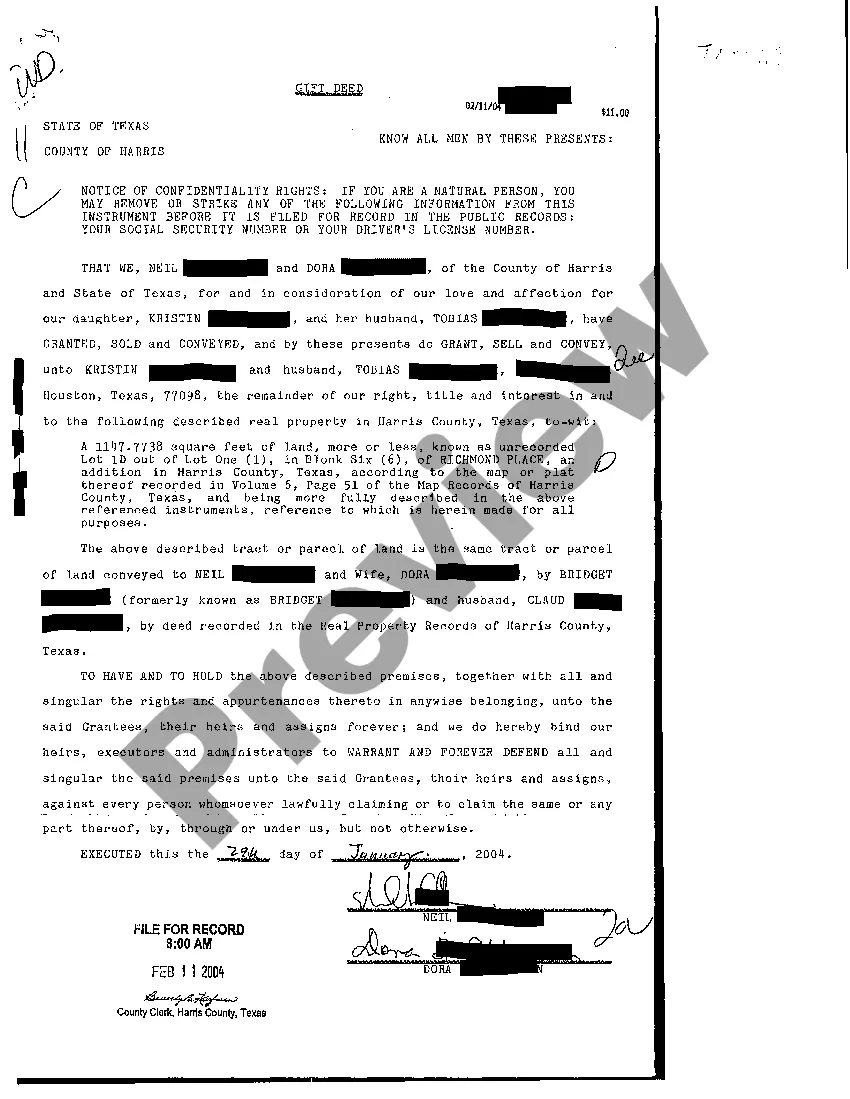

A Houston Texas Gift Deed is a legal document that signifies the transfer of ownership of real property from one person (the donor) to another (the recipient) as a gift, without any exchange of consideration or payment. This deed is commonly used in Houston, Texas, and follows the laws and regulations set forth by the state. Gift deeds are typically used when the donor wants to convey their property to another person as a gift, while still alive. By executing a gift deed, the donor relinquishes any ownership rights and title to the property, transferring it to the recipient, who becomes the new legal owner. The recipient does not need to provide any compensation, as this deed represents the act of voluntary transfer without monetary exchange. A Houston Texas Gift Deed includes essential details such as the names and addresses of both the donor and the recipient, a detailed description of the property being gifted (including its legal description), and the signatures of both parties, along with witnesses and a notary public. This ensures the validity and enforceability of the gift deed. There are a few different types of Houston Texas Gift Deeds, each applicable in specific situations: 1. Inter vivos gift deed: This is the most common type of gift deed, where the donor transfers ownership while still alive. It is often used for estate planning, tax purposes, or simply to pass on property to loved ones. 2. Gift deed with reservation: In certain cases, the donor may want to retain certain rights or benefits from the gifted property, such as the right to live in the property until death. A gift deed with reservation allows the donor to transfer ownership while reserving specific rights. 3. Charitable gift deed: This type of gift deed involves the transfer of property to a charitable organization or institution. It is often used for philanthropic purposes, enabling the donor to contribute to a cause they support while potentially enjoying tax benefits. It is important to consult with a qualified attorney or real estate professional when drafting or executing a Houston Texas Gift Deed, as specific legal requirements and considerations must be adhered to. These include compliance with state laws, proper documentation and recording with the county clerk's office, and potential tax implications.

Houston Texas Gift Deed

Description

How to fill out Houston Texas Gift Deed?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Houston Texas Gift Deed or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Houston Texas Gift Deed complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Houston Texas Gift Deed is proper for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!