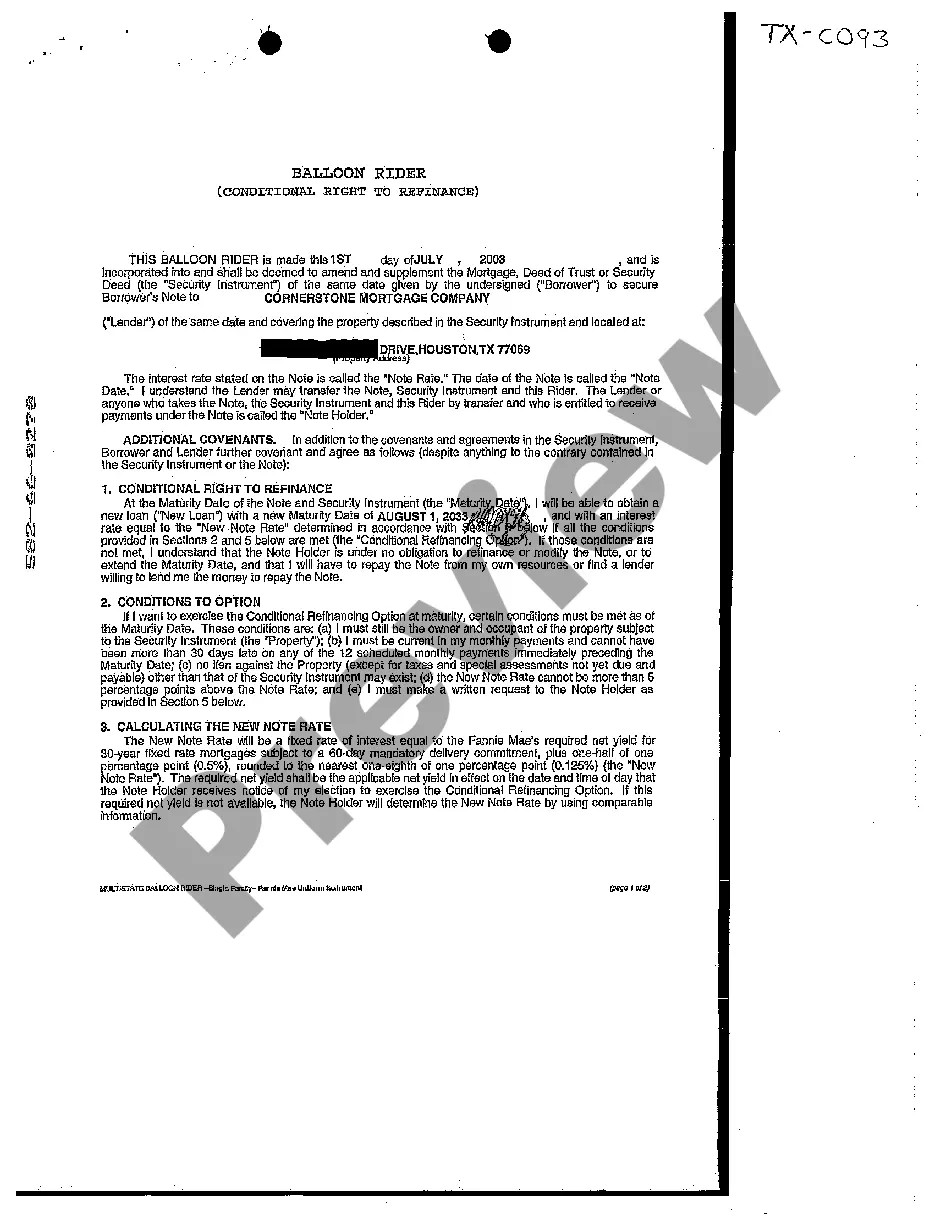

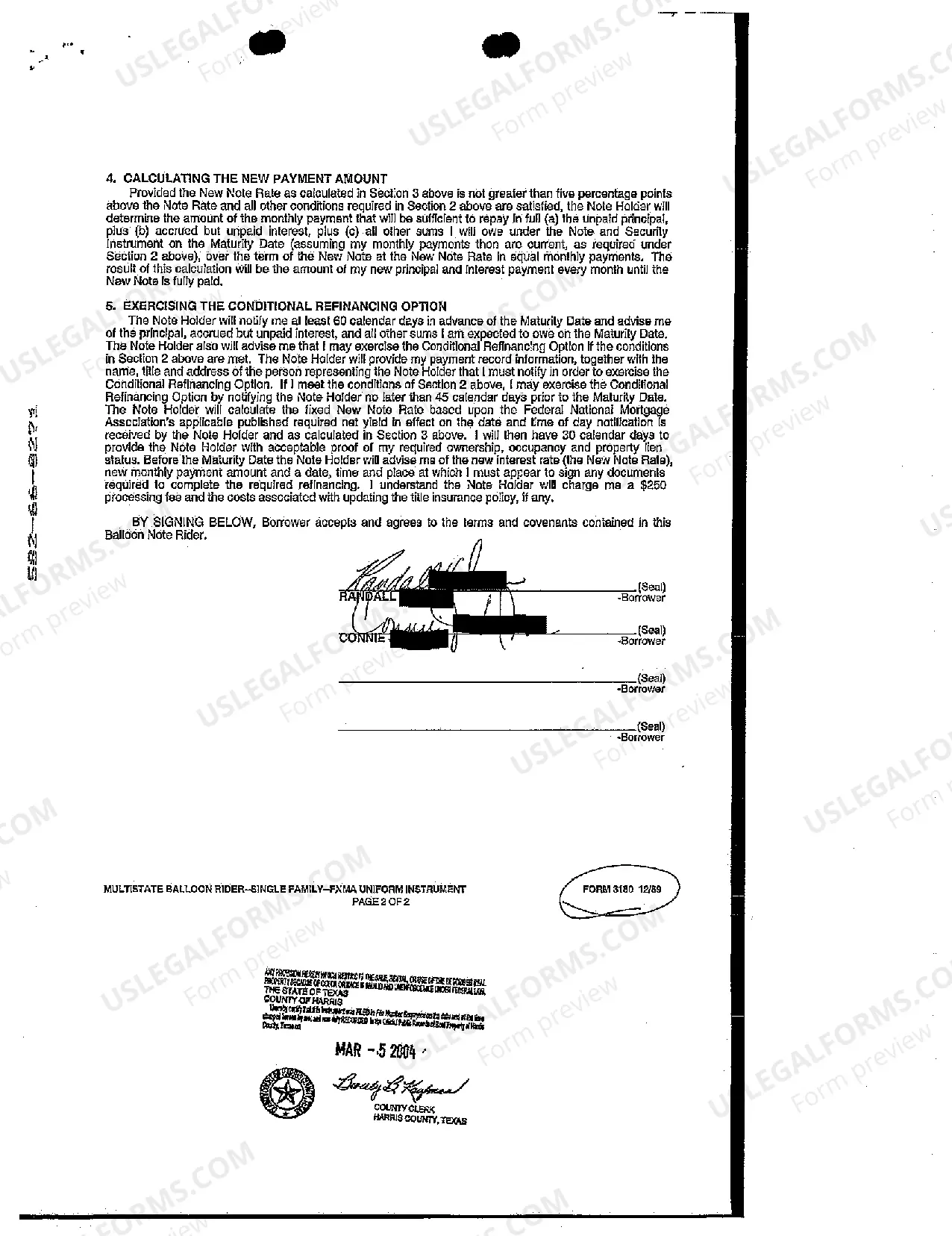

The Houston Texas Balloon Rider Mortgage Amendment refers to a specific type of mortgage modification or addendum that is commonly used in the real estate market in Houston, Texas. This amendment is particularly associated with a unique payment structure known as a "balloon payment," which is a large final payment due at the end of the loan term. Typically, the Houston Texas Balloon Rider Mortgage Amendment is utilized when a borrower wishes to secure a mortgage but anticipates having the means to make a large payment at the end of the loan term. The purpose of this amendment is to allow borrowers to have lower monthly mortgage payments during the initial period, with the understanding that a larger payment will be due at the end. The Houston Texas Balloon Rider Mortgage Amendment sets forth the terms and conditions of the balloon payment, including the specific amount and due date. It also details the interest rate, payment schedule, and other pertinent information related to the loan. This amendment acts as a legal contract between the lender and borrower, ensuring that both parties are aware of and agree to the terms of the balloon payment. While the specific terms of the Houston Texas Balloon Rider Mortgage Amendment may vary depending on the lender and individual circumstances, there are generally two types of balloon mortgages associated with this amendment: 1. Fixed-rate balloon mortgage: In this type, the interest rate remains fixed for a predetermined period (e.g., 5, 7, or 10 years) before a balloon payment is due. During the fixed-rate period, the borrower pays lower monthly installments based on the amortization schedule. However, at the end of the term, a lump sum payment equal to the remaining balance is required. 2. Adjustable-rate balloon mortgage: This type of balloon mortgage has an initial fixed-rate period, typically ranging from 5 to 7 years, during which the interest rate remains constant. After that period, the interest rate adjusts periodically based on market conditions, and a balloon payment is due at the end of the loan term. The Houston Texas Balloon Rider Mortgage Amendment provides borrowers with flexibility in managing their mortgage payments, allowing them to enjoy lower monthly installments initially while planning for the balloon payment at the end of the term. It is essential for borrowers to thoroughly understand the terms and conditions outlined in this amendment and to assess their financial capability before entering into such an agreement.

Houston Texas Balloon Rider Mortgage Amendment

Description

How to fill out Houston Texas Balloon Rider Mortgage Amendment?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any legal education to draft this sort of paperwork from scratch, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Houston Texas Balloon Rider Mortgage Amendment or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Houston Texas Balloon Rider Mortgage Amendment quickly using our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are new to our library, make sure to follow these steps prior to obtaining the Houston Texas Balloon Rider Mortgage Amendment:

- Ensure the form you have chosen is suitable for your location because the rules of one state or county do not work for another state or county.

- Review the document and go through a brief description (if available) of scenarios the paper can be used for.

- In case the form you chosen doesn’t suit your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Houston Texas Balloon Rider Mortgage Amendment once the payment is completed.

You’re good to go! Now you can proceed to print out the document or fill it out online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.