Title: Understanding Tarrant Texas Deed of Trust to Secure Assumption: Types and Description Introduction: Tarrant County, Texas, utilizes Deeds of Trust to Secure Assumption as a legal instrument to secure loans and mortgages. This detailed description will provide insights into the purpose, features, and types of Tarrant Texas Deed of Trust to Secure Assumption, helping borrowers, lenders, and potential property buyers to better understand this essential aspect of real estate transactions. Key Terms and Definitions: 1. Tarrant Texas Deed of Trust: A legal document used as collateral for a loan or mortgage, involving three parties borrowerer trustst oror), the lender (beneficiary), and an impartial trustee. The deed transfers title to a trustee who holds it until the loan is fully repaid. 2. To Secure Assumption: A clause added to the Tarrant Texas Deed of Trust, allowing the borrower to transfer the property while still keeping the original loan intact. This clause permits a new borrower (assignee) to assume the existing loan terms, avoiding additional financing. Types of Tarrant Texas Deed of Trust to Secure Assumption: 1. Standard Deed of Trust to Secure Assumption: This is the most common type of Tarrant Texas Deed of Trust, where the borrower pledges the property as security for a loan. It includes provisions for repayment terms, interest rates, and default conditions. The lender has the ability to initiate foreclosure proceedings in case of default. 2. FHA-Insured Deed of Trust to Secure Assumption: This type of deed features additional requirements set by the Federal Housing Administration (FHA). It allows borrowers to assume loans with lower credit scores and smaller down payments, promoting broader homeownership opportunities. 3. VA-Guaranteed Deed of Trust to Secure Assumption: Designed for military veterans and active duty personnel, this type of deed provides loan guarantee by the Department of Veterans Affairs (VA). It allows for the assumption of VA-backed loans with minimal documentation and reduced closing costs. Description: The Tarrant Texas Deed of Trust to Secure Assumption serves as a legally binding agreement between a borrower and a lender, ensuring the repayment of a loan while transferring the property's title to a trustee. By securing the lender's interests, this document protects the borrower's possession rights and enables a smooth assumption process for future buyers. Typically, the deed specifies the loan amount, interest rate, repayment terms, and any additional conditions agreed upon by both parties. The To Secure Assumption clause grants the borrower the right to assign the loan to a new party, who becomes legally responsible for fulfilling the loan obligations. This feature helps facilitate property transfers without the need for new financing. The Tarrant Texas Deed of Trust to Secure Assumption provides the lender with recourse in the event of default, as they can initiate foreclosure proceedings. This ensures that the lender can recover their investment in case the borrower fails to meet their repayment obligations. Conclusion: Tarrant Texas Deed of Trust to Secure Assumption is a critical legal instrument in real estate transactions within Tarrant County. By understanding its various types and various clauses, prospective borrowers, lenders, and property buyers can navigate the intricacies of loan agreements and property transfers with knowledge and confidence.

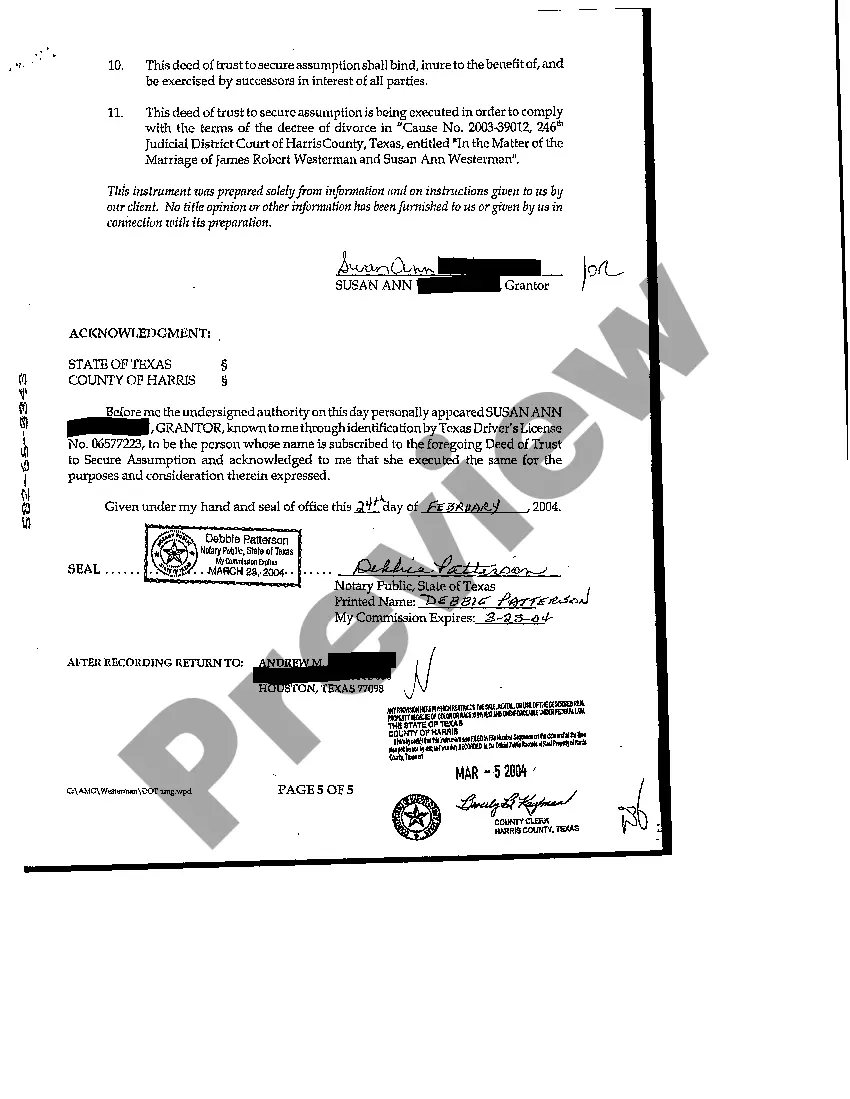

Tarrant Texas Deed of Trust to Secure Assumption

Description

How to fill out Tarrant Texas Deed Of Trust To Secure Assumption?

Benefit from the US Legal Forms and get immediate access to any form sample you want. Our useful platform with a large number of templates makes it simple to find and get almost any document sample you want. You can export, fill, and sign the Tarrant Texas Deed of Trust to Secure Assumption in just a few minutes instead of browsing the web for many hours trying to find an appropriate template.

Using our library is an excellent strategy to raise the safety of your form filing. Our professional legal professionals on a regular basis review all the records to make sure that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the Tarrant Texas Deed of Trust to Secure Assumption? If you have a subscription, just log in to the account. The Download option will appear on all the samples you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the instruction below:

- Find the template you require. Make sure that it is the form you were looking for: examine its title and description, and use the Preview function if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading process. Select Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the document. Pick the format to get the Tarrant Texas Deed of Trust to Secure Assumption and edit and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the web. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Tarrant Texas Deed of Trust to Secure Assumption.

Feel free to make the most of our service and make your document experience as straightforward as possible!