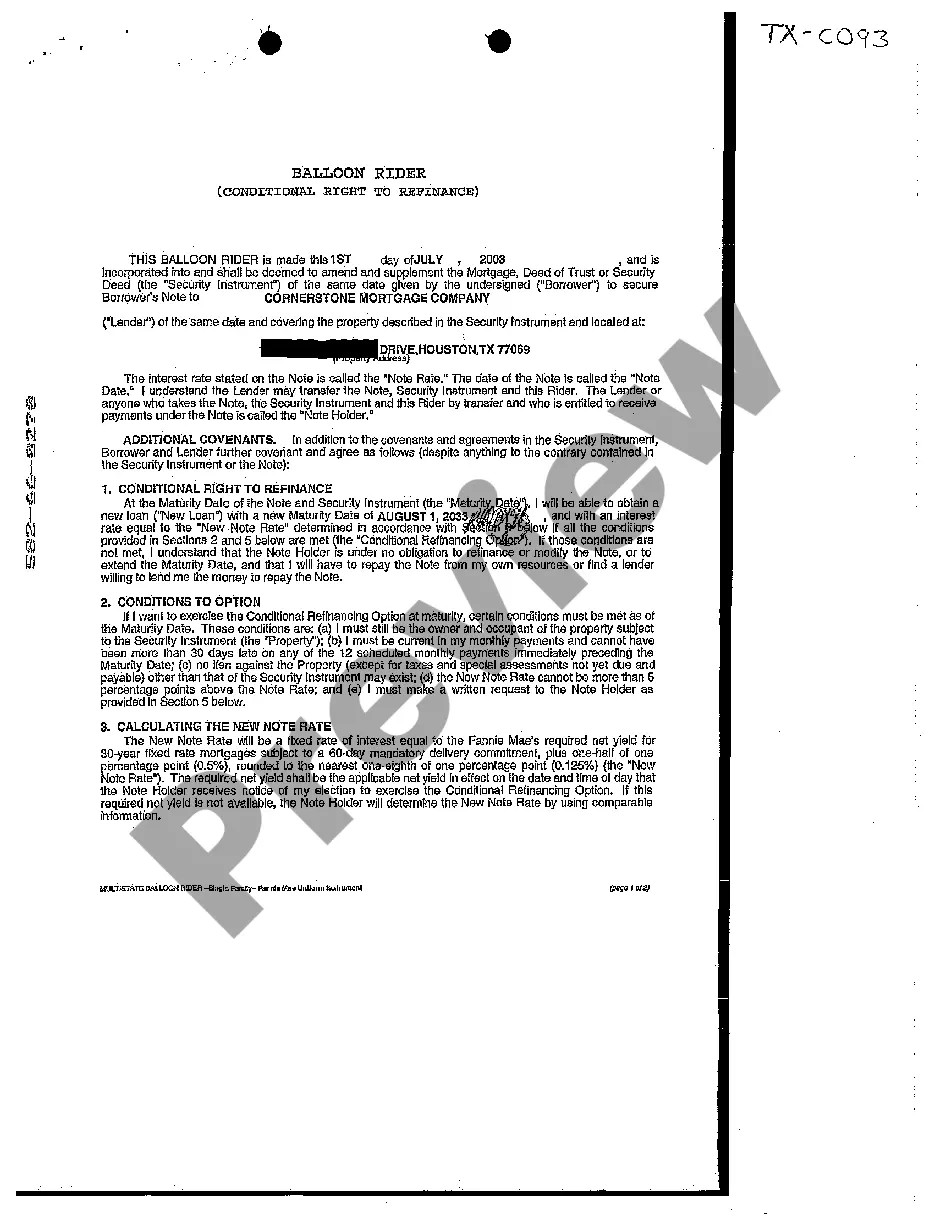

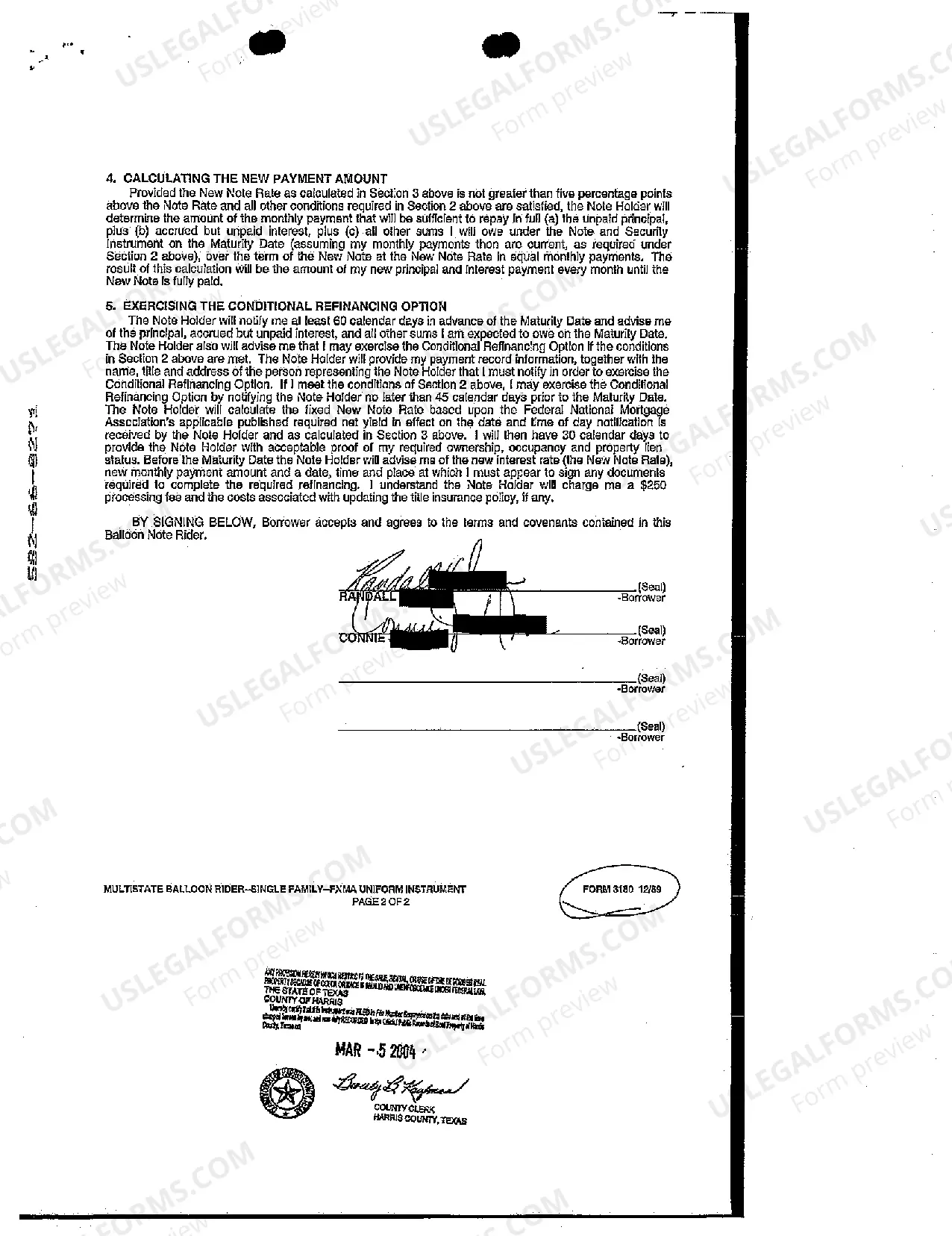

The Killeen Texas Balloon Rider Mortgage Amendment is a legal document that pertains to mortgage loans in the city of Killeen, Texas. These amendments are designed to provide flexibility to borrowers and lenders by introducing a balloon payment option into the mortgage terms. A balloon payment is a large, lump-sum payment that is typically due at the end of a loan term, usually after a series of smaller, regular payments. The Killeen Texas Balloon Rider Mortgage Amendment allows borrowers to have lower monthly payments for a specified period, followed by a single balloon payment to satisfy the remaining loan balance. This type of amendment can be beneficial for individuals who expect their financial situation to improve over time or who plan to sell or refinance the property before the balloon payment becomes due. It can make homeownership more accessible for those who may not qualify for a traditional mortgage or require lower monthly payments in the initial years of the loan. Different types of Killeen Texas Balloon Rider Mortgage Amendments may include variations in the terms and conditions. For example, some amendments may offer a fixed interest rate for the initial period, while others may have an adjustable rate tied to an index. The length of the balloon payment period may also differ, ranging from five to fifteen years, depending on the agreement between the borrower and lender. Furthermore, these amendments may outline provisions for early repayment, prepayment penalties, and the process to convert the loan into a traditional fixed-rate mortgage, among other specifics. It is crucial for borrowers to carefully review the terms and seek professional advice to ensure they fully understand the implications of the balloon rider mortgage amendment. In summary, the Killeen Texas Balloon Rider Mortgage Amendment provides borrowers with an alternative payment option by incorporating a balloon payment into their mortgage terms. These amendments can offer flexibility and accessibility to homeownership, but thorough understanding and consideration of the terms are essential to avoid financial difficulties in the future.

Killeen Texas Balloon Rider Mortgage Amendment

State:

Texas

City:

Killeen

Control #:

TX-C093

Format:

PDF

Instant download

This form is available by subscription

Description

Balloon Rider Mortgage Amendment

The Killeen Texas Balloon Rider Mortgage Amendment is a legal document that pertains to mortgage loans in the city of Killeen, Texas. These amendments are designed to provide flexibility to borrowers and lenders by introducing a balloon payment option into the mortgage terms. A balloon payment is a large, lump-sum payment that is typically due at the end of a loan term, usually after a series of smaller, regular payments. The Killeen Texas Balloon Rider Mortgage Amendment allows borrowers to have lower monthly payments for a specified period, followed by a single balloon payment to satisfy the remaining loan balance. This type of amendment can be beneficial for individuals who expect their financial situation to improve over time or who plan to sell or refinance the property before the balloon payment becomes due. It can make homeownership more accessible for those who may not qualify for a traditional mortgage or require lower monthly payments in the initial years of the loan. Different types of Killeen Texas Balloon Rider Mortgage Amendments may include variations in the terms and conditions. For example, some amendments may offer a fixed interest rate for the initial period, while others may have an adjustable rate tied to an index. The length of the balloon payment period may also differ, ranging from five to fifteen years, depending on the agreement between the borrower and lender. Furthermore, these amendments may outline provisions for early repayment, prepayment penalties, and the process to convert the loan into a traditional fixed-rate mortgage, among other specifics. It is crucial for borrowers to carefully review the terms and seek professional advice to ensure they fully understand the implications of the balloon rider mortgage amendment. In summary, the Killeen Texas Balloon Rider Mortgage Amendment provides borrowers with an alternative payment option by incorporating a balloon payment into their mortgage terms. These amendments can offer flexibility and accessibility to homeownership, but thorough understanding and consideration of the terms are essential to avoid financial difficulties in the future.

Free preview

How to fill out Killeen Texas Balloon Rider Mortgage Amendment?

If you’ve already used our service before, log in to your account and download the Killeen Texas Balloon Rider Mortgage Amendment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Killeen Texas Balloon Rider Mortgage Amendment. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!