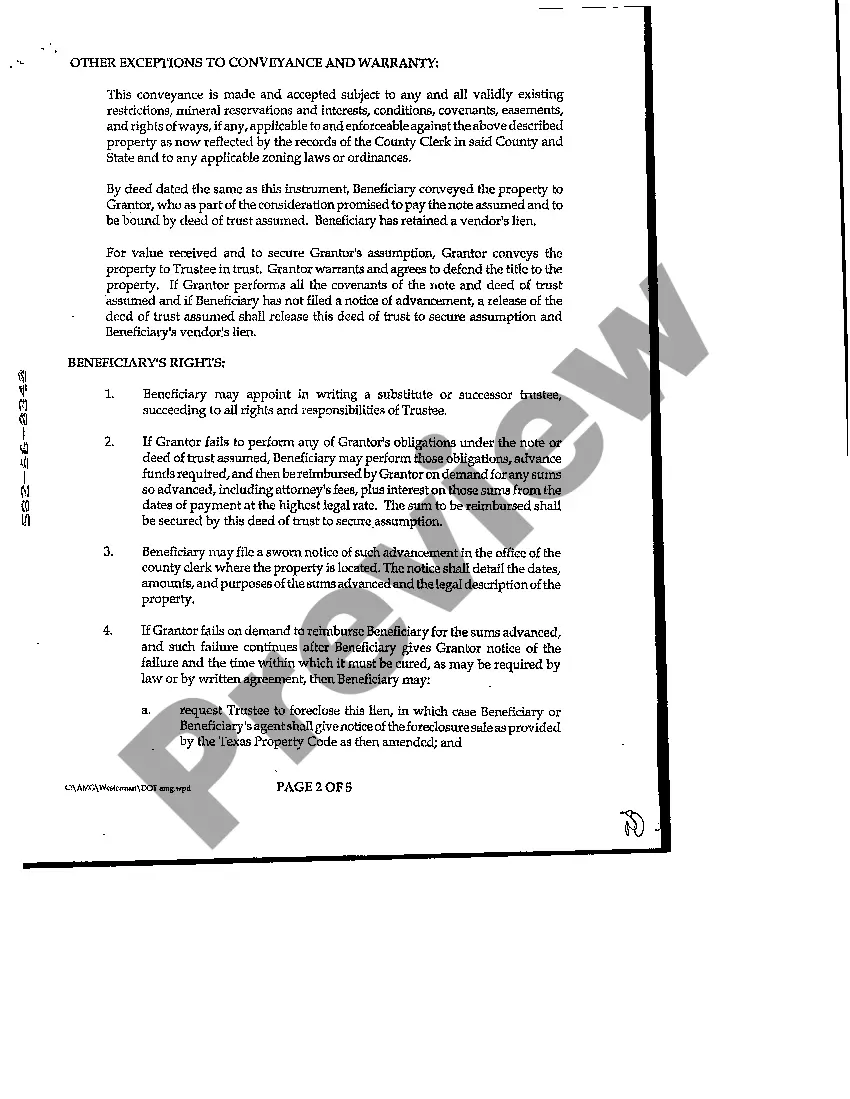

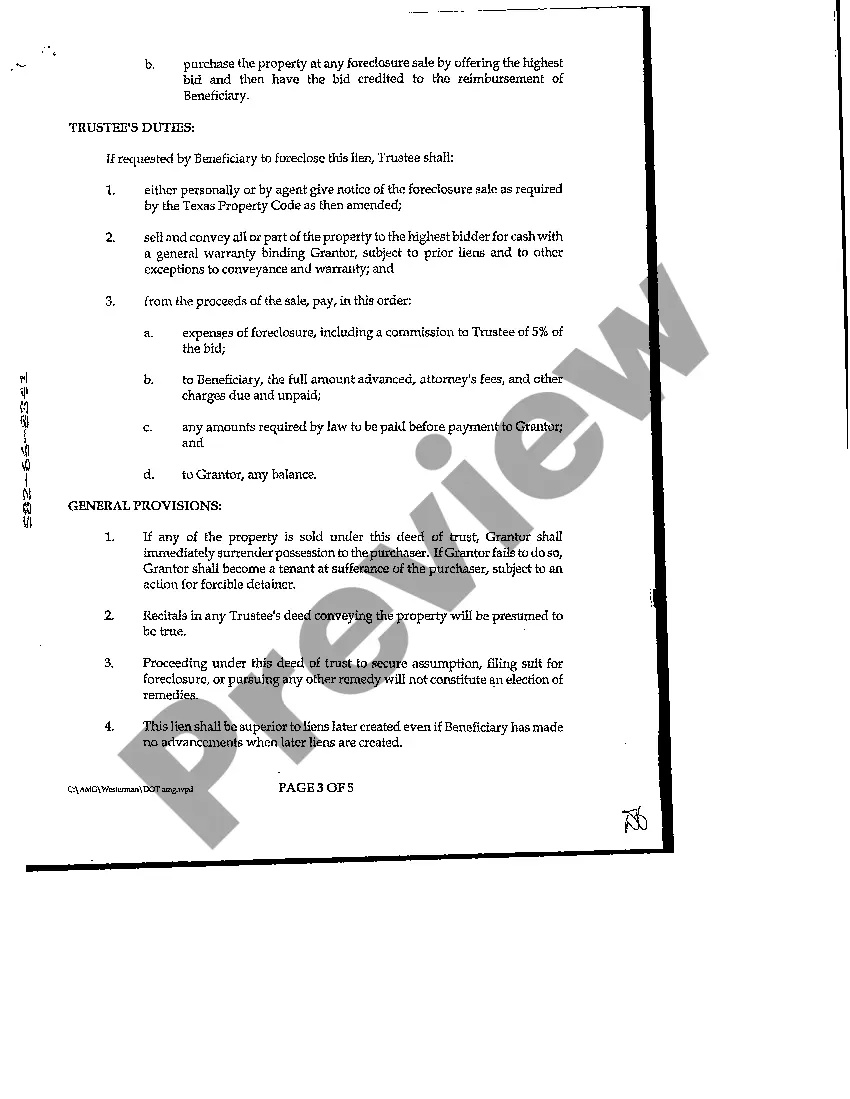

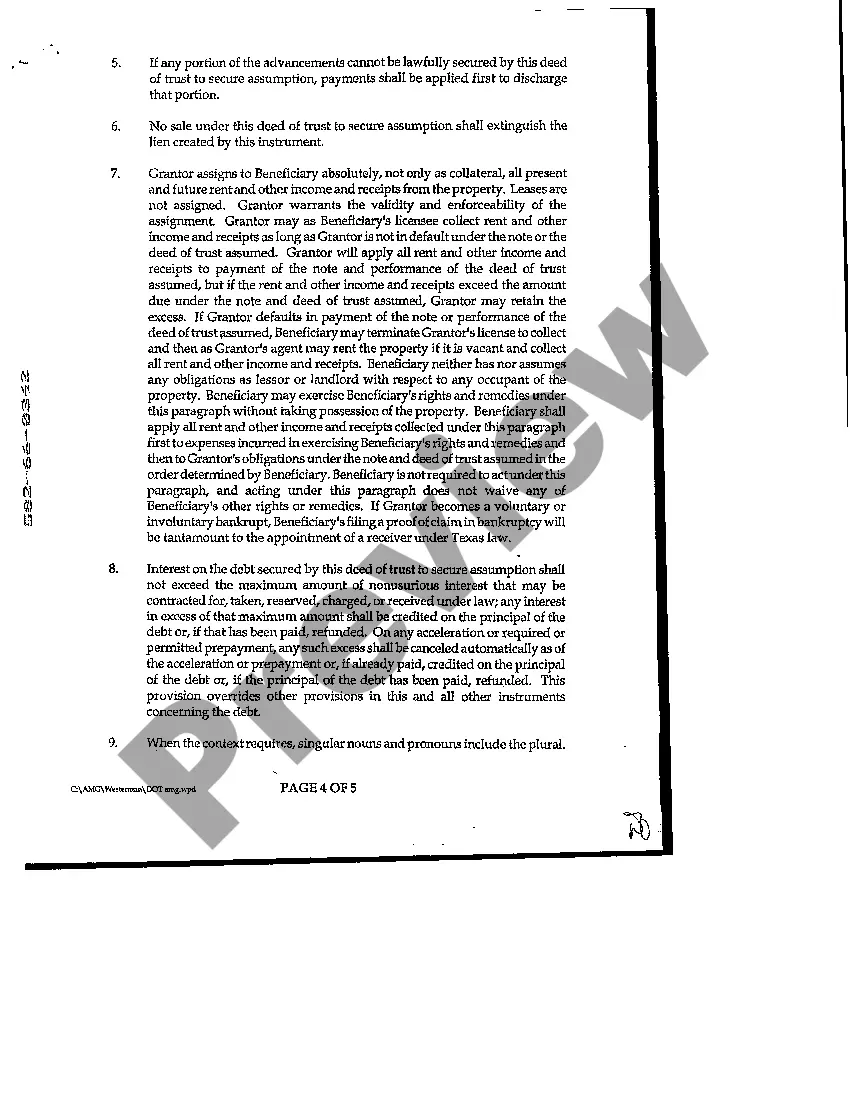

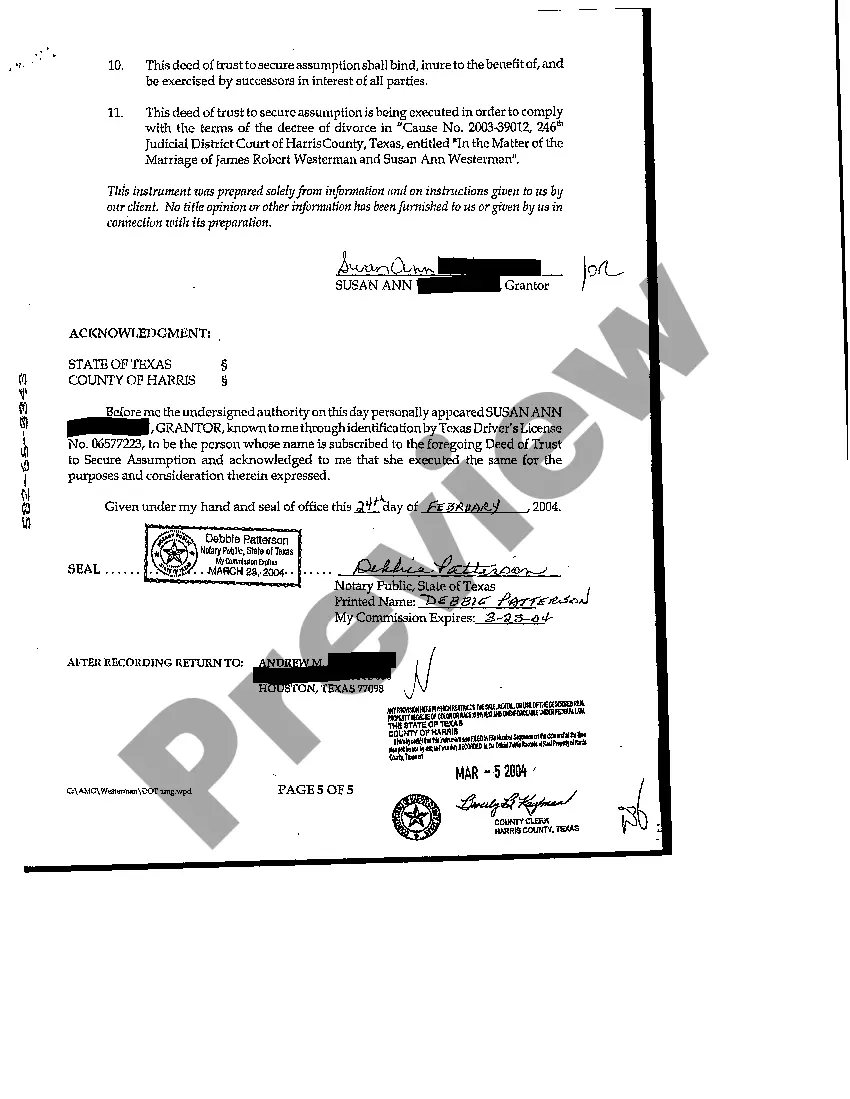

The Austin Texas Deed of Trust to Secure Assumption is a legal document that is used in real estate transactions to secure a loan by conveying an interest in the property being financed. It is commonly used in Austin, Texas, and plays a critical role in protecting the lender's interests in case of default by the borrower. The Deed of Trust to Secure Assumption outlines the terms and conditions of the loan agreement, including the amount borrowed, repayment terms, and interest rates. It also contains provisions that allow the lender to assume possession of the property and initiate foreclosure proceedings in the event of non-payment by the borrower. This document is typically executed at the time of the property purchase or refinancing and is recorded with the county clerk's office to provide public notice of the lender's interest and rights in the property. The Deed of Trust to Secure Assumption creates a lien against the property, giving the lender a legal claim to the property that takes priority over other creditors. There are different types of Deed of Trust to Secure Assumption used in Austin, Texas, tailored to specific circumstances and requirements. Some common types include: 1. Purchase Money Deed of Trust: This type of deed is used when the loan is being used to finance the purchase of the property. It is executed between the buyer (borrower) and the seller's lender. 2. Refinance Deed of Trust: When a borrower is refinancing an existing loan, this type of deed is used to secure the new loan. It replaces the previous deed of trust and creates a lien on the property for the new lender. 3. Home Equity Deed of Trust: This type of deed is used when a borrower is taking out a loan against the equity in their property. Home equity loans allow homeowners to tap into the value of their property for various purposes like home improvements or debt consolidation. The Home Equity Deed of Trust secures the loan and creates a lien on the property. In conclusion, the Austin Texas Deed of Trust to Secure Assumption is a critical legal document in real estate transactions in Austin, Texas. It serves as a legal instrument that outlines the terms and conditions of a loan, secures the lender's interest, and creates a lien on the property. Different types of this deed are tailored to specific circumstances such as purchase, refinance, or home equity loans.

Austin Texas Deed of Trust to Secure Assumption

Description

How to fill out Austin Texas Deed Of Trust To Secure Assumption?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Austin Texas Deed of Trust to Secure Assumption or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Austin Texas Deed of Trust to Secure Assumption complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Austin Texas Deed of Trust to Secure Assumption is suitable for you, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!