A Waco Texas Gift Deed is a legal document used to transfer ownership of real estate from one individual (the donor) to another (the recipient) without any monetary exchange. This transfer is considered a gift, where the donor voluntarily gives up their interest in the property, usually as a gesture of goodwill or to facilitate estate planning. Gift deeds are commonly used for various purposes in Waco, Texas, and understanding the different types can be essential. Here are the main types of Waco Texas Gift Deeds: 1. General Gift Deed: This is the most common type, transferring full ownership of the property to the recipient immediately. 2. Conditional Gift Deed: In this type, certain conditions are attached to the transfer of the property. For example, the donor may specify that the recipient can only take ownership after a certain event occurs, such as reaching a specific age. 3. Remainder Gift Deed: With this type of gift deed, the donor retains a life interest in the property, and only after their passing does the recipient gain full ownership. 4. Gift Deed with Reservation of Life Estate: This type allows the donor to retain the right to live in the property until their death, at which point the recipient becomes the full owner. 5. Joint Tenancy with Right of Survivorship Gift Deed: This type of gift deed transfers ownership to multiple recipients, typically spouses or family members, who hold equal shares. In the event of one recipient's death, their share automatically transfers to the surviving joint tenants. It is essential to consult an experienced real estate attorney in Waco, Texas, when considering a gift deed to ensure all legal requirements are met and to determine the most suitable type based on individual circumstances. The gift deed must be properly executed, signed, and notarized to have legal effect, and it should include a detailed description of the property being gifted. Additionally, gift deeds may have potential tax implications, so it's advisable to consult with a tax professional to understand the potential consequences of proceeding. In summary, a Waco Texas Gift Deed is a legal document used to transfer ownership of real estate as a gift. Understanding the various types of gift deeds and seeking professional advice can help ensure a smooth transfer process while complying with all legal and tax requirements.

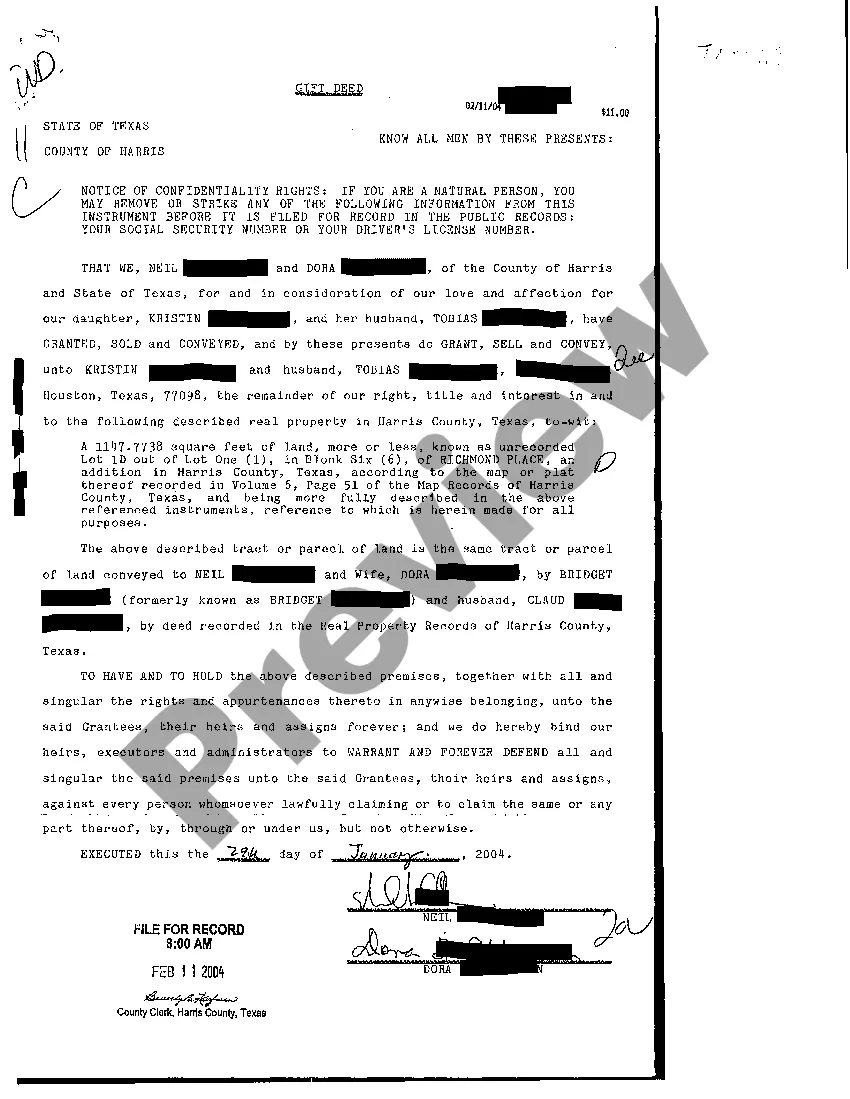

Waco Texas Gift Deed

Description

How to fill out Waco Texas Gift Deed?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Waco Texas Gift Deed or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Waco Texas Gift Deed complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Waco Texas Gift Deed is proper for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!