Frisco Texas Executor's Deed

Description

How to fill out Texas Executor's Deed?

Take advantage of the US Legal Forms and gain immediate access to any form sample you desire.

Our user-friendly site with thousands of documents lets you discover and procure nearly any document sample you need.

You can export, complete, and sign the Frisco Texas Executor's Deed in just a few minutes instead of spending hours online looking for the correct template.

Using our collection is an excellent method to enhance the security of your form submission.

If you don’t have an account yet, follow the guidelines listed below.

Locate the template you need. Ensure that it is the form you were looking for: confirm its title and description, and utilize the Preview option when it is available. If not, use the Search field to find the suitable one.

- Our experienced attorneys routinely review all documents to guarantee that the templates meet the requirements of a specific state and adhere to current laws and regulations.

- How can you get the Frisco Texas Executor's Deed.

- If you hold a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- In addition, you can find all previously saved documents under the My documents menu.

Form popularity

FAQ

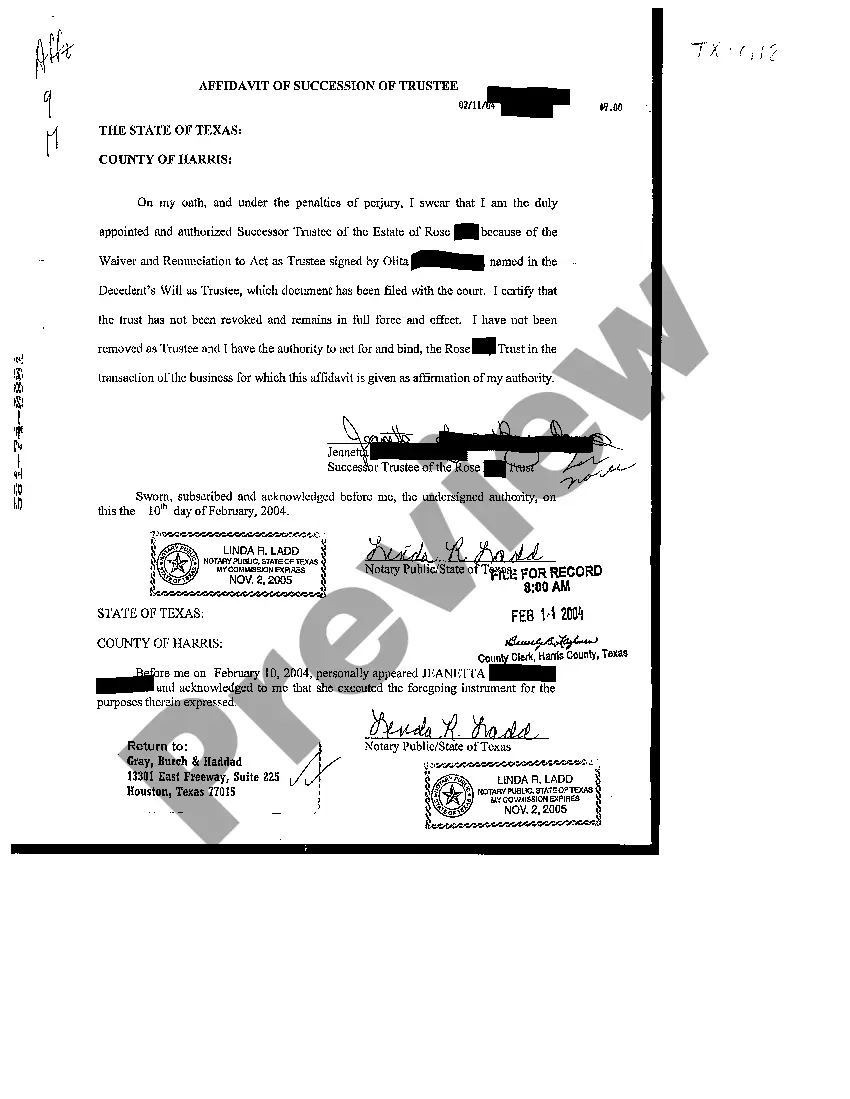

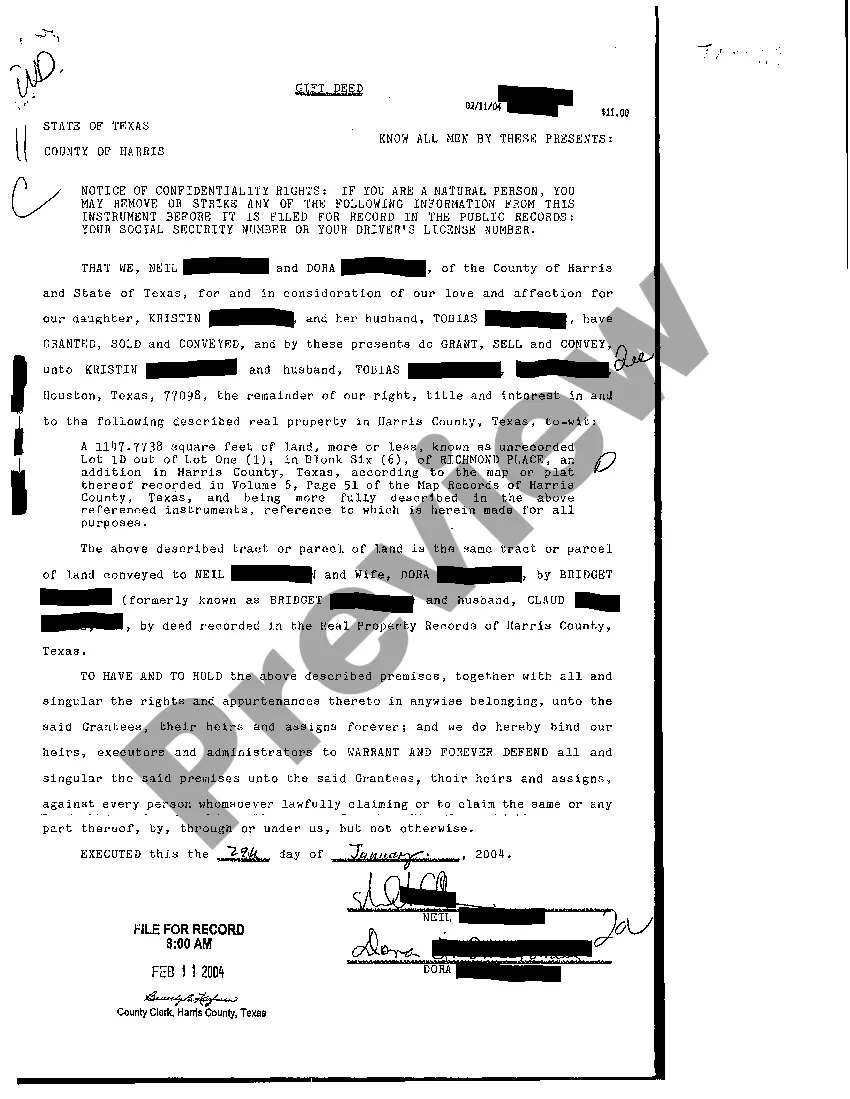

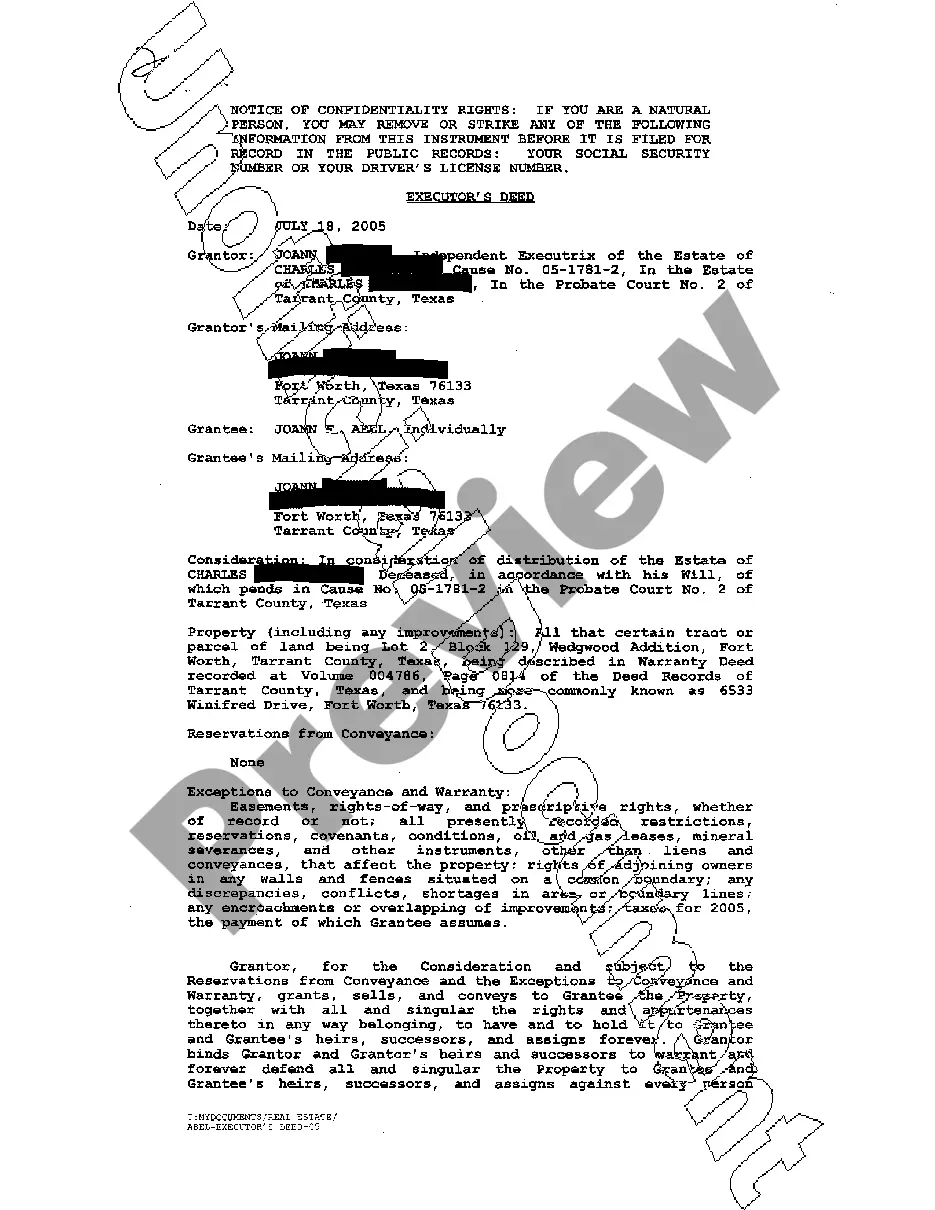

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

What Are Executor Duties in Texas? Locate and notify all beneficiaries of the will; Give notice to the decedent's creditors; Identify and collect all the decedent's assets; Take steps to maintain and protect the assets; Pay all the decedent's debts; Bring a wrongful death suit, if appropriate, if family members do not;

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

Protect Yourself as Executor When Facing Estate Litigation Make sure you follow the written wishes of the deceased.Share information with anyone involved in the estate.Document everything that you do for the estate.

According to Section 352.002 of the Texas Estates Code, Texas executors are entitled to up to 5% of the estate to compensate them for their efforts. When calculating the value of the estate, however, some assets are excluded from that valuation, which decreases the executor's fees.

According to the Estates Code, an executor in Texas is entitled to up to 5% of the estate's total financial transactions. For Example: If an executor has to settle an estate worth $250,000 - if they do their duties correctly, and honestly are entitled up to $12,500 as compensation for administering the estate.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

In order to do this, you'll need to be able to prove to the relevant authorities that you have control over the estate. Usually, this is managed by showing them a copy of the Grant of Probate if a Will is in place, or Letters of Administration, if the estate has been passed into intestacy.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?