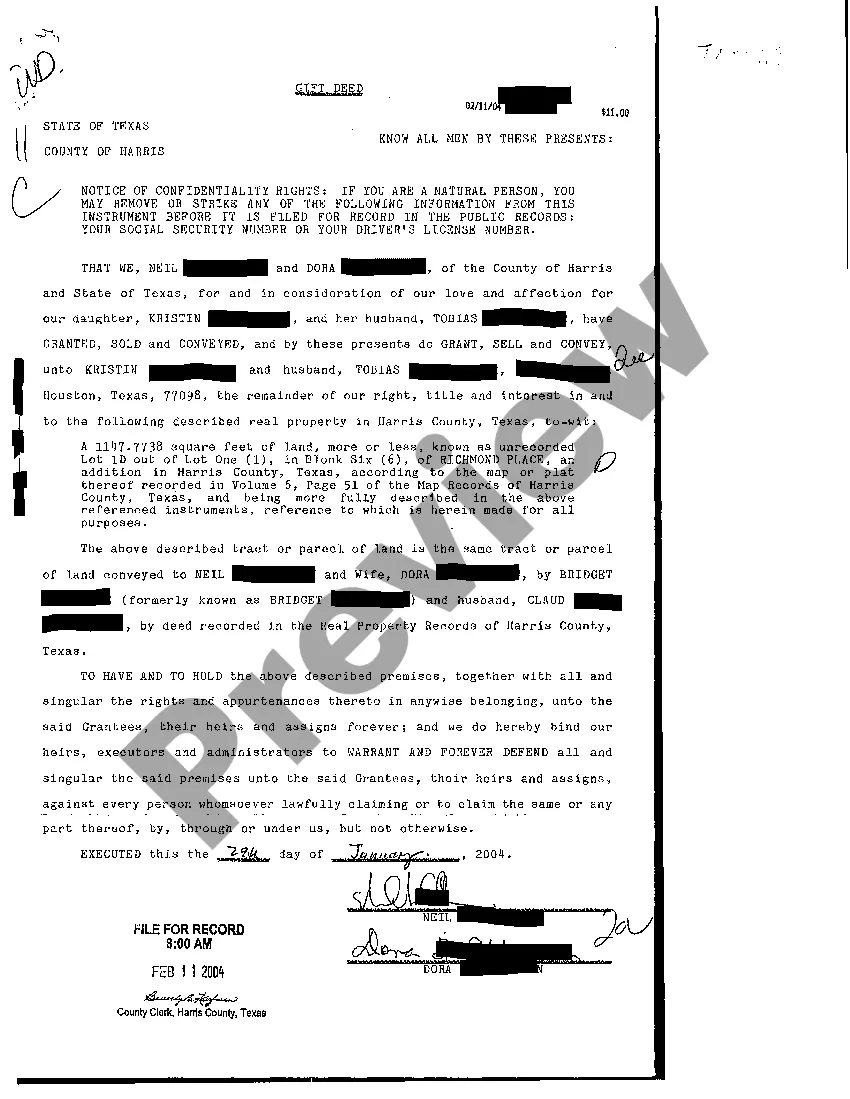

Dallas Texas Gift Deed A Dallas Texas Gift Deed is a legal document used to transfer ownership of real estate as a gift from one party to another in Dallas, Texas. It is commonly used when someone wishes to voluntarily transfer their property without any monetary exchange. The gift deed holds significant importance as it legally establishes the transfer of ownership without involving a purchase or payment. It is typically used between family members, close friends, or even charitable organizations wishing to receive a property as a gift. Keywords: Dallas Texas, Gift Deed, real estate, transfer ownership, voluntary transfer, property, legal document, monetary exchange, family members, close friends, charitable organizations. Types of Dallas Texas Gift Deed: 1. General Gift Deed: This type of gift deed is the most common and straightforward form used when transferring ownership of real estate as a gift in Dallas, Texas. It outlines the details of the donor (current owner) and the recipient (the person receiving the gift) along with a complete legal description of the property being gifted. 2. Conditional Gift Deed: In certain cases, a donor may wish to place specific conditions or restrictions on the gift. These conditions can be related to the recipient's use of the property, such as maintaining it as a personal residence or utilizing it for a specific purpose. The conditional gift deed clearly outlines these conditions, ensuring the donor's intent is fulfilled. 3. Gift Deed with Reservation of Life Estate: This type of gift deed allows the donor to transfer the property as a gift but reserve the right to use or occupy the property for the rest of their life. The recipient becomes the owner of the property once the donor passes away. This arrangement provides the donor with the assurance of continued use and enjoyment of the property while ultimately passing it on to the recipient. 4. Gift Deed with Right of Reversion: Sometimes, a donor may choose to transfer a property as a gift but retain the right to revert ownership back to themselves or their estate under specific circumstances. This type of gift deed includes provisions that state the conditions under which the property will revert to the donor, ensuring their control over the property's future. 5. Joint Tenancy with Right of Survivorship Gift Deed: This form of gift deed is often used between spouses or individuals who wish to own the property jointly. It allows for shared ownership with the right of survivorship, meaning that if one owner passes away, their share automatically transfers to the surviving owner(s) without the need for probate. Keywords: General Gift Deed, Conditional Gift Deed, Gift Deed with Reservation of Life Estate, Gift Deed with Right of Reversion, Joint Tenancy with Right of Survivorship Gift Deed, property, ownership, Dallas Texas, real estate, transfer of ownership, legal description, conditions, restrictions, donor, recipient, life estate, right of survivorship, probate.

Dallas Texas Gift Deed

Description

How to fill out Dallas Texas Gift Deed?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Dallas Texas Gift Deed becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Dallas Texas Gift Deed takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Dallas Texas Gift Deed. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!