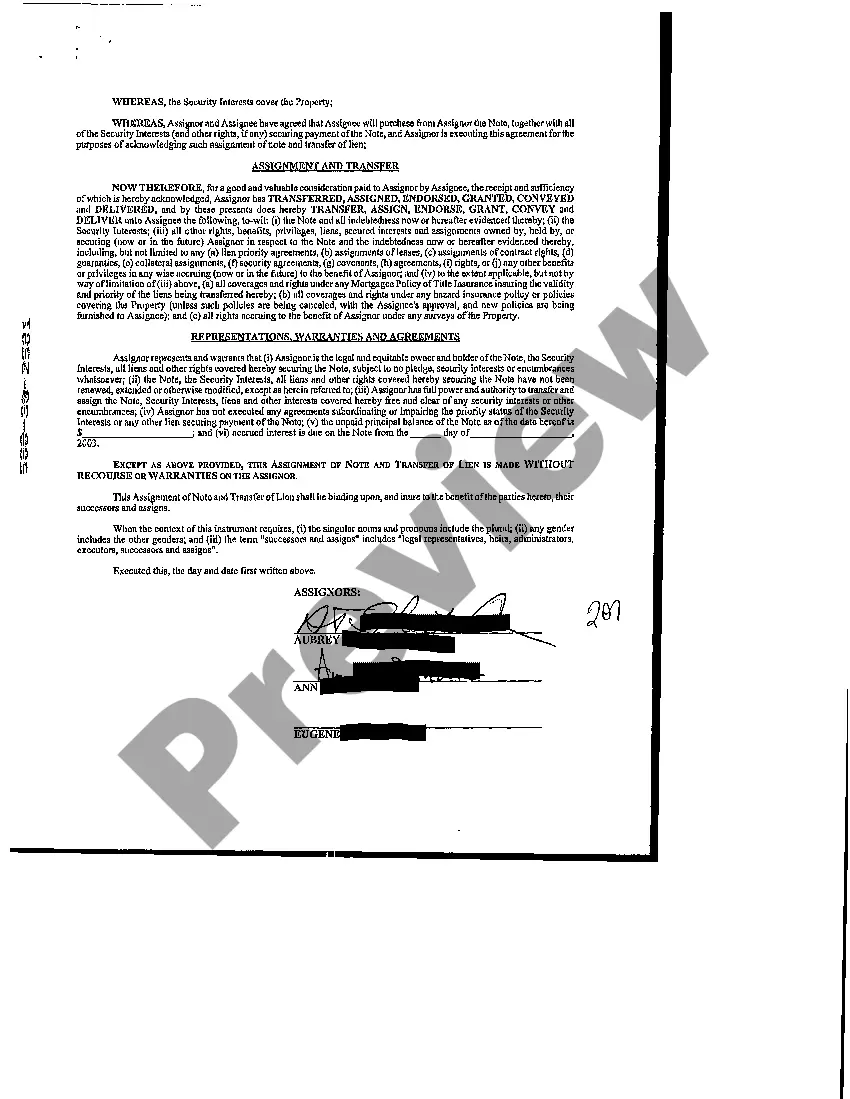

Fort Worth, Texas Assignment of Note and Liens refers to the legal process by which a lender transfers their rights and interest in a promissory note or loan agreement to another party. In this process, the existing lender, known as the assignor, transfers their financial claim or lien on the property to a new lender or assignee. The Assignment of Note and Liens is a common practice in real estate transactions, allowing lenders to secure their interest in a property and protect their financial investment. It provides a legal framework for the transfer of ownership rights and obligations associated with a mortgage or loan agreement. There are different types of Fort Worth Texas Assignment of Note and Liens, depending on the specific circumstances and nature of the transaction. These include: 1. Mortgage Assignment: This is the most common type, where the lender transfers the note and the mortgage associated with a property to a new lender. The new lender then becomes the legal owner of the mortgage and has the right to enforce the payments and foreclose the property if necessary. 2. Deed of Trust Assignment: In some cases, instead of a mortgage, a deed of trust is used to secure a loan. The Assignment of Note and Liens can involve the transfer of both the note and the deed of trust from the original lender to a new lender. 3. Assignment of Lien: This type of assignment involves the transfer of a lien on a property, which can include tax liens, mechanic's liens, judgment liens, or other types of liens. The assignee, typically a financial institution or investor, assumes the rights and responsibilities associated with the lien. The Assignment of Note and Liens process generally requires a written agreement between the parties involved, which clearly outlines the terms of the transfer. It should include details such as the names and contact information of the assignor and assignee, the amount of the note or lien, the property description, and any conditions or restrictions. Once the Assignment of Note and Liens is completed, the assignee becomes responsible for collecting the mortgage payments or enforcing the lien, depending on the specific type of assignment. The assignor, on the other hand, is relieved of their obligations and no longer has any claim or interest in the property. It is important to note that the specifics of a Fort Worth Texas Assignment of Note and Liens may vary depending on local laws and regulations. Therefore, it is advisable to consult with a real estate attorney or legal professional familiar with Texas real estate to ensure compliance with all applicable rules and requirements. Overall, the Assignment of Note and Liens is a crucial legal process that facilitates the transfer of property ownership rights and financial interests in Fort Worth, Texas.

Fort Worth Texas Assignment of Note and Liens

State:

Texas

City:

Fort Worth

Control #:

TX-C111

Format:

PDF

Instant download

This form is available by subscription

Description

Assignment of Note and Liens

Fort Worth, Texas Assignment of Note and Liens refers to the legal process by which a lender transfers their rights and interest in a promissory note or loan agreement to another party. In this process, the existing lender, known as the assignor, transfers their financial claim or lien on the property to a new lender or assignee. The Assignment of Note and Liens is a common practice in real estate transactions, allowing lenders to secure their interest in a property and protect their financial investment. It provides a legal framework for the transfer of ownership rights and obligations associated with a mortgage or loan agreement. There are different types of Fort Worth Texas Assignment of Note and Liens, depending on the specific circumstances and nature of the transaction. These include: 1. Mortgage Assignment: This is the most common type, where the lender transfers the note and the mortgage associated with a property to a new lender. The new lender then becomes the legal owner of the mortgage and has the right to enforce the payments and foreclose the property if necessary. 2. Deed of Trust Assignment: In some cases, instead of a mortgage, a deed of trust is used to secure a loan. The Assignment of Note and Liens can involve the transfer of both the note and the deed of trust from the original lender to a new lender. 3. Assignment of Lien: This type of assignment involves the transfer of a lien on a property, which can include tax liens, mechanic's liens, judgment liens, or other types of liens. The assignee, typically a financial institution or investor, assumes the rights and responsibilities associated with the lien. The Assignment of Note and Liens process generally requires a written agreement between the parties involved, which clearly outlines the terms of the transfer. It should include details such as the names and contact information of the assignor and assignee, the amount of the note or lien, the property description, and any conditions or restrictions. Once the Assignment of Note and Liens is completed, the assignee becomes responsible for collecting the mortgage payments or enforcing the lien, depending on the specific type of assignment. The assignor, on the other hand, is relieved of their obligations and no longer has any claim or interest in the property. It is important to note that the specifics of a Fort Worth Texas Assignment of Note and Liens may vary depending on local laws and regulations. Therefore, it is advisable to consult with a real estate attorney or legal professional familiar with Texas real estate to ensure compliance with all applicable rules and requirements. Overall, the Assignment of Note and Liens is a crucial legal process that facilitates the transfer of property ownership rights and financial interests in Fort Worth, Texas.

Free preview

How to fill out Fort Worth Texas Assignment Of Note And Liens?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal forms for both personal and professional requirements and various real-world situations.

All documents are appropriately organized by area of usage and jurisdiction, making the search for the Fort Worth Texas Assignment of Note and Liens as straightforward and simple as ABC.

Maintaining documentation tidy and compliant with legal requirements is of significant importance. Take advantage of the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the right one that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Purchase the document.