Grand Prairie, Texas Assignment of Note and Liens: A Comprehensive Overview In Grand Prairie, Texas, Assignment of Note and Liens refers to the legal process of transferring a promissory note and associated liens from one party to another. This assignment serves as both a testament to the transfer of debt or obligation and a mechanism for securing the underlying collateral. There are several types of Assignment of Note and Liens commonly encountered in Grand Prairie, Texas, each with their own specific characteristics and implications. Let's delve into the key types below: 1. Mortgage Assignment: In mortgage-related transactions, a Mortgage Assignment of Note and Liens occurs when the promissory note and mortgage/liens securing it are reassigned to a different party, typically a new lender or investor. This transfer enables the assignee to become the legal owner of the debt and the associated property. 2. Deed of Trust Assignment: Similar to the Mortgage Assignment, a Deed of Trust Assignment of Note and Liens allows the transfer of a promissory note and the accompanying deed of trust/liens to another individual or entity. This instrument is commonly used in Texas for real estate transactions, helping establish a lien against the property to secure the repayment of the debt. 3. Security Agreement Assignment: In commercial transactions, a Security Agreement Assignment of Note and Liens entails the transfer of a security interest in personal property from one party to another. This form of lien assignment often occurs when a borrower uses specific personal assets as collateral to secure a loan, such as equipment, inventory, or accounts receivable. 4. UCC Financing Statement Assignment: Under the Uniform Commercial Code (UCC) regulations, a UCC Financing Statement Assignment of Note and Liens allows for the transfer of a debtor's interest in personal property, known as collateral, to a creditor. This form of assignment commonly occurs in business financing arrangements, enabling a lender to secure their interest in the debtor's assets. In Grand Prairie, Texas, Assignment of Note and Liens plays a crucial role in ensuring the proper transfer of debts, obligations, and the security interests associated with them. Implementing these assignments correctly can protect the rights of creditors while establishing the legal framework required for the smooth flow of financial transactions. Note: It is advisable to consult with a qualified attorney or legal professional in Grand Prairie, Texas, familiar with real estate and commercial law, before engaging in any Assignment of Note and Liens to ensure compliance with local regulations and requirements.

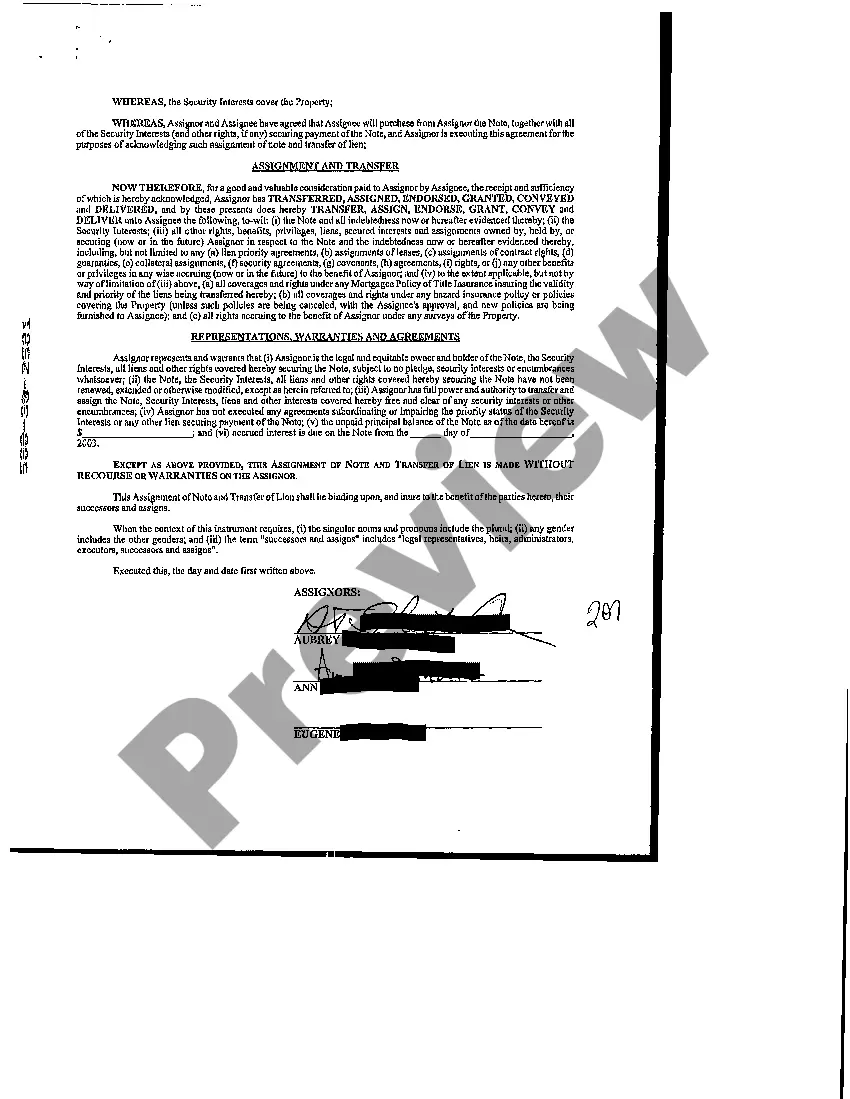

Grand Prairie Texas Assignment of Note and Liens

Description

How to fill out Grand Prairie Texas Assignment Of Note And Liens?

If you are looking for a valid form template, it’s impossible to choose a better service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get a huge number of document samples for company and individual purposes by categories and states, or keywords. Using our advanced search option, getting the most up-to-date Grand Prairie Texas Assignment of Note and Liens is as elementary as 1-2-3. In addition, the relevance of each and every file is proved by a group of professional attorneys that regularly check the templates on our website and update them according to the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Grand Prairie Texas Assignment of Note and Liens is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the sample you need. Look at its description and use the Preview feature to explore its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the appropriate file.

- Affirm your decision. Click the Buy now option. Following that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the format and save it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Grand Prairie Texas Assignment of Note and Liens.

Every single template you add to your profile has no expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to get an additional version for editing or printing, you may return and download it again anytime.

Make use of the US Legal Forms extensive library to get access to the Grand Prairie Texas Assignment of Note and Liens you were seeking and a huge number of other professional and state-specific templates in a single place!