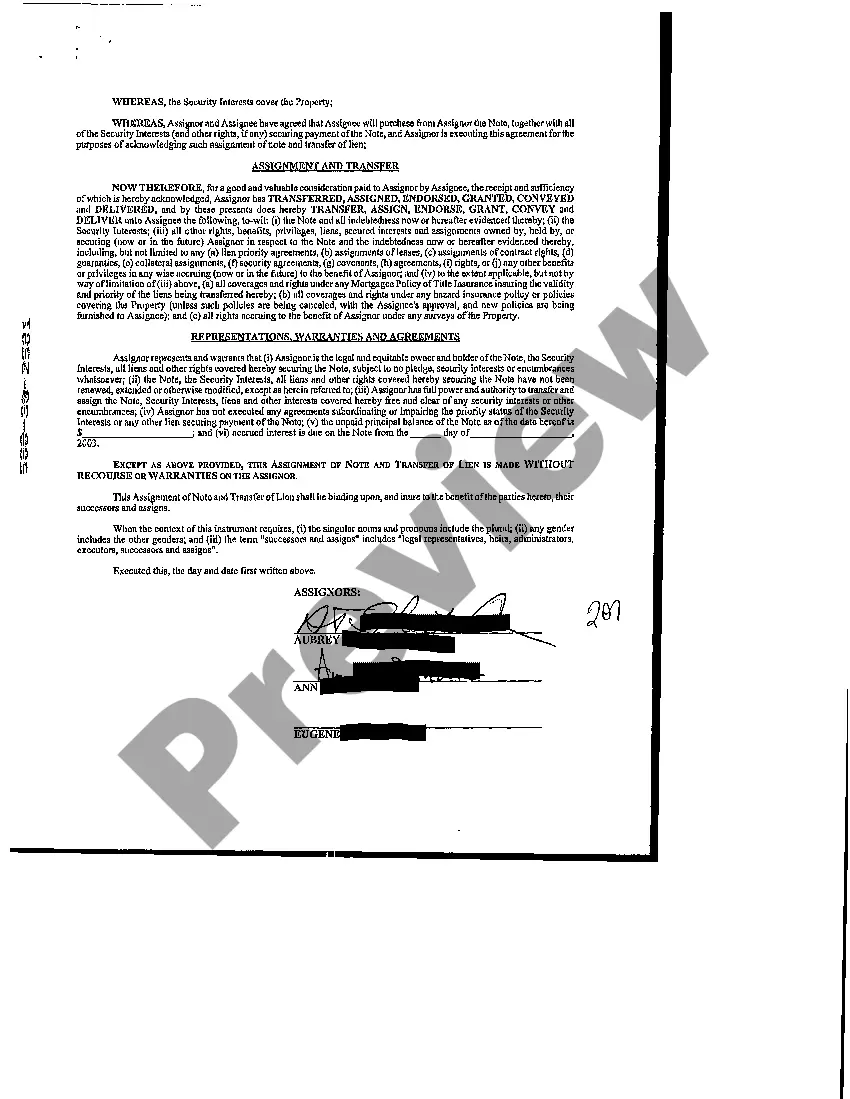

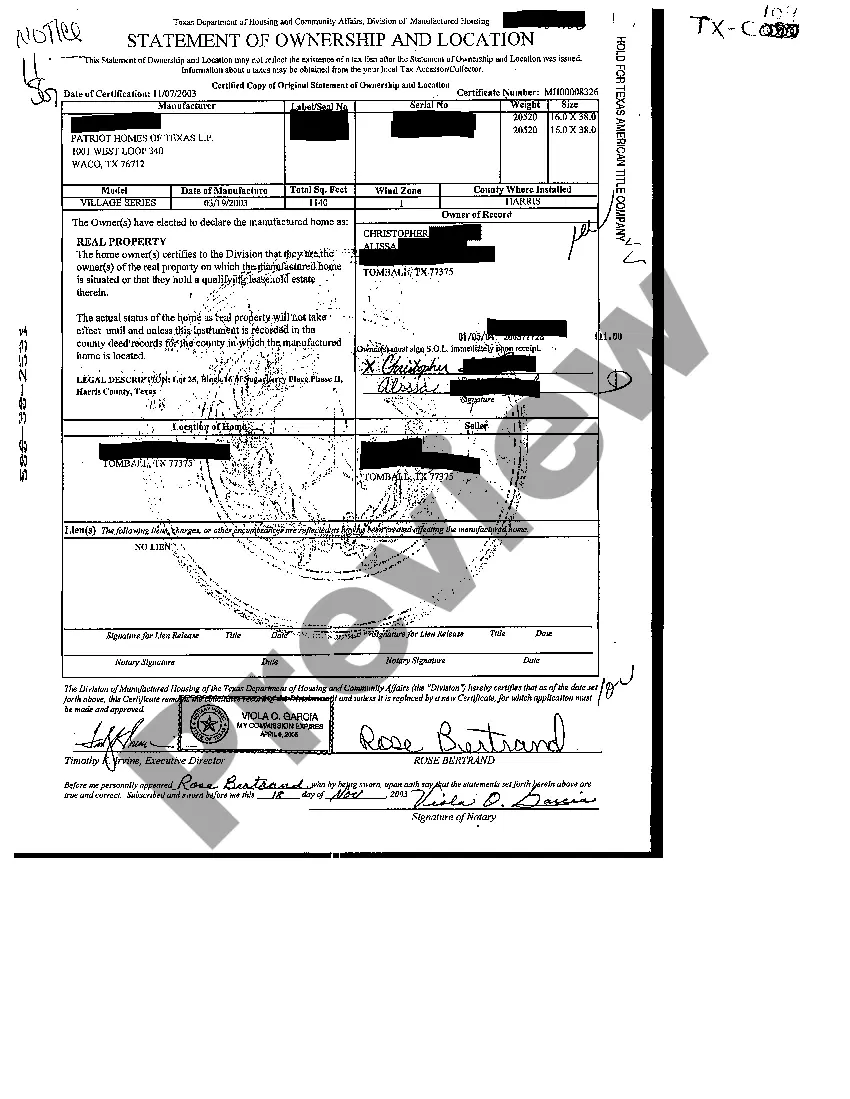

Brownsville Texas Assignment of Note and Liens refer to legal documents that transfer the responsibility of a mortgage note and any associated liens from one party to another in the Brownsville, Texas area. These agreements play a vital role in real estate transactions, ensuring a smooth transfer of ownership and protecting the interests of both the buyer and seller. Below are some types of Brownsville Texas Assignment of Note and Liens: 1. Mortgage Note Assignment: This type of assignment involves the transfer of the mortgage note from the original lender, known as the assignor, to a new lender, known as the assignee. It outlines the terms and conditions of the agreement, including the outstanding loan balance, payment schedule, and any specific conditions agreed upon by both parties. 2. Deed of Trust Assignment: In some cases, the mortgage note is secured by a deed of trust, which is a type of lien on the property. A Deed of Trust Assignment is used to transfer this lien from one party to another. It ensures that the assignee has the right to collect payments, enforce the lien, and potentially foreclose on the property if the borrower defaults on the loan. 3. Release of Lien: This type of assignment involves the removal of a lien from the property's title. It is commonly used when a mortgage is fully paid off, or when the lien is deemed invalid or satisfied. The Release of Lien certifies that the property is free from any encumbrances or claims, allowing the owner to sell or refinance the property without any hindrances. 4. Subordination Agreement: In situations where multiple liens exist on a property, a Subordination Agreement may be used. This type of assignment reorders the priority of the liens, typically to facilitate a new loan or refinancing. By agreeing to subordinate their lien, a lender allows another creditor to have a higher priority claim on the property in case of default. 5. Assignment of Lien holder's Interest: This assignment involves the transfer of the lien holder's interest in a property when the lien is sold or assigned to a third party. The assignment document outlines the rights, responsibilities, and obligations of the new lien holder, including the right to collect payments, pursue foreclosure if necessary, and potential remedies in case of default. It is important to consult with legal professionals or real estate experts familiar with Texas real estate laws when preparing or executing any Brownsville Texas Assignment of Note and Liens to ensure compliance and protect all parties' interests involved.

Brownsville Texas Assignment of Note and Liens

Description

How to fill out Brownsville Texas Assignment Of Note And Liens?

Locating validated templates pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements across various real-life scenarios.

All the files are skillfully organized by area of application and jurisdiction, allowing you to find the Brownsville Texas Assignment of Note and Liens as easily as pie.

Maintaining records tidy and in accordance with legal stipulations is paramount. Utilize the US Legal Forms library to have vital document templates readily available for any requests at your fingertips!

- Verify the Preview mode and document description.

- Ensure you’ve selected the appropriate one that fulfills your needs and completely aligns with your local jurisdiction standards.

- Seek an alternative template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to locate the right one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

To assign a contract in Texas, start by drafting an assignment agreement that includes pertinent details about the original contract. Both parties must sign this agreement to signify their acceptance of the transfer. It's also important to review the original contract for any restrictions on assignment, particularly in cases related to Brownsville Texas Assignment of Note and Liens.

A lien is a legal claim against a property as security for a debt or obligation, while assignment refers to the transfer of rights or interests from one party to another. Understanding how these two concepts interact is vital in scenarios involving property and financial obligations. In the realm of Brownsville Texas Assignment of Note and Liens, these definitions can significantly impact your rights and responsibilities.

A contract is assigned by creating a formal written document that details the assignment. This document should identify the parties involved and describe the contract being assigned. After both the assignor and the assignee sign this document, it is essential to communicate with the other party to the original contract to ensure awareness of the assignment, especially in situations involving Brownsville Texas Assignment of Note and Liens.

To file a release of lien on a property in Texas, complete the appropriate release form and have it signed by the lienholder. Then, file the document with the county clerk in the county where the property is located. This step removes the lien, ensuring your property is clear for future transactions, including those related to Brownsville Texas Assignment of Note and Liens.

To make a contract legal in Texas, ensure that all parties involved agree to the terms and that the contract includes necessary elements such as offer, acceptance, and consideration. Additionally, comply with any specific requirements outlined in Texas law, such as written forms for certain types of agreements. Understanding the basics of the Brownsville Texas Assignment of Note and Liens can also help ensure compliance with legal standards.

To assign a contract, you generally need a written agreement that clearly states the intent to assign your rights under the contract. Ensure that the original contract does not prohibit assignment. You may also need to notify the other party of the assignment to maintain transparency and comply with any legal requirements related to Brownsville Texas Assignment of Note and Liens.

To assign a contract to someone else, you will need to prepare an assignment agreement that names both you and the assignee. Include specific details about the contract being assigned. After both parties sign this document, provide a copy to the other party involved in the original contract. This process is essential when managing a Brownsville Texas Assignment of Note and Liens.

To appeal property taxes in Cameron County, you must file a notice with the Appraisal Review Board within the designated timeframe after receiving your tax notice. Prepare documentation that supports your case, such as appraisals or comparison sales data. Attend the hearing to present your information. Utilizing services related to the Brownsville Texas Assignment of Note and Liens may offer additional insights or guidance during the appeals process, ensuring you understand your rights.

Yes, you can apply for a Texas homestead exemption online in many areas, including Brownsville. The local appraisal district often has an online portal where you can submit your application electronically, making it quick and convenient. Just make sure you have all required documents ready for upload. This efficient process can be very helpful, especially when you also manage aspects related to the Brownsville Texas Assignment of Note and Liens.

To apply for a homestead exemption in Brownsville, TX, you need to fill out an Application for a Texas Homestead Exemption form available from the local appraisal district. Ensure you gather necessary documents, such as proof of residency and identification, making the process smoother. Once completed, submit your application before the deadline to enjoy the tax benefits. For legal assistance, consider exploring resources related to the Brownsville Texas Assignment of Note and Liens.