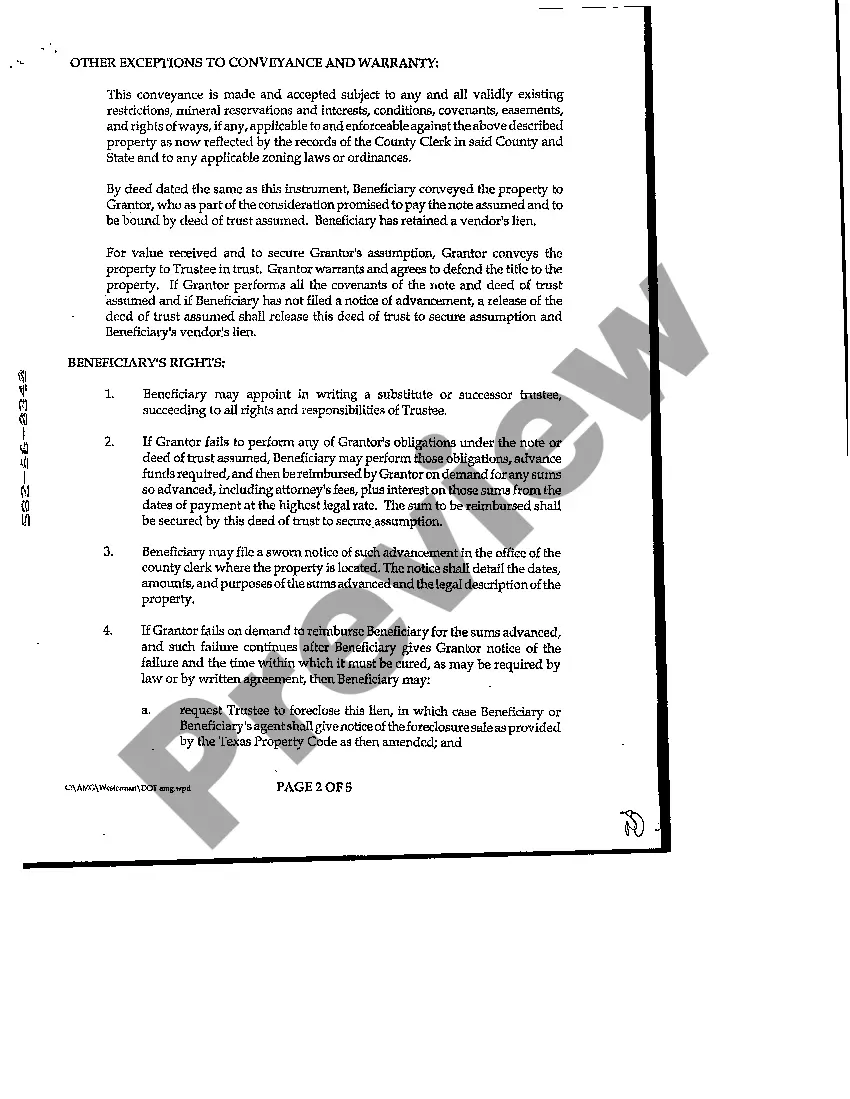

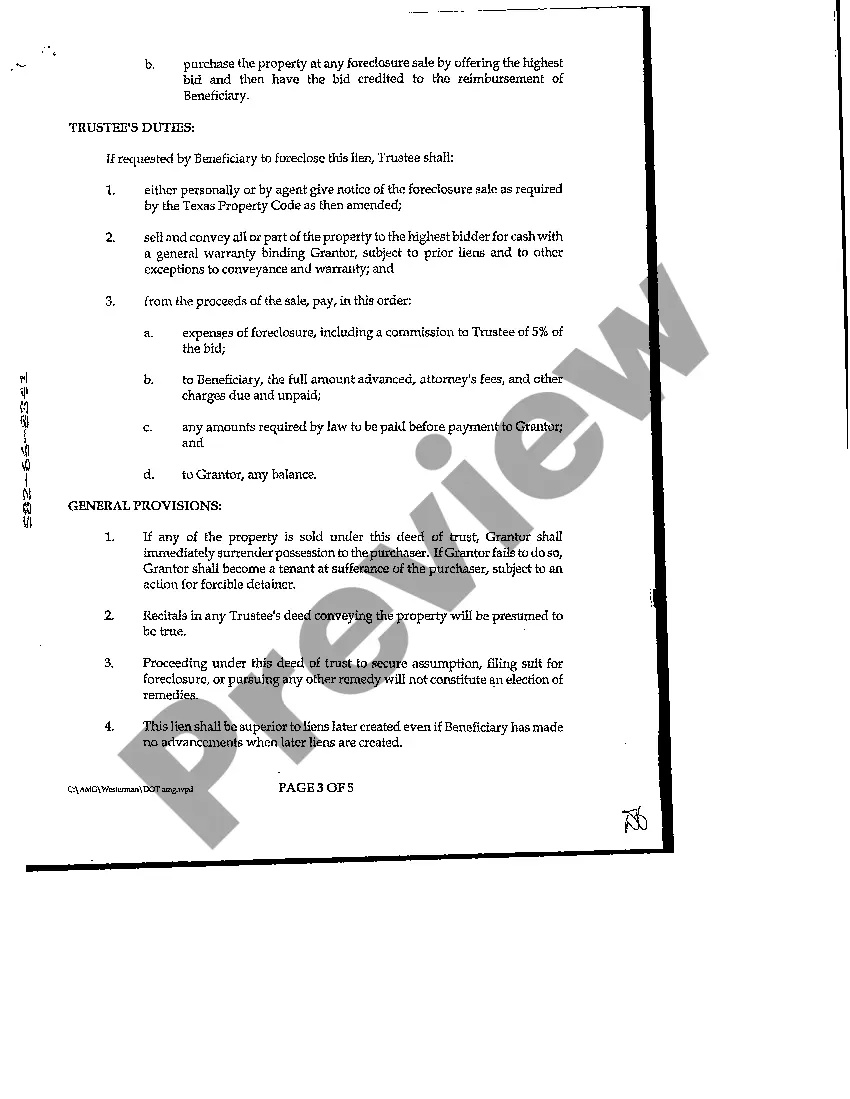

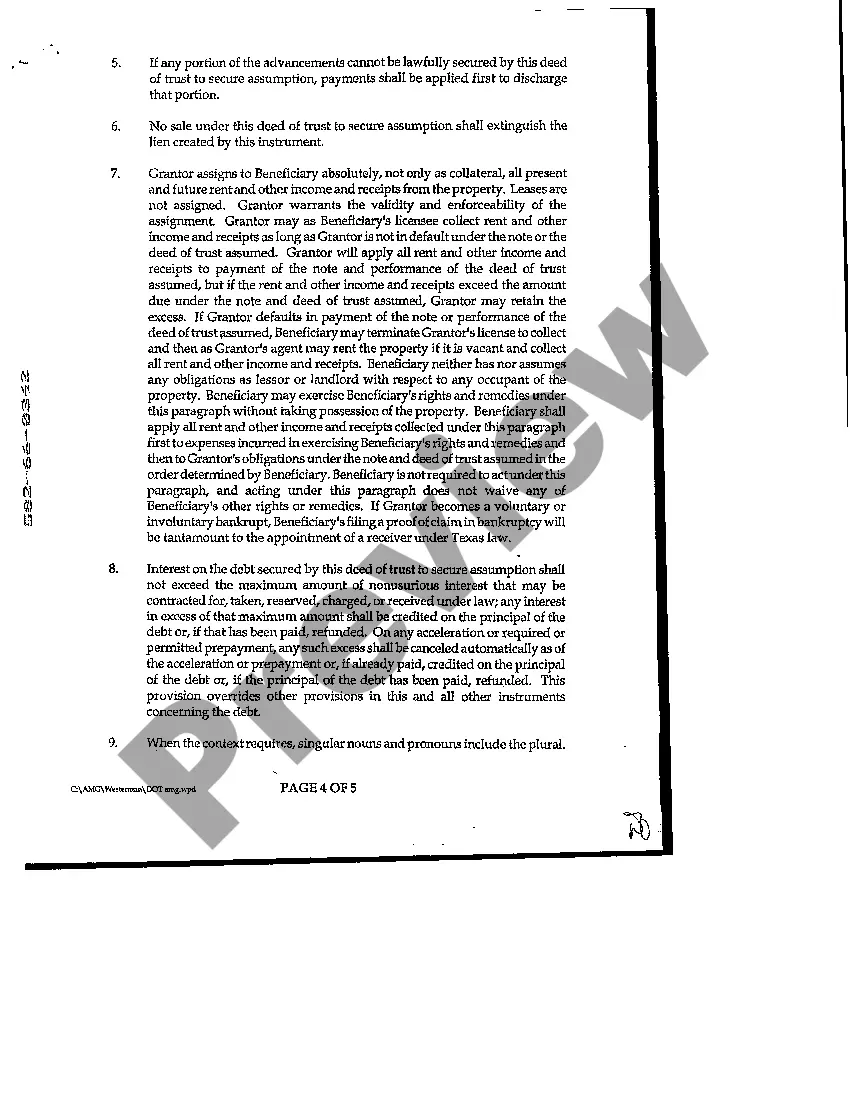

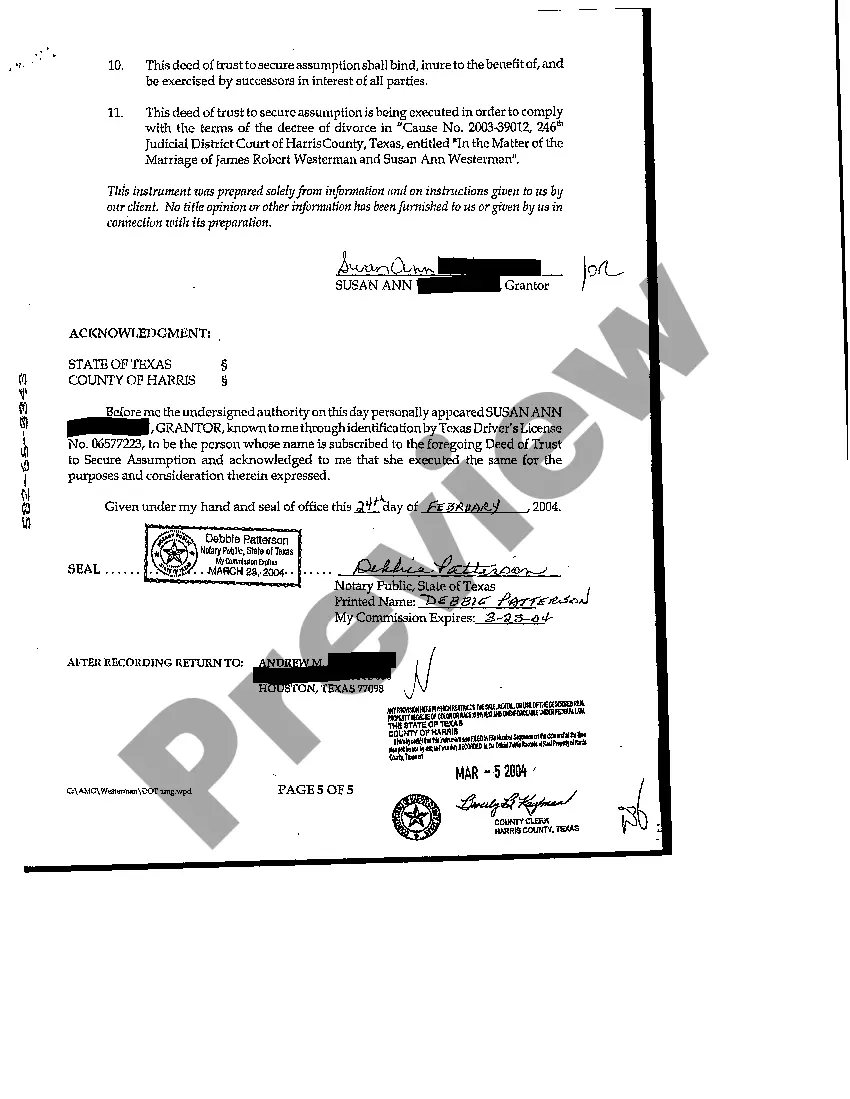

The Pearland Texas Deed of Trust to Secure Assumption is a legal document that serves as a security instrument for a loan or mortgage, allowing lenders to secure the repayment of a debt by establishing a lien on the property in Pearland, Texas. This document outlines the terms and conditions agreed upon by the lender, borrower, and potential assumption. A Pearland Texas Deed of Trust to Secure Assumption typically includes the following key details: 1. Parties involved: The document identifies the lender, borrower, and assumption, if applicable, involved in the transaction. 2. Property description: The document provides a detailed description of the property being used as collateral, including its legal description, address, and any specific features or notable characteristics. 3. Loan details: It outlines the loan amount, interest rate, repayment terms, and any additional terms or conditions agreed upon by the parties. 4. Assumption provisions: If the borrower intends to transfer the loan and property to a new borrower (assumption), this section outlines the requirements, qualifications, and responsibilities of assuming the loan, including creditworthiness and approval from the lender. 5. Default and foreclosure provisions: The deed of trust clearly defines the actions that constitute a default, such as failure to make timely payments, and the consequences of default, such as foreclosure proceedings initiated by the lender. Different types of Pearland Texas Deed of Trust to Secure Assumption may include: 1. Traditional Deed of Trust: This is the typical deed of trust used for a mortgage loan, where the borrower assigns a security interest in the property to the lender until the loan is fully paid off. 2. Deed of Trust with Assumption: This type allows the borrower to transfer the loan and property to a new borrower, who assumes the existing loan obligations while benefiting from the secured interest in the property. 3. Deed of Trust with Due-on-Sale Clause: This variation includes a due-on-sale provision, allowing the lender to demand full repayment of the loan, often at the time of property transfer or assumption. In summary, the Pearland Texas Deed of Trust to Secure Assumption is a legal document that establishes a lien on a property in Pearland, Texas, as security for a loan. It outlines the terms, conditions, and provisions related to assumption of the loan and foreclosure in case of default.

Pearland Texas Deed of Trust to Secure Assumption

Description

How to fill out Pearland Texas Deed Of Trust To Secure Assumption?

If you have previously utilized our service, sign in to your account and store the Pearland Texas Deed of Trust to Secure Assumption on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to all the documents you have purchased: they can be located in your profile under the My documents section whenever you wish to access them again. Make use of the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Ensure you’ve found an appropriate document. Browse through the description and utilize the Preview option, if offered, to verify if it suits your requirements. If it doesn’t match, employ the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Pearland Texas Deed of Trust to Secure Assumption. Choose the file format for your document and download it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Section 13.001 - Validity of Unrecorded Instrument (a) A conveyance of real property or an interest in real property or a mortgage or deed of trust is void as to a creditor or to a subsequent purchaser for a valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

An assumption deed allows a grantee to assume liability for existing indebtedness and promise to discharge one or more existing liens against the property.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

More info

Title 10, Part 1, Chapter 1, §2. Table 2: Proposed Project, with Existing Land Use. Pearland, Texas, where Frank and Judy Haggerty live. Table 3: Existing Land Use within 0. 5 Miles of Proposed Project. Oakville, Oak brook Terrace, Austin, Round Rock, and other cities where Mr. and Mrs. Frank Haggerty live. Appendix A: Project Site Map The developer's proposed project includes, but is not limited to, the project property described on the Project Site Map and the project area described on the Project Site Map. The Project Site Map is an artist render- ING to show a reasonable, prudent, and prudent development plan, a general outline of the site location and the general size of the land use for development on that site. The Developer will not commence any work or any construction until all necessary approvals and permits are received and approved and the Project Site Map is approved by the Planning Committee.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.