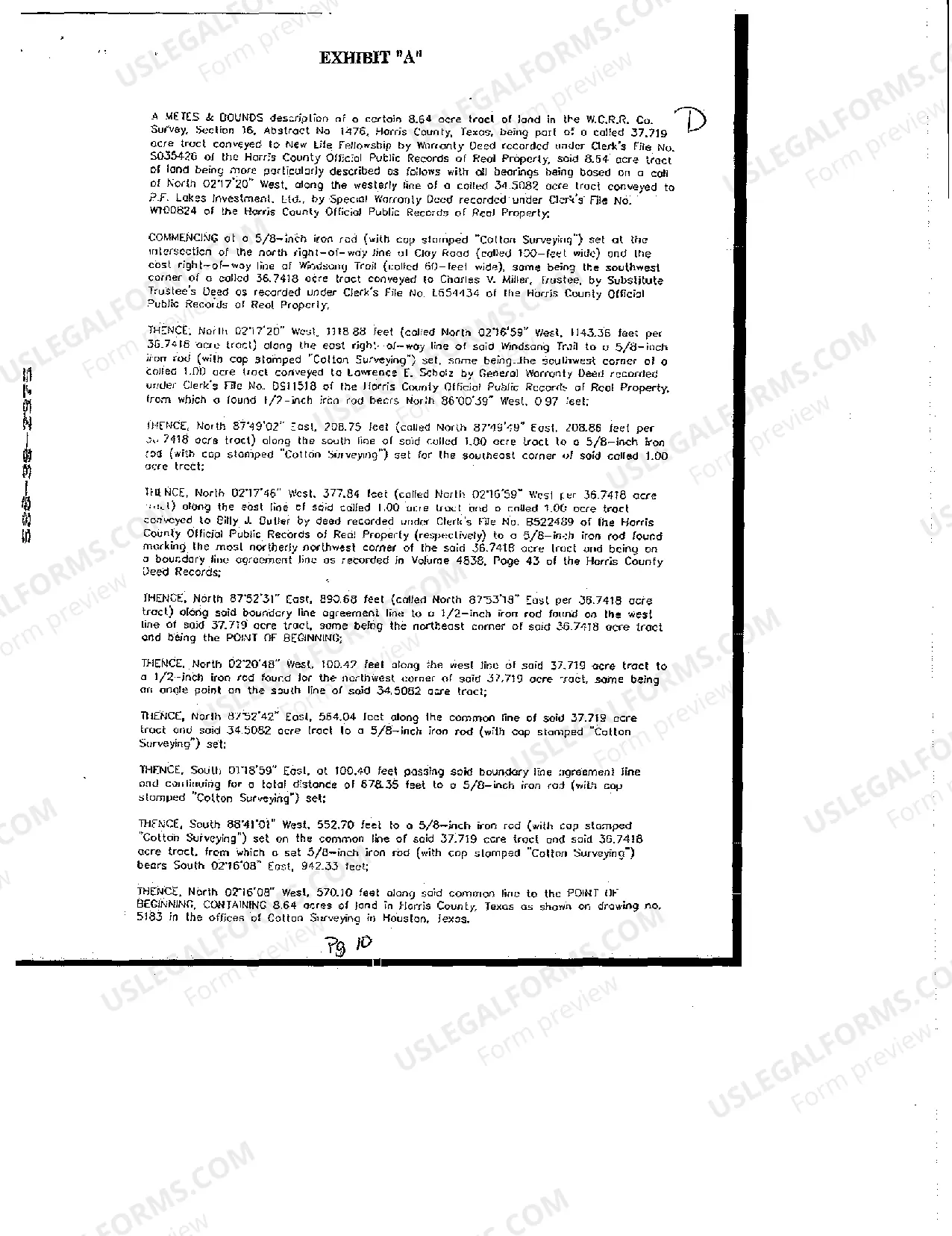

The Sugar Land Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement are crucial legal documents that outline the terms and conditions pertaining to development loans in the city of Sugar Land, Texas. These documents serve to protect the rights and interests of both lenders and borrowers involved in real estate development projects within the Sugar Land region. They help establish a legal framework that ensures repayment of the loan, security for the lender, and protection for the borrower. The Sugar Land Texas Development Loan Deed of Trust is a specific type of deed used to secure a loan by granting a lien on the property. It is an agreement between the borrower, also known as the trust or granter, and the lender, known as the beneficiary or mortgagee. This document enables the lender to claim ownership or sell the property if the borrower defaults on loan payments. Meanwhile, the Security Agreement is an essential component of the overall financing arrangement. It allows the lender to secure the borrower's personal property as collateral or security for the loan. This agreement usually includes details about the type of collateral, its value, and the rights of the lender in case of default. The Financing Statement, often referred to as a UCC-1, is a legal document that provides public notice of the lender's security interest in the borrower's collateral. It is filed with the appropriate government agency, typically the county clerk's office, to establish priority rights and protect the lender's claim against other potential creditors. In terms of different types of Sugar Land Texas Development Loan Deeds of Trust, Security Agreements, and Financing Statements, they may vary based on the specific nature and requirements of the development project. For instance, there might be different loan agreements for residential, commercial, or industrial real estate development projects. Each type would have its own tailored provisions, interest rates, repayment terms, and collateral requirements. Moreover, the parties involved in the loan agreement, such as developers, financial institutions, or private investors, may have their own unique variations of the Sugar Land Texas Development Loan Deed of Trust, Security Agreement, and Financing Statement based on their preferences and risk assessment. Overall, these legal documents play a significant role in the development of real estate projects in Sugar Land, Texas. They ensure proper financing, protect the rights of the parties involved, and establish a clear framework for repayment and collateral security. Any individual or entity involved in real estate development in Sugar Land should seek legal advice and familiarize themselves with the specific requirements and variations of these important documents.

Sugar Land Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Sugar Land Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Do you need a reliable and inexpensive legal forms provider to get the Sugar Land Texas Development Loan Deed of Trust, Security Agreement and Financing Statement? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Sugar Land Texas Development Loan Deed of Trust, Security Agreement and Financing Statement conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Sugar Land Texas Development Loan Deed of Trust, Security Agreement and Financing Statement in any available format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online for good.