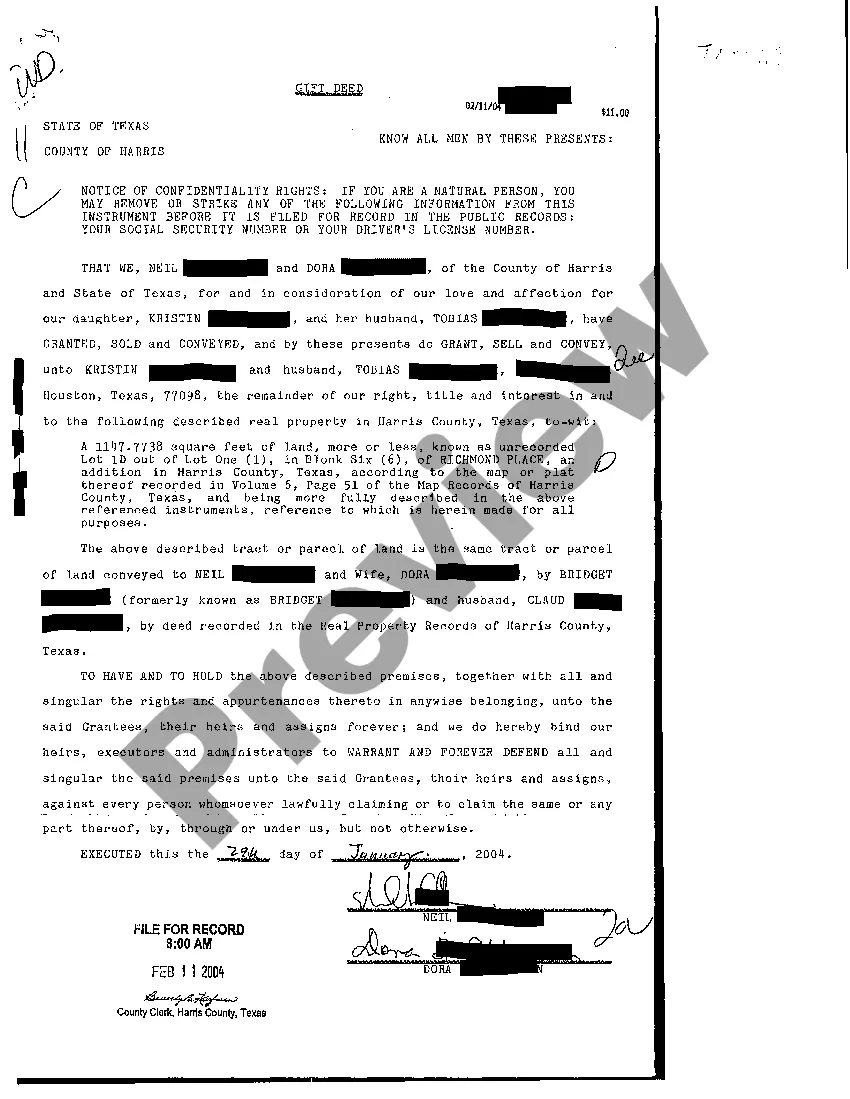

A Harris Texas Gift Deed is a legal document used to transfer real estate property as a gift from one party to another in Harris County, Texas. It is typically used when the current owner, known as the donor, wishes to gift the property to another person, known as the done, without any consideration or payment in return. The Harris Texas Gift Deed must adhere to specific legal requirements and should include vital information about the property and the parties involved in the transfer. This includes the full legal description of the property, the names and addresses of both the donor and the done, and the statement declaring the intention of the transfer as a gift. When it comes to different types of Harris Texas Gift Deed, there are typically no specific variations or classifications. However, some variations may occur based on specific circumstances or legal requirements. These can include: 1. General Gift Deed: This type of gift deed transfers ownership of the property to the done without any conditions or limitations. 2. Conditional Gift Deed: In this type of gift deed, certain conditions or limitations are imposed on the use or transfer of the property. These conditions must be clearly stated in the deed. 3. Gift Deed with Reservation: This type of gift deed allows the donor to retain certain rights or benefits after transferring the property. For example, the donor may reserve the right to continue living in the property for a specified period or to receive income generated by the property. It is important to consult an experienced real estate attorney when preparing a Harris Texas Gift Deed to ensure compliance with local laws and to address any specific circumstances or requirements.

Harris Texas Gift Deed

Description

How to fill out Harris Texas Gift Deed?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Harris Texas Gift Deed or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Harris Texas Gift Deed adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Harris Texas Gift Deed is suitable for your case, you can select the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!