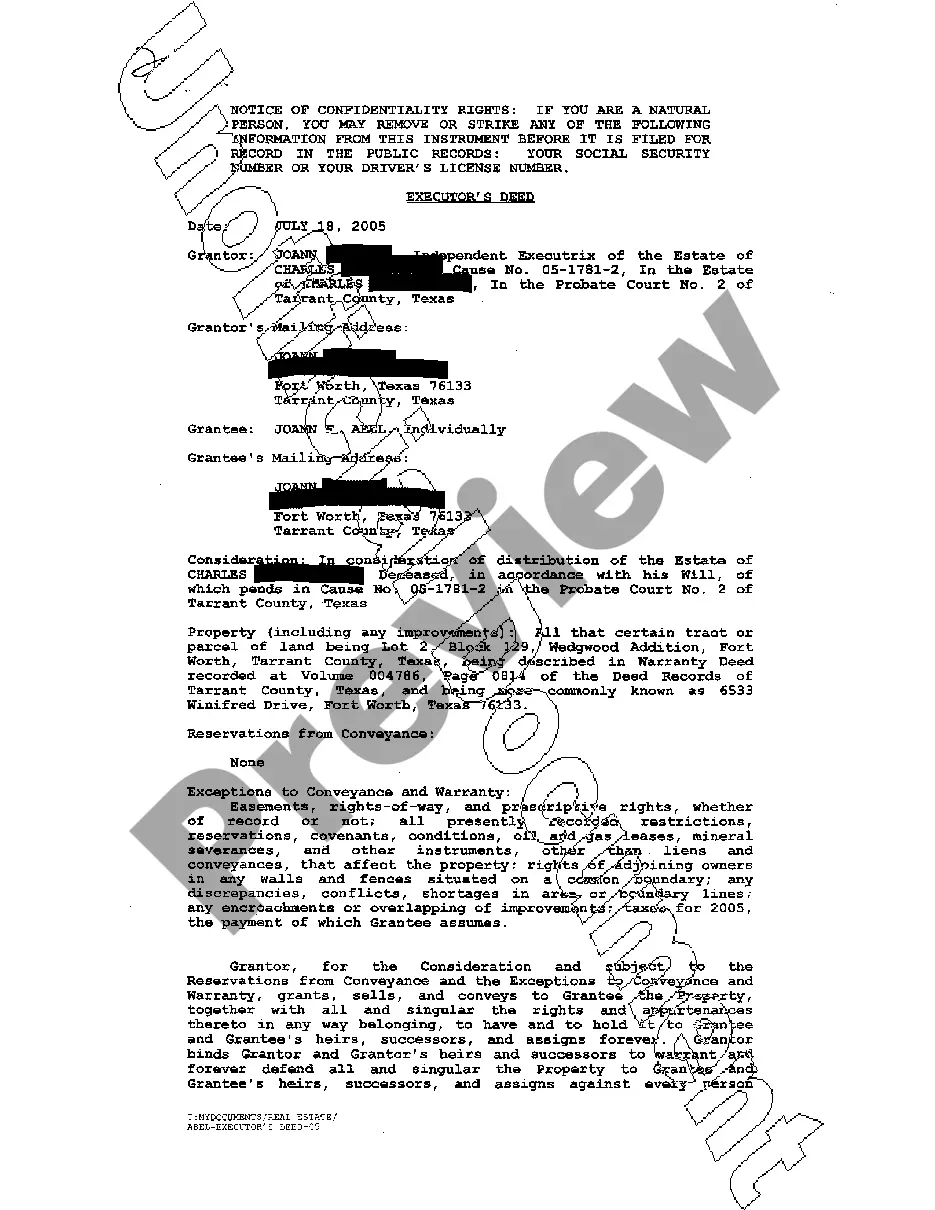

Fort Worth Texas Executor's Deed

Description

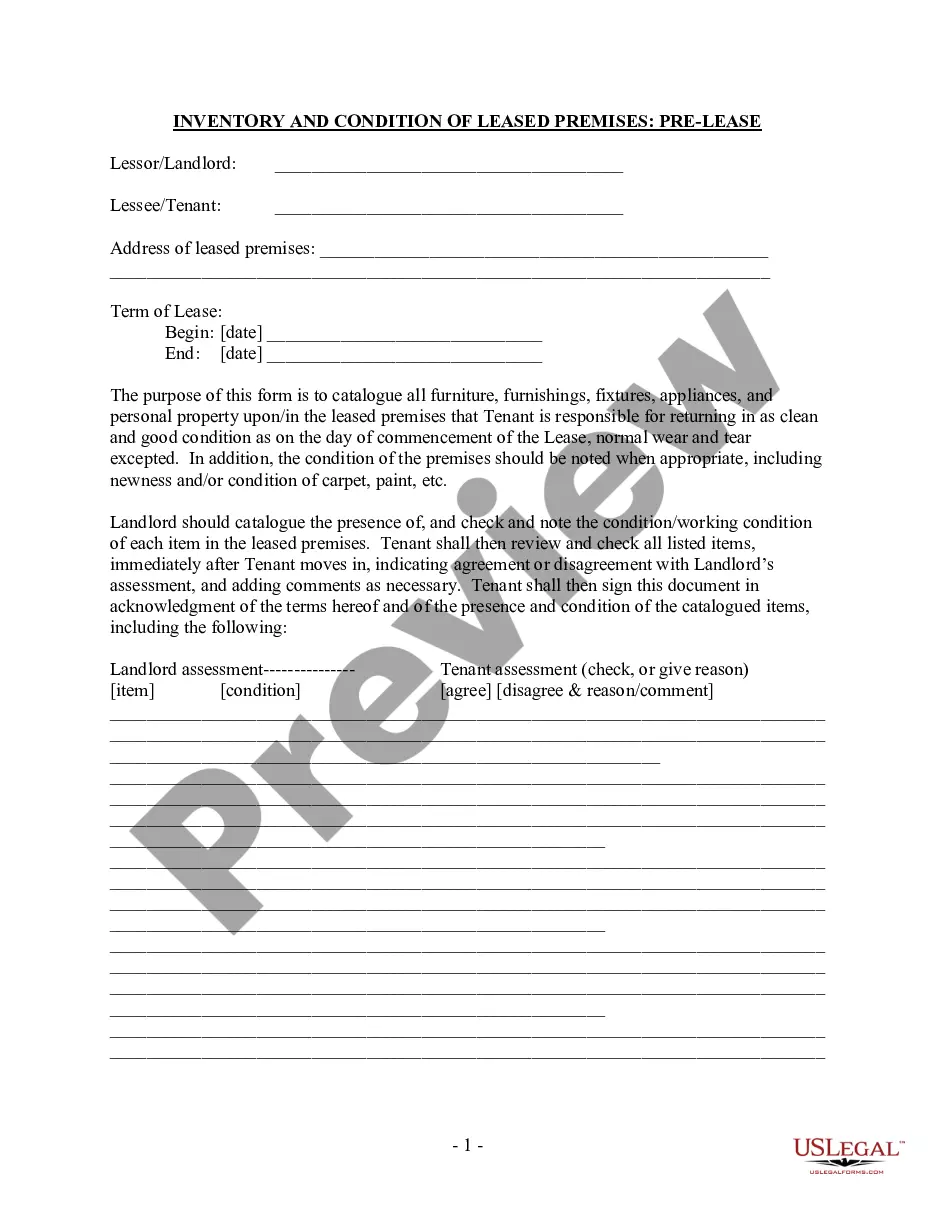

How to fill out Texas Executor's Deed?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly platform, featuring a vast array of document templates, simplifies the process of locating and acquiring nearly any document sample you desire.

You can export, complete, and sign the Fort Worth Texas Executor's Deed in mere minutes, rather than spending hours online searching for the correct template.

Leveraging our library is an excellent method to enhance the security of your form submissions.

The Download button will be visible on all samples you view. Moreover, you can access all previously saved documents in the My documents section.

If you do not have an account yet, follow the instructions below: Access the page containing the form you require. Verify that it is the template you were seeking: confirm its title and description, and utilize the Preview function if available. Otherwise, employ the Search field to locate the desired document.

- Our expert attorneys routinely review all documents to ensure that the templates are suitable for a specific area and compliant with current laws and regulations.

- How can you acquire the Fort Worth Texas Executor's Deed.

- If you possess an account, simply Log In to your profile.