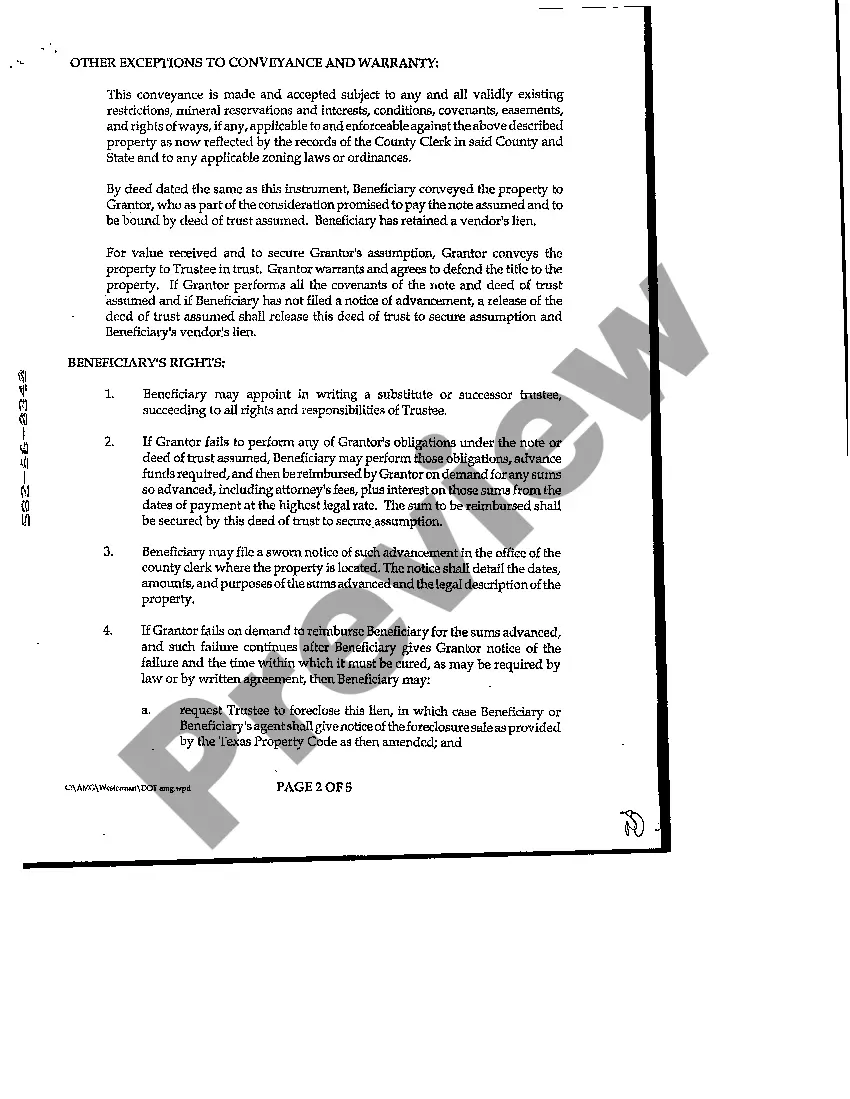

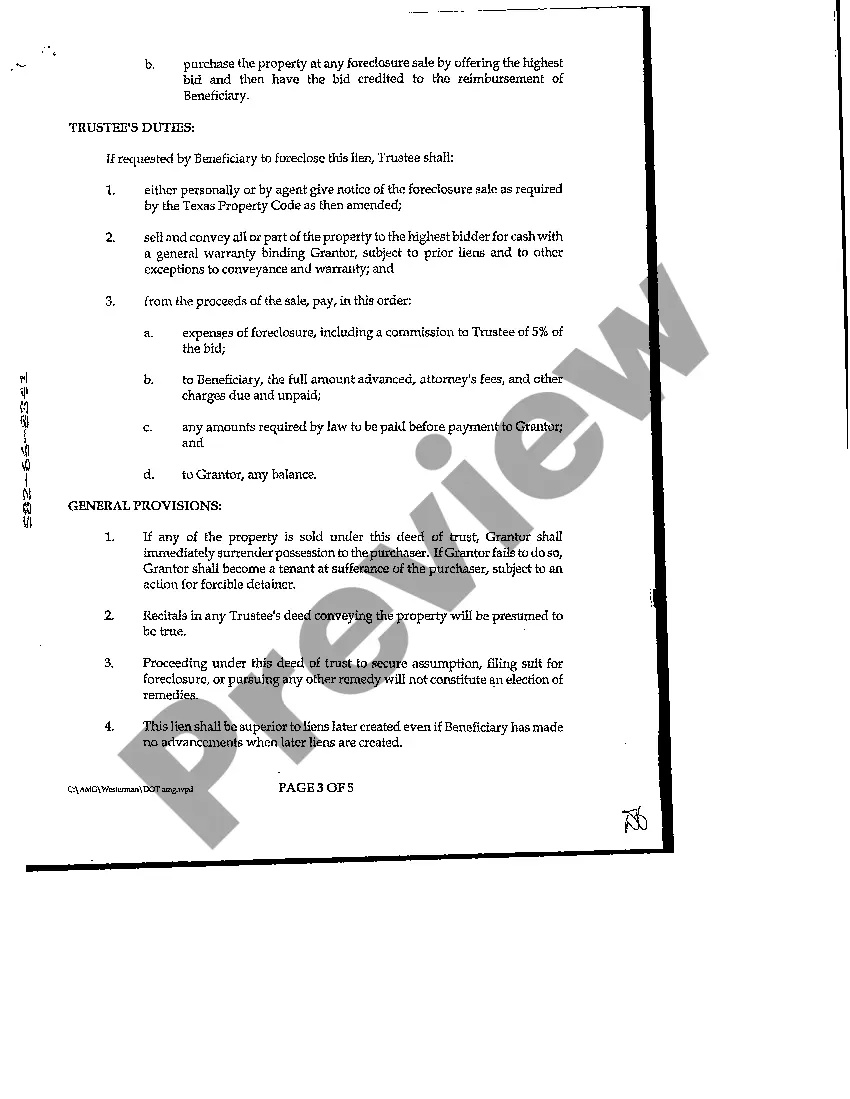

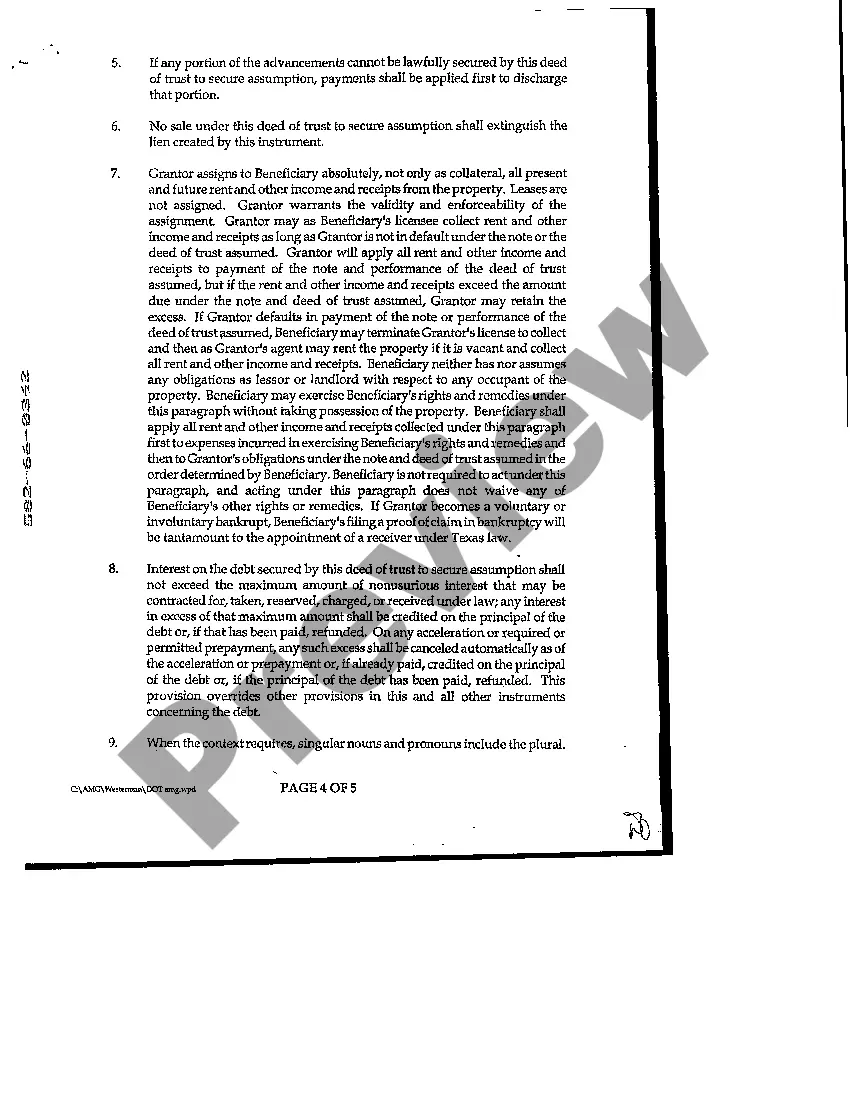

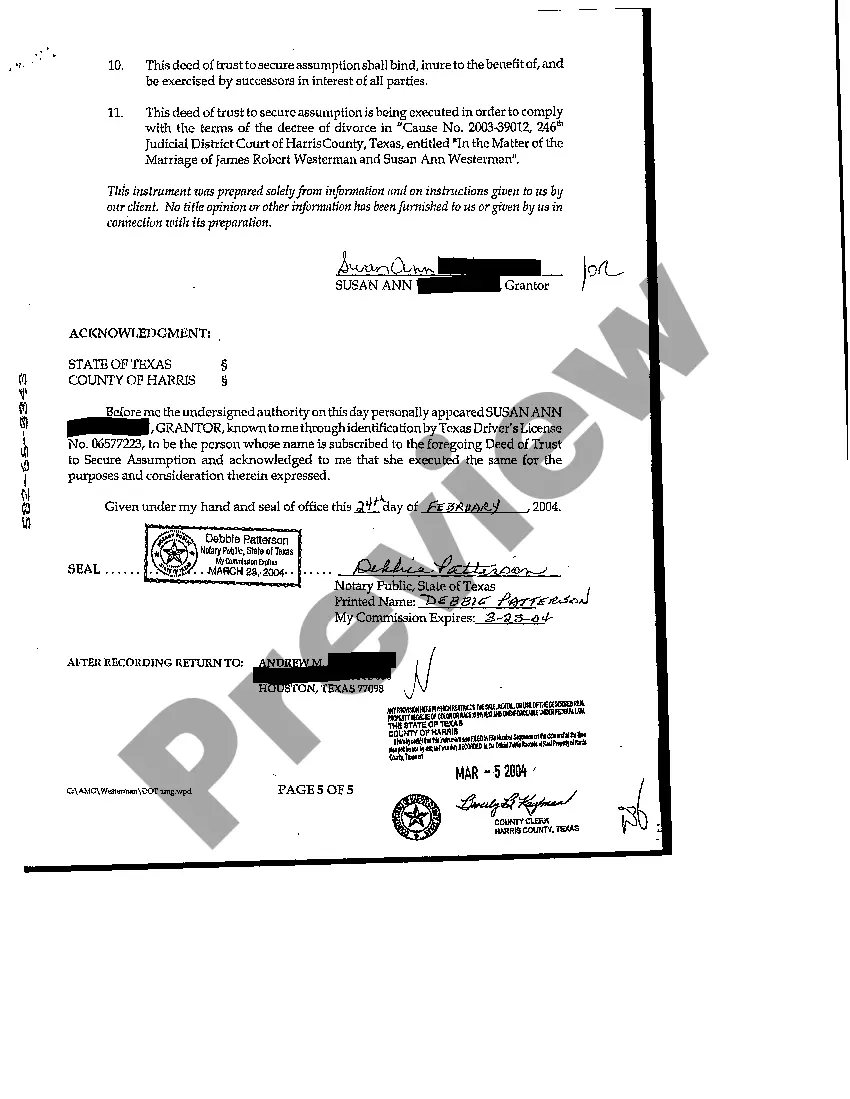

Carrollton Texas Deed of Trust to Secure Assumption is a legal document commonly used in real estate transactions in Carrollton, Texas. It serves as a security instrument to protect the lender's interest in the property when a borrower assumes an existing loan. This detailed description will provide insights into the purpose, types, and key elements of Carrollton Texas Deed of Trust to Secure Assumption. A Carrollton Texas Deed of Trust to Secure Assumption acts as a contract between the lender, borrower, and the assumed party. It creates a lien on the property, giving the lender the right to foreclose if the borrower fails to meet their loan obligations. The purpose of this agreement is to protect the lender's interests and ensure repayment of the assumed loan. There are primarily two types of Carrollton Texas Deed of Trust to Secure Assumption: 1. Assumption Deed of Trust: This type of deed allows a borrower to transfer an existing loan to a new buyer while assuming responsibility for the loan obligations. The new buyer essentially replaces the original borrower and agrees to make the remaining loan payments as per the original terms. 2. Subject-To Deed of Trust: In this type of agreement, a buyer agrees to take ownership of the property subject to the existing mortgage. The buyer is not assuming the loan, but rather taking over the property, making mortgage payments as agreed upon with the seller. The original borrower remains responsible for the loan in this scenario. Key elements of a Carrollton Texas Deed of Trust to Secure Assumption include: 1. Parties Involved: The document should clearly identify the lender, borrower, and the party assuming the loan. This ensures a transparent understanding between all parties. 2. Property Description: Accurate and detailed information about the property being subject to the deed must be included. This ensures clarity and helps prevent any potential disputes. 3. Loan Terms: The deed should outline the terms and conditions of the original loan, including the loan amount, interest rate, repayment schedule, and any other relevant details. These terms are assumed or subject to, as per the agreement. 4. Assumption Obligations: The party assuming the loan must acknowledge their responsibility to repay the remaining balance, including interest, fees, and any additional costs associated with the loan. 5. Rights and Remedies: The deed should mention the lender's rights and remedies in case of default by the assumed party. This may include foreclosure proceedings, the appointment of trustees, and other measures necessary to protect the lender's interest. 6. Governing Law: The deed should specify that it is governed by the laws of the state of Texas, especially pertaining to real estate transactions and mortgage laws. Carrollton Texas Deed of Trust to Secure Assumption plays a crucial role in facilitating real estate transactions by allowing the assumption of existing loans. It protects the lender's interest while providing an opportunity for ownership transfer. Both parties must thoroughly review the deed and consult legal professionals to ensure their rights and obligations are adequately addressed in the agreement.

Carrollton Texas Deed of Trust to Secure Assumption

State:

Texas

City:

Carrollton

Control #:

TX-C094

Format:

PDF

Instant download

This form is available by subscription

Description

Deed of Trust to Secure Assumption

Carrollton Texas Deed of Trust to Secure Assumption is a legal document commonly used in real estate transactions in Carrollton, Texas. It serves as a security instrument to protect the lender's interest in the property when a borrower assumes an existing loan. This detailed description will provide insights into the purpose, types, and key elements of Carrollton Texas Deed of Trust to Secure Assumption. A Carrollton Texas Deed of Trust to Secure Assumption acts as a contract between the lender, borrower, and the assumed party. It creates a lien on the property, giving the lender the right to foreclose if the borrower fails to meet their loan obligations. The purpose of this agreement is to protect the lender's interests and ensure repayment of the assumed loan. There are primarily two types of Carrollton Texas Deed of Trust to Secure Assumption: 1. Assumption Deed of Trust: This type of deed allows a borrower to transfer an existing loan to a new buyer while assuming responsibility for the loan obligations. The new buyer essentially replaces the original borrower and agrees to make the remaining loan payments as per the original terms. 2. Subject-To Deed of Trust: In this type of agreement, a buyer agrees to take ownership of the property subject to the existing mortgage. The buyer is not assuming the loan, but rather taking over the property, making mortgage payments as agreed upon with the seller. The original borrower remains responsible for the loan in this scenario. Key elements of a Carrollton Texas Deed of Trust to Secure Assumption include: 1. Parties Involved: The document should clearly identify the lender, borrower, and the party assuming the loan. This ensures a transparent understanding between all parties. 2. Property Description: Accurate and detailed information about the property being subject to the deed must be included. This ensures clarity and helps prevent any potential disputes. 3. Loan Terms: The deed should outline the terms and conditions of the original loan, including the loan amount, interest rate, repayment schedule, and any other relevant details. These terms are assumed or subject to, as per the agreement. 4. Assumption Obligations: The party assuming the loan must acknowledge their responsibility to repay the remaining balance, including interest, fees, and any additional costs associated with the loan. 5. Rights and Remedies: The deed should mention the lender's rights and remedies in case of default by the assumed party. This may include foreclosure proceedings, the appointment of trustees, and other measures necessary to protect the lender's interest. 6. Governing Law: The deed should specify that it is governed by the laws of the state of Texas, especially pertaining to real estate transactions and mortgage laws. Carrollton Texas Deed of Trust to Secure Assumption plays a crucial role in facilitating real estate transactions by allowing the assumption of existing loans. It protects the lender's interest while providing an opportunity for ownership transfer. Both parties must thoroughly review the deed and consult legal professionals to ensure their rights and obligations are adequately addressed in the agreement.

Free preview

How to fill out Carrollton Texas Deed Of Trust To Secure Assumption?

If you’ve already utilized our service before, log in to your account and save the Carrollton Texas Deed of Trust to Secure Assumption on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Carrollton Texas Deed of Trust to Secure Assumption. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!