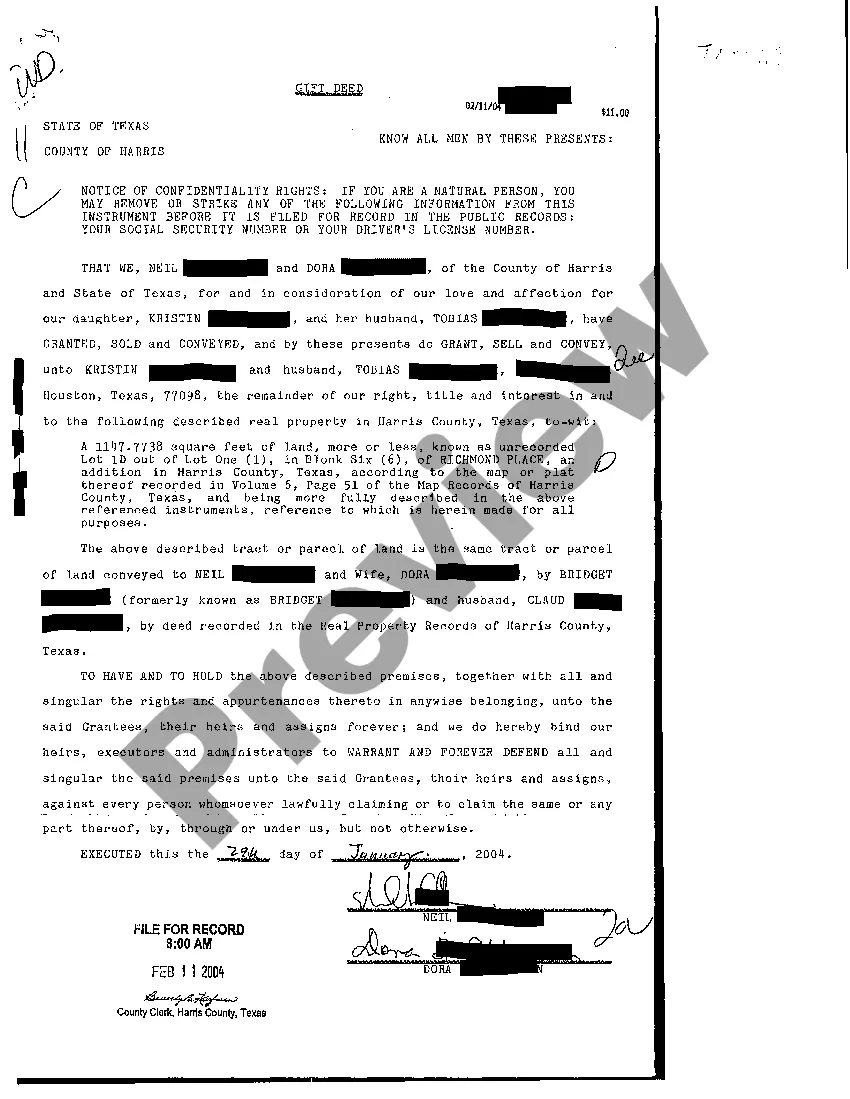

Odessa Texas Gift Deed: A Comprehensive Guide to Understanding and Utilizing Gift Deeds in Odessa, Texas Keywords: Odessa Texas, gift deed, property transfer, real estate, legal document, tax implications, types Introduction: A gift deed is a legal document used in Odessa, Texas, to transfer ownership of real estate property as a gift from one party to another. In this detailed description, we will delve into the specifics of what an Odessa Texas Gift Deed entails, its importance, legal requirements, tax implications, and potential types of gift deeds. 1. Understanding Odessa Texas Gift Deed: A gift deed is a formal instrument that signifies the voluntary transfer of property from a donor (the granter) to a recipient (the grantee) without financial consideration. In Odessa, Texas, it serves as a transparent and legally binding means to ensure the transfer of property ownership without a monetary exchange. 2. Importance of Gift Deeds: Gift deeds hold significant importance in Odessa, Texas, as they provide a method for property owners to bestow their assets upon loved ones or individuals without any monetary obligation. This document allows individuals to transfer real estate voluntarily, usually as a gesture of goodwill during their lifetime or as part of estate planning. 3. Legal Requirements: To create a valid Odessa Texas Gift Deed, certain legal requirements must be met, including: a. Intention: The granter must have the intention to give the property as a gift without expecting anything in return. b. Competent Parties: Both the granter and the grantee must be legally competent to engage in such agreements. c. Written Document: A gift deed must be a written and signed document to have legal validity. d. Acceptance: The grantee must accept the gift either before or at the time of transfer for the deed to be effective. 4. Tax Implications: In Odessa, Texas, gift deeds may have tax implications for both the granter and the grantee. The granter may be subject to federal gift tax if the value of the gifted property exceeds the annual exclusion limit set by the IRS. The grantee, upon receiving the gift, may need to consider potential property tax implications based on the new property's appraised value. 5. Types of Odessa Texas Gift Deeds: While "gift deed" generally refers to the voluntary transfer of property ownership, there are variations that suit different circumstances. Some possible types of gift deeds in Odessa, Texas, include: a. General Gift Deed: The most common type, where the granter transfers ownership without any restrictions or conditions. b. Gift Deed with Reservation: Involves the granter reserving certain rights or interest in the property despite gifting ownership to the grantee. c. Gift Deed to a Trust: Gift deeds can be used to transfer property into a trust, allowing for efficient estate planning and potential tax benefits. d. Gift Deed to Joint Tenants: Property can be gifted with the intention of joint ownership, enabling both parties to share ownership and enjoy certain legal advantages. Conclusion: In Odessa, Texas, a gift deed is a valuable legal instrument that allows property owners to transfer ownership without financial consideration. It safeguards the interests of both the granter and the grantee, ensuring a transparent and legally binding transfer process. Understanding the legal requirements and potential tax implications is crucial when utilizing gift deeds in Odessa, Texas. Knowing the various types of gift deeds available can further tailor the transfer process to meet specific needs and circumstances.

Odessa Texas Gift Deed

Description

How to fill out Odessa Texas Gift Deed?

Are you looking for a reliable and affordable legal forms provider to buy the Odessa Texas Gift Deed? US Legal Forms is your go-to option.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Odessa Texas Gift Deed conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Restart the search in case the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Odessa Texas Gift Deed in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.