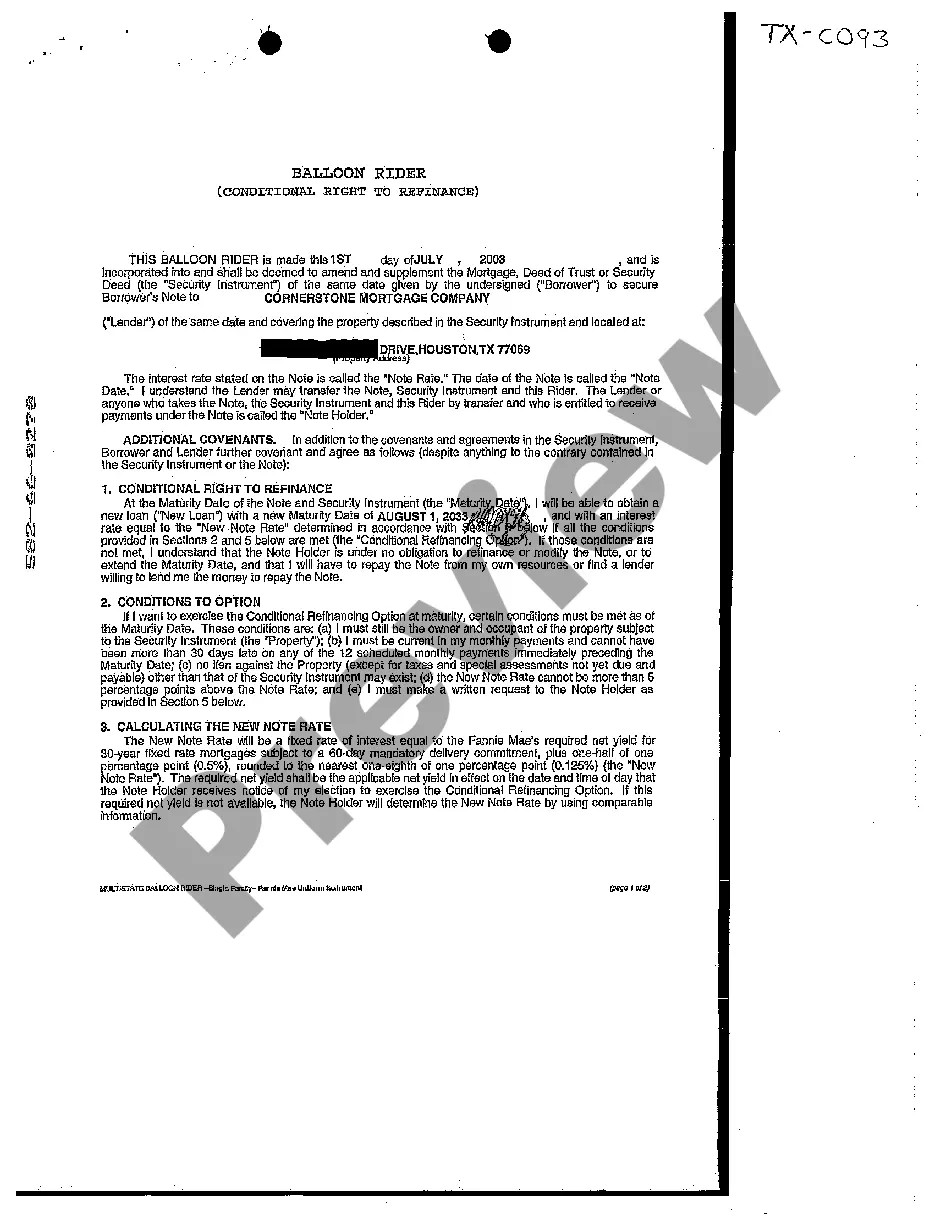

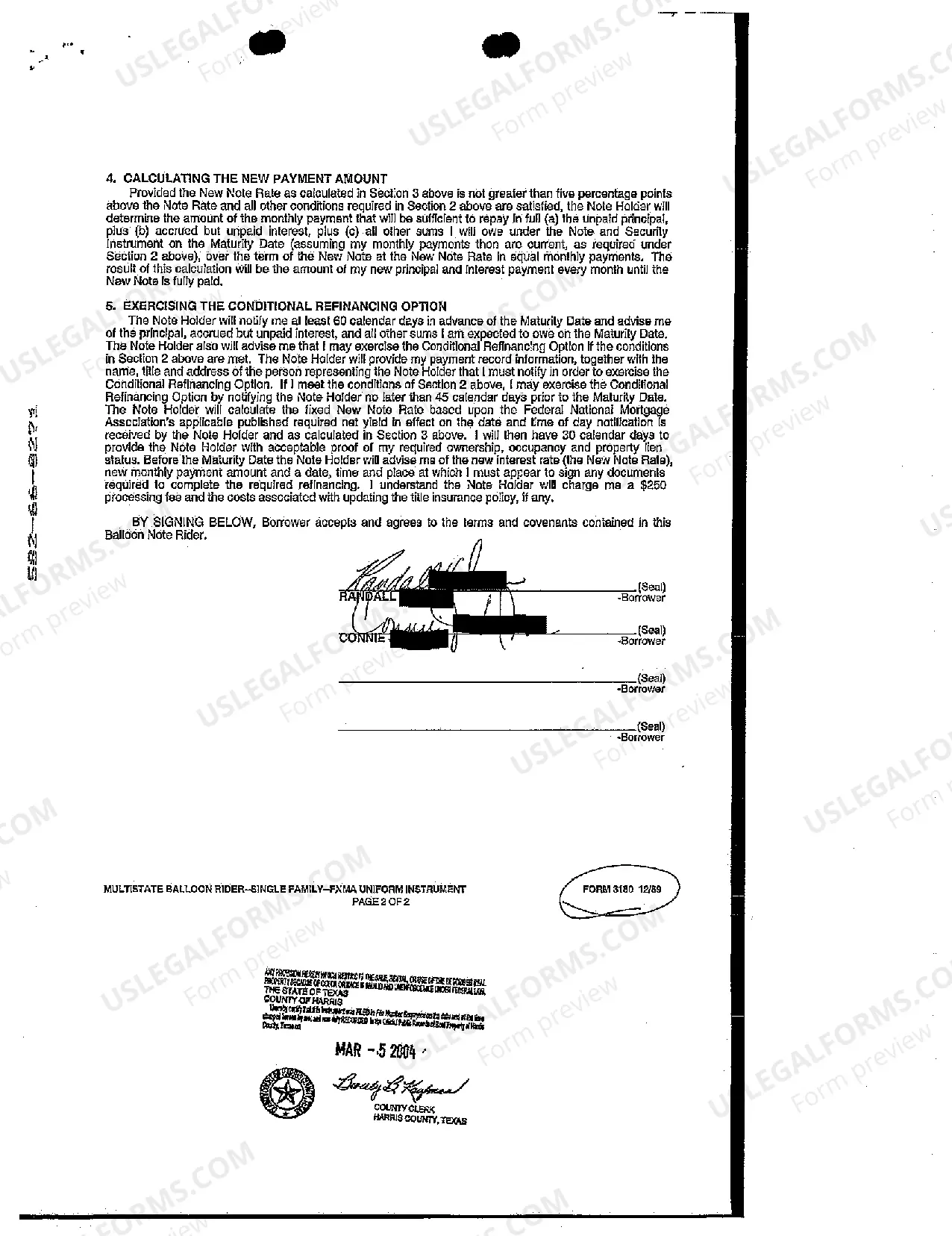

Harris Texas Balloon Rider Mortgage Amendment is a legally binding contract that is used in the state of Texas to modify the terms of a mortgage agreement. It allows homeowners or borrowers to make specific changes to their mortgage loan, particularly ones related to the repayment structure. The Harris Texas Balloon Rider Mortgage Amendment is primarily utilized for mortgages that include a balloon payment feature. A balloon payment is a large lump sum payment that becomes due at the end of the loan term, typically after a period of 5 or 7 years. This type of mortgage is often chosen by borrowers who anticipate refinancing their homes or selling the property before the balloon payment is due. The purpose of the Harris Texas Balloon Rider Mortgage Amendment is to modify the terms of the original mortgage, enabling the borrower to extend the loan term, refinance the loan, or make other necessary changes to avoid the balloon payment. By entering into this amendment, the borrower can alleviate the burden of the large payment and create a more manageable repayment plan. There are different types of Harris Texas Balloon Rider Mortgage Amendments available, depending on the needs of the borrower and the specific terms of the original mortgage. Some commonly used types include: 1. Balloon Refinance Rider: This amendment allows the borrower to refinance the existing mortgage before the balloon payment is due. By obtaining a new loan, the borrower can pay off the original mortgage and avoid the large balloon payment. 2. Balloon Extension Rider: This amendment extends the loan term beyond the initial balloon payment due date. It provides the borrower with additional time to arrange for refinancing, sell the property, or fulfill other payment obligations. 3. Balloon Conversion Rider: This amendment allows the borrower to convert the existing balloon mortgage into a traditional mortgage with fixed monthly payments. It eliminates the balloon payment and spreads the remaining loan balance over a longer period, ensuring a more affordable repayment plan. 4. Balloon Buy down Rider: This type of amendment enables the borrower to reduce the interest rate or monthly payment during the balloon payment period. It provides temporary relief, making the balloon payment more manageable until the borrower can refinance or sell the property. It is crucial for borrowers in Harris County, Texas, to consult with a legal professional or mortgage specialist when considering a Harris Texas Balloon Rider Mortgage Amendment. The specific terms of the amendment, as well as its impact on the overall mortgage agreement, should be thoroughly understood before entering into any modifications. This will ensure that borrowers can make informed decisions about their mortgage repayment strategy and meet their financial obligations effectively.

Harris Texas Balloon Rider Mortgage Amendment

Description

How to fill out Harris Texas Balloon Rider Mortgage Amendment?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person without any law education to create such paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Harris Texas Balloon Rider Mortgage Amendment or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Harris Texas Balloon Rider Mortgage Amendment in minutes using our reliable service. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to downloading the Harris Texas Balloon Rider Mortgage Amendment:

- Be sure the form you have chosen is good for your location because the rules of one state or area do not work for another state or area.

- Preview the document and go through a quick description (if provided) of cases the paper can be used for.

- In case the form you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Harris Texas Balloon Rider Mortgage Amendment as soon as the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.