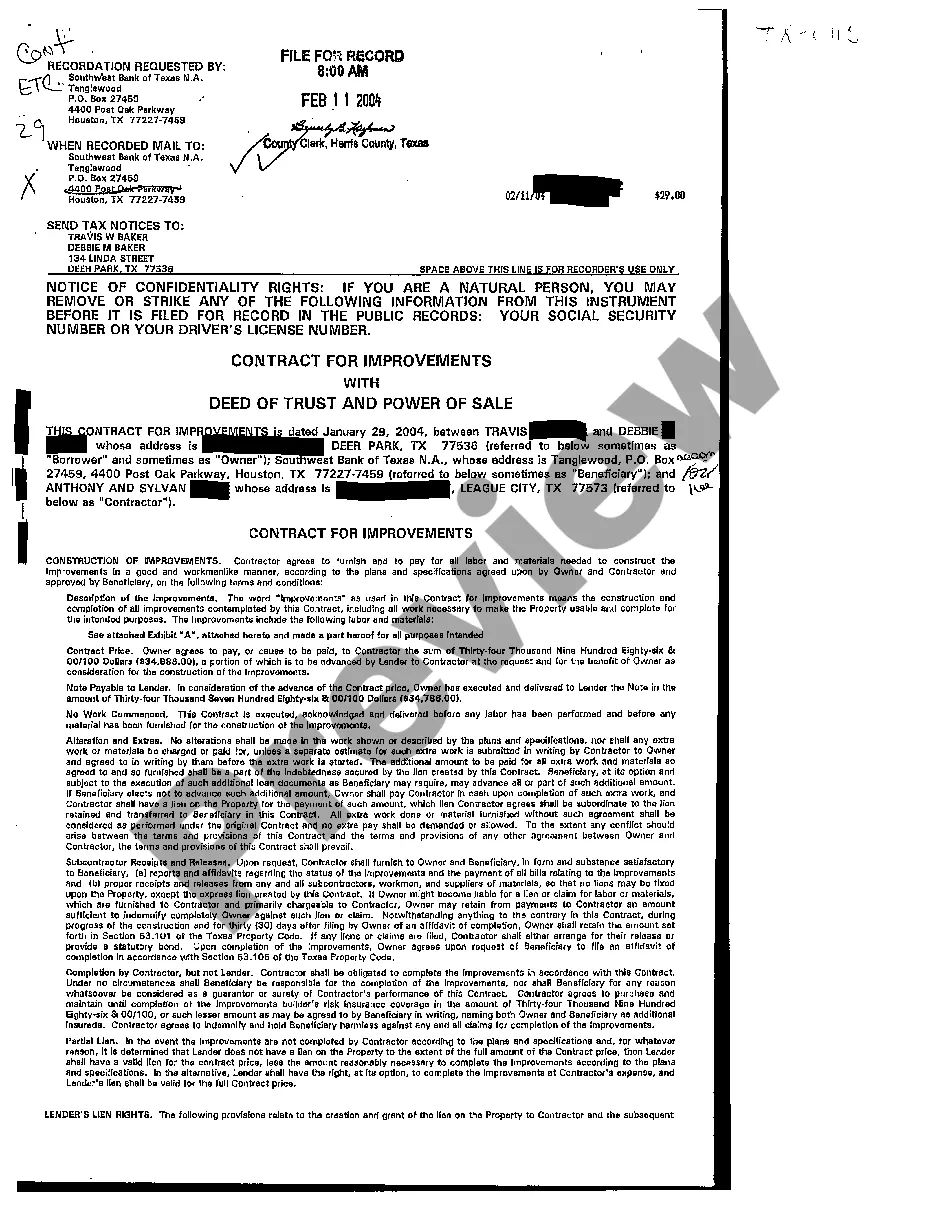

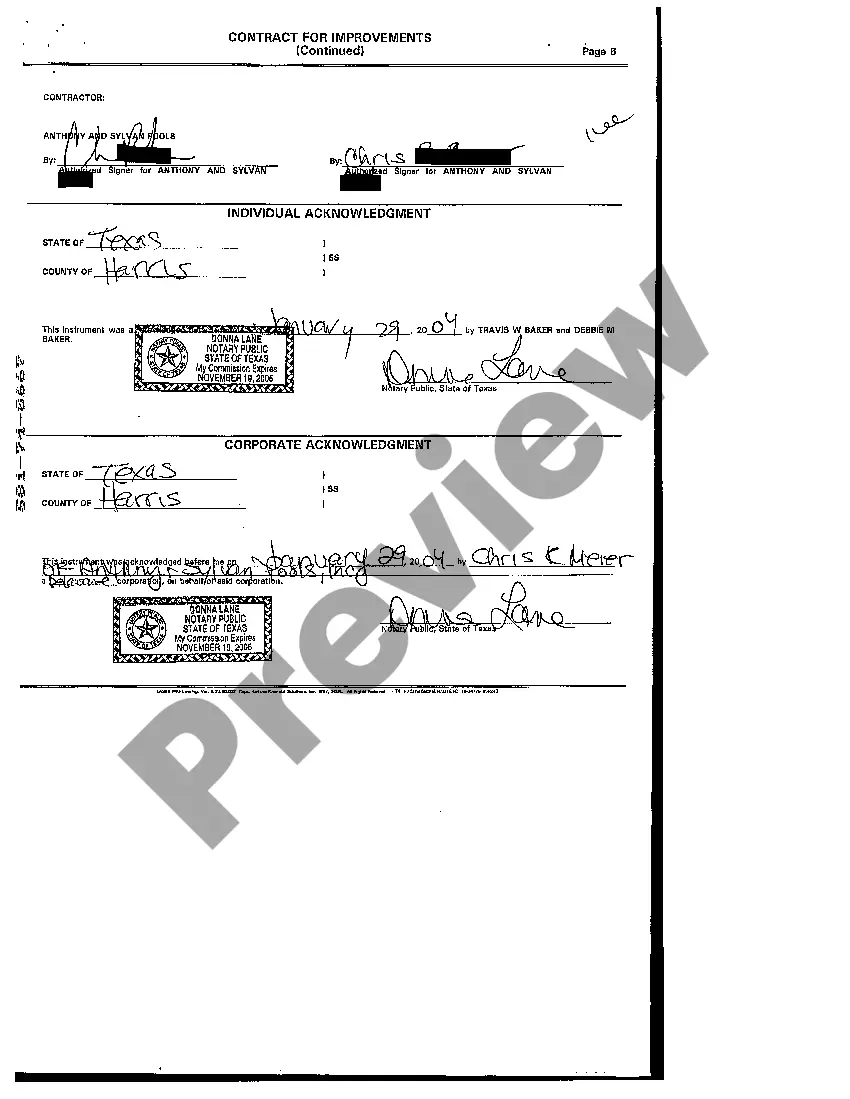

Grand Prairie, Texas Contact for Improvements with Deed of Trust and Power to Sale: In Grand Prairie, Texas, if you are looking to make improvements to a property and need financial assistance, a Deed of Trust and Power to Sale can be a valuable tool. This legal agreement provides a lender with a security interest in the property, allowing them to recoup their investment if the borrower defaults on their loan. There are different types of Contacts for Improvements with Deed of Trust and Power to Sale available in Grand Prairie, Texas, including: 1. Residential Property Improvement Loan: This type of contact is designed for homeowners who wish to renovate or improve their residential property. It allows homeowners to borrow funds based on the equity in their home and secure the loan with a Deed of Trust and Power to Sale. 2. Commercial Property Improvement Loan: For business owners or investors looking to upgrade or expand their commercial property in Grand Prairie, a Commercial Property Improvement Loan can be obtained. This type of loan offers funds for improvements and is secured by a Deed of Trust and Power to Sale on the commercial property. 3. Construction Loan: Construction projects, such as building a new home or commercial property, often require substantial funding. A Construction Loan with a Deed of Trust and Power to Sale can be used to secure financing for these projects, providing the lender with the assurance that they will be able to recover their investment if the borrower defaults. 4. Home Equity Line of Credit (HELOT): A HELOT is a revolving line of credit that allows homeowners to borrow funds for improvements as needed. This type of loan utilizes a Deed of Trust and Power to Sale as collateral, protecting the lender's interests. When entering into a Contact for Improvements with a Deed of Trust and Power to Sale in Grand Prairie, Texas, it is essential to consult with a qualified real estate attorney or financial advisor. These professionals can guide you through the process, ensuring that all legal requirements are met and your rights are protected. Remember, a Deed of Trust and Power to Sale is a legal document that should not be taken lightly. It is crucial to fully understand its terms and implications before proceeding.

Grand Prairie Texas Contact for Improvements with Deed of Trust and Power to Sale

Description

How to fill out Grand Prairie Texas Contact For Improvements With Deed Of Trust And Power To Sale?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no law education to create this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Grand Prairie Texas Contact for Improvements with Deed of Trust and Power to Sale or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Grand Prairie Texas Contact for Improvements with Deed of Trust and Power to Sale in minutes employing our reliable service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, if you are new to our library, ensure that you follow these steps before downloading the Grand Prairie Texas Contact for Improvements with Deed of Trust and Power to Sale:

- Be sure the template you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Review the document and go through a brief description (if provided) of cases the document can be used for.

- In case the one you picked doesn’t suit your needs, you can start again and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Grand Prairie Texas Contact for Improvements with Deed of Trust and Power to Sale once the payment is done.

You’re good to go! Now you can go ahead and print out the document or fill it out online. If you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.