Harris Texas Deed of Trust to Secure Assumption

Description

How to fill out Texas Deed Of Trust To Secure Assumption?

Take advantage of the US Legal Forms and gain instant access to any form template you need.

Our advantageous platform, featuring a vast array of document templates, enables you to locate and acquire nearly any document sample you seek.

You can download, complete, and authorize the Harris Texas Deed of Trust to Secure Assumption in just a few minutes instead of wasting hours scouring the internet for a suitable template.

Utilizing our repository is a fantastic method to enhance the security of your document submissions.

The Download option will be available on all the samples you view. Additionally, you can access all your previously saved documents in the My documents menu.

If you haven't yet created an account, follow the guidelines below.

- Our knowledgeable attorneys routinely review all the documents to ensure that the templates are suitable for a specific area and adhere to current laws and regulations.

- How can you acquire the Harris Texas Deed of Trust to Secure Assumption.

- If you have an account, simply Log In to your profile.

Form popularity

FAQ

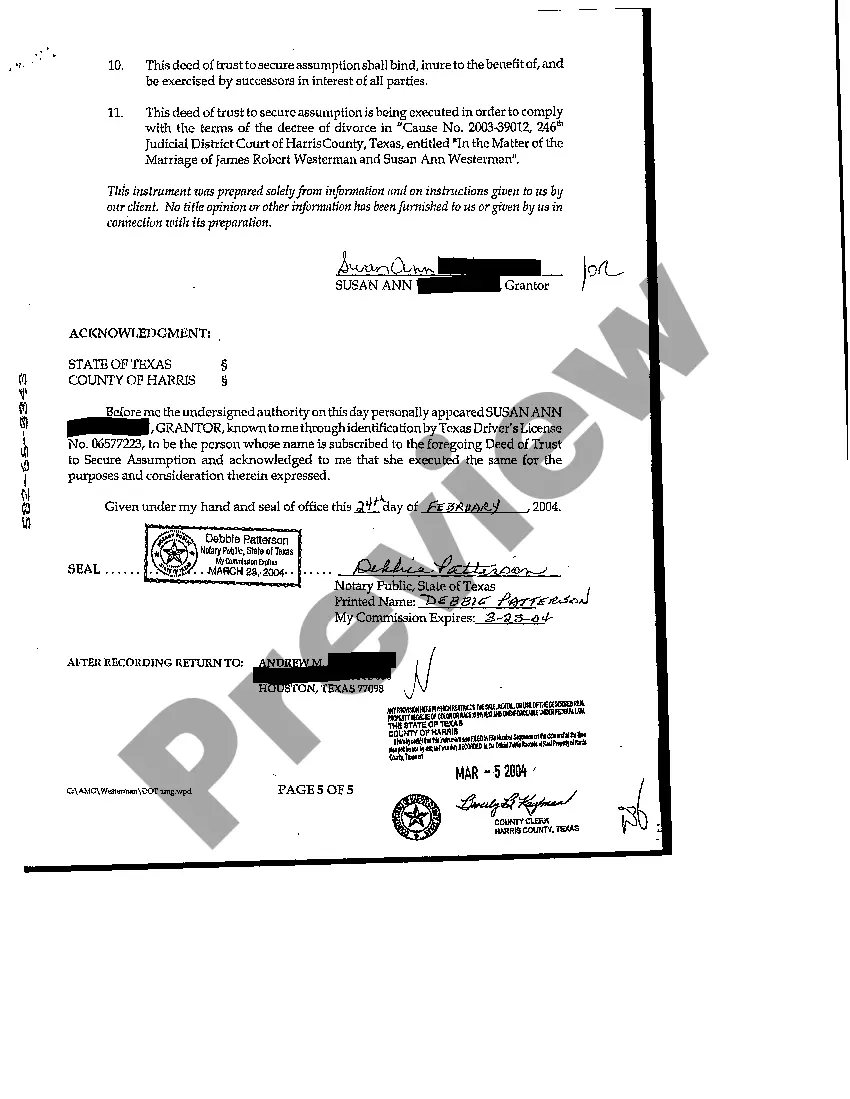

The deed of trust to secure assumption is typically signed by both the borrower and the beneficiary. The borrower agrees to the terms set forth in the deed while the lender ensures their rights are protected. It is essential to review these documents carefully to ensure compliance and understanding of the Harris Texas Deed of Trust to Secure Assumption.

The assignment of a deed of trust is usually signed by the original beneficiary or lender. This document is essential to transfer rights to another party, allowing for continuity in the mortgage agreement. If you require assistance with this process, the uslegalforms platform can help you navigate the legal complexities, especially when dealing with a Harris Texas Deed of Trust to Secure Assumption.

The deed of trust document title is typically signed by the borrower, also known as the trustor. The lender, or the beneficiary, may also be involved in the signing process to validate the agreement. If you are dealing with a Harris Texas Deed of Trust to Secure Assumption, ensure that all parties understand their roles and responsibilities before signing.

An assumption warranty deed in Texas involves the transfer of the property where the new owner takes over the existing mortgage obligations. This means the buyer assumes the liability of the mortgage, while the original borrower remains responsible if the new borrower defaults. Understanding the differences between this and a Harris Texas Deed of Trust to Secure Assumption can help you make informed decisions in real estate transactions.

Filing a deed of trust in Texas involves a few important steps to ensure it is legally binding. First, you need to prepare the deed of trust document, which outlines the terms agreed upon by the borrower and lender. Next, you must have the deed notarized to authenticate it. Finally, submit the signed document to the appropriate county clerk's office for recording. Using UsLegalForms can streamline this process and provide the necessary templates for a Harris Texas Deed of Trust to Secure Assumption.

In Texas, the parties involved in a Harris Texas Deed of Trust to Secure Assumption must include the borrower, the lender, and the trustee. The borrower and the lender execute the deed to formalize the agreement, while the trustee signs to confirm their role as the neutral party holding the title. It’s crucial to ensure that all signatures are properly executed to uphold the validity of the agreement.

In a Harris Texas Deed of Trust to Secure Assumption, the beneficiary is typically the lender or financial institution that provided the funds for the property. They have the legal right to receive payments from the borrower, and in case of default, they can reclaim the property through the trustee. This arrangement underscores the importance of ensuring that all parties clearly understand their roles in the transaction.

A deed of assumption allows a buyer to take over the existing mortgage of the seller, thus assuming responsibility for the debt. In the context of the Harris Texas Deed of Trust to Secure Assumption, this means that the buyer becomes liable for the mortgage payments while the lender still holds the mortgage originally taken out by the seller. This arrangement can benefit both parties, as it offers a smooth transition of responsibilities without the need for additional financing.

In Texas, a Harris Texas Deed of Trust to Secure Assumption functions by transferring the legal title of the property to a trustee while keeping the equitable title with the borrower. This means that if the borrower defaults, the lender can initiate a non-judicial foreclosure through the trustee. Since Texas law favors this process, it can be quicker than judicial foreclosures seen in other states. Understanding this mechanism can empower you to make informed decisions in real estate transactions.

Using a Harris Texas Deed of Trust to Secure Assumption provides several advantages over a traditional mortgage. A deed of trust allows for a faster and more streamlined process in securing funding for your property. Additionally, it involves three parties—the borrower, the lender, and the trustee—which adds a level of protection for all involved. This structure can often lead to quicker resolutions in case of disputes or defaults.