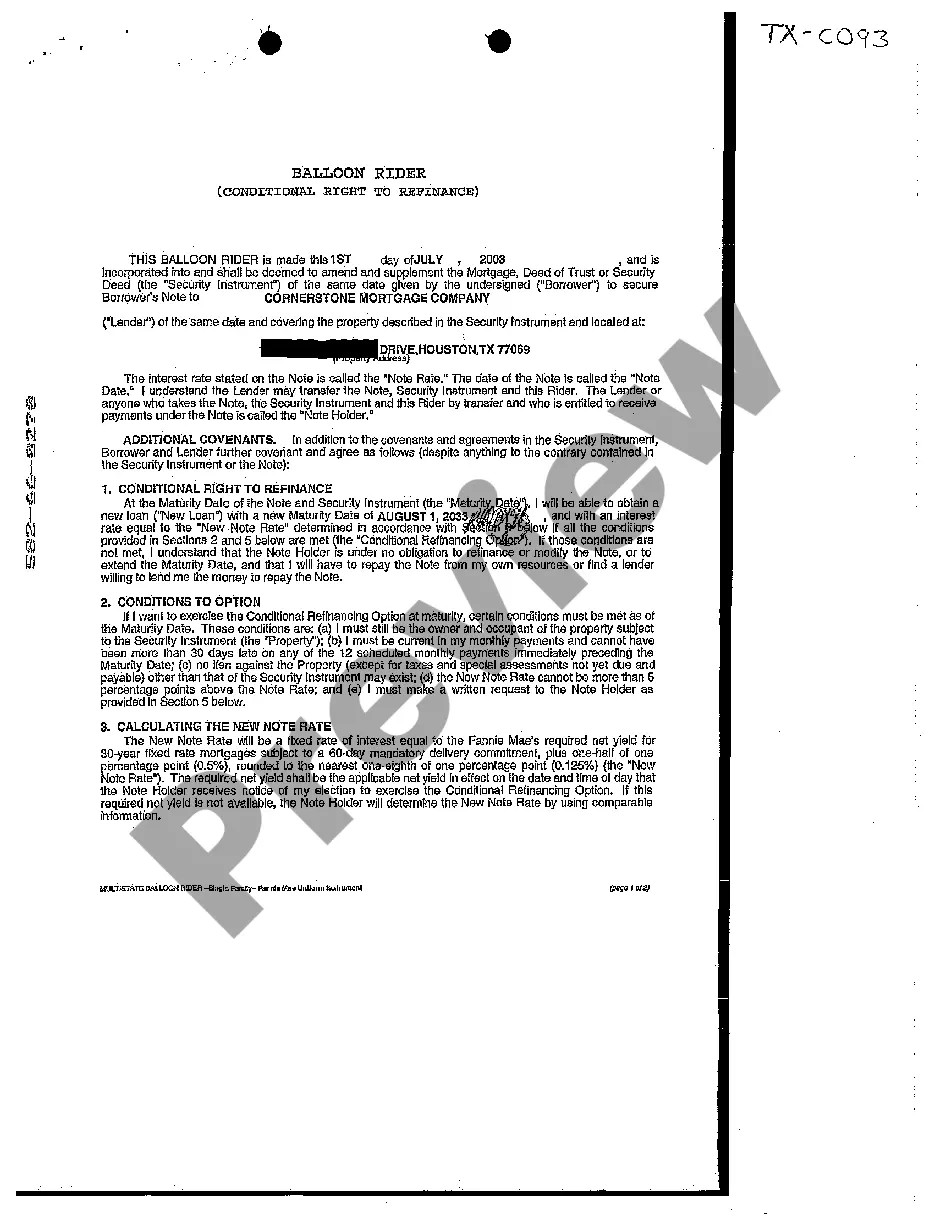

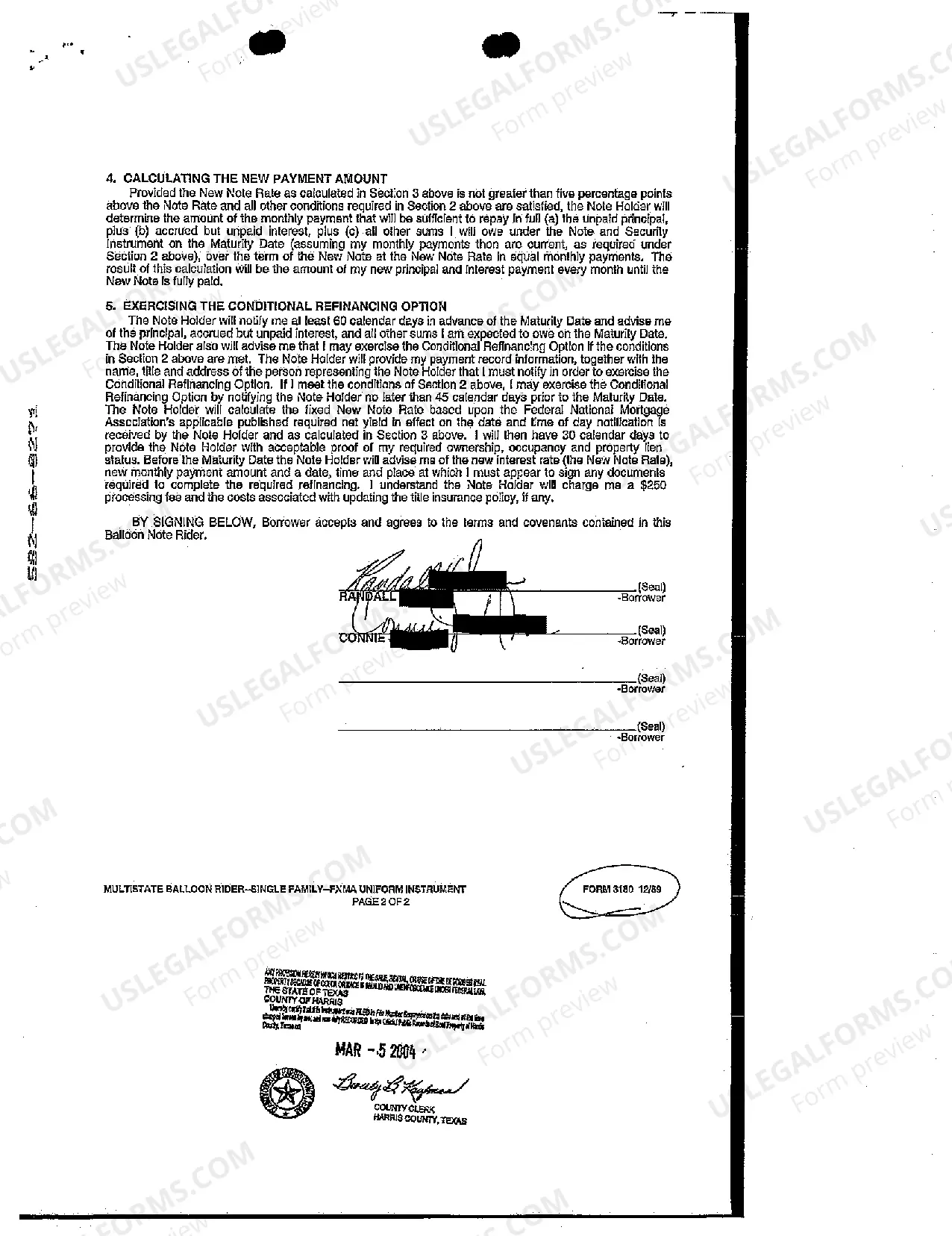

The Sugar Land Texas Balloon Rider Mortgage Amendment is a legal document that is commonly used in real estate transactions, particularly in Sugar Land, Texas. This amendment is specifically related to mortgage loans and is executed by borrowers and lenders to modify the terms of an existing mortgage agreement, typically involving the insertion of a "balloon payment" clause. A balloon payment is a large, lump-sum payment that is due at the end of a loan term. In the case of a Sugar Land Texas Balloon Rider Mortgage Amendment, the borrower agrees to make scheduled monthly payments over the course of the loan term, usually 5 to 7 years, and then pay off the remaining balance in a single payment when the loan matures. This balloon payment is often significantly larger than the monthly payments made during the loan term. The purpose of implementing a balloon payment clause through the Sugar Land Texas Balloon Rider Mortgage Amendment is to provide borrowers with flexible payment options and a lower monthly payment obligation during the initial period of the loan. This can be particularly beneficial for borrowers who expect an increase in their income or significant changes in their financial situation in the coming years. There can be different types or variations of the Sugar Land Texas Balloon Rider Mortgage Amendment, depending on the specific terms agreed upon by the borrower and lender. Some common variations include: 1. Traditional Balloon Rider: This is the most common type where the borrower agrees to make regular monthly payments for a specific term, and at the end of the term, a balloon payment is due. 2. Conditional Balloon Rider: This type includes certain conditions that need to be met for the balloon payment to take effect. For example, the borrower may be required to make additional payments or meet certain performance criteria before the balloon payment comes due. 3. Adjustable-Rate Balloon Rider: This variation combines the concept of the balloon payment with an adjustable interest rate. The interest rate charged on the loan can fluctuate over time, potentially impacting the size of the balloon payment at the end of the loan term. It's important for borrowers considering a Sugar Land Texas Balloon Rider Mortgage Amendment to thoroughly review the terms and conditions of the amendment before signing. Consulting a real estate attorney or mortgage professional can help ensure a comprehensive understanding of the potential risks and benefits associated with this type of mortgage agreement modification.

Sugar Land Texas Balloon Rider Mortgage Amendment

Description

How to fill out Sugar Land Texas Balloon Rider Mortgage Amendment?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Sugar Land Texas Balloon Rider Mortgage Amendment or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Sugar Land Texas Balloon Rider Mortgage Amendment complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Sugar Land Texas Balloon Rider Mortgage Amendment would work for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!