Lewisville Texas Assignment of Note and Liens: A Comprehensive Overview In Lewisville, Texas, the assignment of note and liens refers to a legal process where a party transfers the rights and interests of a mortgage note and associated liens from one entity to another. This detailed description aims to explain the key aspects and different types of these assignments, shedding light on their role in the real estate and financial landscape. 1. Assignment of Note: The assignment of note denotes the transfer of the lender's interest in a promissory note secured by a mortgage lien. It involves one party (assignor) relinquishing their rights, title, and benefits under the note to another party (assignee). This assignment typically occurs when a mortgage lender sells the loan to another entity, such as a financial institution or an investment trust. 2. Assignment of Liens: The assignment of liens refers to the transfer of the mortgage lien, which is the legal claim against a property to secure repayment of a debt (the promissory note). Through an assignment of liens, the existing lien holder (assignor) conveys their rights and interests in the lien to a new entity (assignee). This process enables the assignee to enforce and collect the outstanding loan amount. Types of Lewisville Texas Assignment of Note and Liens: a. Partial Assignment: A partial assignment of note and liens occurs when only a portion of the promissory note or mortgage lien is transferred to another party. This can happen in situations where the original lender wants to sell a fraction of the loan amount or when multiple institutions co-originate a loan and subsequently assign their respective portions to different investors. b. Full Assignment: In a full assignment of note and liens, the entire promissory note and mortgage lien are transferred from the assignor to the assignee. This type of assignment is common when a lender wants to completely sell the loan or when a borrower refinances their mortgage, resulting in the original loan being entirely replaced by a new one. c. Assignments Due to Default: Assignments of note and liens can also occur due to loan default or the need for foreclosure proceedings. As an assignor, the original lender might transfer the note and lien to a service or foreclosure attorney to proceed with collection efforts and legal actions on behalf of the beneficiary. d. Collateral Assignment: A collateral assignment of note and liens involves using the promissory note and associated lien as collateral for another loan. In this scenario, the assignor pledges the rights and benefits under the note to secure the repayment of a different debt with a separate lender, granting them an interest in the original loan until the collateral assignment is released. It's important to note that Lewisville, Texas Assignment of Note and Liens must comply with applicable state and federal laws, including specific requirements for document recording and notifications to involved parties. Professionals knowledgeable in real estate law, such as real estate attorneys or title companies, play a crucial role in overseeing these assignments to ensure proper execution and protection of the parties involved. In conclusion, the Lewisville Texas Assignment of Note and Liens involves the transfer of rights and interests in a promissory note and mortgage lien. This process can occur partially or fully, due to default or refinancing, and may also involve collateral assignments. Proper understanding and adherence to the legal procedures governing these assignments are essential for safeguarding the interests of all involved parties.

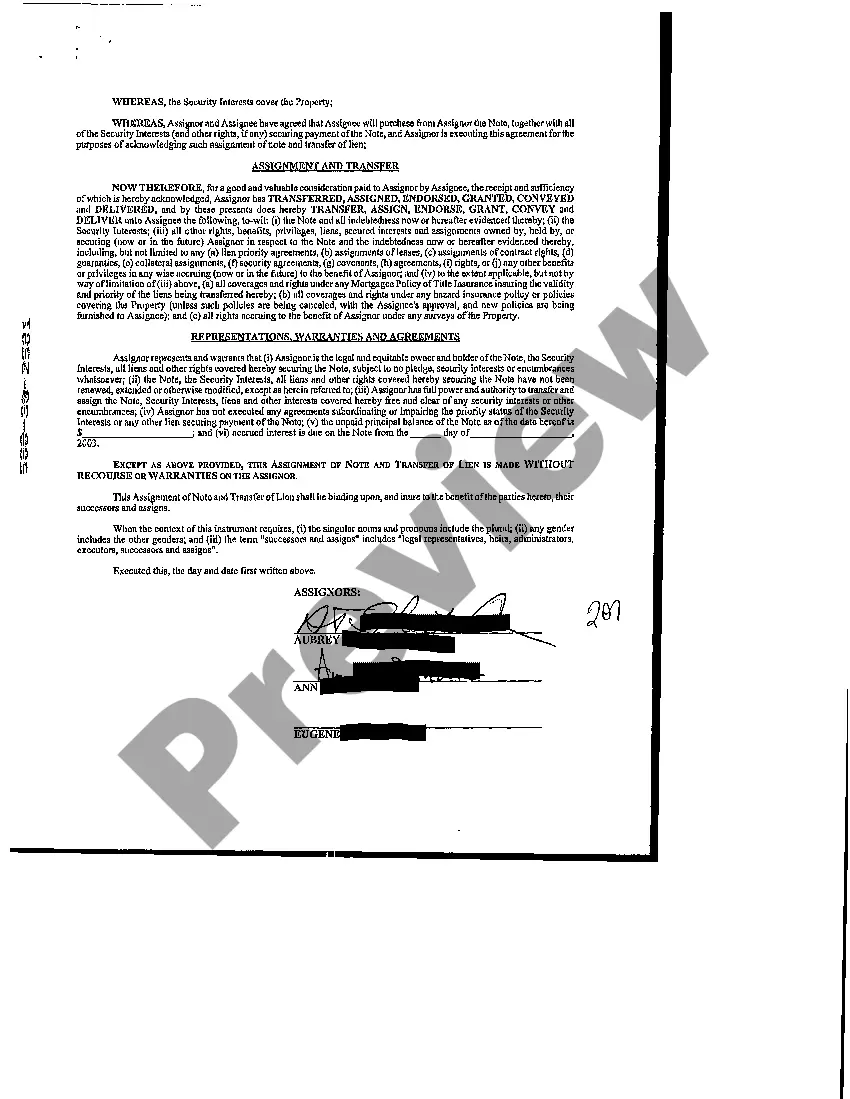

Lewisville Texas Assignment of Note and Liens

Description

How to fill out Lewisville Texas Assignment Of Note And Liens?

Are you looking for a trustworthy and affordable legal forms supplier to get the Lewisville Texas Assignment of Note and Liens? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Lewisville Texas Assignment of Note and Liens conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Lewisville Texas Assignment of Note and Liens in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal papers online for good.