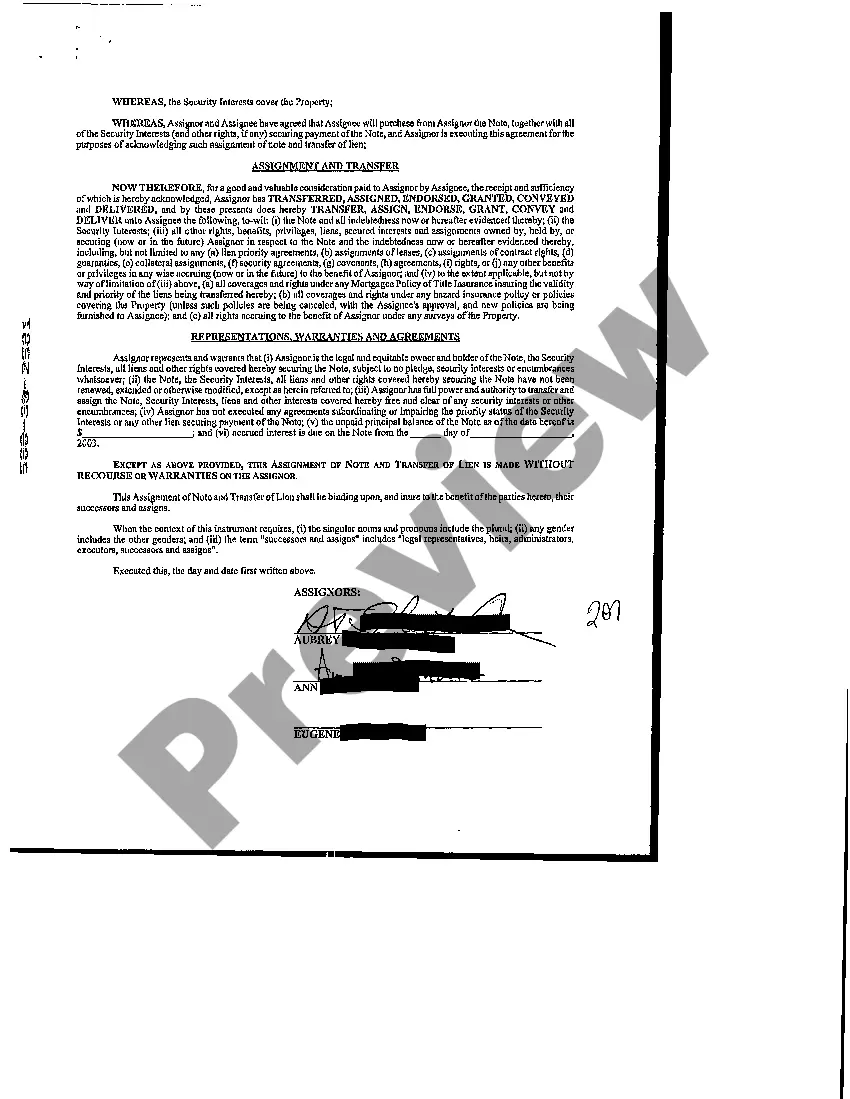

Pasadena, Texas Assignment of Note and Liens involves the transfer of rights and interests in an existing promissory note, as well as any associated liens, to another individual or entity. This legal transaction is commonly utilized in real estate and financial transactions, enabling parties involved to secure their interests, enforce agreements, and protect investments. Specifically, an Assignment of Note refers to the transfer of all rights, title, and interest in a promissory note from the original lender, known as the assignor, to the assignee, who becomes the new holder of the note. It essentially allows the assignee to step into the shoes of the original lender and reap the benefits, including receiving payments, enforcing the terms of the note, and potentially foreclosing on the collateral if necessary. Furthermore, when discussing Pasadena, Texas Assignment of Note and Liens, it's essential to consider the different types that exist, including: 1. Assignment of Mortgage: This type involves the transfer of the mortgage loan document, along with the associated promissory note, from one lender to another. By doing so, the assignee becomes the new mortgagee (lender) and assumes all rights, privileges, and obligations. 2. Assignment of Deed of Trust: Unlike a mortgage, this type of assignment relates to a deed of trust, which is commonly used in Texas instead of mortgages. The assignor transfers the deed of trust and the note to the assignee, granting them the authority to manage and enforce the loan terms and secure their collateral interests. 3. Assignment of Lien: This form of assignment addresses various types of liens, such as mechanic's liens or property tax liens. It involves the transfer of the lien rights from the original lien holder to a new party. This enables the new holder to pursue legal action or take other necessary steps to satisfy the debt owed by the debtor. 4. Assignment of Security Interest: In certain cases, a lender may secure a loan by obtaining a security interest in personal property or assets owned by the borrower. An Assignment of Security Interest allows the assignee to assume the lender's rights to that collateral, offering protection if the borrower violates the loan agreement. Pasadena, Texas Assignment of Note and Liens plays an integral role in the real estate and financial sectors by facilitating the transfer of rights and interests in promissory notes and associated liens. It ensures the parties involved, whether lenders or investors, have the legal mechanisms to protect their investments and enforce the agreed-upon terms. By utilizing various types of assignments, individuals and entities in Pasadena, Texas can effectively navigate the complexities of lending and security interests.

Pasadena Texas Assignment of Note and Liens

Description

How to fill out Pasadena Texas Assignment Of Note And Liens?

Locating validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the files are appropriately categorized by use and legal jurisdictions, making it simple and swift to find the Pasadena Texas Assignment of Note and Liens.

Finalizing your purchase requires you to enter your credit card information or use your PayPal account to settle the payment. Download the Pasadena Texas Assignment of Note and Liens, preserving the template on your device to complete it and retrieve it in the My documents section of your profile whenever necessary. Maintaining documents orderly and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have vital document templates for any requirements readily available!

- Be familiar with the Preview mode and document description.

- Ensure you’ve selected the appropriate one that satisfies your needs and fully aligns with your local jurisdictional criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your criteria, advance to the next step.

- Purchase the document. Click the Buy Now button and select the subscription plan you wish to choose. You will need to create an account to access the library’s resources.

Form popularity

FAQ

Yes, a lien can be placed on a house that is held in a trust. However, this process requires careful consideration of the trust's terms and provisions. If you are navigating this situation, the Pasadena Texas Assignment of Note and Liens offers useful resources and templates to help protect your interests and ensure compliance with Texas law.

In Texas, a deed of trust lien requires a written agreement between the borrower and the lender that includes a legal description of the property. This document must be signed by the borrower and notarized before being recorded with the county clerk. The Pasadena Texas Assignment of Note and Liens can help streamline this process, ensuring you have the correct documentation and guidance.

The assignment and transfer of lien is typically signed by the current lienholder, who voluntarily transfers their rights to another entity. Depending on the scenario, the new lienholder may also need to acknowledge the transfer. Clarity in this process is essential in Pasadena Texas Assignment of Note and Liens to ensure all parties understand their rights and responsibilities.

A lien can be both beneficial and problematic, depending on the situation. On one hand, it protects creditors by ensuring they have a claim to an asset if debts are unpaid. On the other hand, it may restrict your ability to manage or sell your property freely. In the realm of Pasadena Texas Assignment of Note and Liens, understanding the implications of a lien is crucial for informed decision-making.

When a lien is placed on you, it signifies that a creditor has a legal claim to your property due to unpaid debts. This can hinder your ability to sell or refinance the property until the lien is resolved. In Pasadena, Texas Assignment of Note and Liens, knowing your options for addressing a lien can help protect your financial interests and assets.

A lien assignment is the formal transfer of a lien from one creditor to another. This can occur for various reasons, including selling the debt or restructuring financial agreements. Understanding lien assignments is critical in Pasadena Texas Assignment of Note and Liens, as it affects your rights and responsibilities concerning any secured debts.

The assignment of lien refers to the process where the current lienholder transfers their rights over the lien to another party. This means that the new party becomes responsible for enforcing the lien. In Pasadena, Texas, knowing the specifics of lien assignments is essential for property owners or lenders dealing with debt collection or property sales.

A lien is a legal claim against an asset, often used as security for a debt. An assignment involves transferring rights or interest in an asset, such as a lien, from one party to another. In the context of the Pasadena Texas Assignment of Note and Liens, understanding these terms helps you navigate financial obligations and property rights more confidently.

A lien transfer involves changing the holder of the lien on a property. In the context of a Pasadena Texas Assignment of Note and Liens, this typically means that the original lien holder assigns their rights to another party. This process requires proper documentation to ensure the transfer is legally binding and recognized. You can streamline this process with resources available through uslegalforms, making it easier to navigate the complexities of lien transfers.

Yes, a promissory note can be used as the basis for a lien when it is secured by real estate or personal property. When you sign a promissory note, the lender can place a lien on the property as security for repayment. In discussions about Pasadena Texas Assignment of Note and Liens, it's important to understand how a promissory note can create a legal framework for securing investments. Utilizing resources from USLegalForms can help simplify the legal requirements involved in this process.