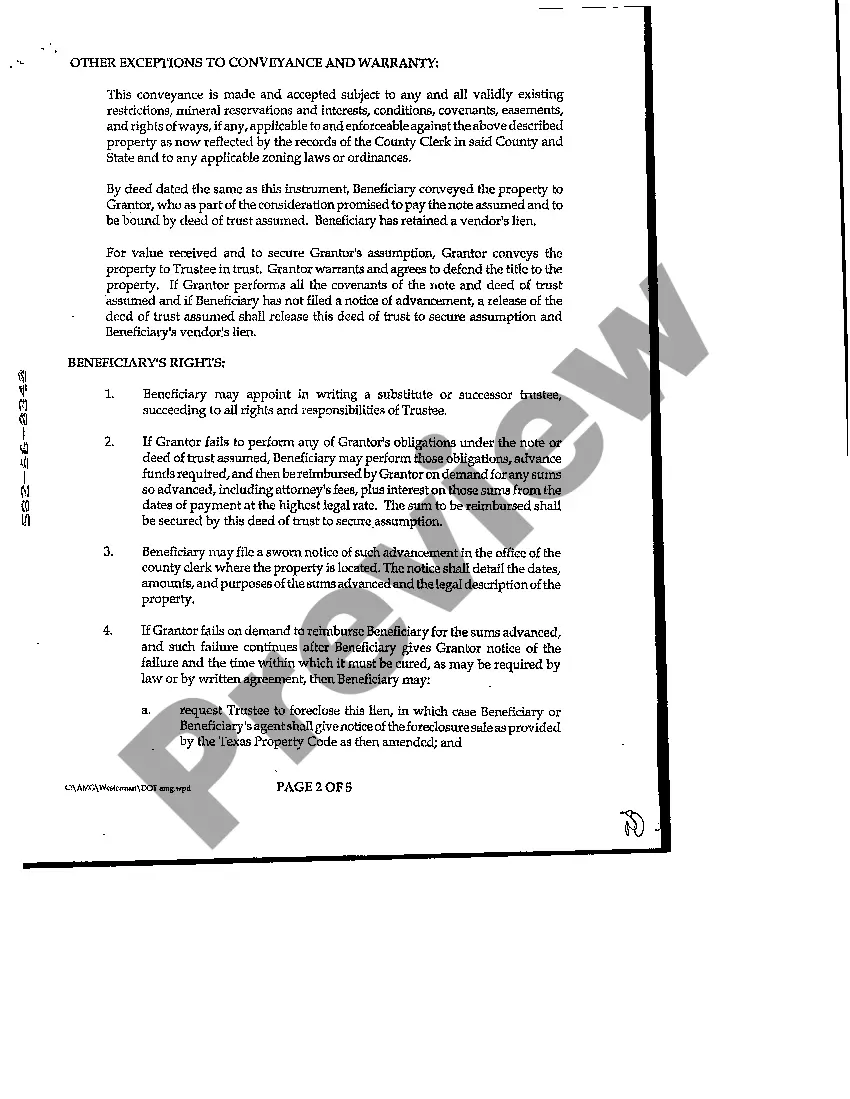

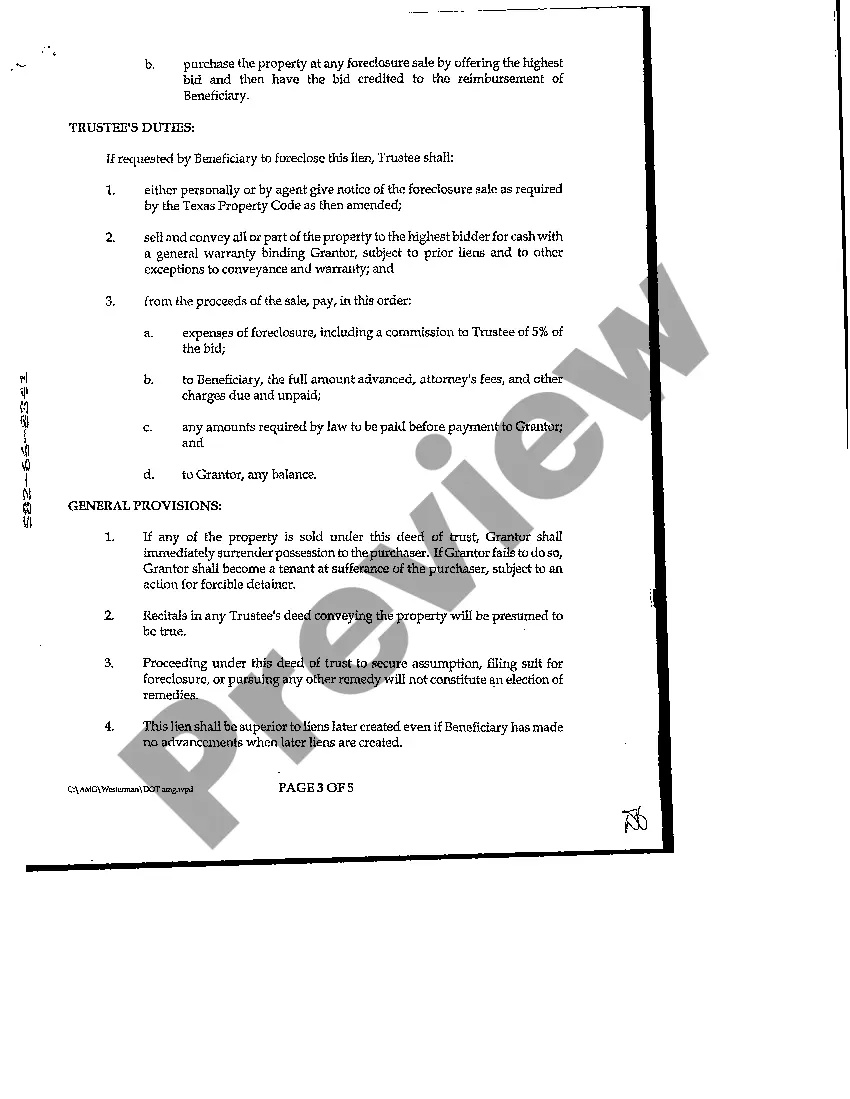

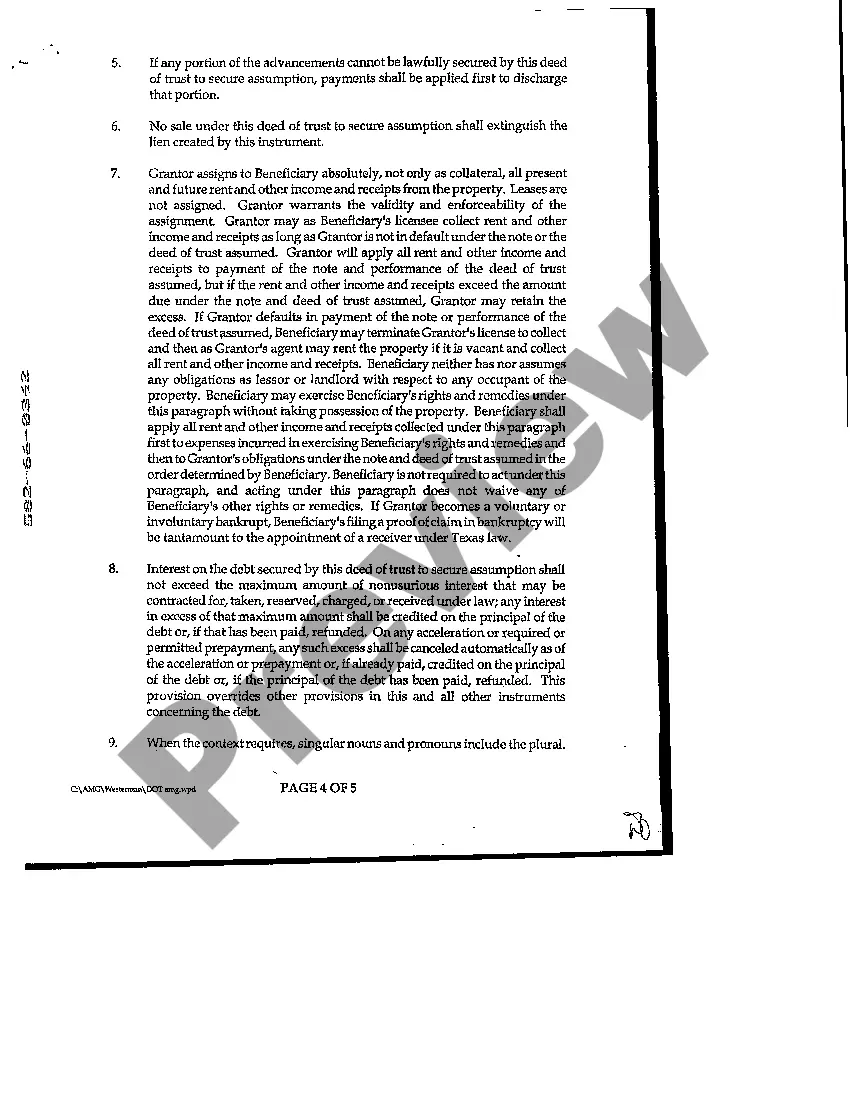

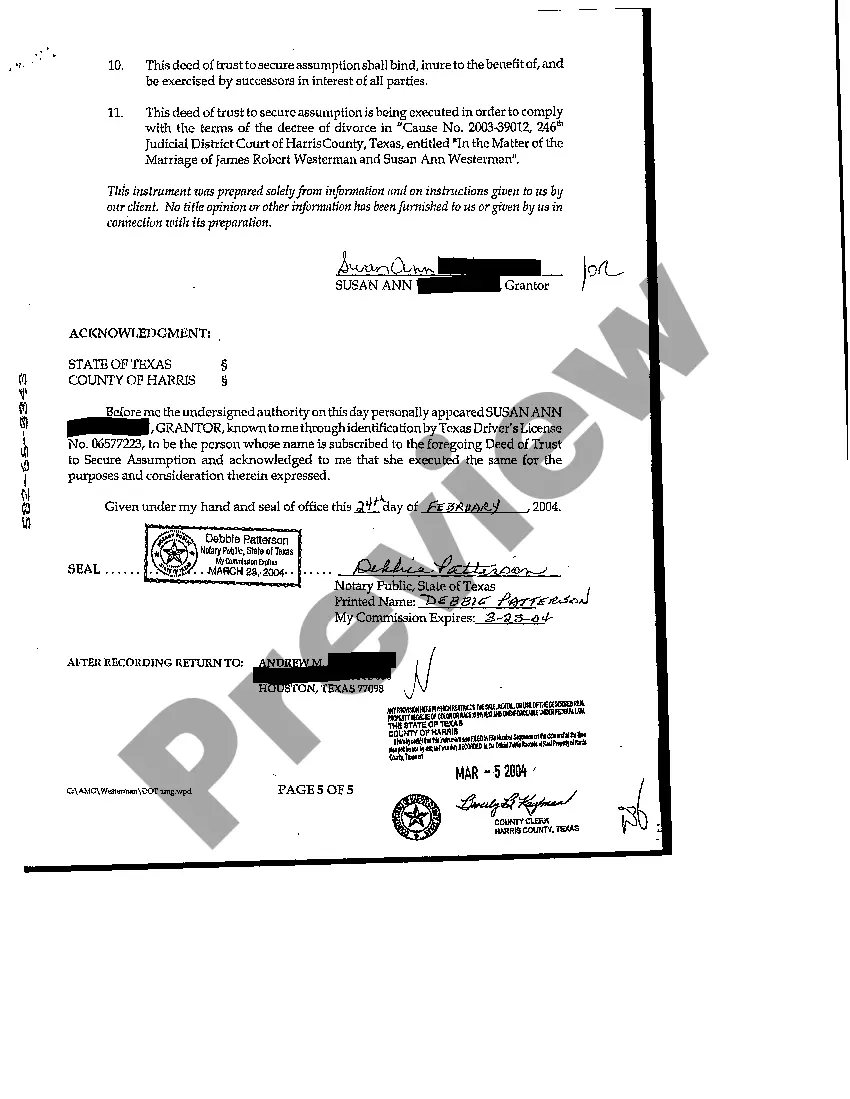

League City, Texas Deed of Trust to Secure Assumption is a legal document commonly used in real estate transactions in League City, Texas. This document serves as a security instrument that allows a lender to secure a loan by using the property as collateral. The Deed of Trust to Secure Assumption outlines the terms and conditions of the loan and provides legal protection to both the lender and the borrower. One of the main purposes of the League City, Texas Deed of Trust to Secure Assumption is to ensure that the lender has a claim on the property in case the borrower defaults on the loan. This means that if the borrower fails to make the required payments or violates any terms of the loan agreement, the lender has the right to initiate a foreclosure process to recover the outstanding balance. The Deed of Trust to Secure Assumption is composed of several sections: 1. Parties involved: This section identifies the parties entering into the agreement, including the lender (often a financial institution) and the borrower (usually the property owner). 2. Property description: Here, the Deed of Trust provides a detailed description of the property being used as collateral for the loan. This typically includes the address, legal description, and other identifying details. 3. Loan terms: This section outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any fees or penalties associated with late payments or default. 4. Assumption provision: The League City Deed of Trust to Secure Assumption may include an assumption provision that allows the borrower to transfer the loan to another party with the lender's consent. This provision ensures that any future owner of the property becomes responsible for the loan. 5. Default and remedies: This section explains the consequences of default, including the lender's rights to initiate foreclosure proceedings and recover any outstanding amounts owed. Some different types of Deed of Trust to Secure Assumption that may be specific to League City, Texas, include: 1. Residential Deed of Trust to Secure Assumption: Used for residential properties, such as single-family homes, townhouses, or condominiums. 2. Commercial Deed of Trust to Secure Assumption: Applicable to commercial properties, including office buildings, retail spaces, or industrial facilities. 3. Investment Property Deed of Trust to Secure Assumption: Specific to properties purchased for investment purposes, such as rental properties or vacation homes. It is crucial for both lenders and borrowers in League City, Texas, to carefully review and understand the terms and conditions outlined in the Deed of Trust to Secure Assumption. Seeking legal advice from a qualified professional can ensure compliance with applicable laws and protect the interests of all parties involved.

League City Texas Deed of Trust to Secure Assumption

State:

Texas

City:

League City

Control #:

TX-C094

Format:

PDF

Instant download

This form is available by subscription

Description

Deed of Trust to Secure Assumption

League City, Texas Deed of Trust to Secure Assumption is a legal document commonly used in real estate transactions in League City, Texas. This document serves as a security instrument that allows a lender to secure a loan by using the property as collateral. The Deed of Trust to Secure Assumption outlines the terms and conditions of the loan and provides legal protection to both the lender and the borrower. One of the main purposes of the League City, Texas Deed of Trust to Secure Assumption is to ensure that the lender has a claim on the property in case the borrower defaults on the loan. This means that if the borrower fails to make the required payments or violates any terms of the loan agreement, the lender has the right to initiate a foreclosure process to recover the outstanding balance. The Deed of Trust to Secure Assumption is composed of several sections: 1. Parties involved: This section identifies the parties entering into the agreement, including the lender (often a financial institution) and the borrower (usually the property owner). 2. Property description: Here, the Deed of Trust provides a detailed description of the property being used as collateral for the loan. This typically includes the address, legal description, and other identifying details. 3. Loan terms: This section outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any fees or penalties associated with late payments or default. 4. Assumption provision: The League City Deed of Trust to Secure Assumption may include an assumption provision that allows the borrower to transfer the loan to another party with the lender's consent. This provision ensures that any future owner of the property becomes responsible for the loan. 5. Default and remedies: This section explains the consequences of default, including the lender's rights to initiate foreclosure proceedings and recover any outstanding amounts owed. Some different types of Deed of Trust to Secure Assumption that may be specific to League City, Texas, include: 1. Residential Deed of Trust to Secure Assumption: Used for residential properties, such as single-family homes, townhouses, or condominiums. 2. Commercial Deed of Trust to Secure Assumption: Applicable to commercial properties, including office buildings, retail spaces, or industrial facilities. 3. Investment Property Deed of Trust to Secure Assumption: Specific to properties purchased for investment purposes, such as rental properties or vacation homes. It is crucial for both lenders and borrowers in League City, Texas, to carefully review and understand the terms and conditions outlined in the Deed of Trust to Secure Assumption. Seeking legal advice from a qualified professional can ensure compliance with applicable laws and protect the interests of all parties involved.

Free preview

How to fill out League City Texas Deed Of Trust To Secure Assumption?

If you’ve already utilized our service before, log in to your account and download the League City Texas Deed of Trust to Secure Assumption on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your League City Texas Deed of Trust to Secure Assumption. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!