Round Rock Texas is a city located in Williamson County, Texas. When it comes to real estate transactions, one important aspect to consider is the Assignment of Note and Liens. Understanding what this entails is essential for buyers, sellers, and lenders involved in property transactions in Round Rock. Assignment of Note and Liens, generally speaking, refers to the transfer of both debt obligations (notes) and legal claims (liens) associated with a property from one party to another. In Round Rock, various types of Assignment of Note and Liens can occur, each serving different purposes and involving different parties. Some notable ones include: 1. Assignment of Mortgage Note: This type of assignment involves the transfer of a mortgage note, which represents the borrower's promise to repay the loan, from the original lender to another party. The assignee takes over the rights and obligations associated with the note, including the right to receive payments and enforce the terms. 2. Assignment of Deed of Trust: In Texas, a Deed of Trust is often used instead of a mortgage to secure a loan. An Assignment of Deed of Trust involves the transfer of the deed of trust from the original beneficiary (lender) to another party. This assignment allows the new beneficiary to enforce the terms and conditions of the deed of trust, including the right to foreclose on the property in case of default. 3. Assignment of Judgment Liens: A judgment lien is a legal claim against a property that arises when a court grants a judgment in favor of a creditor against a debtor. An Assignment of Judgment Lien occurs when the creditor transfers their claim to another party. The assignee then has the right to pursue the debt by enforcing the lien against the property. 4. Assignment of Tax Liens: When property owners fail to pay their property taxes, the government may place a tax lien on the property. An Assignment of Tax Liens involves the transfer of the tax lien from the taxing authority to another party, such as an investor or a tax lien certificate holder. The assignee then has the right to collect the outstanding taxes and, in some cases, foreclose on the property if the debt remains unpaid. Understanding the different types of Round Rock Texas Assignment of Note and Liens is crucial for individuals involved in real estate transactions. Whether buying or selling property, it is imperative to work with knowledgeable professionals who can guide you through the complexities of these assignments, ensuring a smooth and legally compliant transaction.

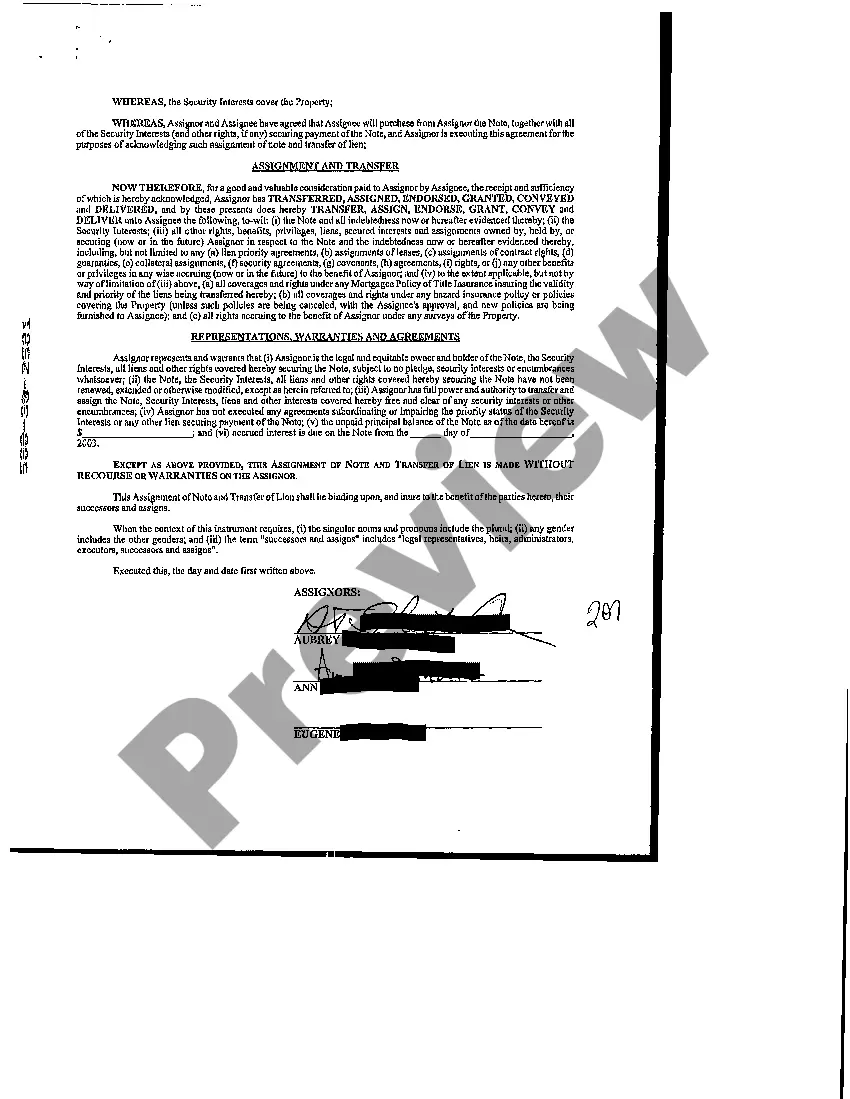

Round Rock Texas Assignment of Note and Liens

State:

Texas

City:

Round Rock

Control #:

TX-C111

Format:

PDF

Instant download

This form is available by subscription

Description

Assignment of Note and Liens

Round Rock Texas is a city located in Williamson County, Texas. When it comes to real estate transactions, one important aspect to consider is the Assignment of Note and Liens. Understanding what this entails is essential for buyers, sellers, and lenders involved in property transactions in Round Rock. Assignment of Note and Liens, generally speaking, refers to the transfer of both debt obligations (notes) and legal claims (liens) associated with a property from one party to another. In Round Rock, various types of Assignment of Note and Liens can occur, each serving different purposes and involving different parties. Some notable ones include: 1. Assignment of Mortgage Note: This type of assignment involves the transfer of a mortgage note, which represents the borrower's promise to repay the loan, from the original lender to another party. The assignee takes over the rights and obligations associated with the note, including the right to receive payments and enforce the terms. 2. Assignment of Deed of Trust: In Texas, a Deed of Trust is often used instead of a mortgage to secure a loan. An Assignment of Deed of Trust involves the transfer of the deed of trust from the original beneficiary (lender) to another party. This assignment allows the new beneficiary to enforce the terms and conditions of the deed of trust, including the right to foreclose on the property in case of default. 3. Assignment of Judgment Liens: A judgment lien is a legal claim against a property that arises when a court grants a judgment in favor of a creditor against a debtor. An Assignment of Judgment Lien occurs when the creditor transfers their claim to another party. The assignee then has the right to pursue the debt by enforcing the lien against the property. 4. Assignment of Tax Liens: When property owners fail to pay their property taxes, the government may place a tax lien on the property. An Assignment of Tax Liens involves the transfer of the tax lien from the taxing authority to another party, such as an investor or a tax lien certificate holder. The assignee then has the right to collect the outstanding taxes and, in some cases, foreclose on the property if the debt remains unpaid. Understanding the different types of Round Rock Texas Assignment of Note and Liens is crucial for individuals involved in real estate transactions. Whether buying or selling property, it is imperative to work with knowledgeable professionals who can guide you through the complexities of these assignments, ensuring a smooth and legally compliant transaction.

Free preview

How to fill out Round Rock Texas Assignment Of Note And Liens?

If you’ve already utilized our service before, log in to your account and download the Round Rock Texas Assignment of Note and Liens on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Round Rock Texas Assignment of Note and Liens. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!