Pearland Texas Assignment of Note and Liens is a legal process that involves the transfer of a promissory note and the associated lien rights from one party to another. This assignment is commonly used in real estate transactions, where a borrower transfers their rights and obligations under a note to a new lender or investor. In Pearland, Texas, there are various types of Assignment of Note and Liens, each serving different purposes and involving specific parties. Some of these types include: 1. Mortgage Assignment: This type of assignment involves the transfer of a mortgage from one entity to another, typically when a loan is sold or when a borrower refinances their mortgage. 2. Deed of Trust Assignment: Similar to a mortgage assignment, a deed of trust assignment transfers the lien rights and the associated promissory note from one party to another. This is commonly done when a property is sold or when a borrower refinances their loan. 3. Assignment of Judgment Liens: This type of assignment occurs when a creditor transfers their rights to collect on a judgment lien to another party. It provides the new assignee with the authority to enforce the lien and collect the outstanding debt. 4. Assignment of Mechanic's Liens: In the construction industry, contractors or suppliers who have not been paid for their work or materials may file a mechanic's lien on a property. An assignment of mechanic's liens allows the lien holder to transfer their rights to collect the amount owed to another party, typically a collection agency or an investor. 5. Assignment of Tax Liens: When property owners fail to pay their property taxes, the municipality or governmental entity places a tax lien on the property. The assignment of tax liens involves the transfer of these liens to another party, who then has the right to collect the delinquent taxes. The Pearland Texas Assignment of Note and Liens process usually requires legal documentation, including an assignment agreement, which outlines the terms of the transfer and ensures that all parties involved are aware of their rights and responsibilities. It is essential to consult with a real estate attorney or a qualified professional to navigate these transactions accurately and adhere to state laws and regulations.

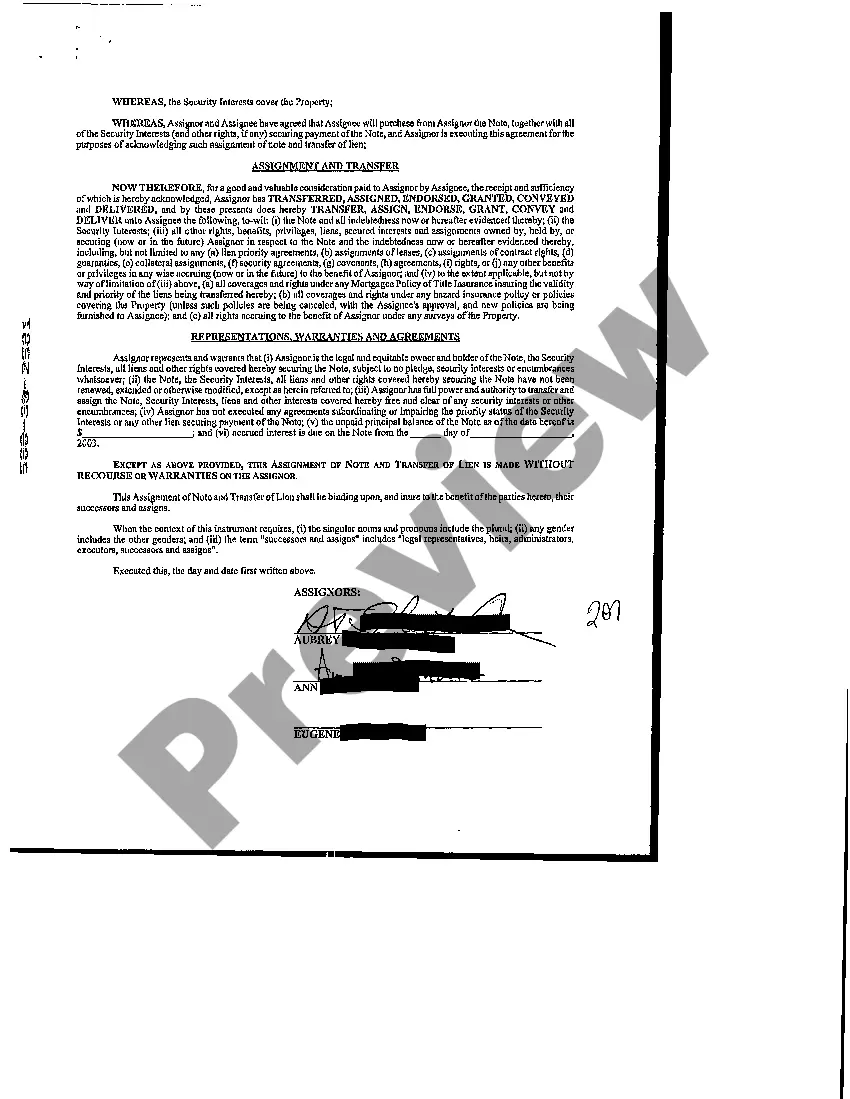

Pearland Texas Assignment of Note and Liens

Description

How to fill out Pearland Texas Assignment Of Note And Liens?

Do you need a trustworthy and inexpensive legal forms provider to get the Pearland Texas Assignment of Note and Liens? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Pearland Texas Assignment of Note and Liens conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Start the search over in case the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Pearland Texas Assignment of Note and Liens in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online for good.