Keywords: Odessa Texas, Assignment of Note, Assignment of Liens, types In Odessa, Texas, an Assignment of Note refers to the legal transfer of rights and obligations associated with a promissory note from one party to another. A promissory note is a written promise to repay a debt, typically containing details such as the principal amount, interest rates, repayment schedule, and any other terms agreed upon by the parties involved. Often, individuals or businesses choose to assign their promissory notes to others to either collect on the debt or transfer the financial responsibility. Similarly, an Assignment of Liens in Odessa, Texas involves the assignment of a legal claim, known as a lien, from one party to another. A lien is a legal right or interest that a creditor holds over a property, typically as security for a debt owed by the property owner. By assigning a lien, the creditor transfers their rights to enforce the lien and potentially foreclose on the property to recover the debt owed. In Odessa, Texas, there can be different types of Assignments of Note and Assignments of Liens, each serving a specific purpose: 1. Assignment of Mortgage: This type of assignment transfers the creditor's interest in a mortgage loan to another party. It often occurs when a mortgage company sells its loans to another lender or investor, allowing the new party to collect mortgage payments and handle the associated mortgage lien. 2. Assignment of Deed of Trust: In Texas, a deed of trust is commonly used instead of a mortgage to secure a loan. An Assignment of Deed of Trust transfers the lien interest associated with the deed from one entity to another, such as when a bank sells a loan to another financial institution. 3. Assignment of Judgment Lien: When a court awards a judgment against a debtor, the creditor may place a judgment lien on the debtor's property. An Assignment of Judgment Lien allows the creditor to transfer their rights to the judgment and the associated lien to another party, potentially enabling faster collection or satisfying another debt. 4. Assignment of Mechanic's Lien: Construction contractors and suppliers often file mechanic's liens against a property when they are not paid for work or supplies furnished. An Assignment of Mechanic's Lien permits the contractor or supplier to transfer their lien rights to another party, possibly to ease cash flow or involve a debt collection specialist. Assignments of Note and Liens play a crucial role in the financial landscape of Odessa, Texas, allowing for the transfer of debt obligations and lien rights among parties for various purposes. It is essential to consult legal professionals familiar with Texas laws when dealing with these assignments to ensure compliance and protect the rights and interests of all parties involved.

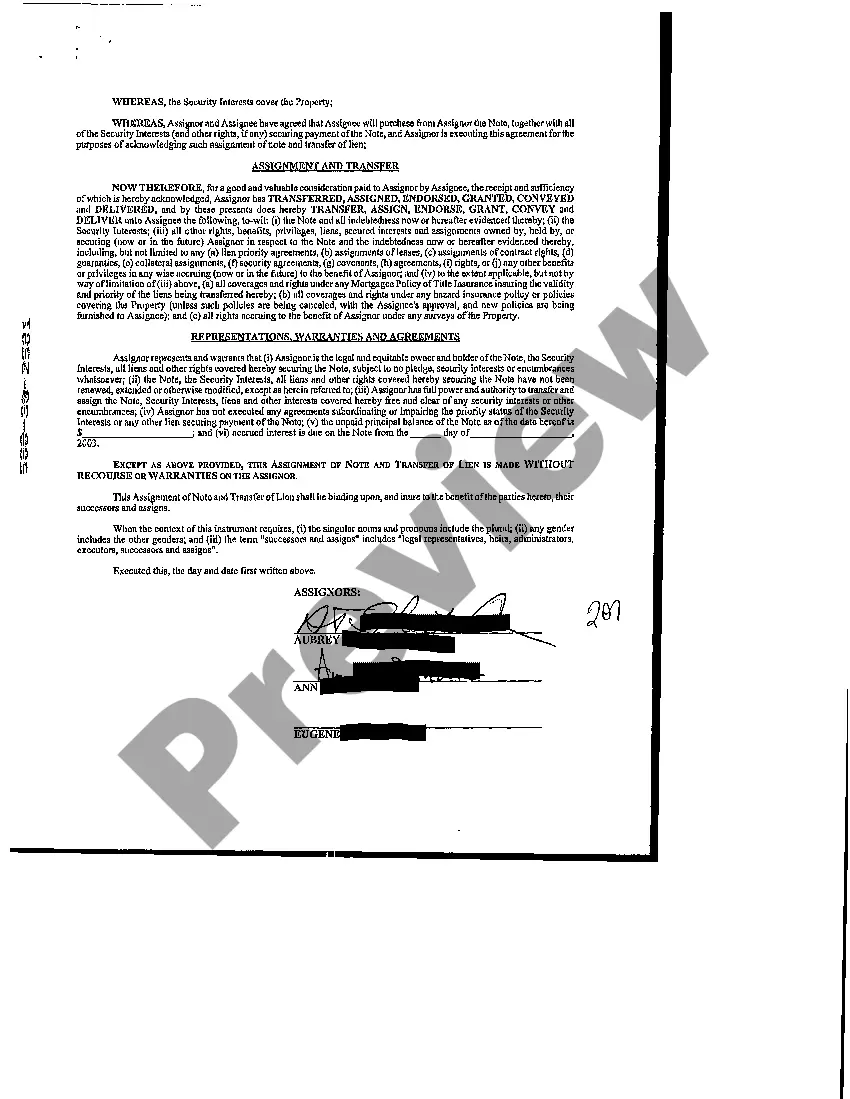

Odessa Texas Assignment of Note and Liens

Description

How to fill out Odessa Texas Assignment Of Note And Liens?

If you are looking for a relevant form template, it’s difficult to find a more convenient platform than the US Legal Forms website – probably the most comprehensive libraries on the internet. Here you can get a huge number of form samples for organization and personal purposes by categories and states, or keywords. Using our high-quality search option, finding the latest Odessa Texas Assignment of Note and Liens is as elementary as 1-2-3. Furthermore, the relevance of every document is proved by a group of expert lawyers that regularly review the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our system and have a registered account, all you need to receive the Odessa Texas Assignment of Note and Liens is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have chosen the sample you require. Check its information and utilize the Preview feature to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to discover the appropriate document.

- Confirm your selection. Choose the Buy now option. Following that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the received Odessa Texas Assignment of Note and Liens.

Every single template you add to your account does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an additional version for editing or printing, you may return and download it once again at any moment.

Make use of the US Legal Forms extensive library to get access to the Odessa Texas Assignment of Note and Liens you were looking for and a huge number of other professional and state-specific templates on one website!