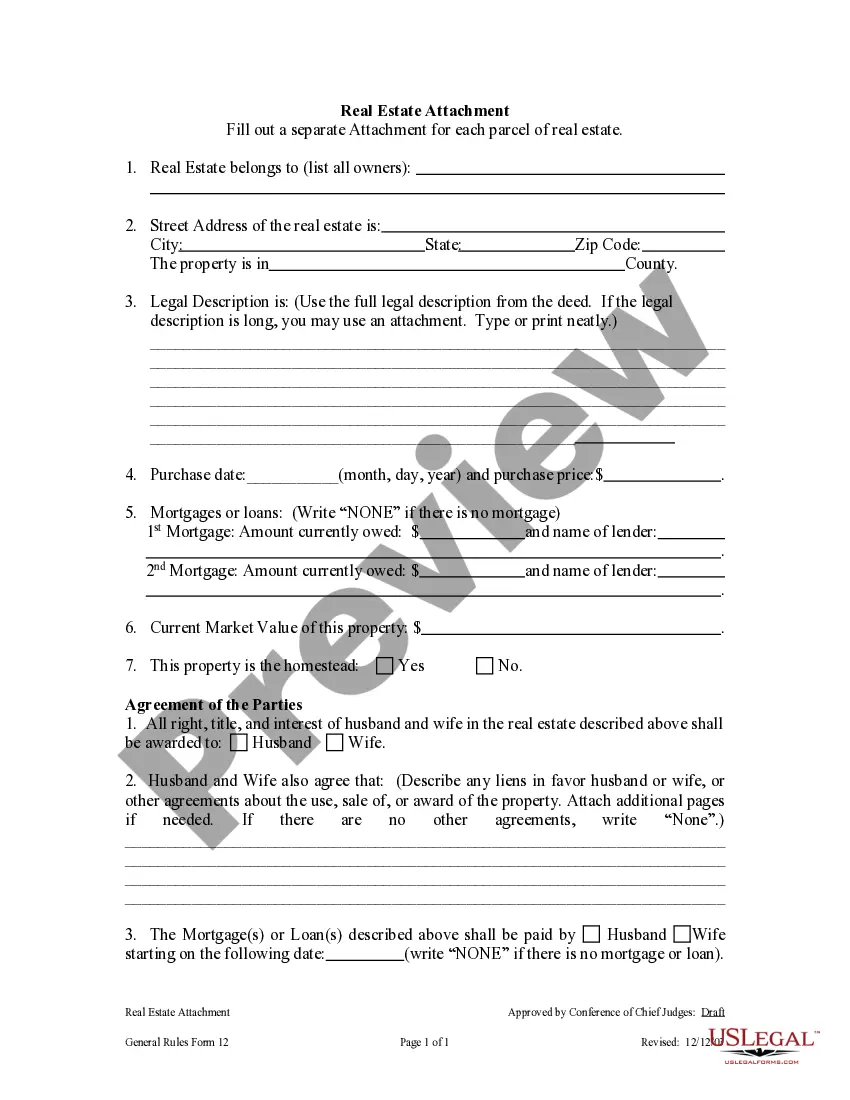

The College Stations Texas Deed of Trust to Secure Assumption is a legal document that is commonly used in real estate transactions in College Station, Texas. It is executed when a borrower is assuming an existing mortgage loan on a property. This deed of trust serves as a security for the new borrower, protecting the lender's interests in case of default or non-payment. Keywords: College Station Texas, Deed of Trust to Secure Assumption, real estate transactions, mortgage loan, borrower, existing loan, security, lender, default, non-payment. There are two different types of College Station Texas Deed of Trust to Secure Assumption: 1. Open Deed of Trust to Secure Assumption: This type of deed of trust allows the borrower to assume the existing loan while keeping its terms intact. The assumption is subject to the lender's approval and may require meeting certain eligibility criteria such as creditworthiness and financial stability. With an open deed of trust, the borrower becomes responsible for the repayment of the original loan and assumes any remaining balance or interest on it. 2. Closed Deed of Trust to Secure Assumption: In this type of deed of trust, the process of assumption is more restricted and typically limited to specific circumstances defined in the mortgage agreement. It may require the lender's consent and may involve negotiations on terms and conditions. The closed deed of trust ensures that the new borrower assumes the loan responsibly and meets specific conditions set out by the lender before granting their approval. In both types of College Station Texas Deed of Trust to Secure Assumption, it is crucial to carefully read and understand the terms and conditions stated in the document. Seek legal advice or consult with a real estate professional to ensure a smooth and legally compliant assumption process.

College Station Texas Deed of Trust to Secure Assumption

Description

How to fill out College Station Texas Deed Of Trust To Secure Assumption?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal education to create such papers from scratch, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the College Station Texas Deed of Trust to Secure Assumption or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the College Station Texas Deed of Trust to Secure Assumption in minutes using our reliable platform. If you are already an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the College Station Texas Deed of Trust to Secure Assumption:

- Ensure the template you have found is good for your location because the regulations of one state or county do not work for another state or county.

- Preview the document and read a short outline (if available) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment method and proceed to download the College Station Texas Deed of Trust to Secure Assumption as soon as the payment is completed.

You’re all set! Now you can go ahead and print out the document or complete it online. If you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

In Texas, a deed of trust to secure assumption must be signed by the borrower, the lender, and any necessary witnesses or notaries as required by law. This ensures that the agreement is legally binding and enforceable. If you are exploring a College Station Texas Deed of Trust to Secure Assumption, having all parties present and informed is critical for a smooth transaction.

In Texas, a deed of trust can typically be prepared by an attorney, a title company, or a qualified individual well-versed in real estate law. It’s important to ensure that the document meets legal requirements to protect your interests. If you are considering a College Station Texas Deed of Trust to Secure Assumption, using professionals who understand local regulations can simplify the process for you.

Yes, a warranty deed serves as a legal document that transfers ownership of a property in Texas. It provides a guarantee that the seller holds clear title to the property and has the right to sell it. In the context of a College Station Texas Deed of Trust to Secure Assumption, establishing clear ownership is crucial for any transaction.

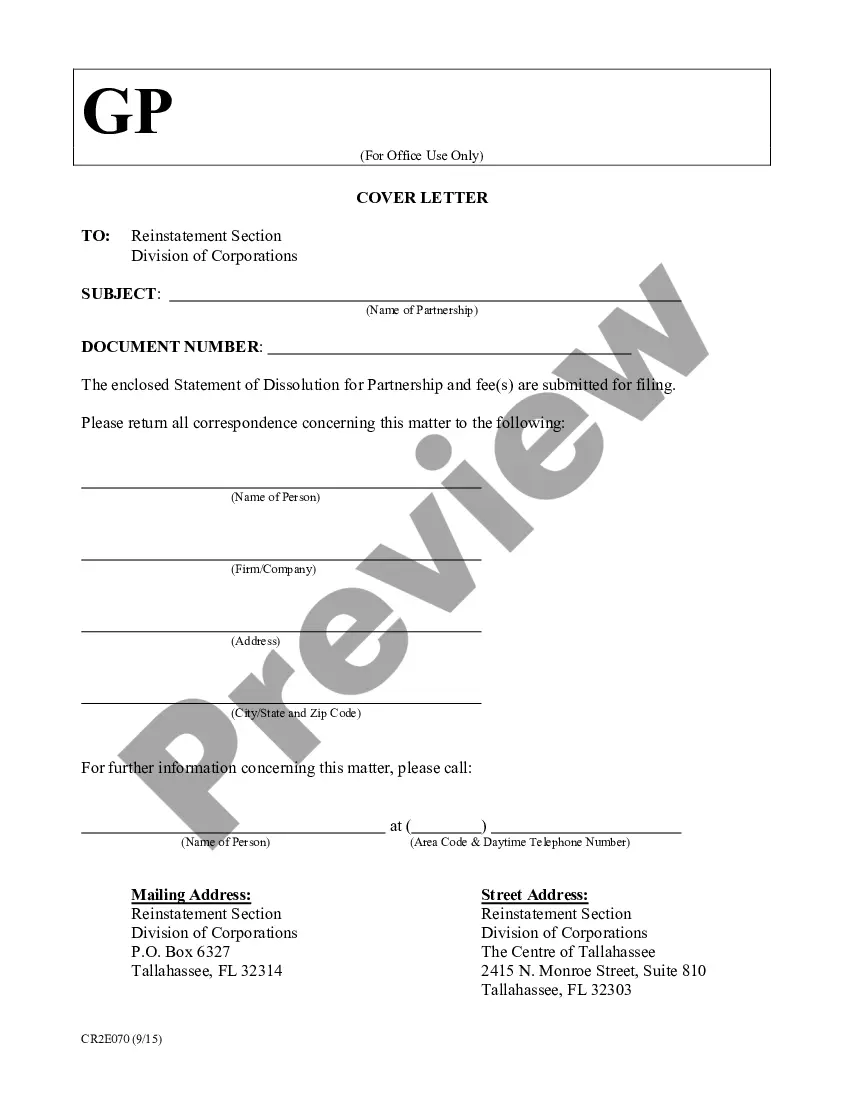

To file a deed of trust in Texas, you must first complete the deed template accurately. After signing, file the document with the county clerk’s office where the property is located. Remember that the deed must contain specific information to be legally binding. Using USLegalForms, you can find a wealth of resources that guide you through each step to ensure compliance with local laws.

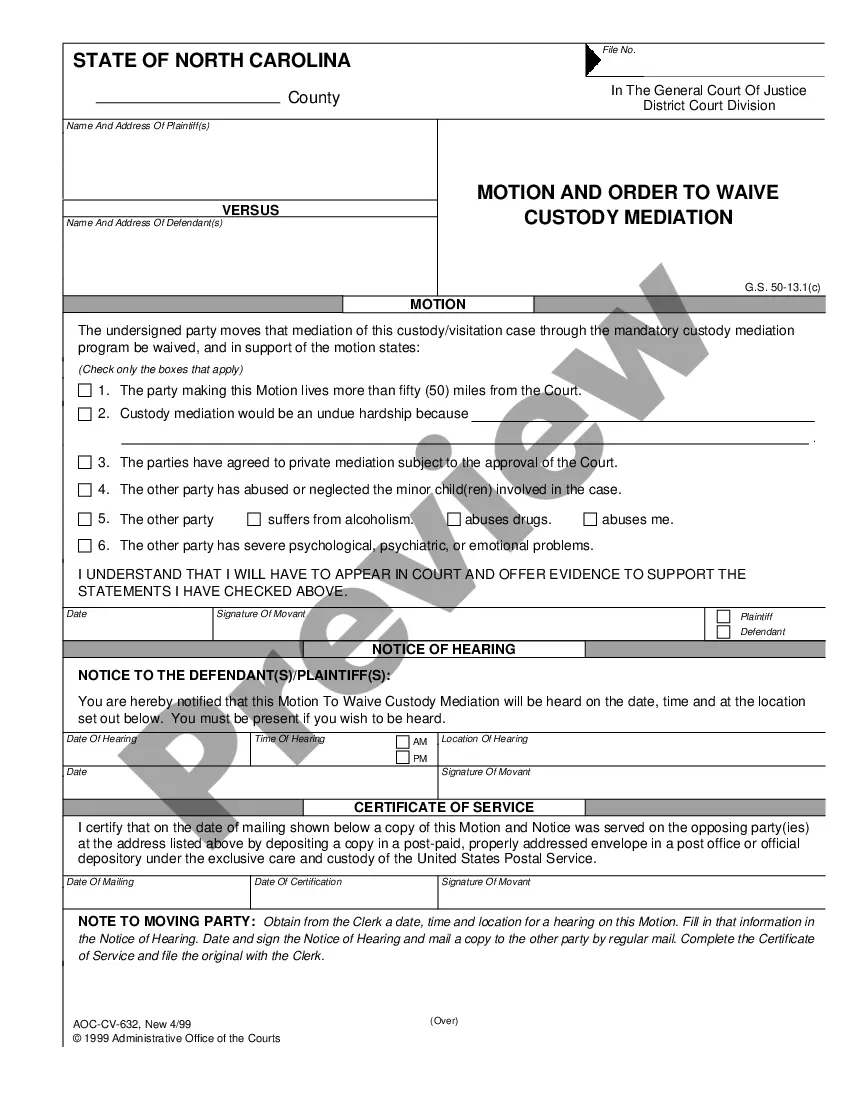

You do not need a lawyer to transfer a deed in Texas, but having legal guidance can simplify the process. While many homeowners choose to handle the transfer themselves, a legal professional can ensure that all requirements are met correctly. This is especially true when dealing with a College Station Texas Deed of Trust to Secure Assumption, where legal nuances may arise. Using services like USLegalForms can also make this process more straightforward.

A deed of trust to secure assumption in Texas is a legal document that allows a borrower to transfer their mortgage obligations to another party. This process can simplify the transfer of ownership and ensure that the new owner takes over the financial responsibilities associated with the property. Using a College Station Texas Deed of Trust to Secure Assumption can streamline property transactions, making them more efficient. Consider exploring US Legal Forms to find the right templates and guidance for creating your deed of trust.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

An assumption deed allows a grantee to assume liability for existing indebtedness and promise to discharge one or more existing liens against the property.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.