The Wichita Falls Texas Deed of Trust to Secure Assumption is a legal document that grants a lender a security interest in a property located in Wichita Falls, Texas, in order to secure the repayment of a loan. This type of deed is commonly used in real estate transactions and helps protect the lender's interests in the property in case the borrower defaults on the loan. The document outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. It also specifies the responsibilities of both the lender and the borrower throughout the loan period. The Wichita Falls Texas Deed of Trust to Secure Assumption contains several important clauses. One such clause is the assumption clause, which allows a new borrower to assume the loan and take over the payments from the original borrower. This can occur when the property is sold, and the new owner wants to continue the existing loan rather than obtaining a new mortgage. Another clause commonly found in this type of deed is the default clause. This clause outlines the actions the lender can take if the borrower fails to meet their obligations, such as making timely payments. It may include provisions for late fees, foreclosure processes, and the lender's right to sell the property to recoup their losses. The Wichita Falls Texas Deed of Trust to Secure Assumption may also include an acceleration clause, which grants the lender the right to demand the immediate repayment of the entire loan balance if certain conditions are not met. This typically occurs when the borrower defaults on the loan or violates the terms of the agreement. It is important for both the lender and the borrower to thoroughly review and understand the terms outlined in the Wichita Falls Texas Deed of Trust to Secure Assumption before signing. It is recommendable for both parties to seek legal counsel to ensure that their interests are protected and that they comply with all applicable laws and regulations. Some possible variations or types of Wichita Falls Texas Deed of Trust to Secure Assumption may include adjustable-rate mortgages (ARM's), fixed-rate mortgages, balloon mortgages, and government-insured mortgages such as Federal Housing Administration (FHA) loans or Veterans Affairs (VA) loans. Each type may have specific provisions and eligibility requirements, catering to different borrowers' needs and financial situations.

Wichita Falls Texas Deed of Trust to Secure Assumption

Description

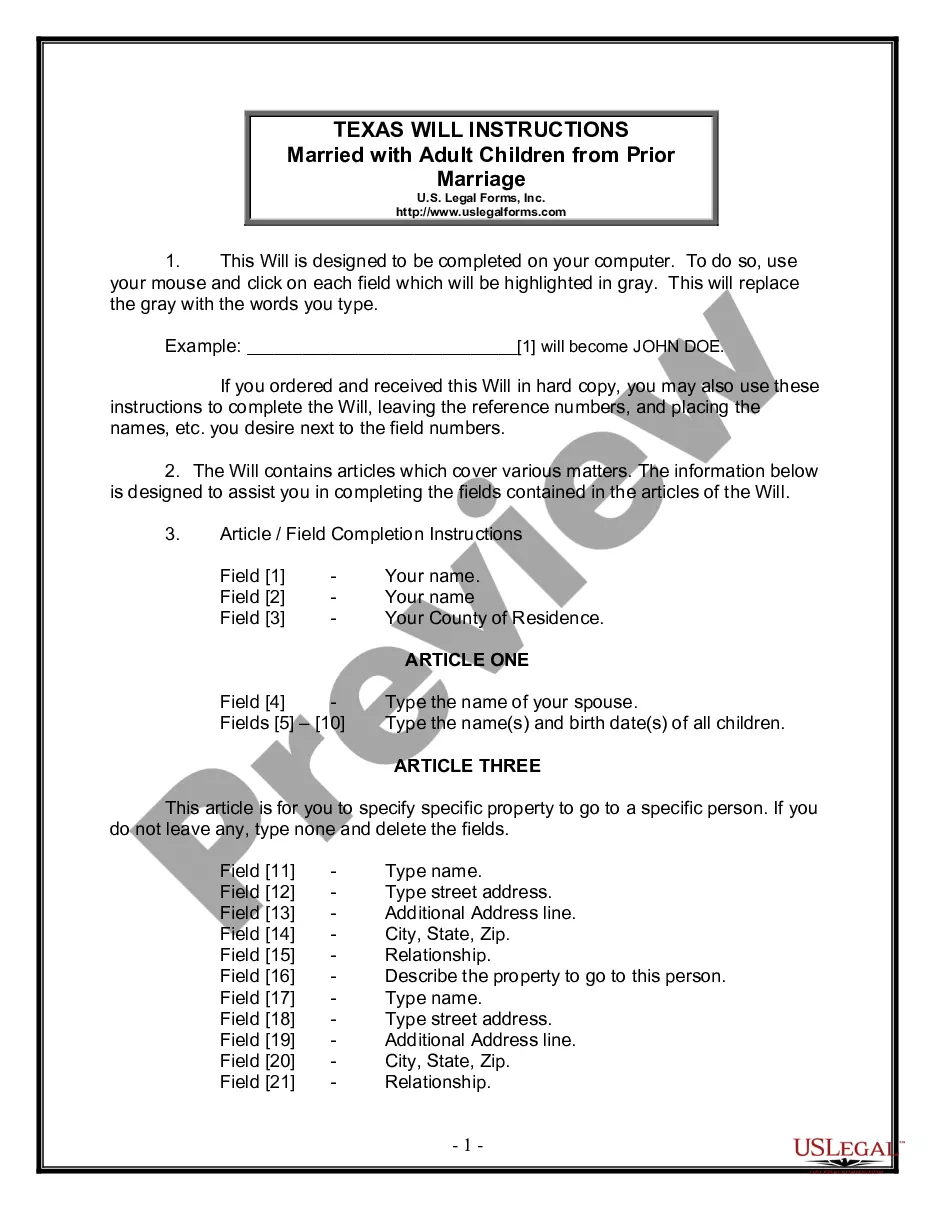

How to fill out Wichita Falls Texas Deed Of Trust To Secure Assumption?

If you are looking for a valid form, it’s difficult to find a better place than the US Legal Forms site – probably the most extensive online libraries. Here you can get thousands of form samples for business and personal purposes by categories and regions, or keywords. With our high-quality search function, finding the most recent Wichita Falls Texas Deed of Trust to Secure Assumption is as easy as 1-2-3. Additionally, the relevance of each and every document is proved by a team of skilled lawyers that on a regular basis check the templates on our platform and revise them in accordance with the newest state and county demands.

If you already know about our platform and have an account, all you need to receive the Wichita Falls Texas Deed of Trust to Secure Assumption is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Check its information and use the Preview option to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the needed file.

- Affirm your choice. Click the Buy now button. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the received Wichita Falls Texas Deed of Trust to Secure Assumption.

Every form you add to your account does not have an expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to receive an additional copy for modifying or printing, feel free to come back and save it once again anytime.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Wichita Falls Texas Deed of Trust to Secure Assumption you were seeking and thousands of other professional and state-specific templates on one platform!

Form popularity

FAQ

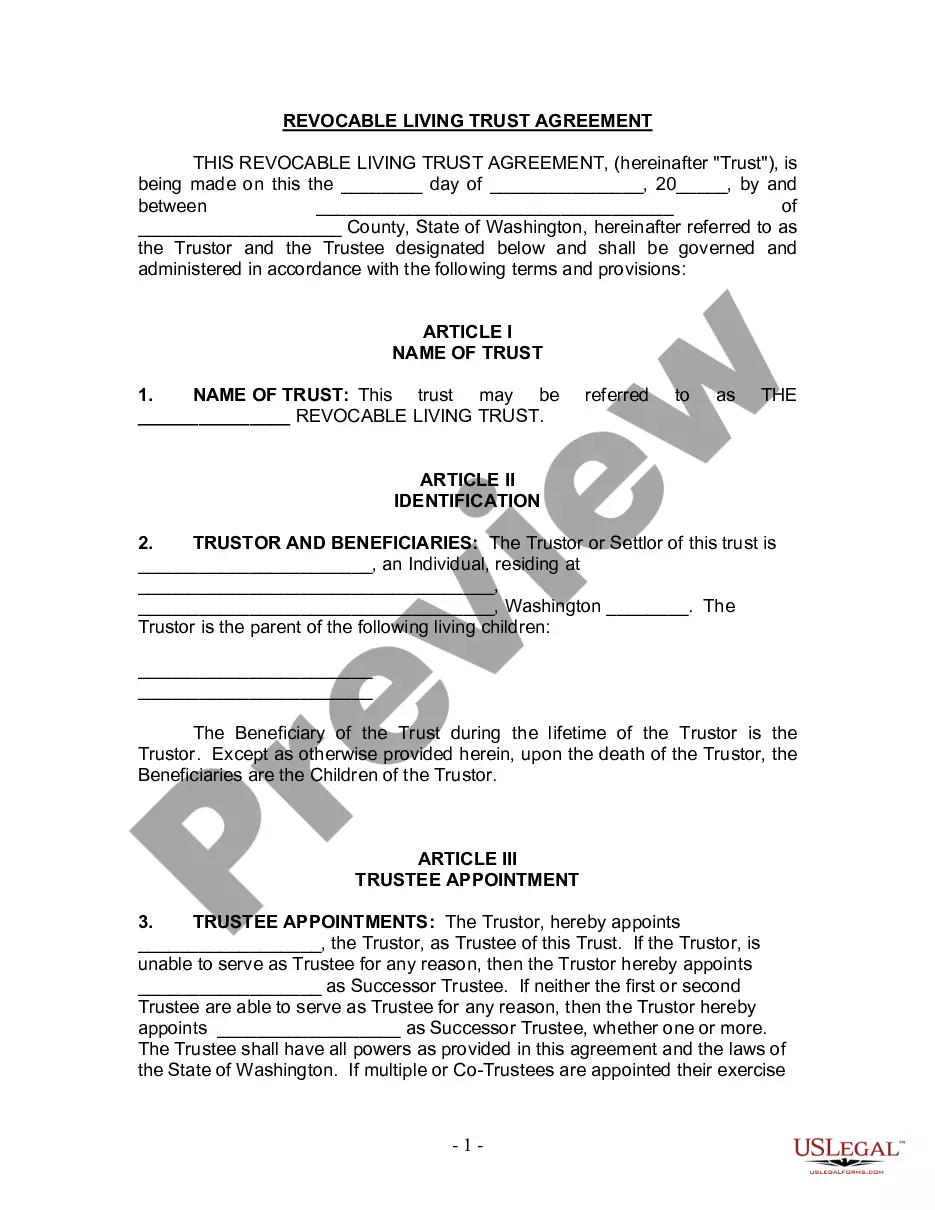

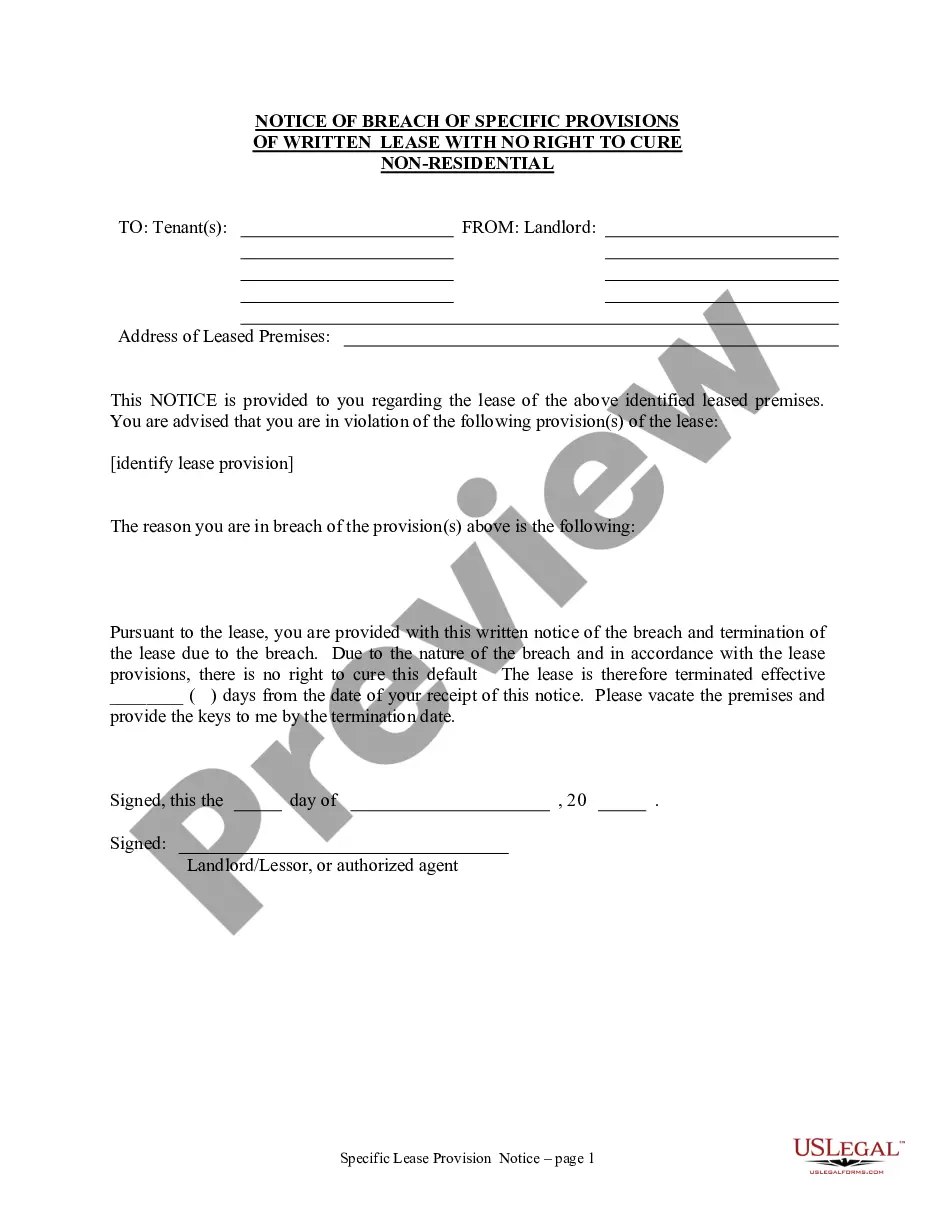

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

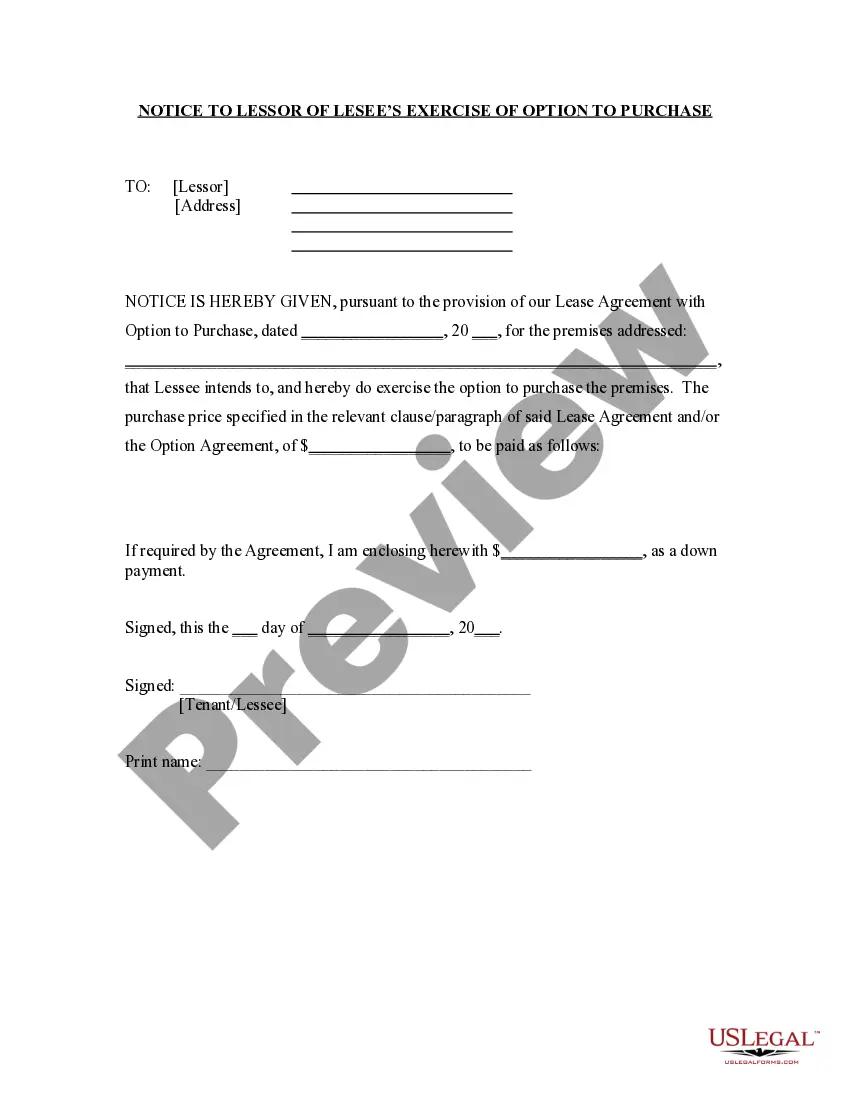

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

An assumption deed allows a grantee to assume liability for existing indebtedness and promise to discharge one or more existing liens against the property.