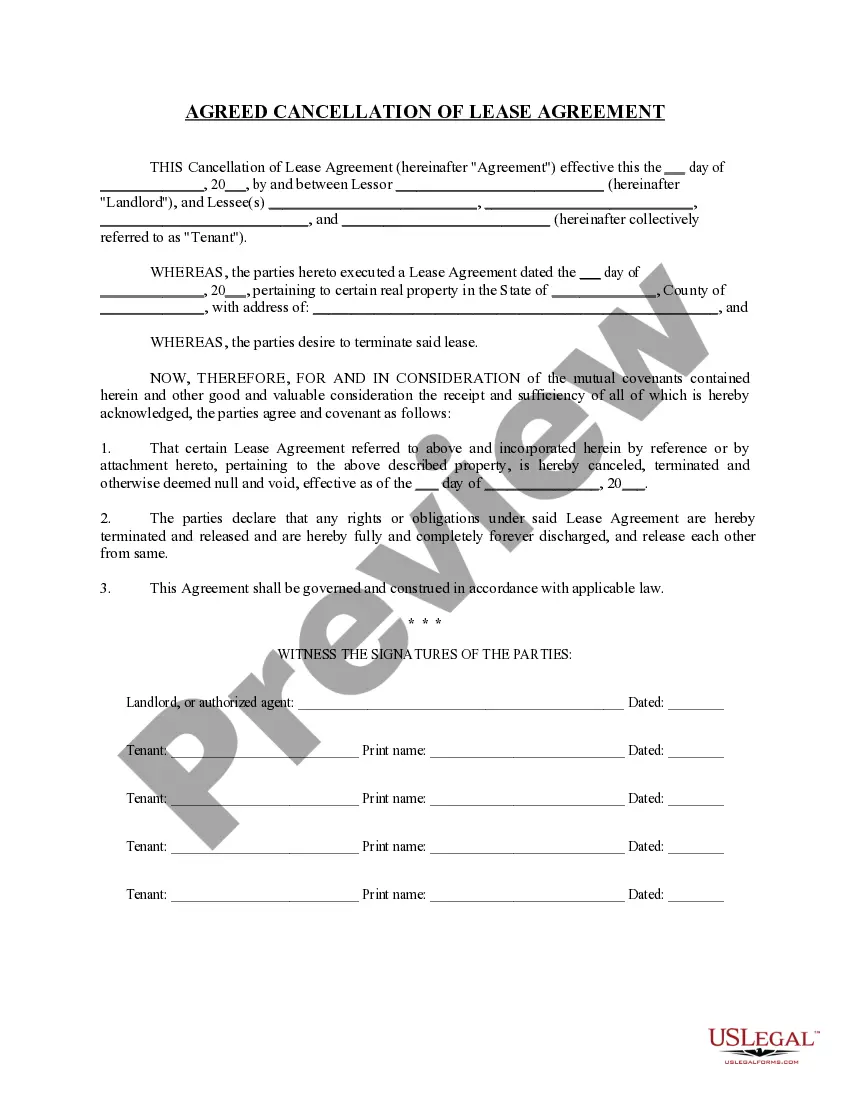

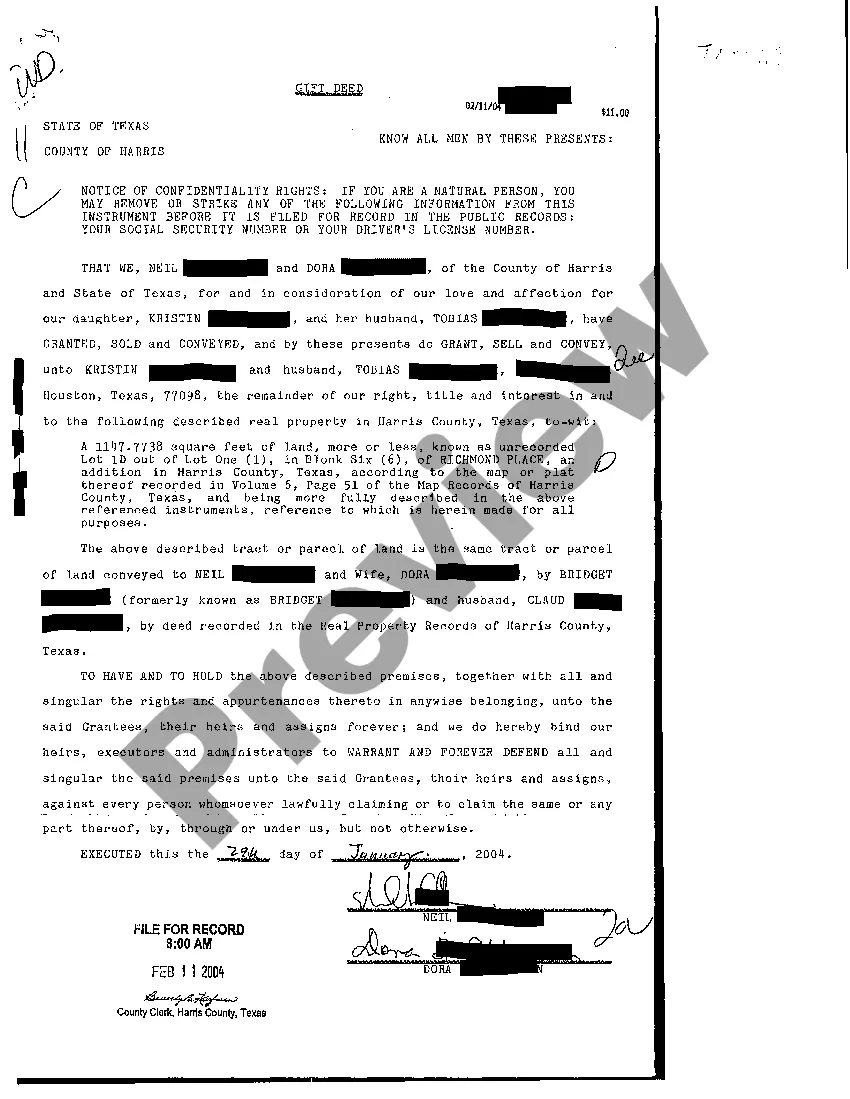

A Fort Worth Texas Gift Deed is a legal document used to transfer ownership of real estate from one person (the donor) to another person (the recipient) without any exchange of money or other consideration. It is a voluntary act of giving a property as a gift and is typically executed out of love, generosity, or to facilitate estate planning. The gift deed must meet specific legal requirements to be valid in Fort Worth, Texas. It must be in writing, signed by the donor, and properly acknowledged or notarized. The gift deed should also include a clear description of the property being gifted, including its legal boundaries and any improvements on the land. Additionally, the deed should state the names and addresses of both the donor and the recipient. There are various types of gift deeds that can be used in Fort Worth, Texas, depending on the specific circumstances and intentions of the parties involved. These include: 1. Simple Gift Deed: This is a basic gift deed used when there are no special conditions or restrictions attached to the gift. It simply transfers ownership of the property from the donor to the recipient. 2. Gift Deed with Reservation: In this type of gift deed, the donor retains the right to use the property for a specified period or until their death. This allows the donor to continue living in or using the property while ultimately transferring ownership to the recipient. This type of gift deed is often used for estate planning purposes. 3. Gift Deed with Conditions: A gift deed with conditions imposes certain requirements or restrictions on the recipient's use of the property. For example, the donor may specify that the property can only be used for residential purposes or that it cannot be sold or transferred to a third party. 4. Gift Deed in Trust: This type of gift deed involves transferring the property to a trust, with the recipient as the beneficiary. The trust then holds the property for the recipient's benefit, typically with specific instructions on how the property should be managed or used. It is important to consult with a qualified real estate attorney or legal professional to ensure that the Fort Worth Texas Gift Deed meets all legal requirements and accurately reflects the donor's intentions. Additionally, it is recommended to consult with a tax advisor to understand any potential tax consequences associated with gifting real estate.

Fort Worth Texas Gift Deed

State:

Texas

City:

Fort Worth

Control #:

TX-C119

Format:

PDF

Instant download

This form is available by subscription

Description

Gift Deed

A Fort Worth Texas Gift Deed is a legal document used to transfer ownership of real estate from one person (the donor) to another person (the recipient) without any exchange of money or other consideration. It is a voluntary act of giving a property as a gift and is typically executed out of love, generosity, or to facilitate estate planning. The gift deed must meet specific legal requirements to be valid in Fort Worth, Texas. It must be in writing, signed by the donor, and properly acknowledged or notarized. The gift deed should also include a clear description of the property being gifted, including its legal boundaries and any improvements on the land. Additionally, the deed should state the names and addresses of both the donor and the recipient. There are various types of gift deeds that can be used in Fort Worth, Texas, depending on the specific circumstances and intentions of the parties involved. These include: 1. Simple Gift Deed: This is a basic gift deed used when there are no special conditions or restrictions attached to the gift. It simply transfers ownership of the property from the donor to the recipient. 2. Gift Deed with Reservation: In this type of gift deed, the donor retains the right to use the property for a specified period or until their death. This allows the donor to continue living in or using the property while ultimately transferring ownership to the recipient. This type of gift deed is often used for estate planning purposes. 3. Gift Deed with Conditions: A gift deed with conditions imposes certain requirements or restrictions on the recipient's use of the property. For example, the donor may specify that the property can only be used for residential purposes or that it cannot be sold or transferred to a third party. 4. Gift Deed in Trust: This type of gift deed involves transferring the property to a trust, with the recipient as the beneficiary. The trust then holds the property for the recipient's benefit, typically with specific instructions on how the property should be managed or used. It is important to consult with a qualified real estate attorney or legal professional to ensure that the Fort Worth Texas Gift Deed meets all legal requirements and accurately reflects the donor's intentions. Additionally, it is recommended to consult with a tax advisor to understand any potential tax consequences associated with gifting real estate.

How to fill out Fort Worth Texas Gift Deed?

If you’ve already utilized our service before, log in to your account and download the Fort Worth Texas Gift Deed on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Fort Worth Texas Gift Deed. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!