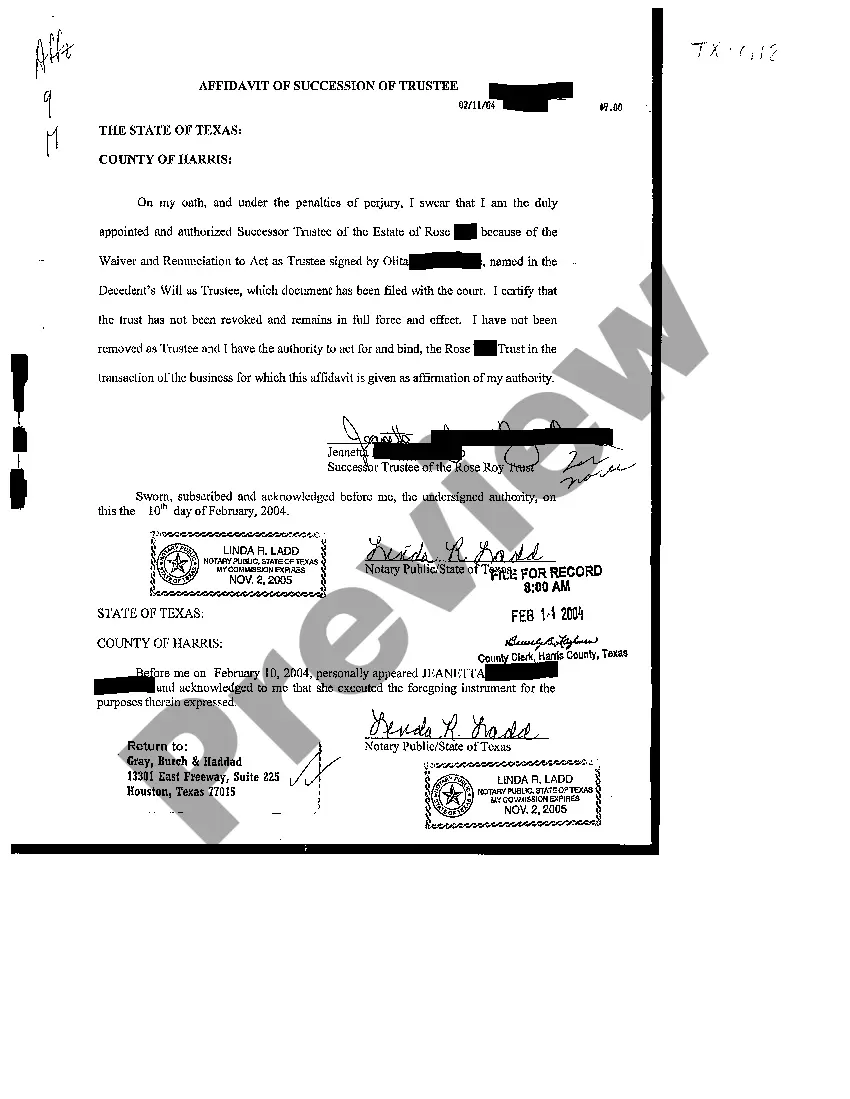

The Beaumont Texas Affidavit of Succession of Trustee is a legal document that is utilized in estate planning and probate matters. This affidavit is used when there is a change in the trustee of a trust due to various reasons such as the retirement, resignation, incapacitation, or death of the current trustee. This affidavit is immensely crucial as it serves as official proof that the successor trustee has taken over the responsibilities and duties of the previous trustee. It provides a formal recognition and acknowledgment of the new trustee's authority to manage and administer the trust. The main purpose of the Beaumont Texas Affidavit of Succession of Trustee is to facilitate a smooth transition of power and ensure that the trust is properly managed and protected. It helps establish that the successor trustee has the legal right to manage the assets, distribute the trust's property, and fulfill the terms and conditions of the trust. It is important to note that there may be different types of Beaumont Texas Affidavit of Succession of Trustee, each specifically designed to meet certain circumstances or requirements. These may include: 1. Voluntary Succession: This type of affidavit is filed when the current trustee willingly relinquishes their role and appoints a successor trustee of their choice. 2. Involuntary Succession: This affidavit is used when the current trustee is no longer capable of carrying out their duties due to incapacitation or death, and a successor trustee needs to be appointed by the court. 3. Succession by Court Order: In some cases, the court may intervene and order the appointment of a new trustee due to legal disputes, breaches of fiduciary duty, or conflicts of interest. 4. Corporate Succession: This affidavit is required when a corporate trustee, such as a bank or trust company, needs to appoint a new trustee to manage the trust on their behalf. When completing the Beaumont Texas Affidavit of Succession of Trustee, it is essential to provide accurate and detailed information about the previous and successor trustees, the trust involved, as well as any relevant supporting documents. Additionally, it is crucial to consult with an attorney or legal professional to ensure compliance with applicable laws and regulations in order to avoid any legal complications in the future.

Beaumont Texas Affidavit of Succession of Trustee

Description

How to fill out Beaumont Texas Affidavit Of Succession Of Trustee?

Take advantage of the US Legal Forms and obtain instant access to any form sample you need. Our helpful website with a large number of documents makes it simple to find and obtain almost any document sample you require. You can export, complete, and sign the Beaumont Texas Affidavit of Succession of Trustee in a matter of minutes instead of surfing the Net for many hours seeking a proper template.

Utilizing our catalog is a great strategy to increase the safety of your form submissions. Our professional legal professionals regularly review all the documents to ensure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How can you get the Beaumont Texas Affidavit of Succession of Trustee? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips below:

- Find the template you require. Make sure that it is the form you were hoping to find: examine its title and description, and take take advantage of the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Pick the format to get the Beaumont Texas Affidavit of Succession of Trustee and modify and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable document libraries on the internet. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the Beaumont Texas Affidavit of Succession of Trustee.

Feel free to make the most of our service and make your document experience as efficient as possible!