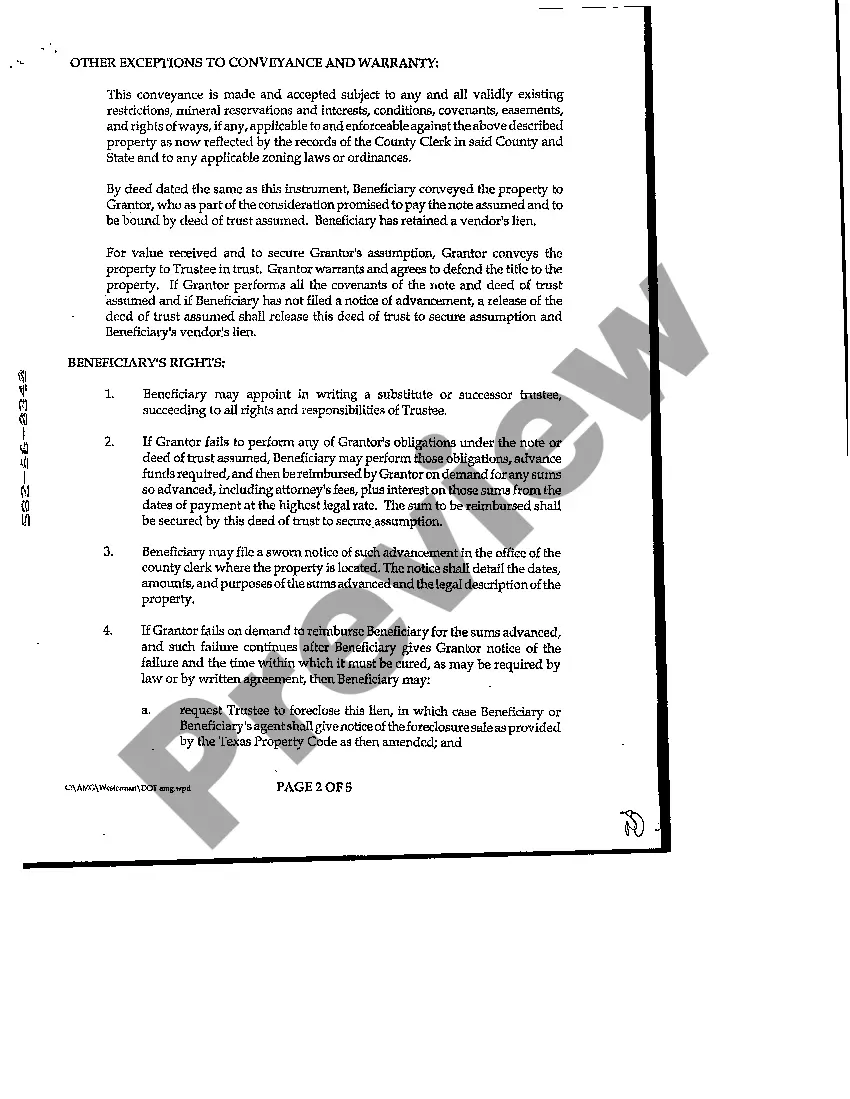

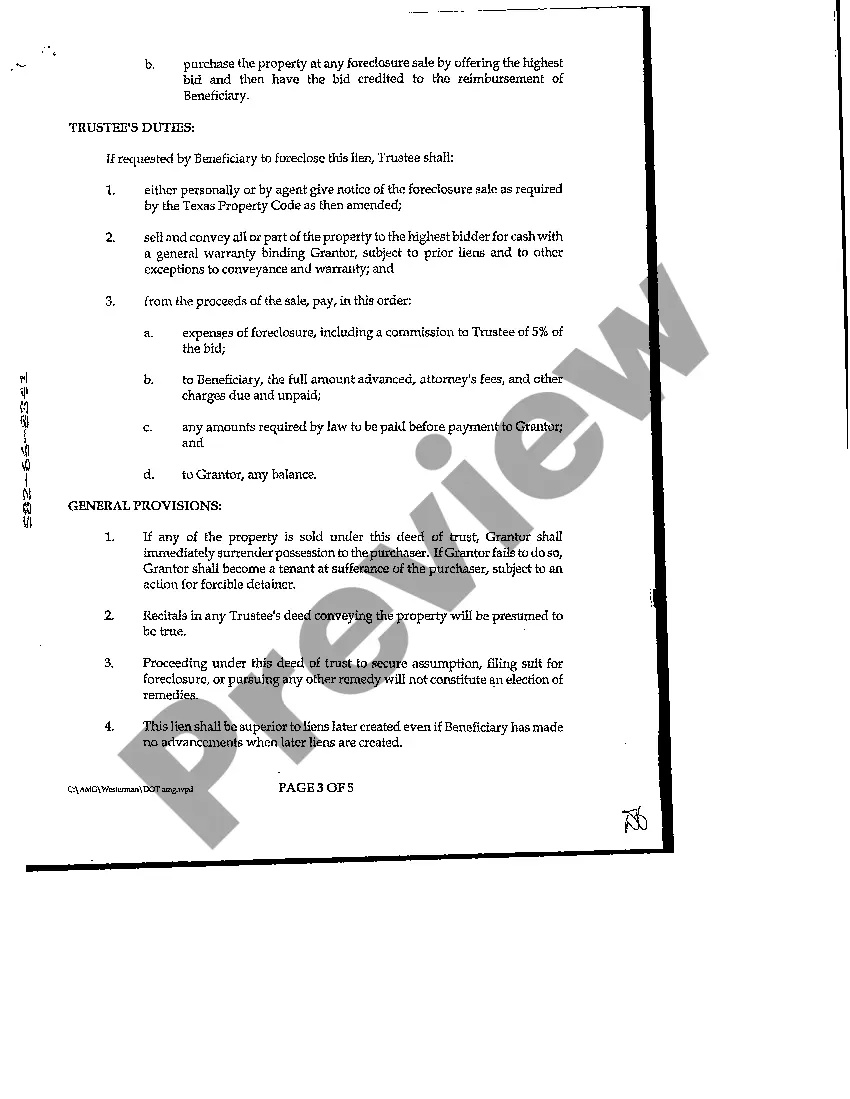

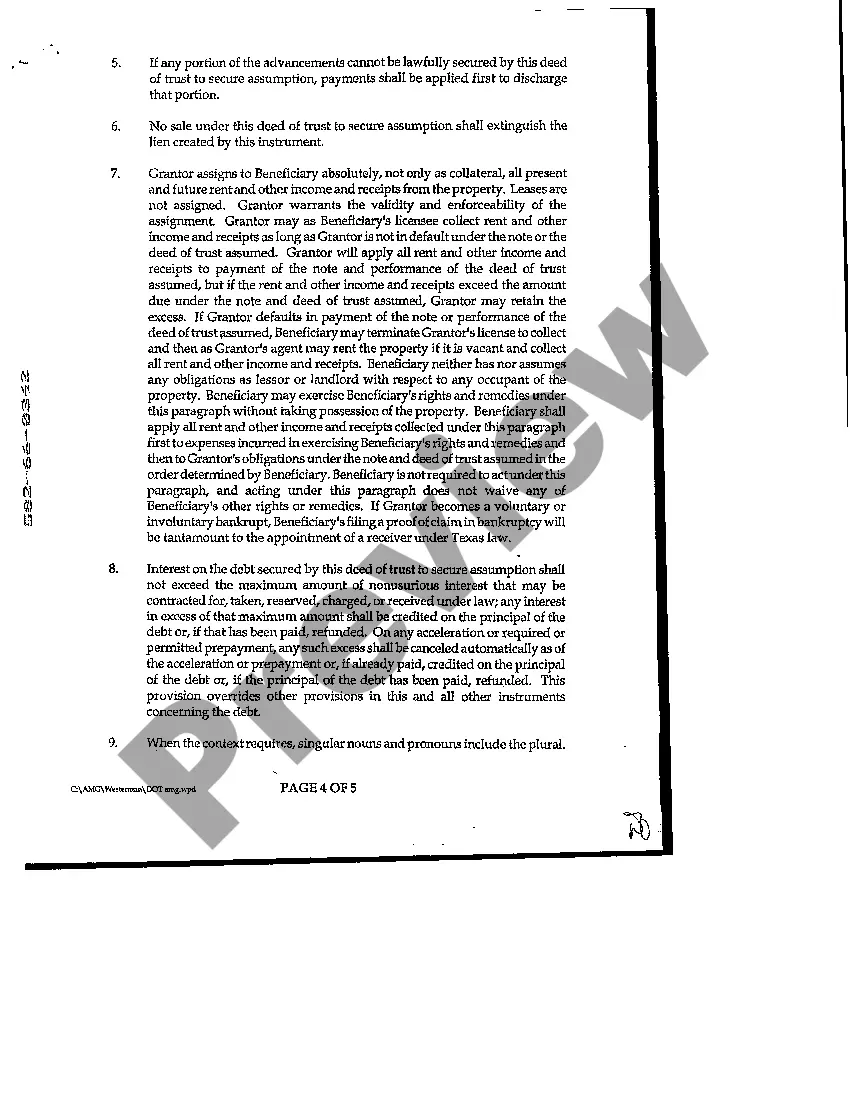

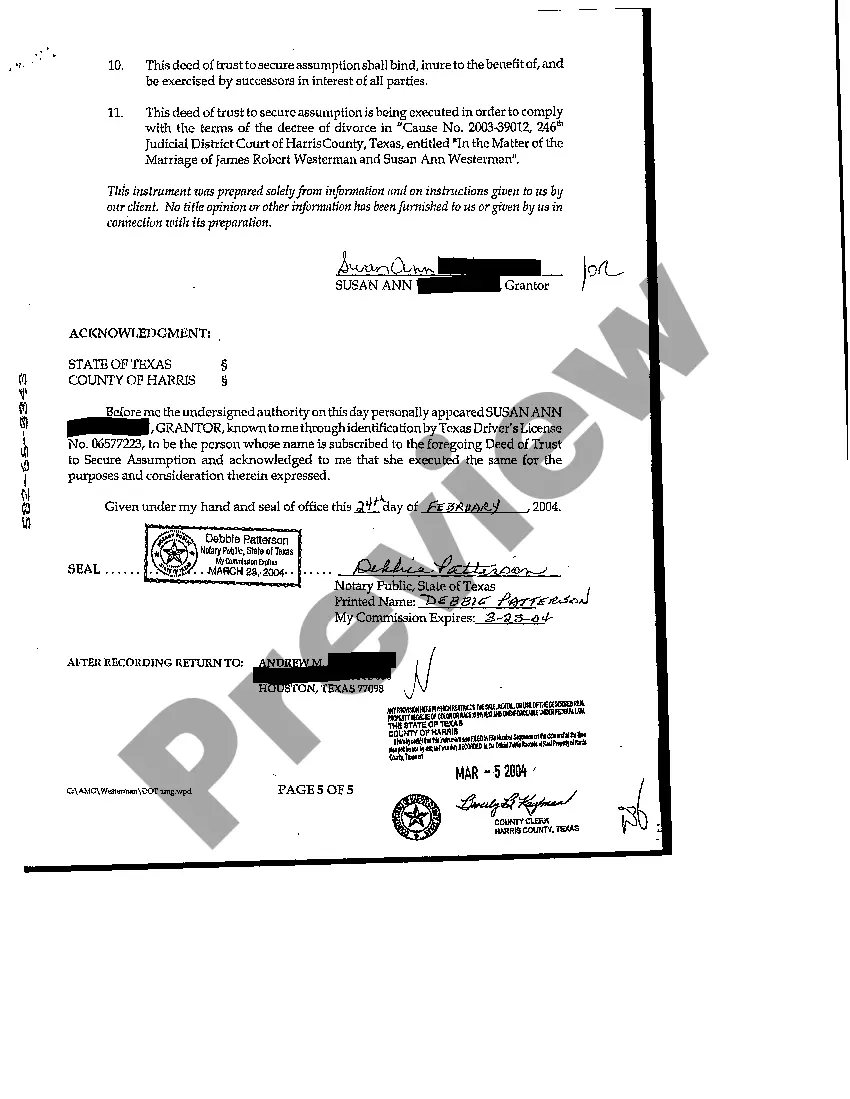

The Houston Texas Deed of Trust to Secure Assumption is a legal document that serves as a type of mortgage agreement specifically used in the state of Texas, more specifically in Houston. This document is designed to outline the terms and conditions of a real estate loan, securing the lender's interest in the property until the loan is fully repaid. The Deed of Trust to Secure Assumption includes several key elements and parties involved. These parties typically include the borrower (also known as the trust or), the lender (also known as the beneficiary), and a third-party trustee who holds legal title to the property until the loan is paid off. This document is recorded at the county clerk's office where the property is located, providing a public record of the loan and securing the lender's interest against any potential claims or disputes. The Deed of Trust allows the lender to foreclose on the property if the borrower defaults on the loan, providing an added layer of security for the lender. There are different types of Houston Texas Deed of Trust to Secure Assumption, depending on the specific terms and conditions agreed upon between the parties involved. Some common types include: 1. Fixed-rate Deed of Trust: This type of Deed of Trust sets a fixed interest rate for the duration of the loan. The borrower makes regular monthly payments towards the principal and interest, ensuring stability and predictability in loan repayment. 2. Adjustable-rate Deed of Trust: In this type of Deed of Trust, the interest rate is subject to change over time. Typically, an adjustable-rate Deed of Trust will have an initial fixed rate for a certain period, after which the interest rate can vary based on market conditions. 3. Wraparound Deed of Trust: This type of Deed of Trust allows a new lender to assume an existing loan by "wrapping" a new loan around the previous loan. The borrower makes a single payment to the new lender, who then distributes the appropriate amount to the previous lender. This type of Deed of Trust can be helpful when the original loan has favorable terms or interest rates. 4. Balloon Deed of Trust: A balloon Deed of Trust involves making smaller monthly payments for a fixed period, such as 5 or 7 years, with a larger final payment, or "balloon payment," due at the end of the term. This type of Deed of Trust is often used when the borrower anticipates a larger sum of money in the future to make the final payment. It is essential for both borrowers and lenders to have a thorough understanding of the terms and conditions outlined in the Houston Texas Deed of Trust to Secure Assumption as it serves to protect the rights and interests of all parties involved in the real estate transaction.

Houston Texas Deed of Trust to Secure Assumption

Description

How to fill out Houston Texas Deed Of Trust To Secure Assumption?

Are you in search of a dependable and affordable legal document provider to acquire the Houston Texas Deed of Trust to Secure Assumption? US Legal Forms is your best option.

Whether you need a simple agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your divorce through the judiciary, we have you covered. Our platform provides over 85,000 current legal document templates for personal and commercial use. All templates we offer are not generic and are tailored to the specific regulations of individual states and counties.

To download the document, you must Log In, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired document templates at any time in the My documents section.

Is this your first visit to our website? No problem. You can create an account in a matter of minutes, but before that, ensure to do the following.

Now you can register your account. Then select the subscription option and proceed with the payment. Once the payment is processed, download the Houston Texas Deed of Trust to Secure Assumption in any available format. You can revisit the website whenever needed and redownload the document free of charge.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online.

- Confirm if the Houston Texas Deed of Trust to Secure Assumption aligns with your state and local regulations.

- Review the form’s details (if available) to understand who and what the document is appropriate for.

- Restart your search if the template does not suit your legal needs.

Form popularity

FAQ

A deed is a legal document which transfers the ownership of a property from a seller to a buyer; whereas a deed of trust is a document or mortgage alternative in many states which does not transfer the property directly to the buyer but transfers it to a trustee or company which holds the title as security until the

Recording Deeds Texas does not require that a deed be recorded in the county clerk's real property records in order to be valid. The only requirement is that it is executed and delivered to the grantee, which then makes the transfer fully effective.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

If a deed is not recorded, then the grantor could sell the land to a second grantee. In that case, the second grantee would get to keep the land if they were the first to record their deed and did not have actual knowledge of the deed to the first grantee.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

: a deed by which a trustee assumes or appoints a new cotrustee.

An assumption deed allows a grantee to assume liability for existing indebtedness and promise to discharge one or more existing liens against the property.

Interesting Questions

More info

The reason for the wording on these documents is that it “secures” the property from the adverse party at the time of the assumption. Mortgage Undertaker. If you have an adverse party who wants to take over the mortgage to sell, you are in a better spot with legal aid. However, there are specific guidelines in Texas for an “adverse party.” In order to avoid a foreclosure case, it doesn't matter how you are in the process of acquiring a mortgage. If you have an adverse party who wants to take over the mortgage to sell, you are in a better spot with legal aid. However, there are specific guidelines in Texas for an “adverse party.” In order to avoid a foreclosure case, it doesn't matter how you are in the process of acquiring a mortgage. Legal Aid to the Rescue. Your insurance company will have insurance to protect the lenders.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.