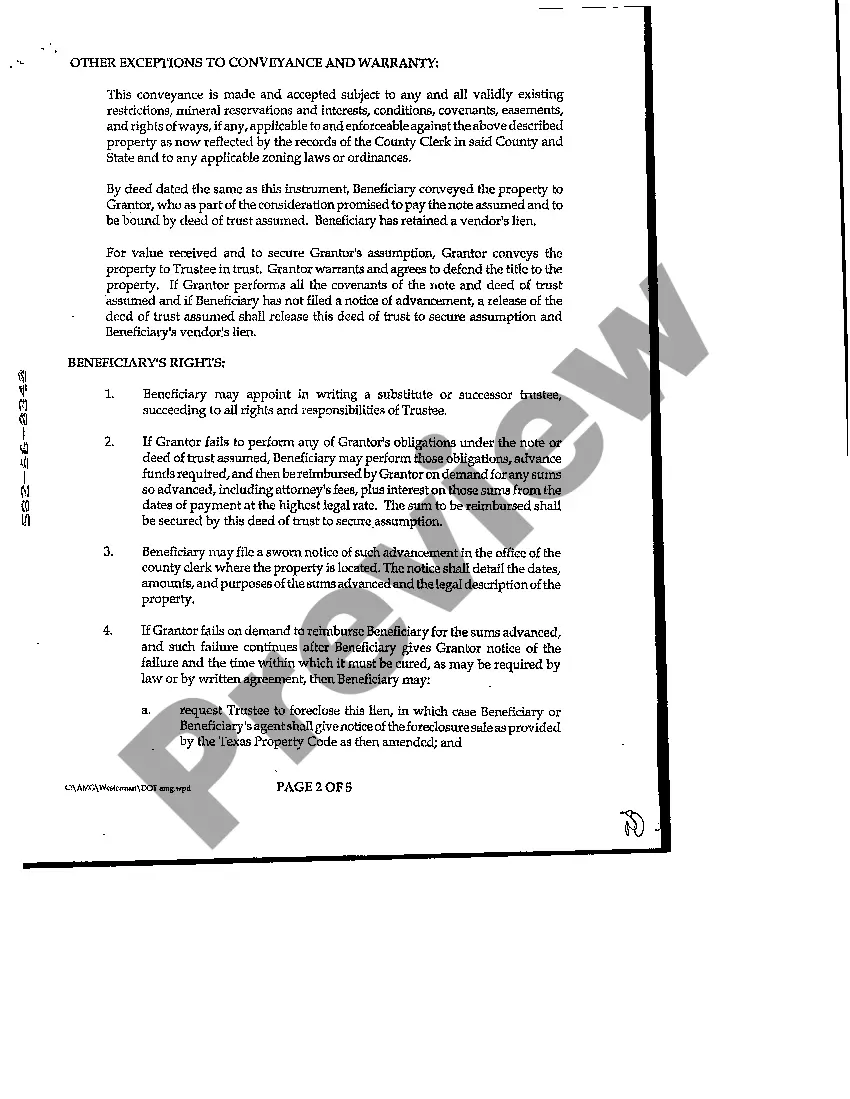

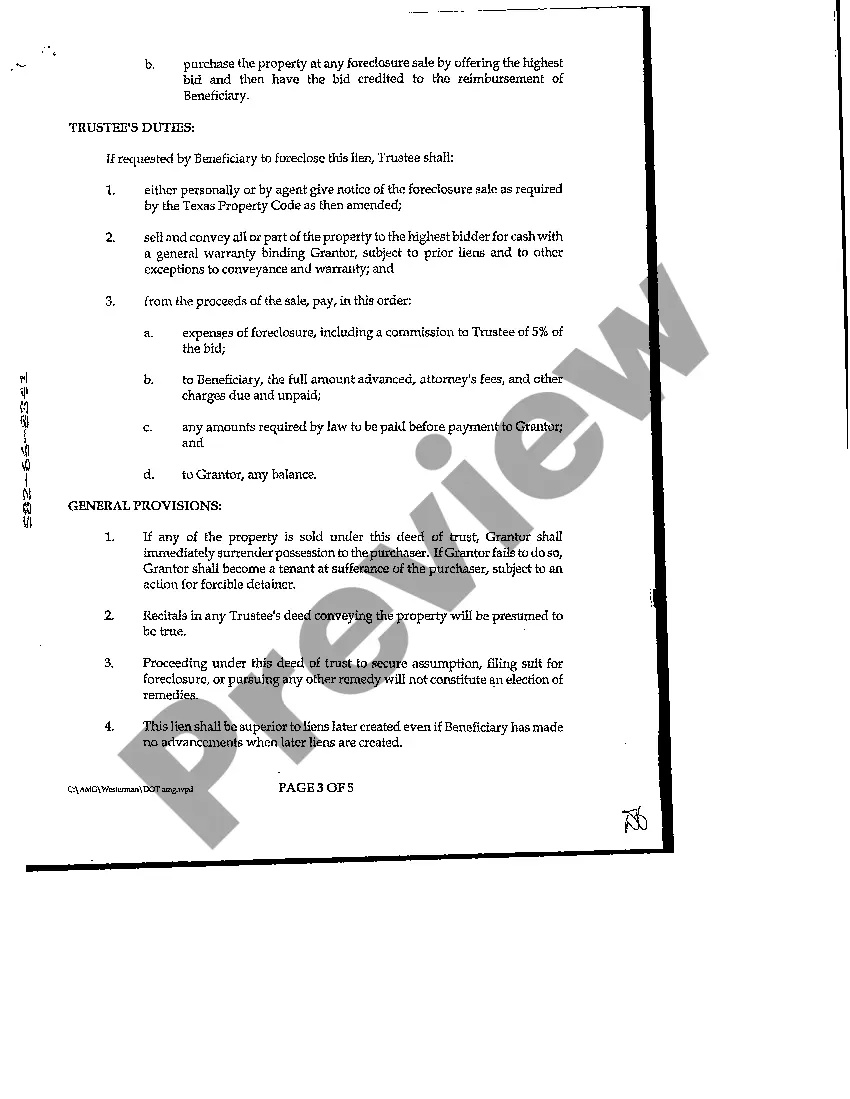

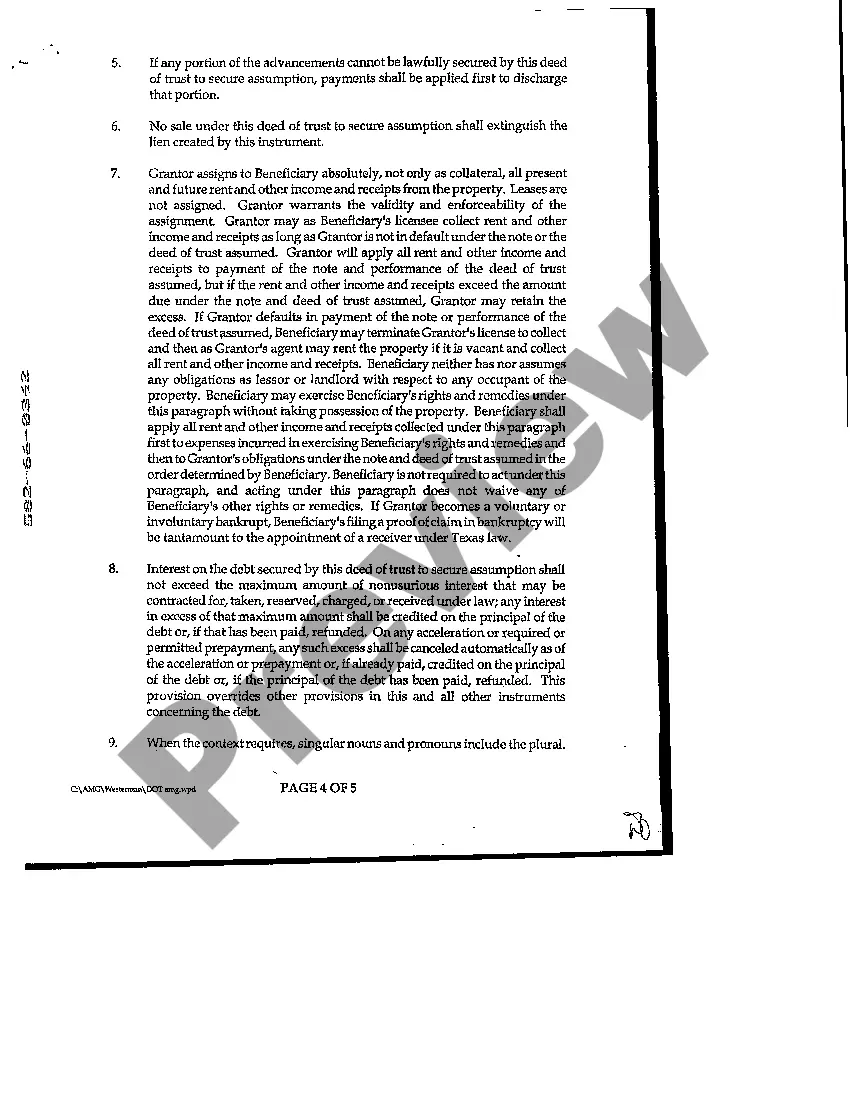

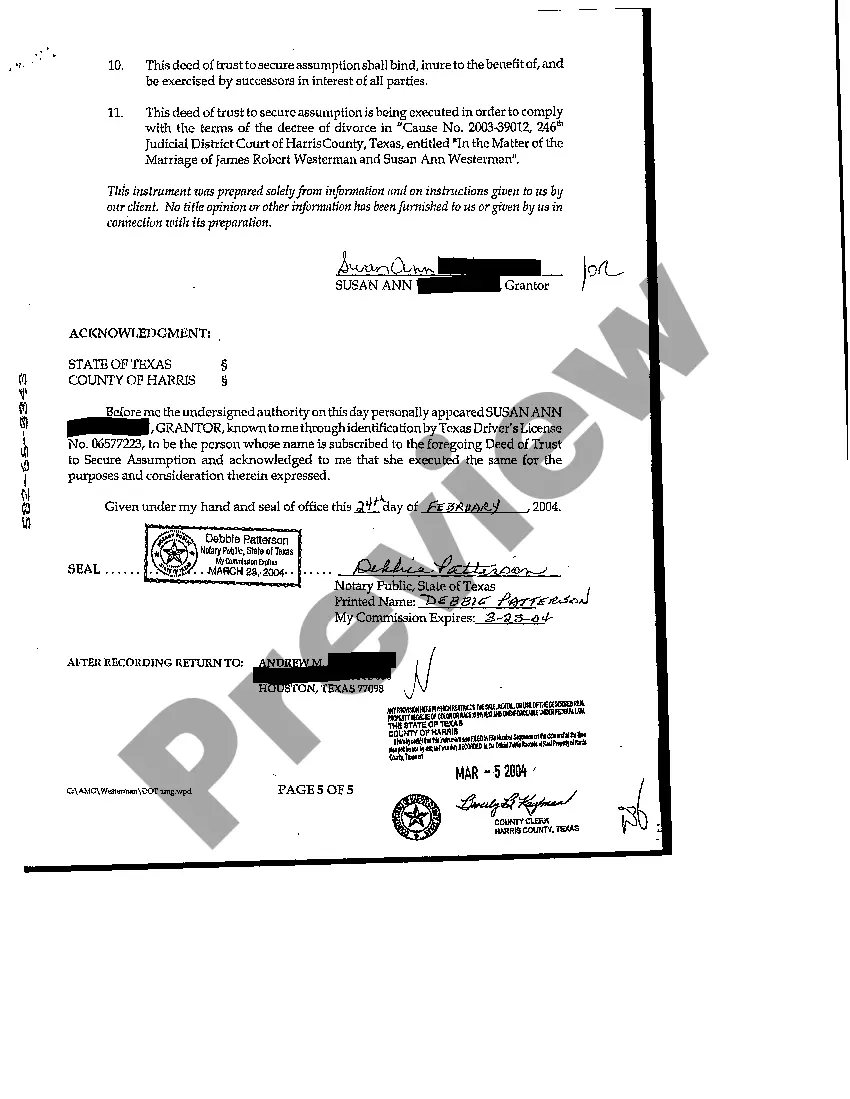

The Fort Worth Texas Deed of Trust to Secure Assumption is a legal document that is commonly used in real estate transactions in Fort Worth, Texas. It serves as a security instrument that allows a lender to secure a loan with an interest in the property being financed. Keywords: Fort Worth, Texas, Deed of Trust, Secure Assumption, real estate transactions, legal document, security instrument, lender, loan, interest, property, financed. In a Deed of Trust to Secure Assumption, the property owner (known as the borrower or trust or) transfers the legal title of their property to a third party (known as the trustee). This third party holds the legal title until the loan is paid off, at which point the title is transferred back to the borrower. This trustee is typically a neutral party chosen by the lender or agreed upon by both parties. The Deed of Trust serves as a security agreement for the lender (known as the beneficiary), providing them with the right to foreclose on the property if the borrower defaults on the loan. This foreclosure process allows the lender to sell the property in order to recover the owed debt. Although there may be variations in the Fort Worth Texas Deed of Trust to Secure Assumption, they generally follow a similar structure and contain common elements such as: 1. Identification of the parties involved: The document will identify the borrower, lender, and trustee involved in the transaction. 2. Property description: The Deed of Trust will include a detailed description of the property being financed, including the legal description and address. 3. Loan terms: It will specify the terms of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. 4. Granting clause: This clause outlines the borrower's intent to transfer the title of the property to the trustee as security for the loan. 5. Default and remedies: The document will detail the specific events that constitute a default, such as failure to make timely payments, and the remedies available to the lender in case of default, including foreclosure. 6. Assumption provisions: In some cases, the Deed of Trust to Secure Assumption may include provisions that allow the borrower to assume the loan, allowing them to take over the payments and responsibilities of the original borrower. Other types of Deeds of Trust in Fort Worth, Texas may include variations such as Deed of Trust with Assignment of Rents, Deed of Trust for First Lien, and Deed of Trust for Second Lien, depending on the specific needs and arrangements of the parties involved. In summary, the Fort Worth Texas Deed of Trust to Secure Assumption is a crucial legal document in real estate transactions, providing lenders with the security they need while allowing borrowers to obtain financing for their properties.

Fort Worth Texas Deed of Trust to Secure Assumption

Description

How to fill out Fort Worth Texas Deed Of Trust To Secure Assumption?

If you are looking for a valid form template, it’s difficult to find a more convenient place than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can find a huge number of templates for organization and personal purposes by types and regions, or keywords. With the high-quality search feature, getting the most recent Fort Worth Texas Deed of Trust to Secure Assumption is as easy as 1-2-3. Furthermore, the relevance of every file is proved by a team of professional attorneys that on a regular basis check the templates on our platform and update them in accordance with the newest state and county regulations.

If you already know about our platform and have an account, all you need to get the Fort Worth Texas Deed of Trust to Secure Assumption is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the sample you want. Look at its explanation and use the Preview feature to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to discover the needed file.

- Confirm your decision. Choose the Buy now button. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Fort Worth Texas Deed of Trust to Secure Assumption.

Every single template you add to your user profile does not have an expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you need to get an additional duplicate for modifying or printing, you can return and export it again at any moment.

Take advantage of the US Legal Forms professional collection to gain access to the Fort Worth Texas Deed of Trust to Secure Assumption you were looking for and a huge number of other professional and state-specific samples in a single place!