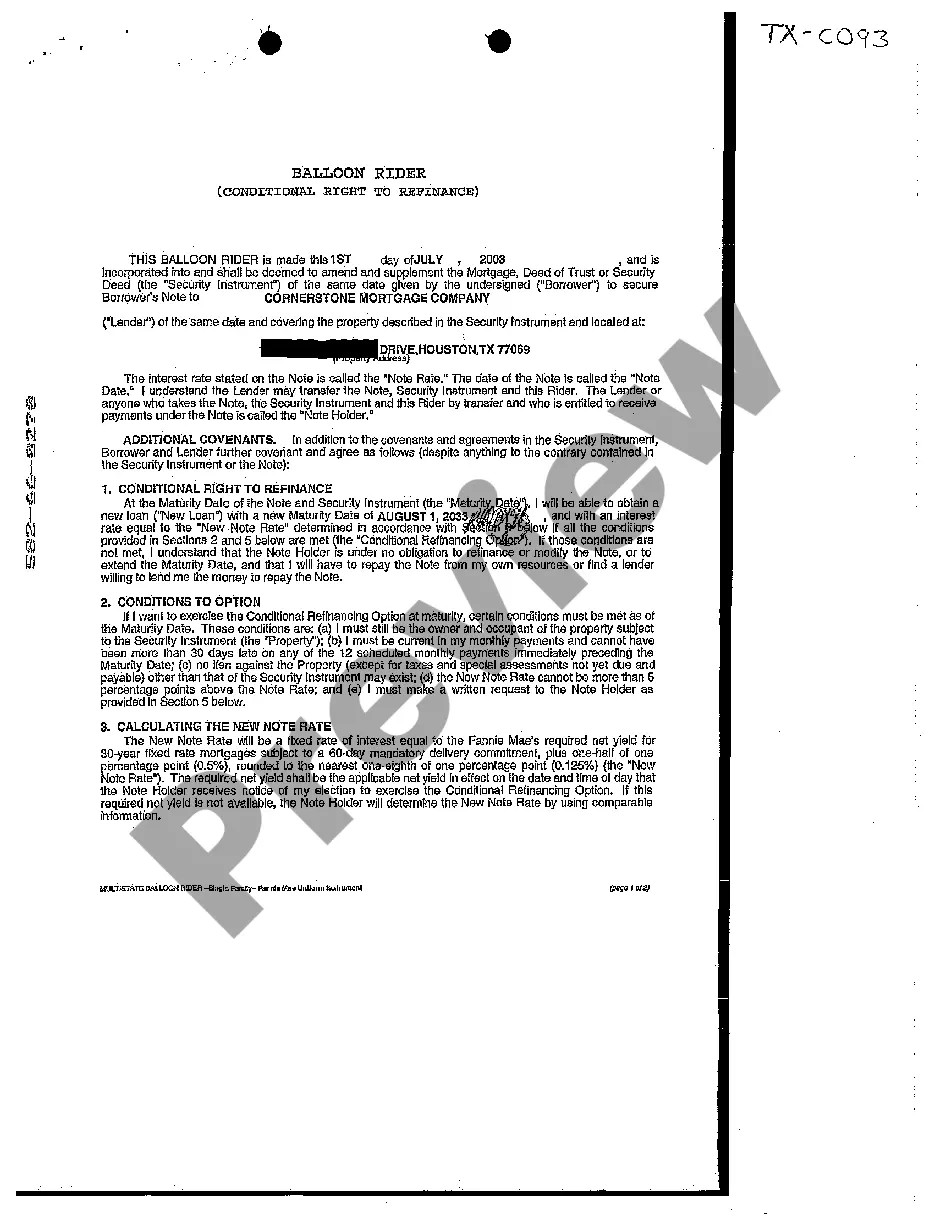

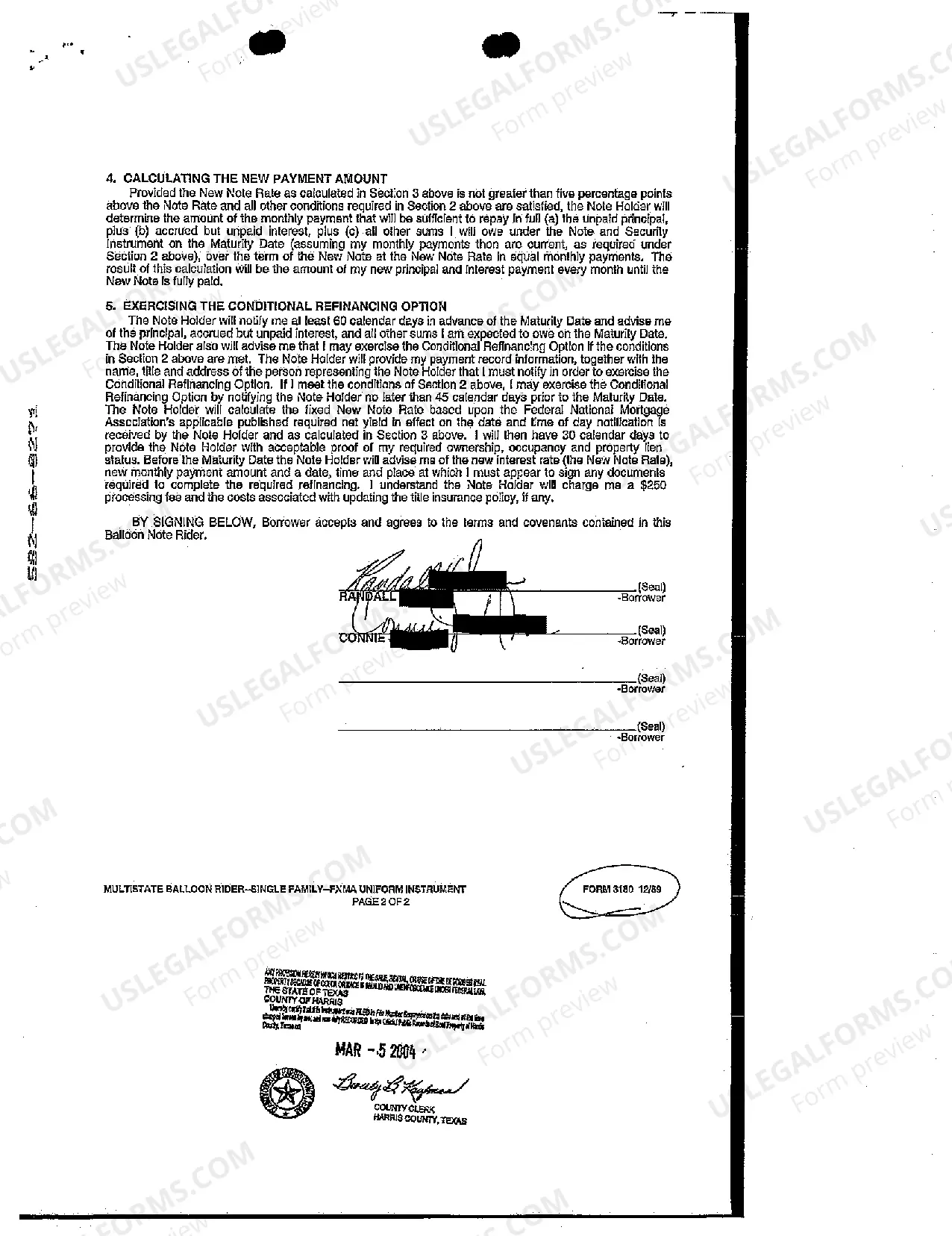

The Brownsville Texas Balloon Rider Mortgage Amendment is a legal document that modifies the terms and conditions of a mortgage loan agreement in the city of Brownsville, Texas. This amendment specifically addresses the inclusion of a balloon payment in the mortgage loan, which is a large payment due at the end of the loan term. The purpose of the Brownsville Texas Balloon Rider Mortgage Amendment is to provide an alternative lending option for homebuyers who may struggle to qualify for conventional mortgage loans or who are looking for more flexibility in their loan terms. This amendment allows borrowers to make lower monthly payments throughout the loan term by deferring a portion of the principal until the end of the loan. One type of Brownsville Texas Balloon Rider Mortgage Amendment is the Fully Amortizing Balloon Payment. With this type of amendment, borrowers make regular monthly payments that are calculated based on a fully amortized loan schedule, meaning the loan is paid off in full by the end of the loan term. However, a lump sum balloon payment will still be due at the end of the loan term. Another type of Brownsville Texas Balloon Rider Mortgage Amendment is the Interest-Only Balloon Payment. This amendment allows borrowers to make monthly payments that only cover the interest portion of the loan for a specified period, typically ranging from 3 to 10 years. At the end of this period, a balloon payment will be due, which includes the remaining principal balance. It is important to note that the terms and availability of the Brownsville Texas Balloon Rider Mortgage Amendment may vary depending on the lender and the specific loan program. Borrowers considering this type of mortgage amendment should carefully review and understand all the terms, including the interest rate, loan term, balloon payment amount, and potential risks associated with balloon mortgages. In conclusion, the Brownsville Texas Balloon Rider Mortgage Amendment offers an alternative lending option for homebuyers in Brownsville who are seeking more flexibility in their loan terms and lower monthly payments. This amendment includes the incorporation of a balloon payment either at the end of the loan term or after an interest-only period. Potential borrowers should consult with lenders and thoroughly review the terms to determine if this mortgage amendment aligns with their financial goals and circumstances.

Brownsville Texas Balloon Rider Mortgage Amendment

Description

How to fill out Brownsville Texas Balloon Rider Mortgage Amendment?

If you are looking for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can find thousands of templates for business and personal purposes by categories and regions, or keywords. With the high-quality search option, finding the most recent Brownsville Texas Balloon Rider Mortgage Amendment is as elementary as 1-2-3. In addition, the relevance of every record is confirmed by a group of skilled lawyers that regularly review the templates on our website and revise them based on the newest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Brownsville Texas Balloon Rider Mortgage Amendment is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the form you need. Check its explanation and make use of the Preview option to explore its content. If it doesn’t meet your needs, use the Search field at the top of the screen to discover the appropriate document.

- Confirm your choice. Select the Buy now button. After that, select your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Select the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the received Brownsville Texas Balloon Rider Mortgage Amendment.

Each form you save in your profile has no expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to have an additional version for enhancing or creating a hard copy, feel free to come back and download it once again at any moment.

Make use of the US Legal Forms professional library to get access to the Brownsville Texas Balloon Rider Mortgage Amendment you were seeking and thousands of other professional and state-specific samples in one place!