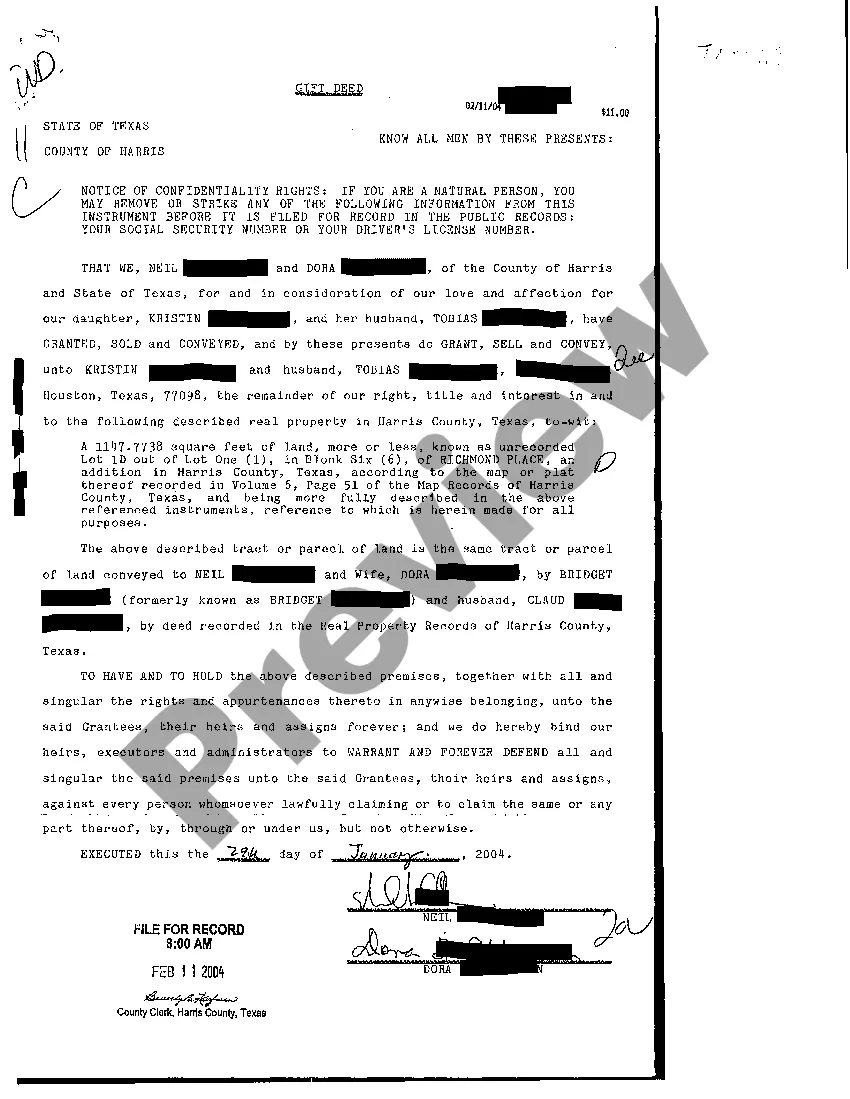

A Collin Texas Gift Deed is a legal document that allows individuals in Collin County, Texas, to transfer ownership of real property as a gift to another person without any monetary exchange. This type of deed is commonly used to transfer property between family members or close friends with no consideration involved. A Collin Texas Gift Deed includes essential information such as the names and addresses of both the donor (the person giving the gift) and the done (the person receiving the gift), a detailed description of the property being transferred, and a statement declaring the intention of the transfer as a gift without any financial compensation. It is important to note that a Collin Texas Gift Deed must be executed with the same formalities as a regular deed, including being in writing, signed by the donor in the presence of a notary public, and subsequently recorded in the Collin County public records to provide legal notice to the public. Different types of Collin Texas Gift Deeds may include: 1. General Gift Deed: This is the most common type of gift deed used in Collin County, Texas. It involves transferring ownership of real property from the donor to the done as an outright gift without any conditions or limitations. 2. Gift Deed with Reservation: In this type of gift deed, the donor transfers ownership of the property to the done as a gift but retains certain rights or reservations, such as the right to continue living in the property for a specified period or the right to use a portion of the property for specific purposes. 3. Gift Deed with Conditions: In some cases, a gift deed may include specific conditions or restrictions imposed by the donor. These conditions could dictate how the property is to be used or maintained, or even specify that ownership will revert to the donor if the done fails to meet certain obligations. 4. Joint Tenancy with Right of Survivorship: While not strictly a gift deed, joint tenancy with right of survivorship is another method of transferring ownership of property as a gift in Collin County, Texas. This allows two or more individuals to hold equal ownership interests in the same property, with the right of survivorship ensuring that the surviving joint tenant(s) automatically inherit the property upon the death of one tenant. It is crucial to consult with a qualified attorney or real estate professional familiar with Collin County, Texas laws and regulations regarding gift deeds to ensure the proper execution and recording of the document.

Collin Texas Gift Deed

Description

How to fill out Collin Texas Gift Deed?

Benefit from the US Legal Forms and have instant access to any form template you require. Our beneficial website with thousands of documents makes it simple to find and get almost any document sample you need. It is possible to export, fill, and sign the Collin Texas Gift Deed in a few minutes instead of surfing the Net for many hours seeking an appropriate template.

Utilizing our catalog is a superb way to raise the safety of your record submissions. Our professional attorneys on a regular basis check all the documents to ensure that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Collin Texas Gift Deed? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. In addition, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Open the page with the form you require. Make certain that it is the template you were looking for: examine its headline and description, and use the Preview option if it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to get the Collin Texas Gift Deed and modify and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the web. We are always ready to assist you in virtually any legal process, even if it is just downloading the Collin Texas Gift Deed.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

Gift (i.e. immovable property received without consideration) received only on the occasion of marriage of the individual is not charged to tax. Apart from marriage there is no other occasion when gift received by an individual is not chargeable to tax.

Gift deeds in Texas are valid, but there are requirements above and beyond those of a regular deed. A gift deed is a document that transfers title to land. It can be informal, but the grantor's intent must be to immediately divest himself of the property where he no longer has control over the land.

General Warranty Gift Deed in Texas A gift deed can be a General Warranty Deed or a Special Warranty Deed which states that the property is a Gift. These deeds need to be in writing and signed by the person giving the property in front of any notary.

Gift deeds are not considered income. If the home is sold, the income is taxable. When a gift deed is created, it is important to know if you are subject to federal gift taxation for the home or property. If that taxation is not paid by the donor, the recipient is going to be responsible for that tax.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2021 is $15,000 per year per recipient, increasing to $16,000 in 2022.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

The Texas Gift Deed requirements are similar to the requirements of most deeds. The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

Gift Deeds in Texas As its title indicates, the gift deed transfers ownership of property as a gift; the person providing the gift, the grantor, expects nothing in return for the transfer. The property is a free gift with no strings attached.